With the summer travel surge starting to fizzle out and fall setting in, the momentum in travel seems to be ebbing. The dip in Travel Intent is evident across most sectors, seemingly driven by seasonal trends, with some potential influence by cleanliness and customer service concerns with specific brands. However, there's a silver lining for some: budget airlines are witnessing a noticeable surge.

HundredX analyzed more than 280,000 pieces of customer feedback across the travel sector from August 2022 through August 2023 to find:

Key Takeaways

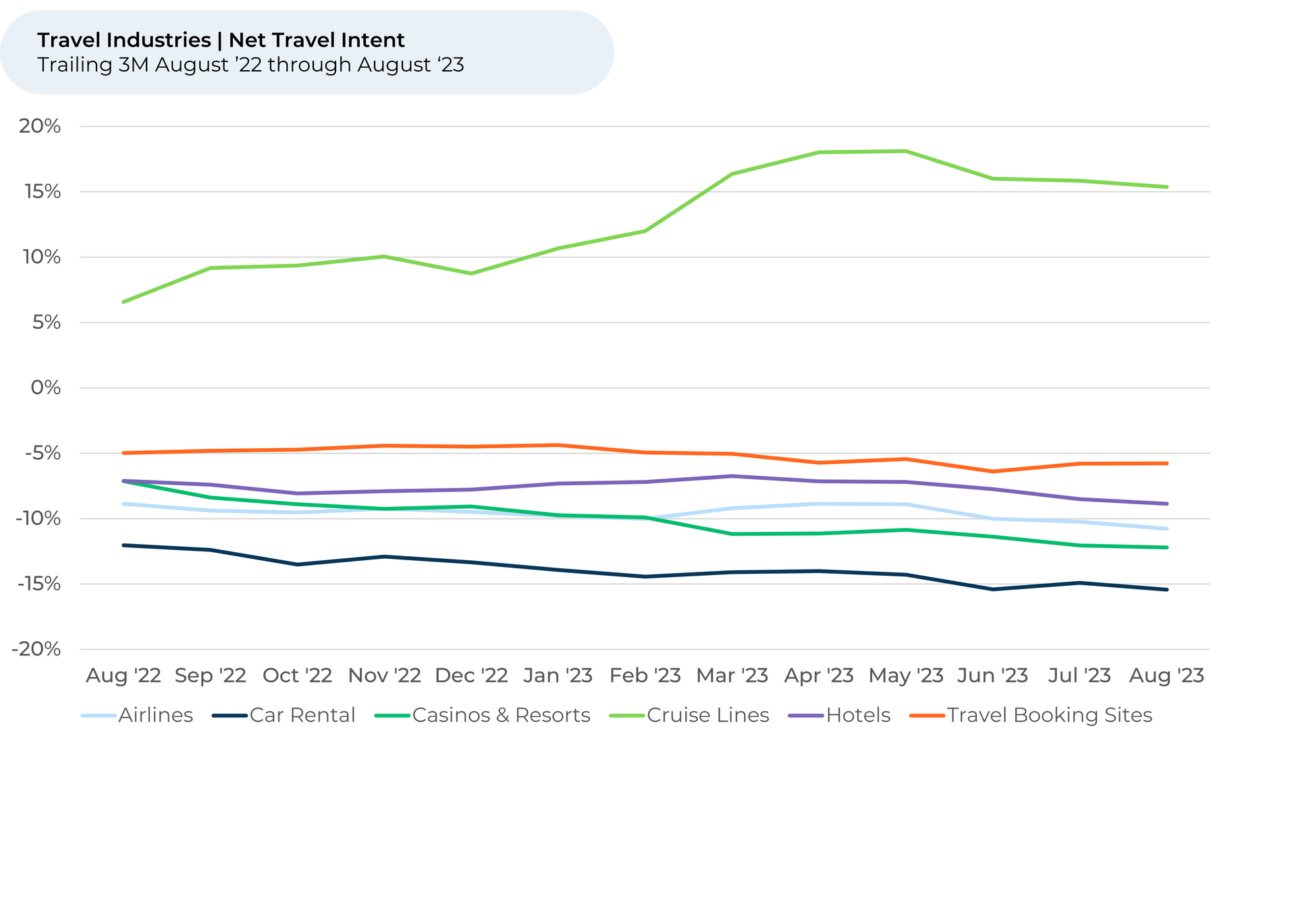

- Travel Intent¹ ,² has dipped for most travel-related industries over the past three months, falling the most for cruise lines (-3%), compounding the drop we’ve seen since it reached a high in May 2023.

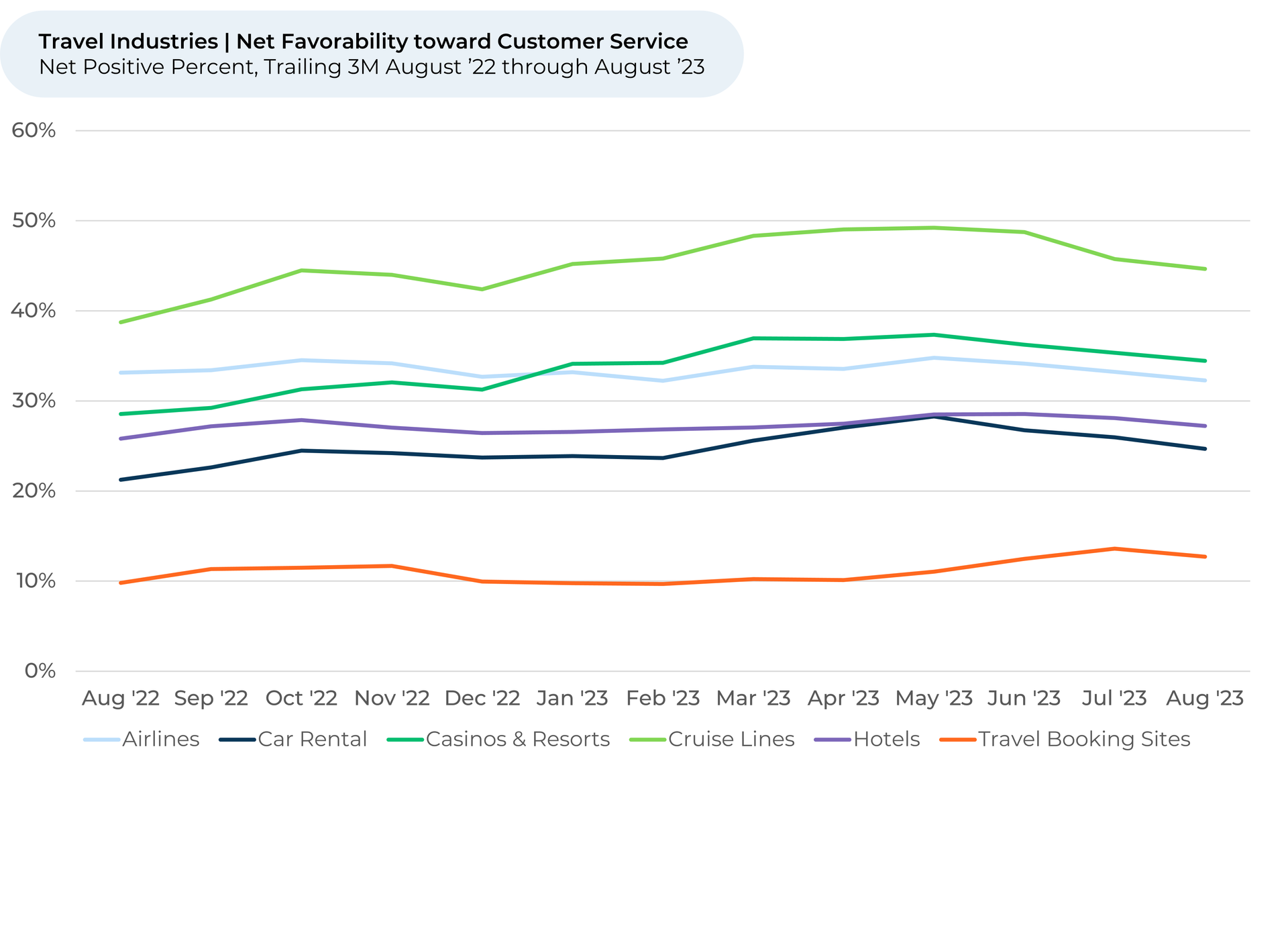

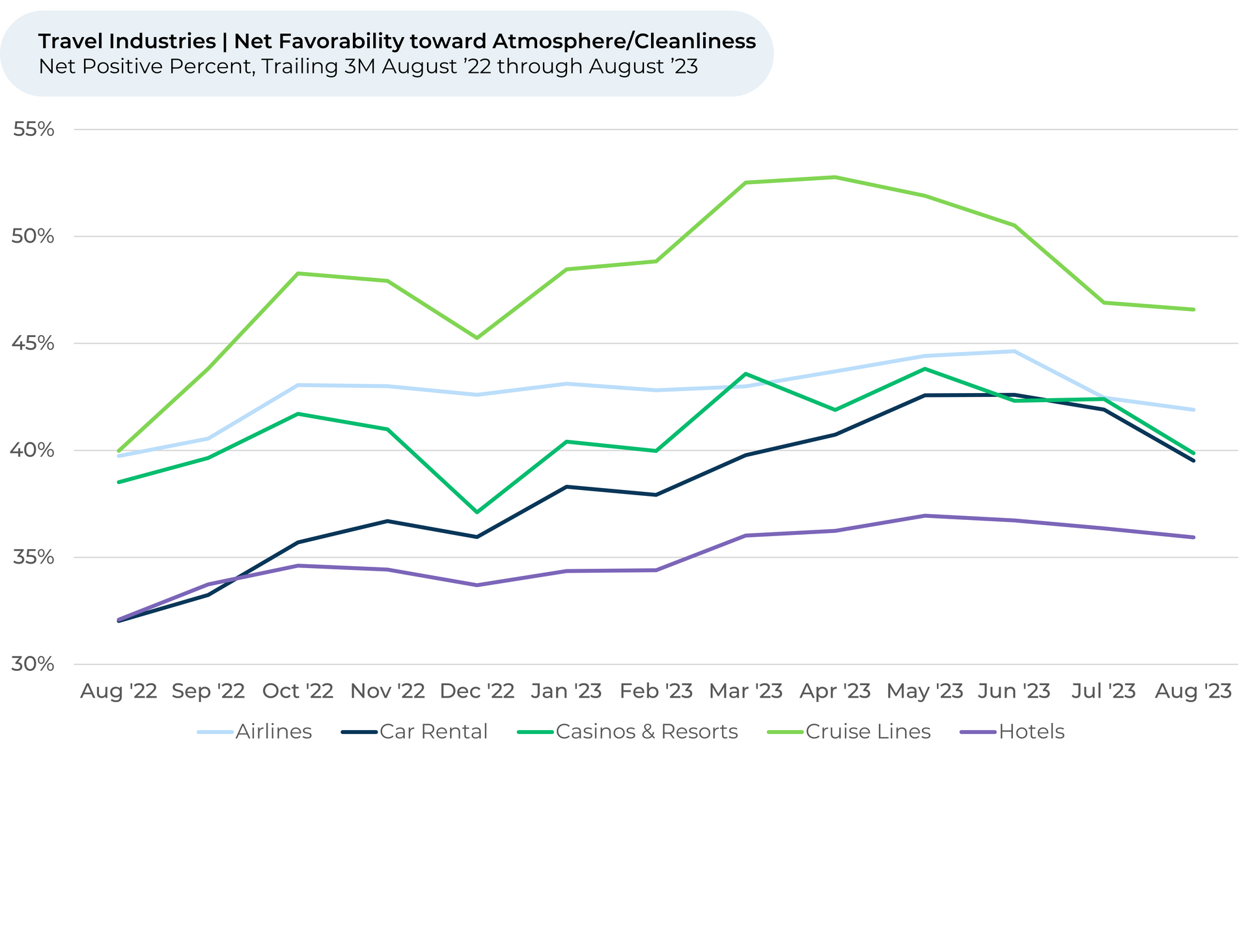

- Notably, perception³ toward customer service and atmosphere/cleanliness dipped for most travel-related industries, falling the most for cruise lines. The dips, coming after recent reports of unclean airplanes and cruise ships, could help explain the Travel Intent dip.

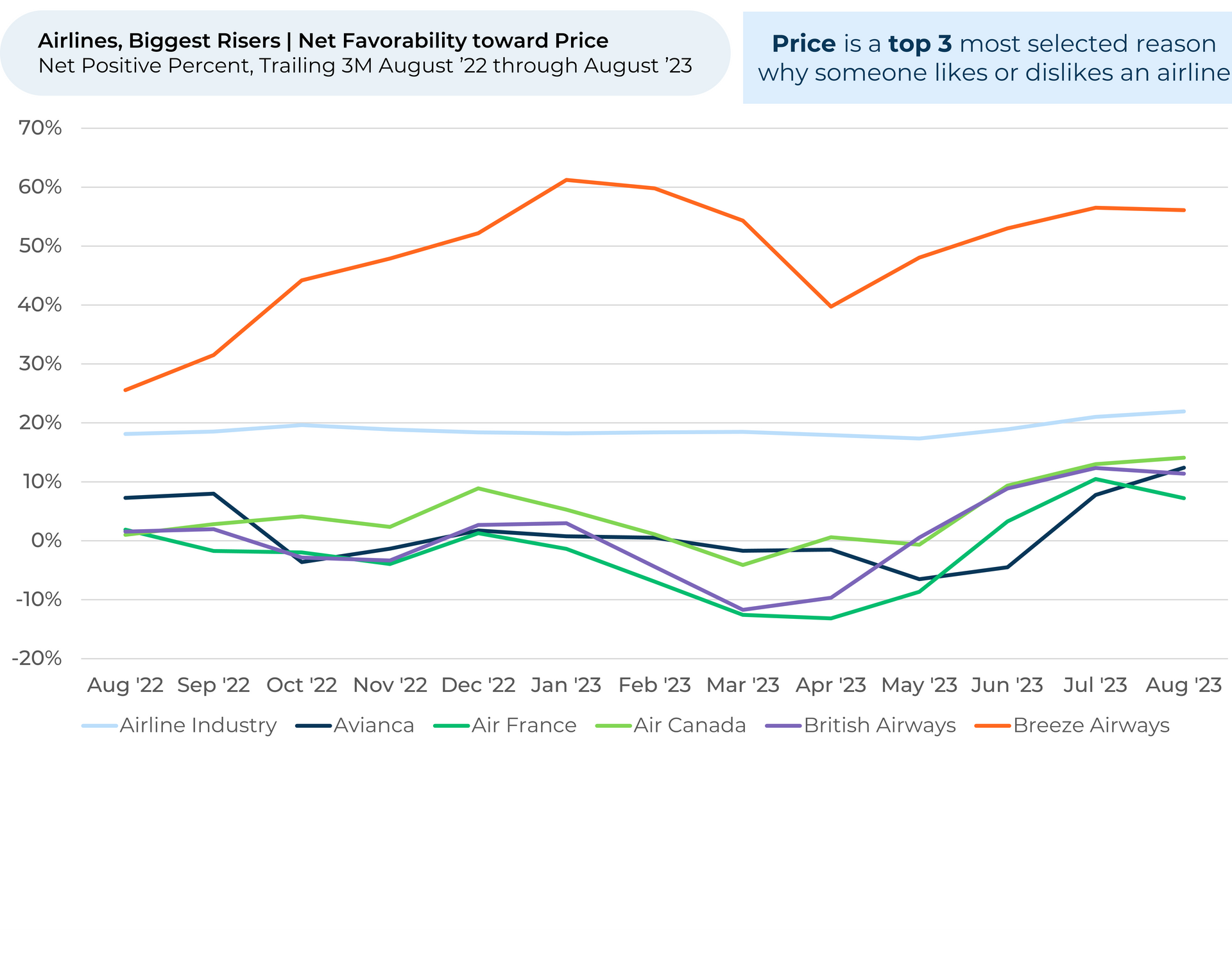

- Customer perception toward price increased for most travel-related industries, jumping the most (+5%) for airlines. Airlines have been slashing prices as the summer travel season comes to a close.

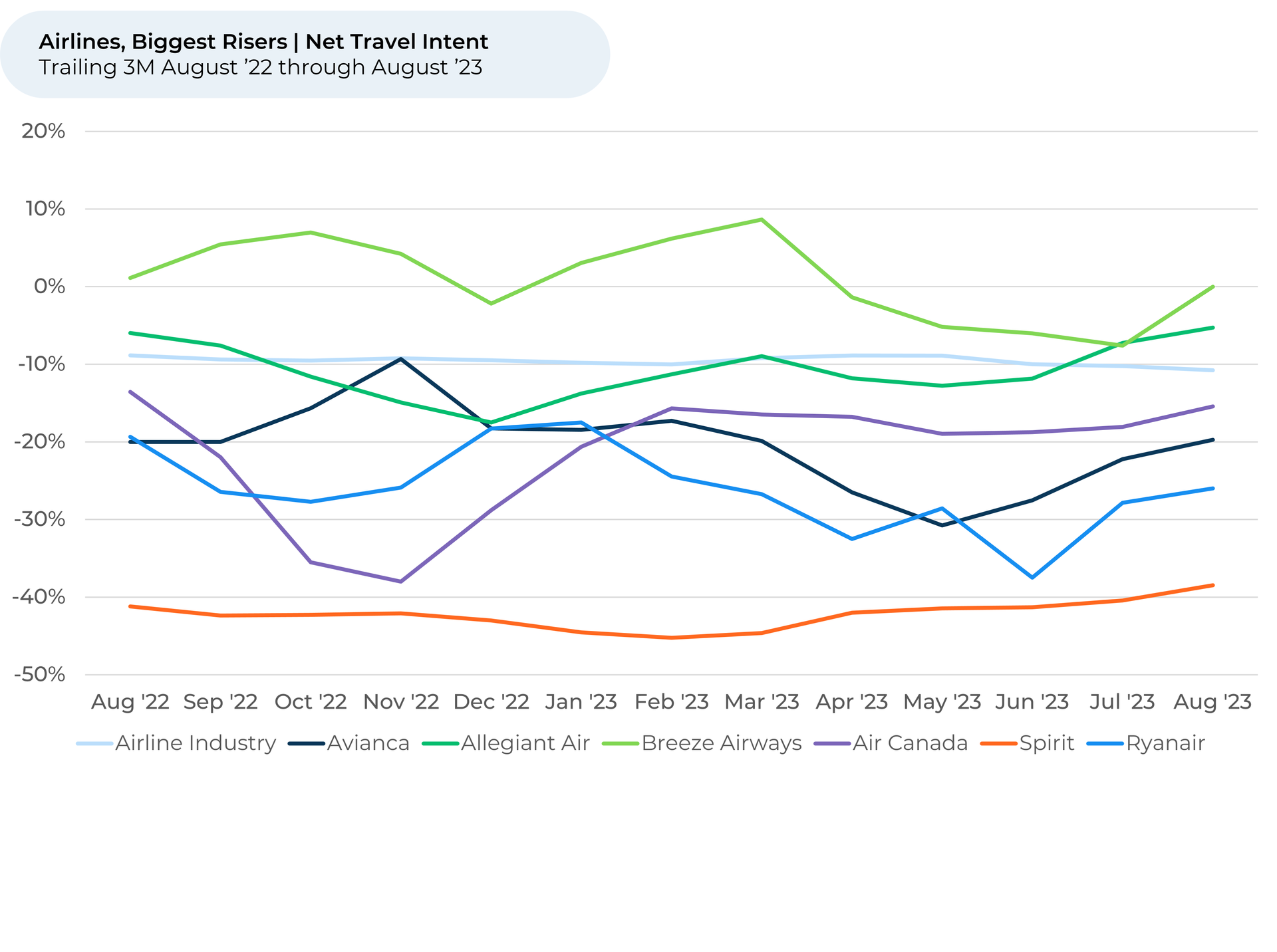

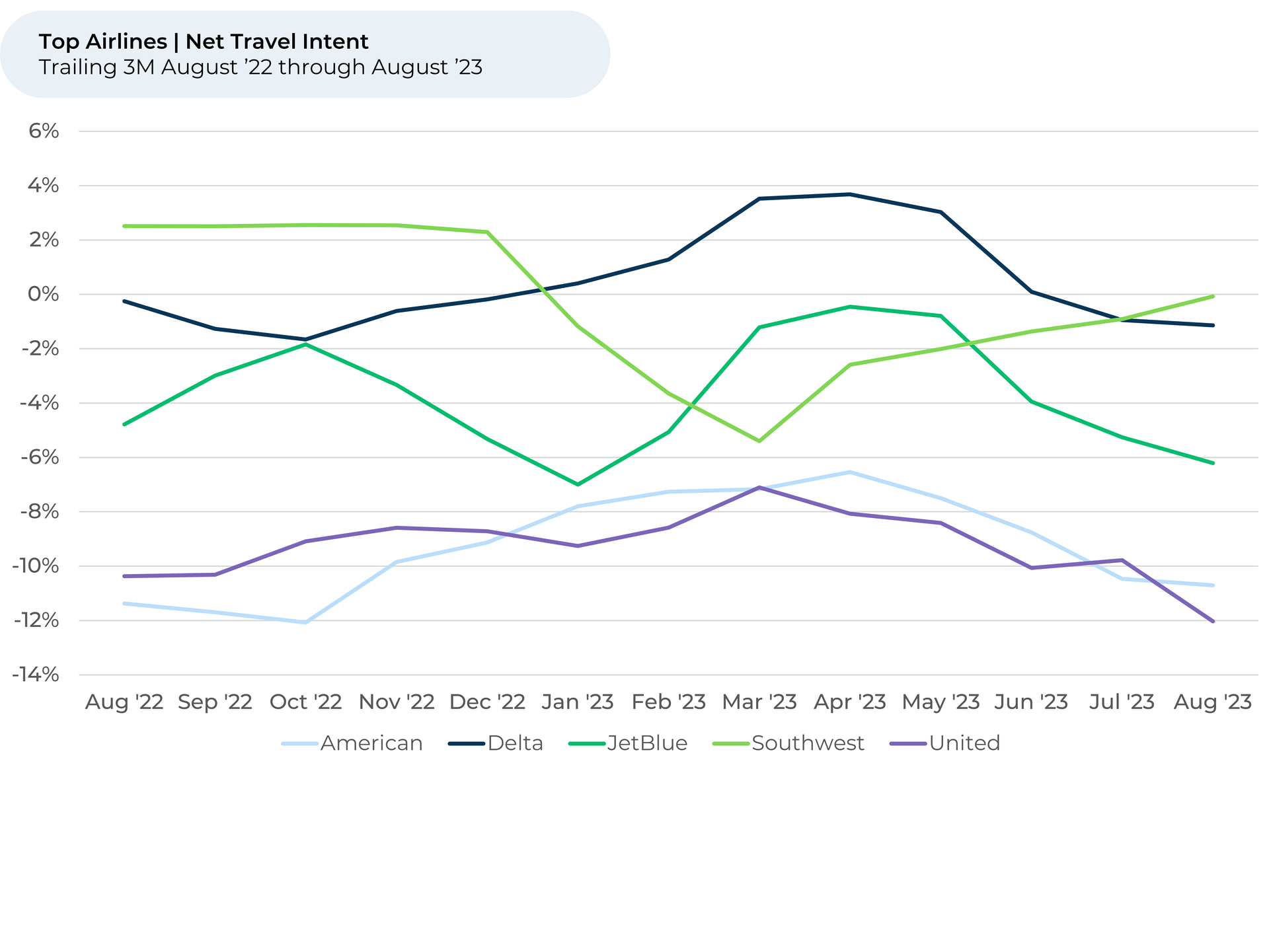

- Since May, Travel Intent has increased the most for budget airlines, while decreasing for the bigger, more expensive airlines. The relative moves indicate people may be watching their wallets amid still-above-normal inflation.

Discover HundredX insights into Travel Trends:

Slide title

Write your caption hereButton

Slide title

Over the past three months, Travel Intent has dipped for most travel industries except for travel booking sites. It fell the most for cruise lines (-3%), although cruise is still up 8% over the year. Cruise is the only travel industry to show Travel Intent growth over the year.

Button

Slide title

Perception toward customer service could help explain why the notable Travel Intent dip in cruise lines. Customer perception toward customer service dipped 5% for cruise lines over the past three months, more than any other travel-related industry.

Button

Slide title

Customer perception toward atmosphere and cleanliness also sank the most for cruise lines (-5%). Favorability sank for all travel-related industries, with hotels being the most resilient (-1%). The dips come after myriad news reports of unclean and potentially biohazardous situations on planes and cruise ships.

Button

Slide title

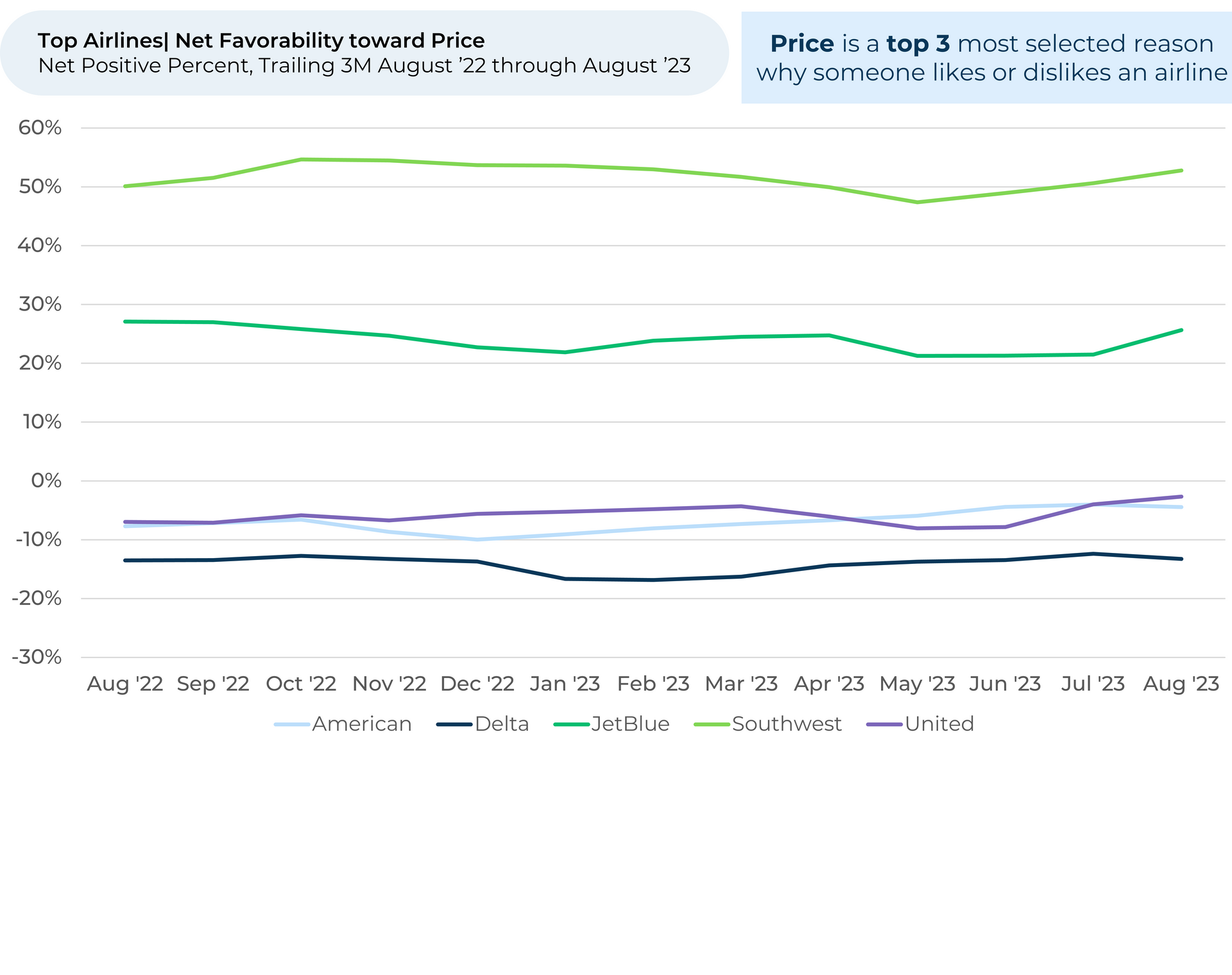

It’s not all bad news for the travel sector, however. Customer perception toward price increased for most travel-related industries over the past three months, jumping the most (+5%) for airlines.

Button

Slide title

Customer perception toward price increased the most for lower cost and international airlines over the past three months. Many airlines started offering fall travel discounts over the past couple of months – budget airline Breeze, for example, slashed costs by 30% in August. British Airways, meanwhile, lowered costs enough to beat Ryanair – a historically low-cost airline.

Button

Slide title

Price favorability increased for the biggest U.S. airlines as well, with Southwest and United jumping the most (+5%) over the last three months. Booking site Hopper found domestic flights in July were 11% cheaper than the year before. It expects flight prices to dip an additional 2% in August before rising ahead of winter holiday travel.

Button

Slide title

The biggest Travel Intent gainers are largely international and cheaper airlines. Some of these correspond to the biggest price perception gainers (Avianca, Breeze Airways). Still, many of these airlines, including Spirit and Ryanair, are known for their low prices, indicating customers are rotating towards budget airlines amid still high inflation.

Button

Slide title

And customers seem to be turning away from the bigger, more expensive airlines. Travel Intent dropped 3% - 5% for American, Delta, JetBlue and United since May. It rose 2% for Southwest, which has been recovering from a March low after it faced technical problems that grounded thousands of flights during the 2022 winter holiday season.

Button

Please contact our team for a deeper look at HundredX's travel data, which includes more than 680,000 pieces of customer feedback across close to 180 travel-related brands.

- All metrics presented, including Net Travel Intent (Travel Intent), and Net Positive Percent / Net Favorability are presented on a trailing three-month basis unless otherwise noted.

- Travel Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less. We find businesses that see Travel Intent trends gain versus the industry have often seen revenue growth rates, margins and/or market share also improve versus peers

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

See where businesses and industries are going

All Rights Reserved | HundredX, Inc