The streaming industry has made progress but still has further to go navigating one of its biggest hurdles in years – production delays for movies and shows resulting from Hollywood writers and actors going on strike. To make up for the hole, platforms have turned to alternatives such as more international content, unscripted / reality shows and live events streaming on multiple channels simultaneously.

At the same time, industry heavy hitters like Disney+, Hulu, and Netflix tweaked their prices, which annoyed customers already grappling with inflation.

Viewers seemingly haven’t been satisfied with the content substitutions and plan changes, as the strikes and price adjustments seem to have contributed to a 1% dip in Usage Intent¹,² across the streaming industry that began in May through August.

It appears ending the strikes and getting new content back on the platforms needs to be a top strategic priority, particularly for Disney and Netflix, who have seen the biggest recent drops in Usage Intent. The Writers Guild (WGA) ended its strike September 27, while the Screen Actor’s Guild (SAG-AFTRA) is expected to meet with studios to find a resolution soon. The industry hopes it can next reach agreements with the actors who are still on strike soon.

Analyzing more than 100,000 pieces of customer feedback across 23 video streaming services, we find:

Key Takeaways

- Since April (the strike began May 2nd), Usage Intent dropped the most for Netflix and Disney+. From April to mid-September, Usage Intent fell 3% for both but rose 1% for the rest of the industry (and +1% increase for Apple TV+ and Amazon Prime TV)

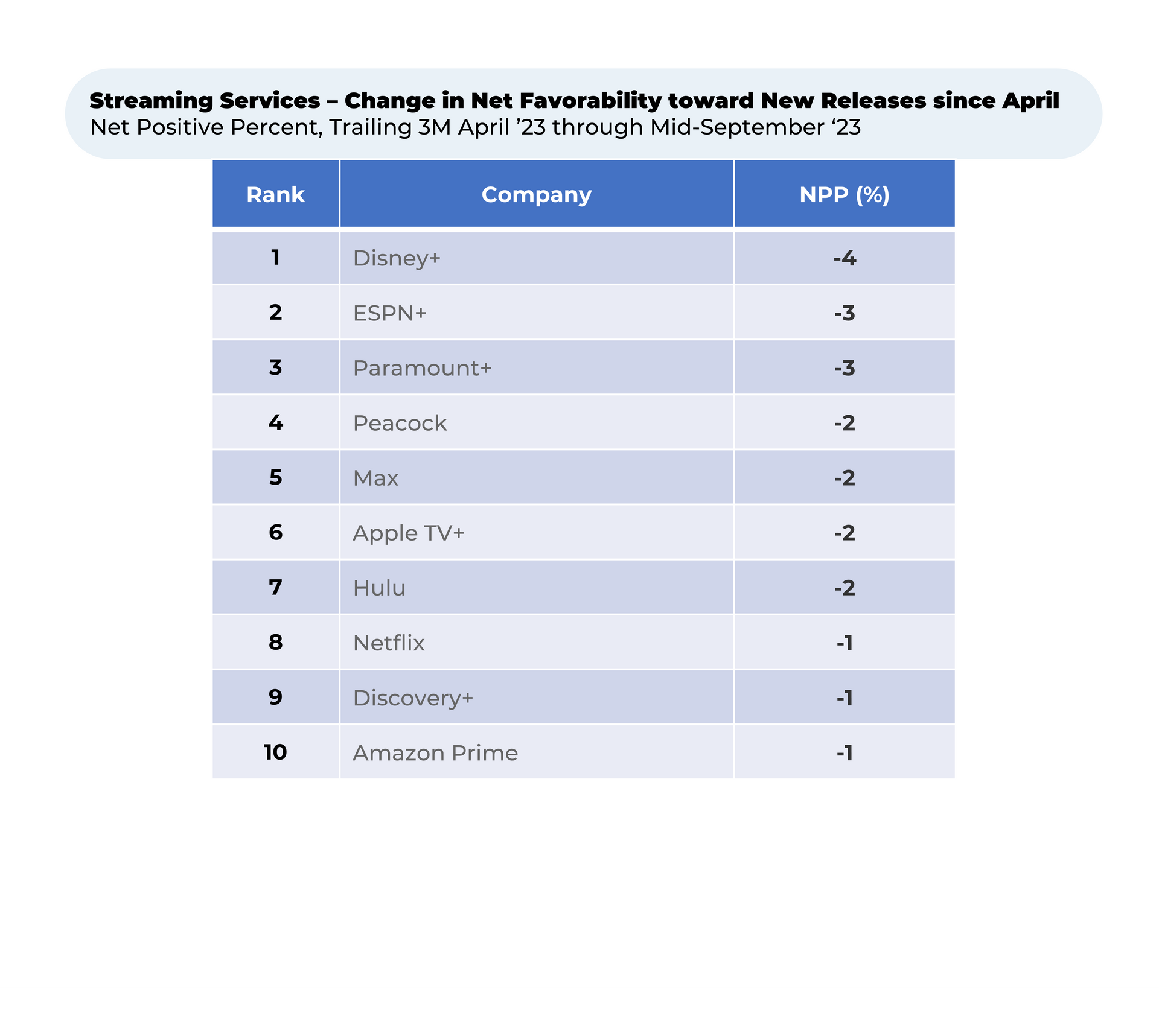

- Content delays played a role, with delays of popular movies and shows like Disney+’s season 2 of Marvel anthology What If… Customer favorability toward Original Content and New Releases fell 3% each since April for the streaming industry. Disney+, Paramount+, and Max saw the biggest declines.

- Customer perception toward price³ fell sharply for Disney+ and Netflix over the past few months (4% and 3% respectively), despite remaining stable for the video streaming industry as a whole.

Discover HundredX insights into Video Streaming Trends:

Slide title

Write your caption hereButton

Slide title

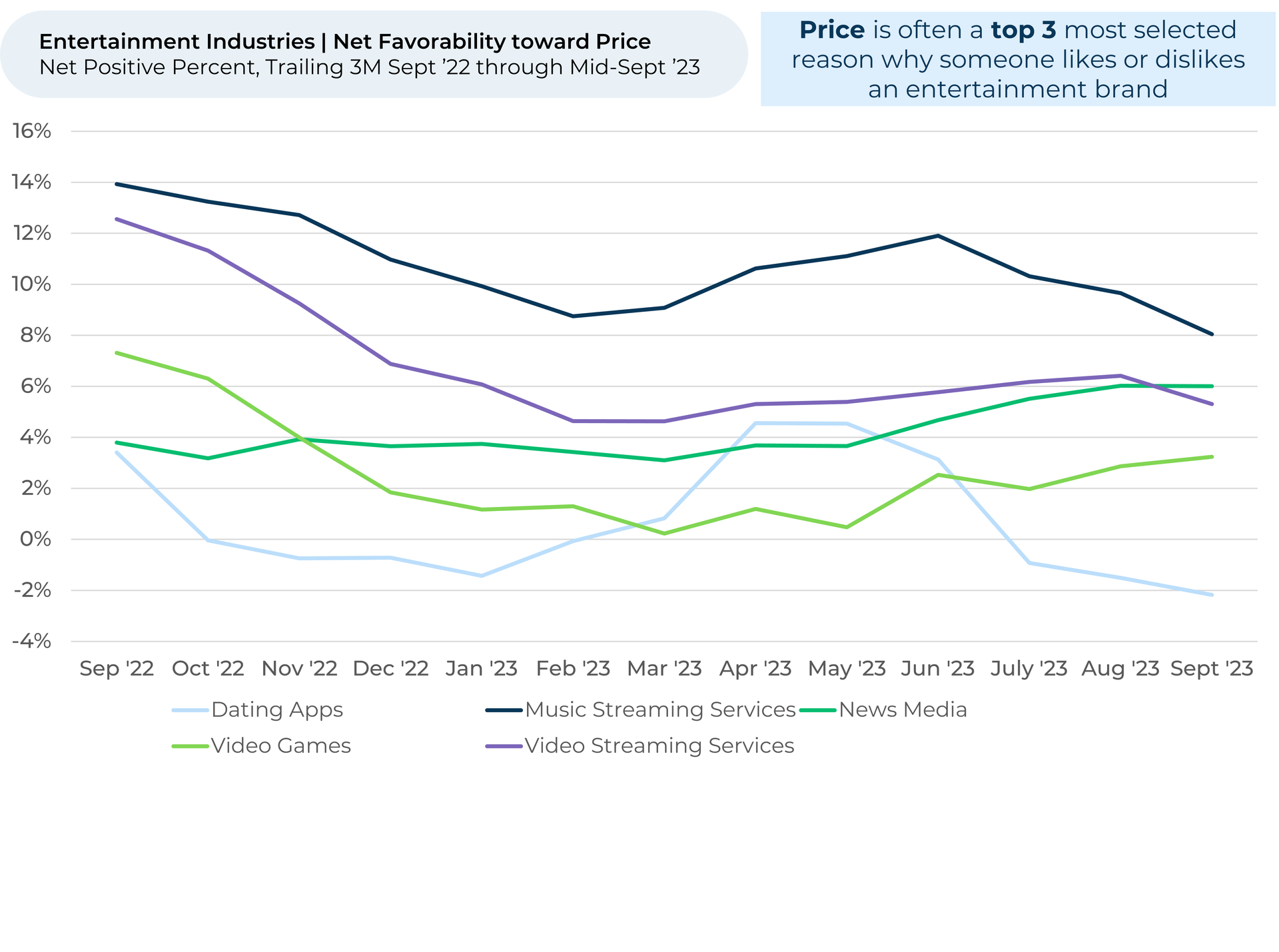

Over the past three months, customers felt happier about the prices of most entertainment industries except dating apps (-5%) and music streaming (-4%). Several popular dating apps hiked prices over the past several months and some introduced ultra-expensive plans. Similarly, several music services, including YouTube Music and Amazon Music raised prices over the past few months. In July, Spotify announced its first price increase in 12 years.

Button

Slide title

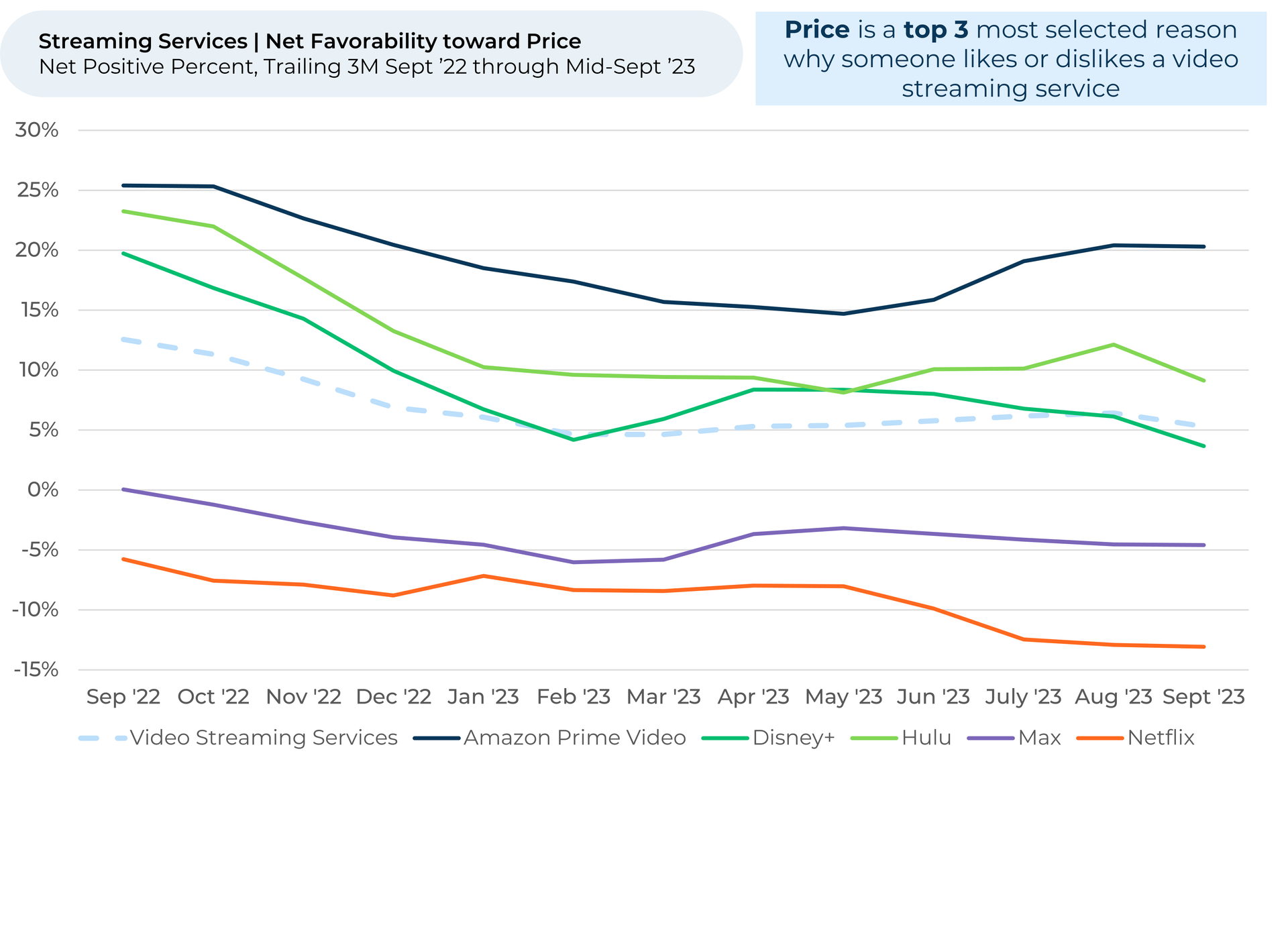

Price favorability in the video streaming industry remained stable in the last three months, but saw a 7% drop since September 2022, primarily driven by declines in Disney+ (-16%), Hulu (-14%), and Netflix (-7%). Disney’s two price hikes within a year for ad-free subscriptions, once in late 2022 and again in October 2023, have boosted ad-free subscription costs 75% for Disney+ and 38% for Hulu.

Button

Slide title

Price increases in the streaming industry, alongside the May-September Hollywood writer's strike, likely caused a 1% dip in Usage Intent over the past year. The decline in streaming Usage Intent since April contrasts with its stability from September to April, suggesting the strike played a part. Meanwhile, dating apps also faced a 1% Usage Intent decline, while news media rose by 6%. Other entertainment sectors remained stable or improved.

Button

Slide title

Netflix and Disney+ fell the most in Usage Intent since April. In addition to coinciding with the Hollywood writer’s strike, the dips also come after both services raised prices. Numerous Netflix and Disney+ shows and movies were delayed into late 2023 or 2024 by the strike.

Button

Slide title

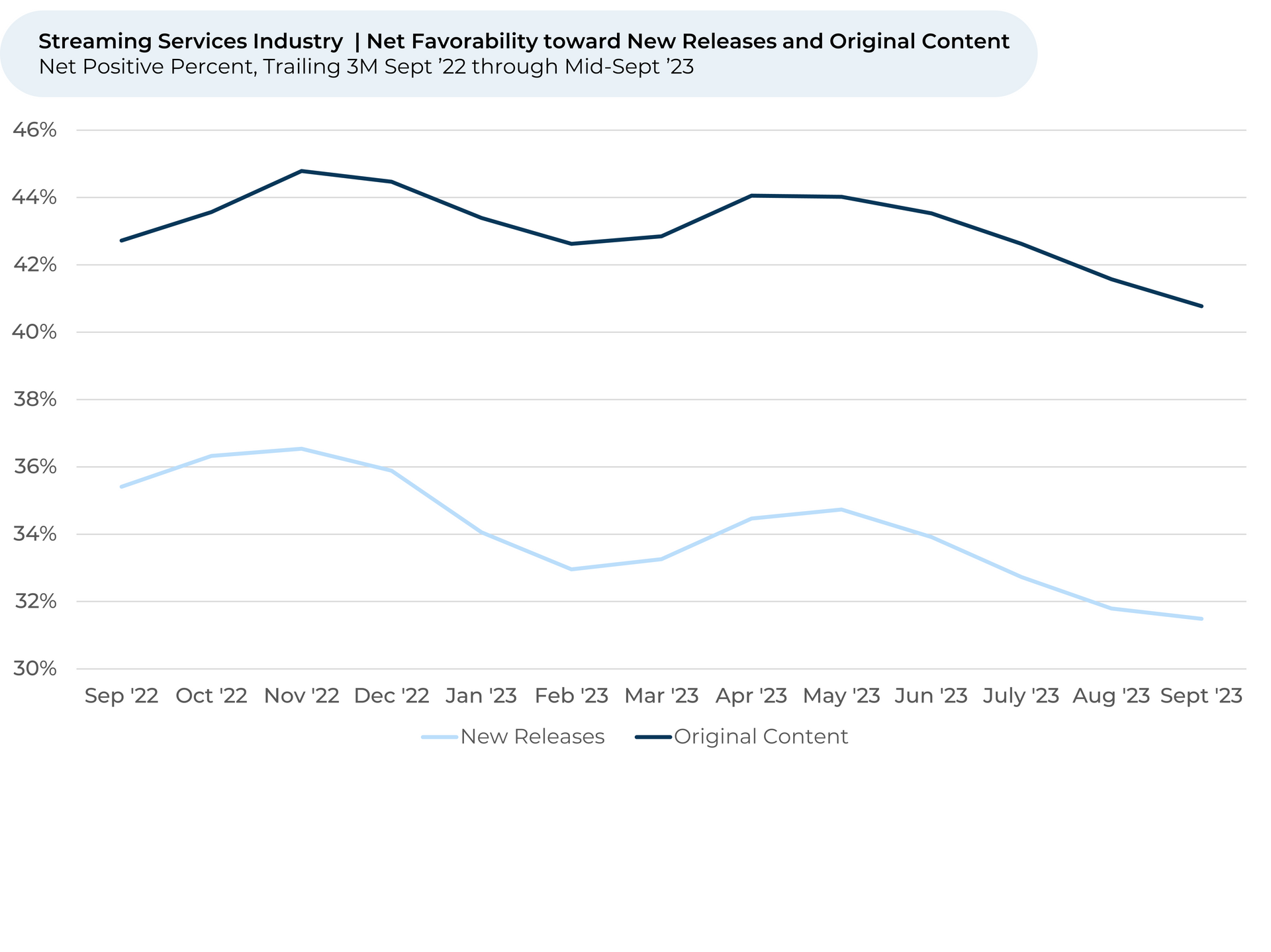

The Writers Guild of America (WGA) strike, which was followed by a strike from SAG-AFTRA actors, seems to have effected customer perception toward content. Since April, customer favorability toward original content (-3%) and new releases (-3%) fell more since April than from September to April (-1% for new releases and +1% for original content).

Button

Slide title

Disney+ has seen the biggest declines in feelings towards new releases after postponing the release of its hit Marvel animated anthology What If… from summer 2023 to December 2023.

Button

Please contact our team for a deeper look at HundredX's video streaming data, which includes more than 230,000 pieces of customer feedback across 23 streaming services.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Sentiment / Net Positive Percent are presented on a trailing three-month basis unless otherwise noted.

- Usage Intent reflects the percentage of customers who plan to use a specific brand during the next 12 months, minus the percentage who plan to use less. We find businesses that see customer Intent trends gain versus the industry have often seen revenue growth rates, margins, and/or market share also improve versus peers.

- HundredX measures net favorability toward a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.

See where businesses and industries are going

All Rights Reserved | HundredX, Inc