Customers are questioning the brand values and trustworthiness of the auto industry after the United Auto Workers (UAW) launched a strike against Ford, General Motors, and Stellantis, but it isn’t impacting their loyalty yet. We believe it is most likely because the strikes are not materially impacting customer perception of vehicle availability, pricing and service levels yet. But as the strike continues into its second month, that could soon change. We’ll be monitoring for loyalty and market share shifts.

The strikes started on September 15. As of October 15, more than 30,000 UAW members have walked out of assembly plants to demand better pay and benefits. Analyzing more than 85,000 pieces of customer feedback across 45 auto brands from September 2022 through mid-October 2023, we find:

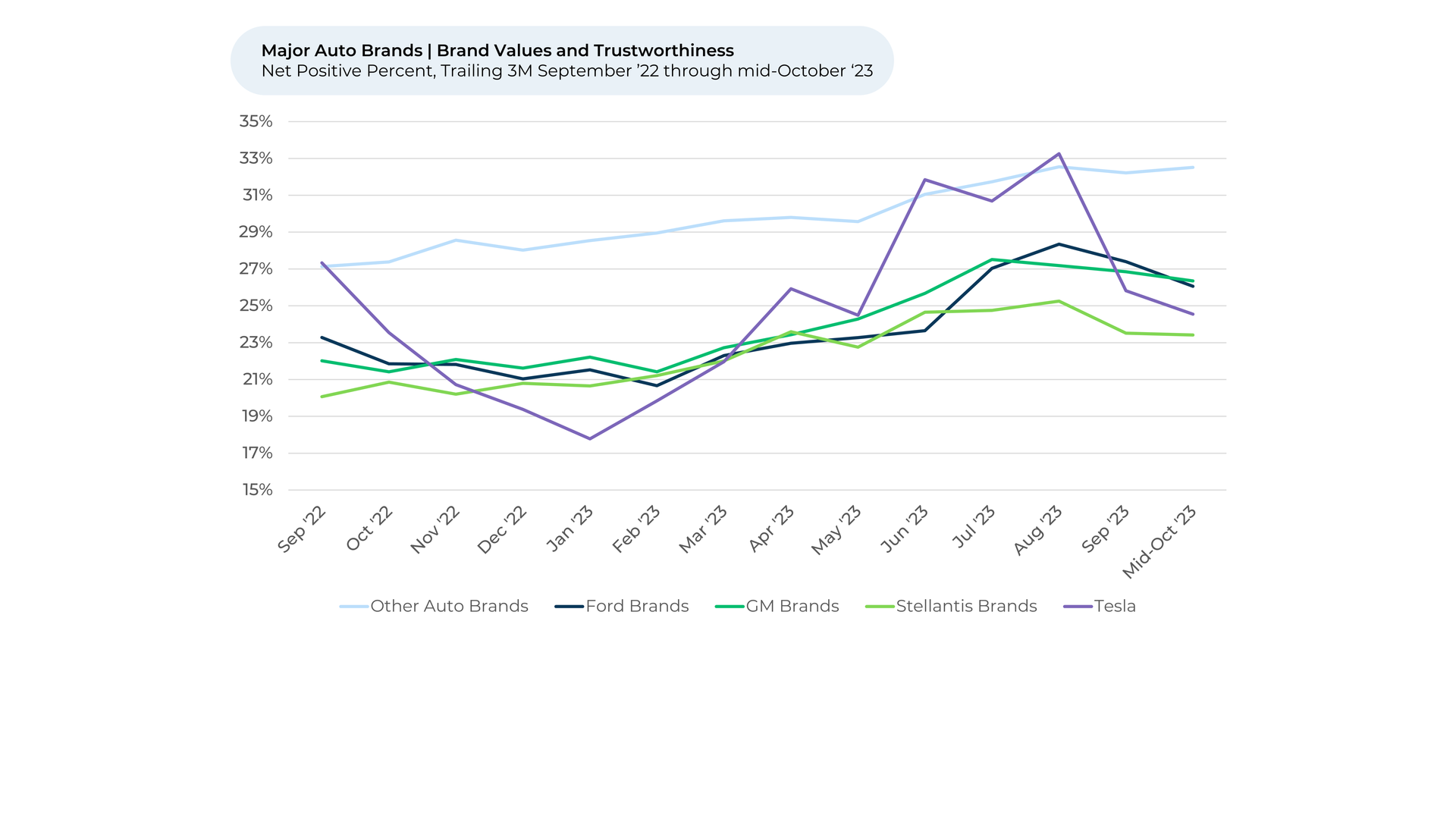

- In general, customers feel worse about the brand value and trustworthiness of the big three U.S. automakers.¹,² Since August, sentiment toward brand values fell 2% for Ford and Stellantis brands, and 1% for General Motors brands³, while staying stable for the rest of the industry.

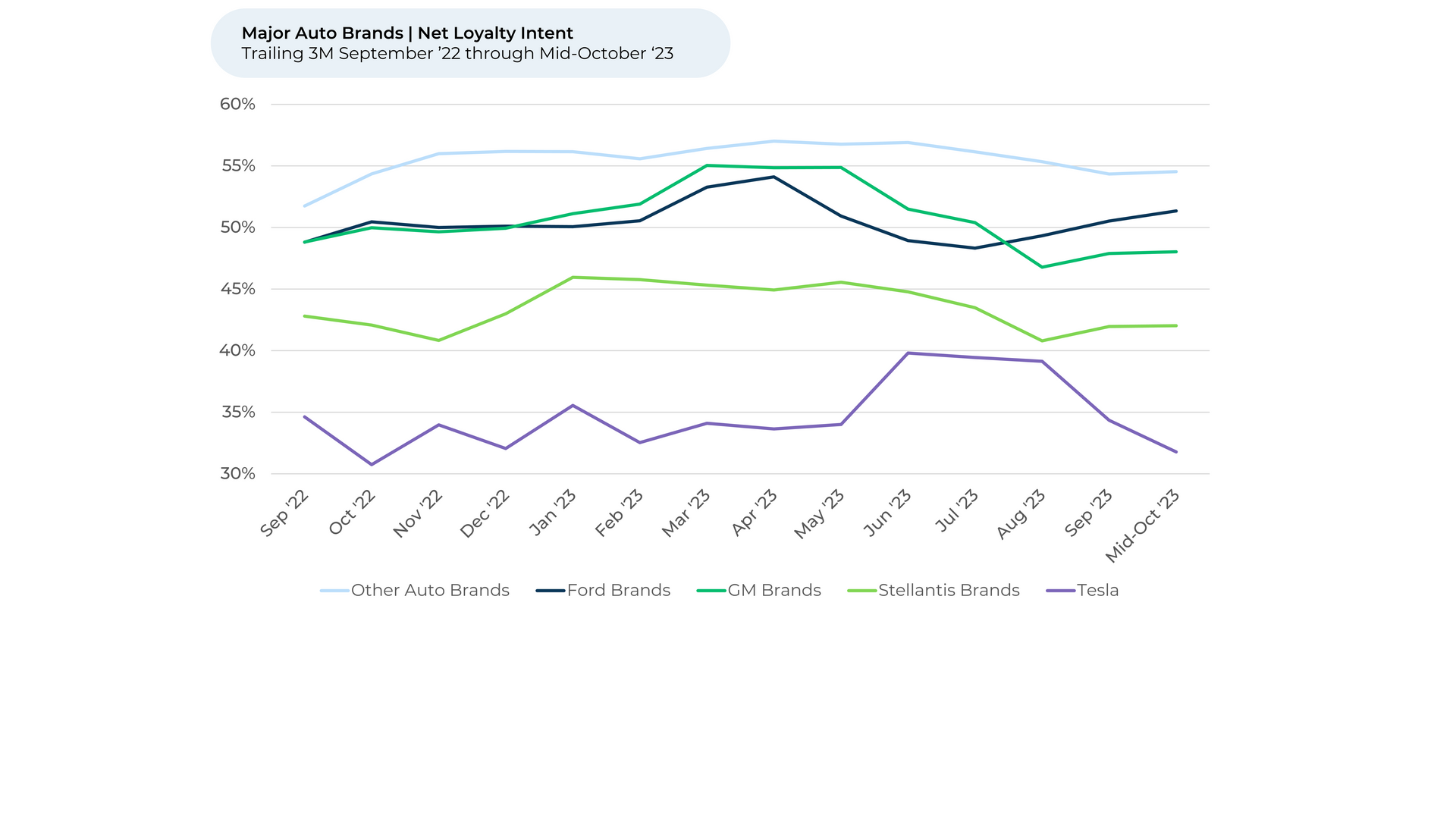

- That brand value dip hasn’t translated to dips in customer loyalty, however. Brand loyalty⁴ actually grew for the big three automakers over the past month.

- While some believed Tesla could be a beneficiary, its Loyalty Intent has actually dropped more than all other auto makers since August (down 7%), reversing all gains over the summer from its April price cuts. It announced another round of price cuts last week.

Slide title

Write your caption hereButton

Slide title

Customers felt unhappier about the brand values and trustworthiness of the big three automakers on the back of the strikes from August to mid-October. Perception dipped for Ford(-2%), Stellantis (-2%), and General Motors (-1%) reversing positive momentum the companies had before August. Perception for other brands (ex. Tesla) were flat.

Button

Slide title

As of mid-October, that dip in brand values and trustworthiness hasn’t impacted customer loyalty. In fact, customer loyalty toward General Motors, Stellantis and Ford brands grew 1%-2% since August, while falling 7% for Tesla and 1% for the other brands.

Button

Slide title

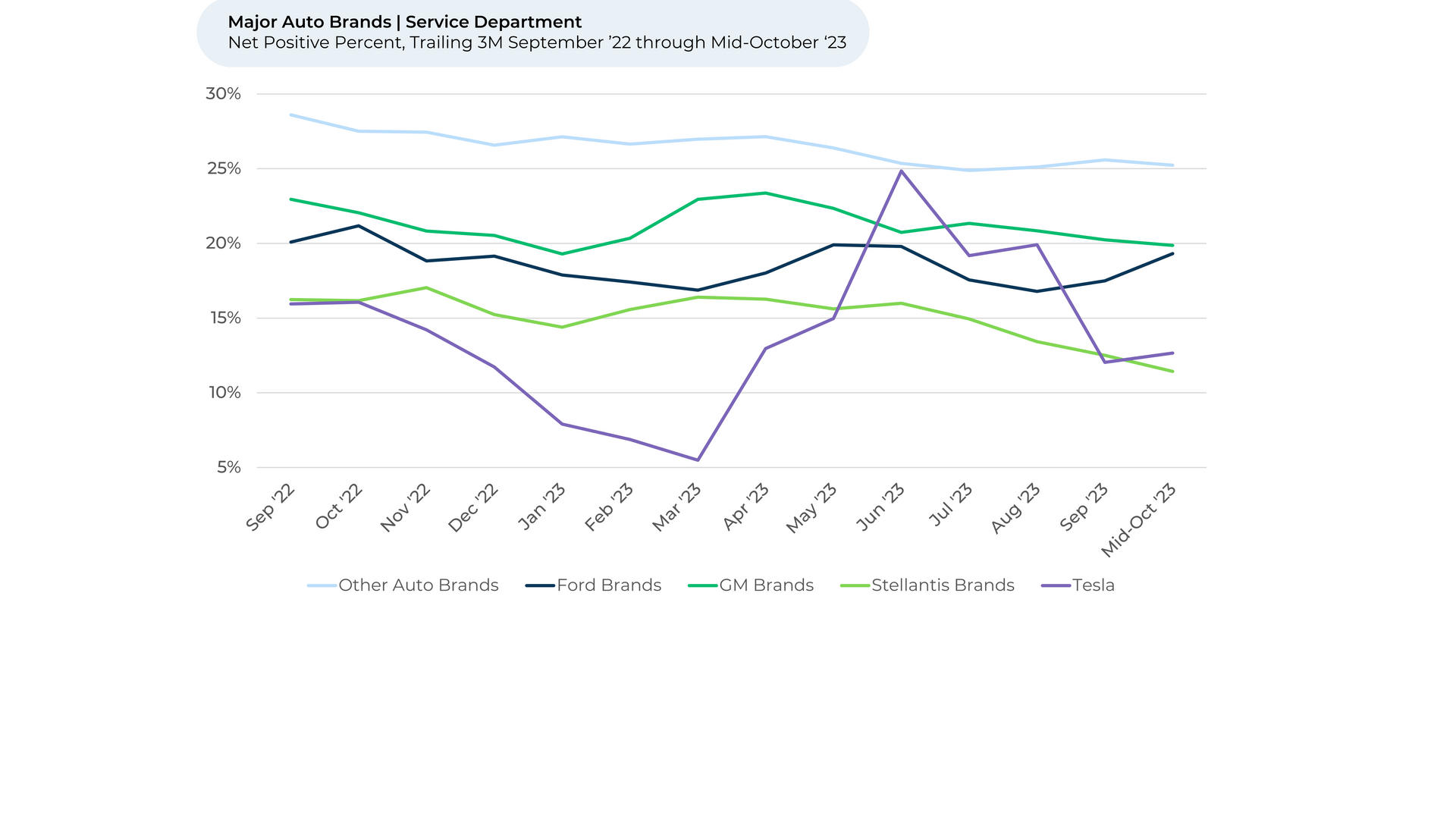

Customers likely haven’t felt the impacts of the strikes yet. While experts are predicting service

departments may soon struggle sourcing new parts, customer perceptions toward service

departments seem generally unchanged for the big three auto makers since August.

Button

Slide title

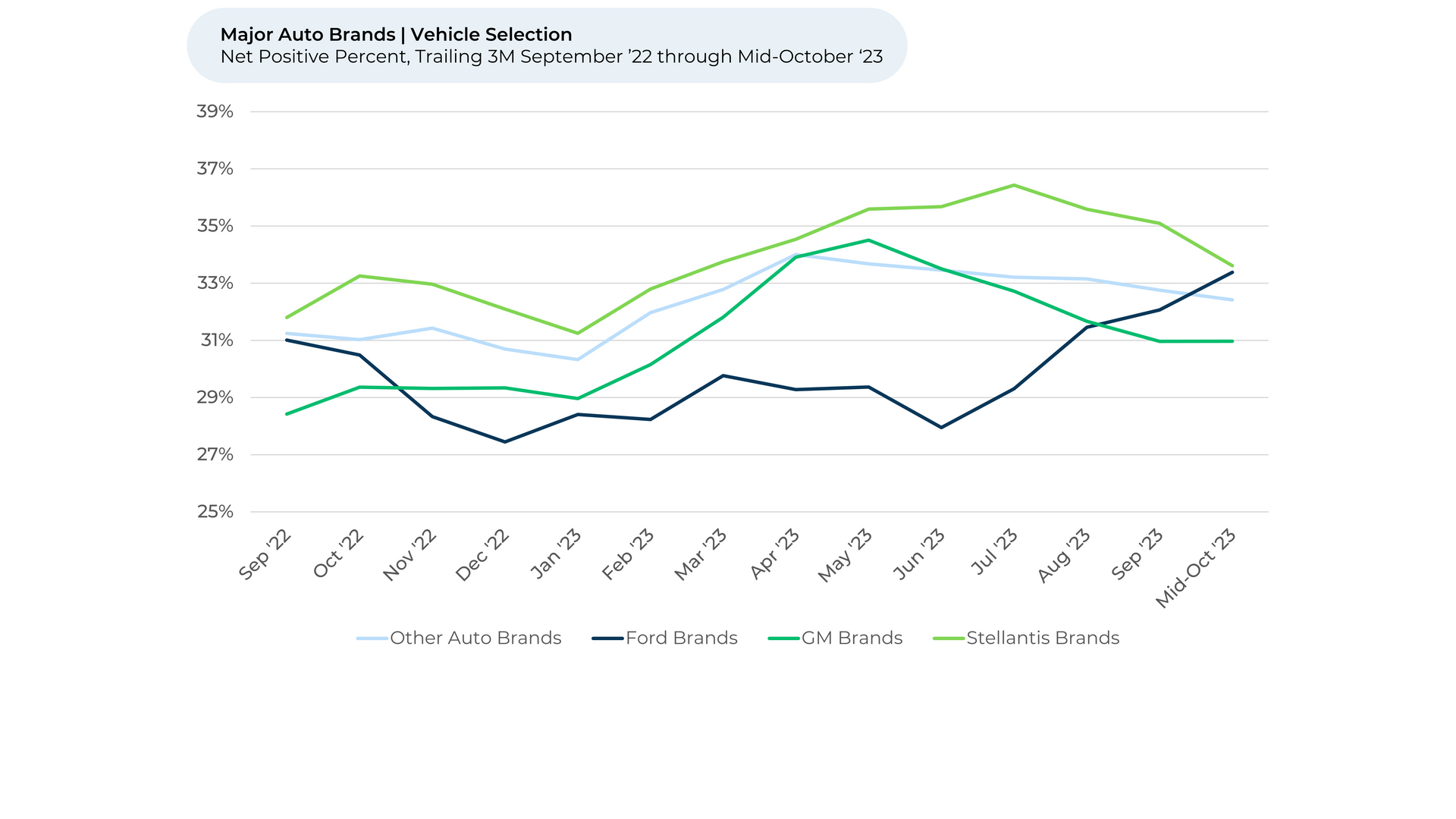

As the UAW strike continues into its second month, car buyers may soon see reduced stock and options. Customer perceptions haven’t seemed to be negatively impacted over the last

month.

Button

Slide title

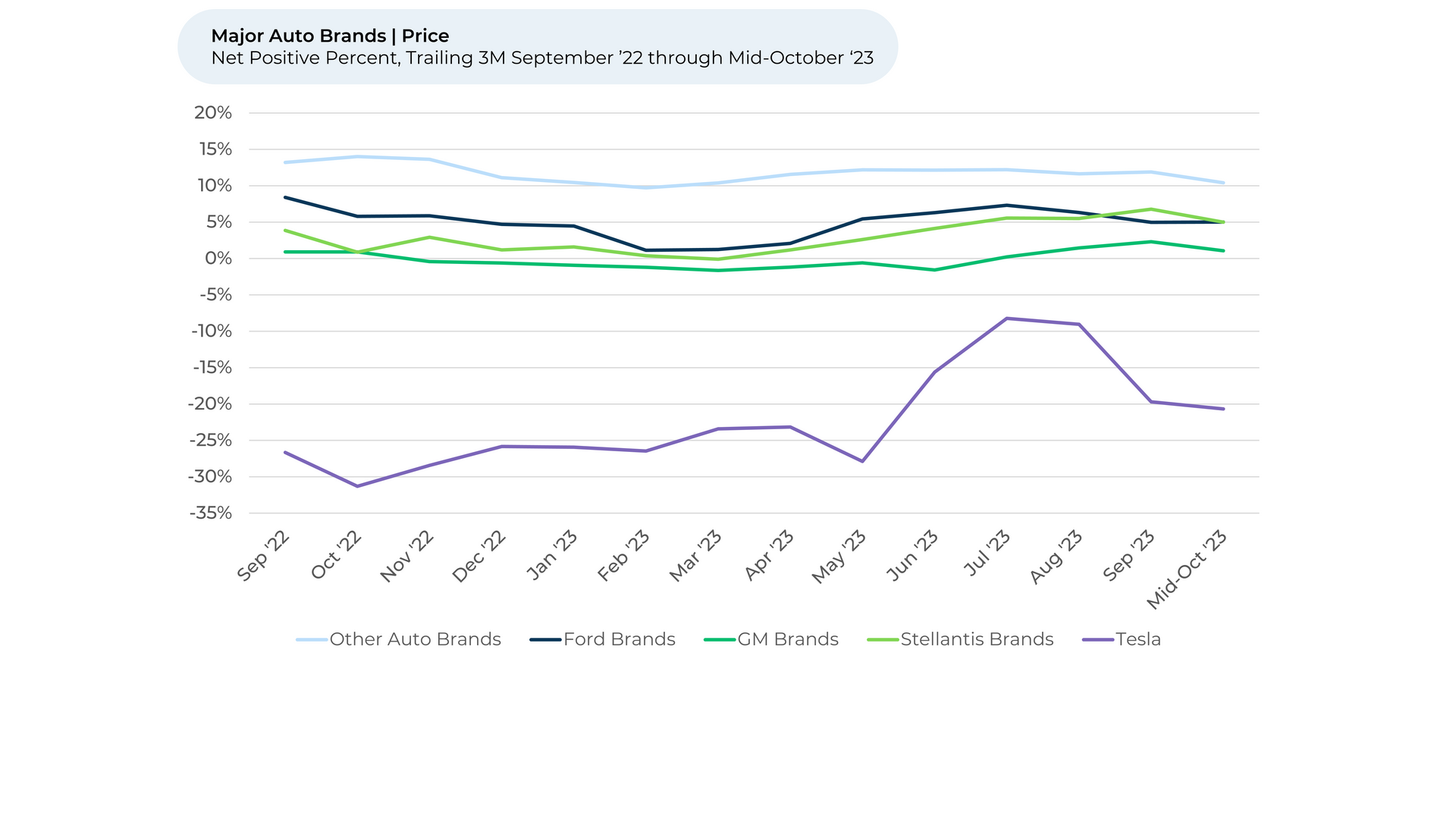

With inventory shrinking, prices may go up. GM and Stallantis customers have been feeling

happier about the price of their vehicles of choice over the past several months. HundredX

will monitor customer feedback to see if this changes in the near future.

Button

Please contact our team for a deeper look at HundredX's autos data, which includes more than 240,000 pieces of customer feedback across 45 auto brands.

- All metrics presented, including Net Loyalty Intent (Loyalty Intent), and Net Positive Percent / Favorability are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Ford brands: Ford, Lincoln. General Motors brands: Buick, Cadillac, Chevrolet, GMC. Stellantis brands: Chrysler, Dodge, Jeep, Ram.

- Loyalty intent reflects the percentage of customers who plan to purchase a specific car brand again minus the percentage who plan to switch to a new one. We find businesses that see Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

See where businesses and industries are going

All Rights Reserved | HundredX, Inc