This report was originally published as part of our exclusive subscriber content in our November 2022 newsletter.

While the near-term focus for Disney centered on margins and employee dynamics, arguably the most important and durable question Bob Iger and the Board must understand is the state of the customer experience across its key streaming and parks businesses. HundredX looked to “The Crowd,” 130,000 customer experience summaries across the major competitors in those two business lines in the US, including over 30,000 pieces of feedback related to Disney. We zeroed in on Disney+ and Theme Parks, the two areas generating the most discussion.

WHAT WE HEARD FROM THE CROWD

Key Takeaways

Video Streaming Services

Disney experienced strong U.S. subscriber growth in Disney+ on the back of significant spending on content and promotional activity. It remains to be seen whether management can successfully sustain or grow Disney+ U.S. market share while keeping spending on new content stable, increasing pricing for its ad-free tier, and introducing a new ad-supported tier this December.

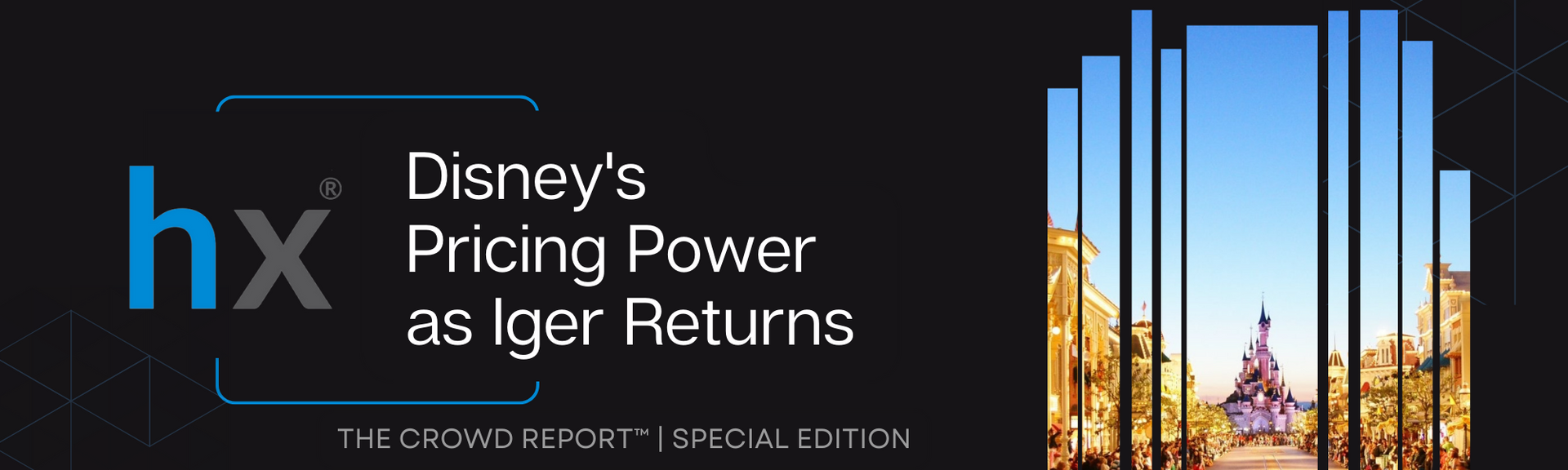

Disney+ Usage Intent1 fell April 2022 to October 2022, while the industry was flat over the same time period. Usage Intent for streaming services reflects the percentage of customers who expect to use the service more over the next 12 months minus those that intend to use it less. We find streaming businesses that see Usage Intent trends lag the industry have often seen domestic net subscriber growth also lag peers.

WHAT STANDS OUT TO THE CROWD FOR DISNEY+

Customer Satisfaction Drivers

Ease of Use

Prices

Variety

New Releases

According to The Crowd, Ease of Use, Prices, Variety, and New Releases, are the most important customer satisfaction drivers within streaming services.

Analyzing these factors, we find:

- Disney+ maintained better customer sentiment on all 16 factors we track for streaming services, including the top 4 mentioned above.

- Disney’s largest leads are in New Releases and Original Content.

- Disney sentiment for Price and Value are both positive and have had stable leads over peers for the last six months, potentially implying management should be able to successfully raise prices.

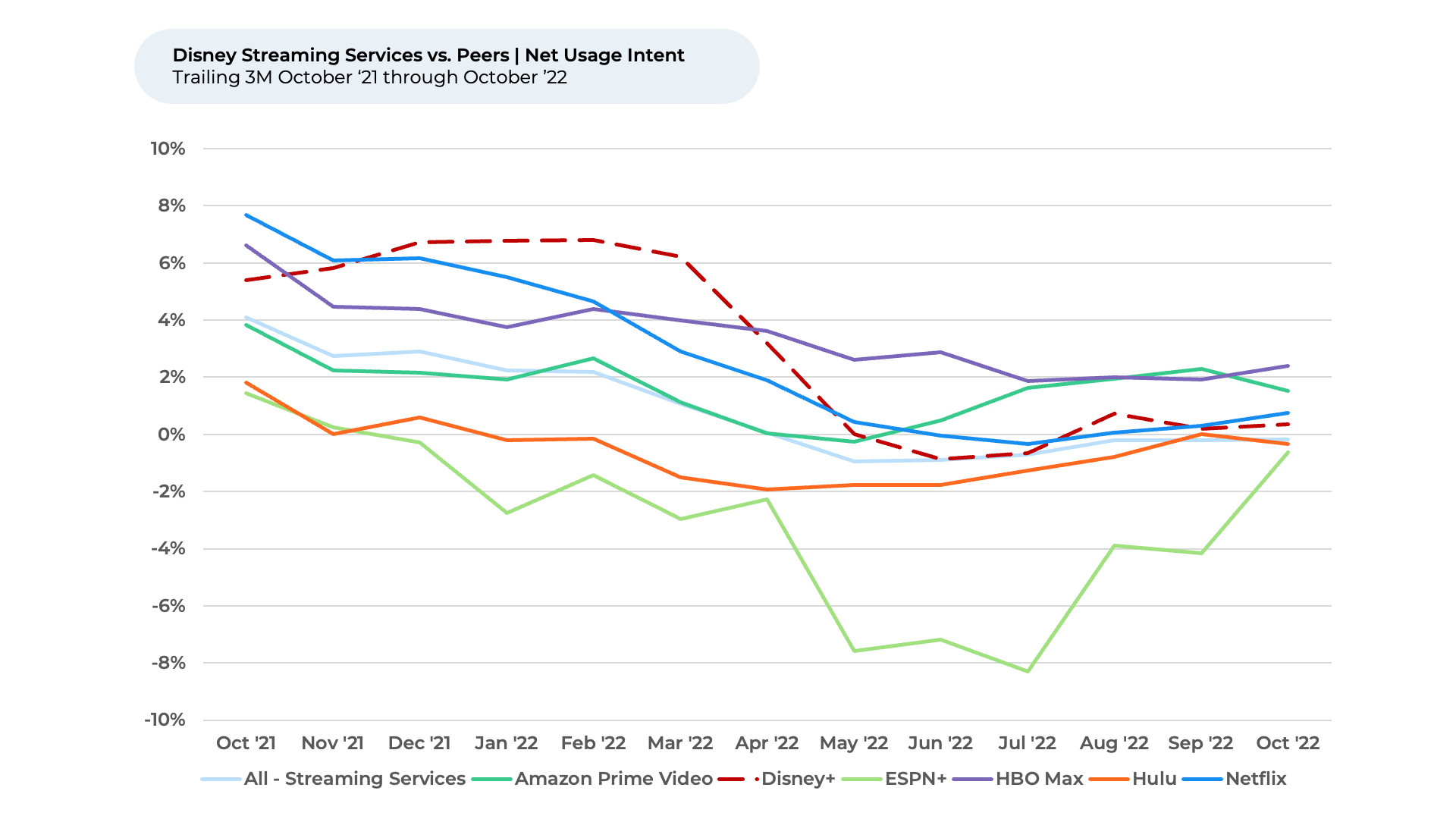

Disney+ maintains a large lead over competitors in consumers’ sentiment towards New Releases. HundredX measures sentiment1 as the percentage of customers who view a factor as a reason they like the brand minus the percentage who see it as a reason they don’t like the brand. Disney+’s sentiment rose slightly in October from July 2022, most likely due to its massive investment in content. The most recent quarter, running July through September, was the first time Marvel, Pixar, Lucasfilm, and Disney Animation studios had releases during the same quarter. Disney spent about $30bn on content in 2022 and intends to spend slightly more in 2023.

Disney+’s lead in sentiment vs. peers remained stable for Price and Value, while also showing advantages vs. peers on every other driver we track. While Disney+ is raising prices in December, the situation differs from Netflix, when it raised prices in January 2022 and saw sentiment plummet during subsequent months. At the time, Netflix’s sentiment on pricing was at parity with the industry. It had advantages in New Releases and Original Content but was near parity or at a slight deficit on Programming Quality, Subscription Options, and Brand Values.

We believe Disney+’s more favorable position in our drivers indicates it probably has more pricing power than Netflix did. Disney plans to increase the cost of its Disney+ ad-free tier in December 2022 by 40%, while also launching a new ad-supported tier at the current price of the ad-free tier. We will continue to monitor sentiment on Price, Value, and all other drivers following the planned increase.

Disney Parks

Purchase Intent1

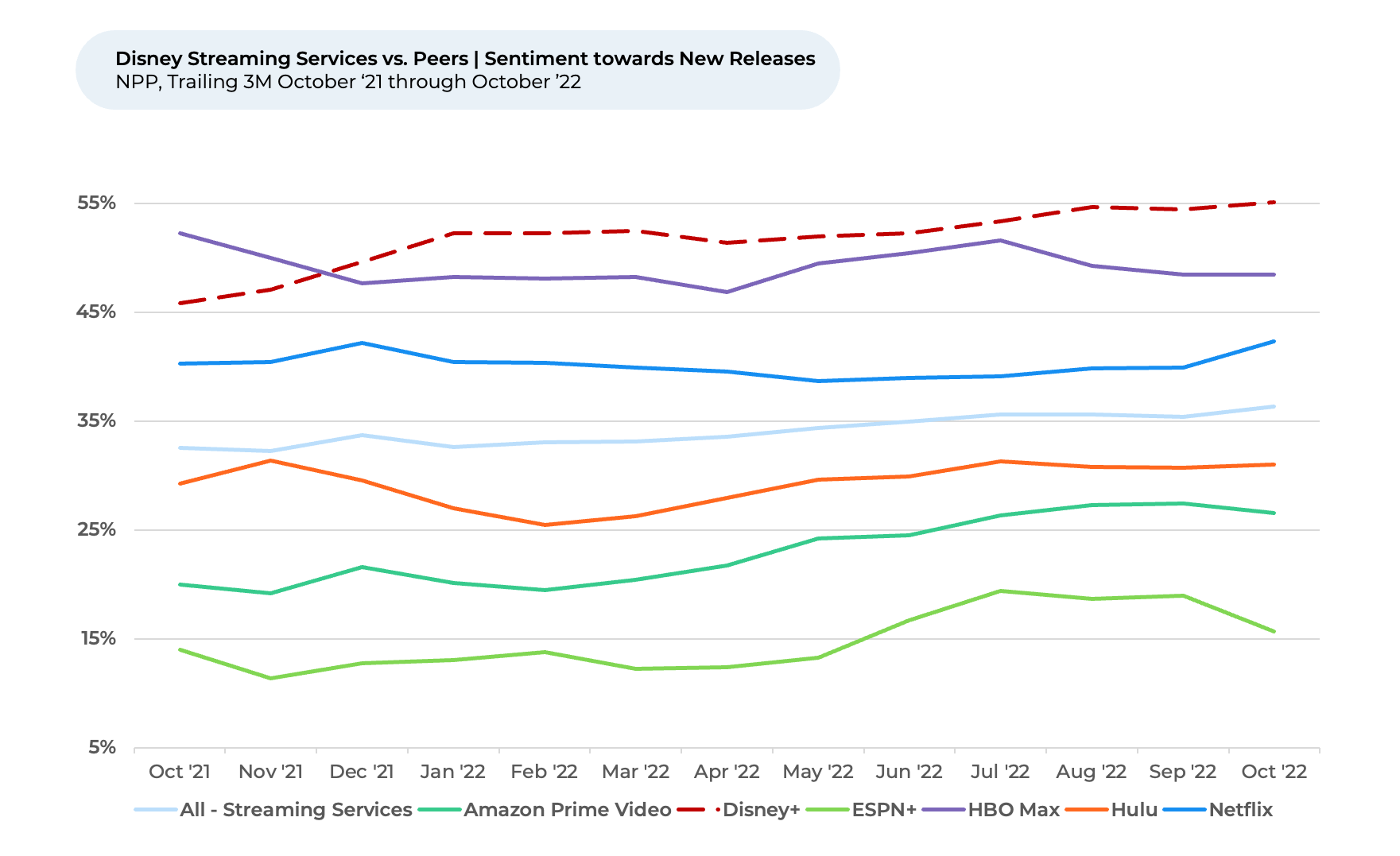

for Theme Parks we cover has trended down by 3% over the last six months. It fell by 5% for Disney World but was actually flat for Disneyland over the same time period. Purchase Intent for theme parks reflects the percentage of customers who expect to visit the park more over the next 12 months minus the percentage who plan to visit less. We find brands that see their spread in Purchase Intent improve vs. peers tend to see stronger growth rates and market share gain. J

WHAT STANDS OUT TO THE CROWD FOR DISNEY PARKS

Customer Satisfaction Drivers

Attractions

Rides

Pricing

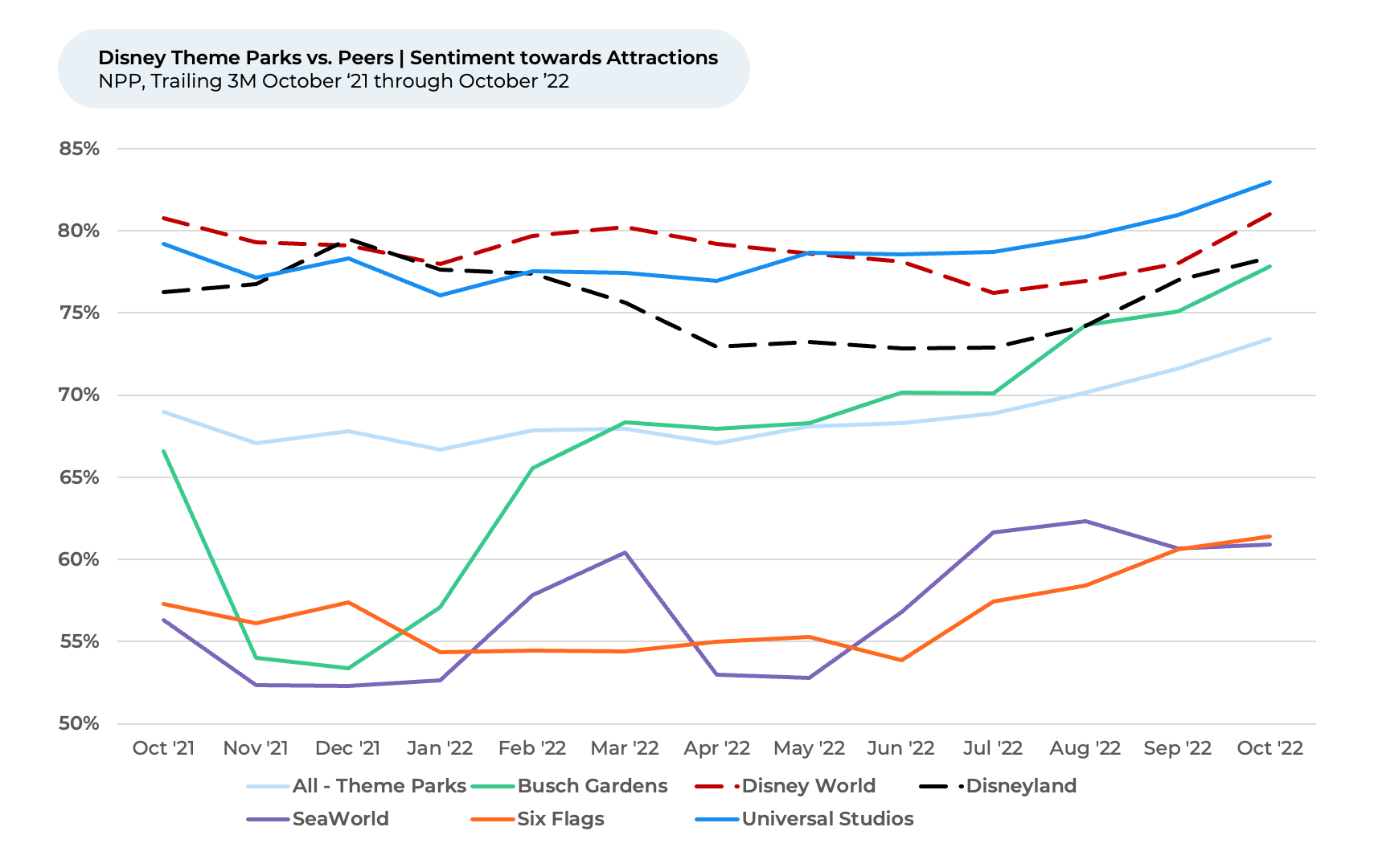

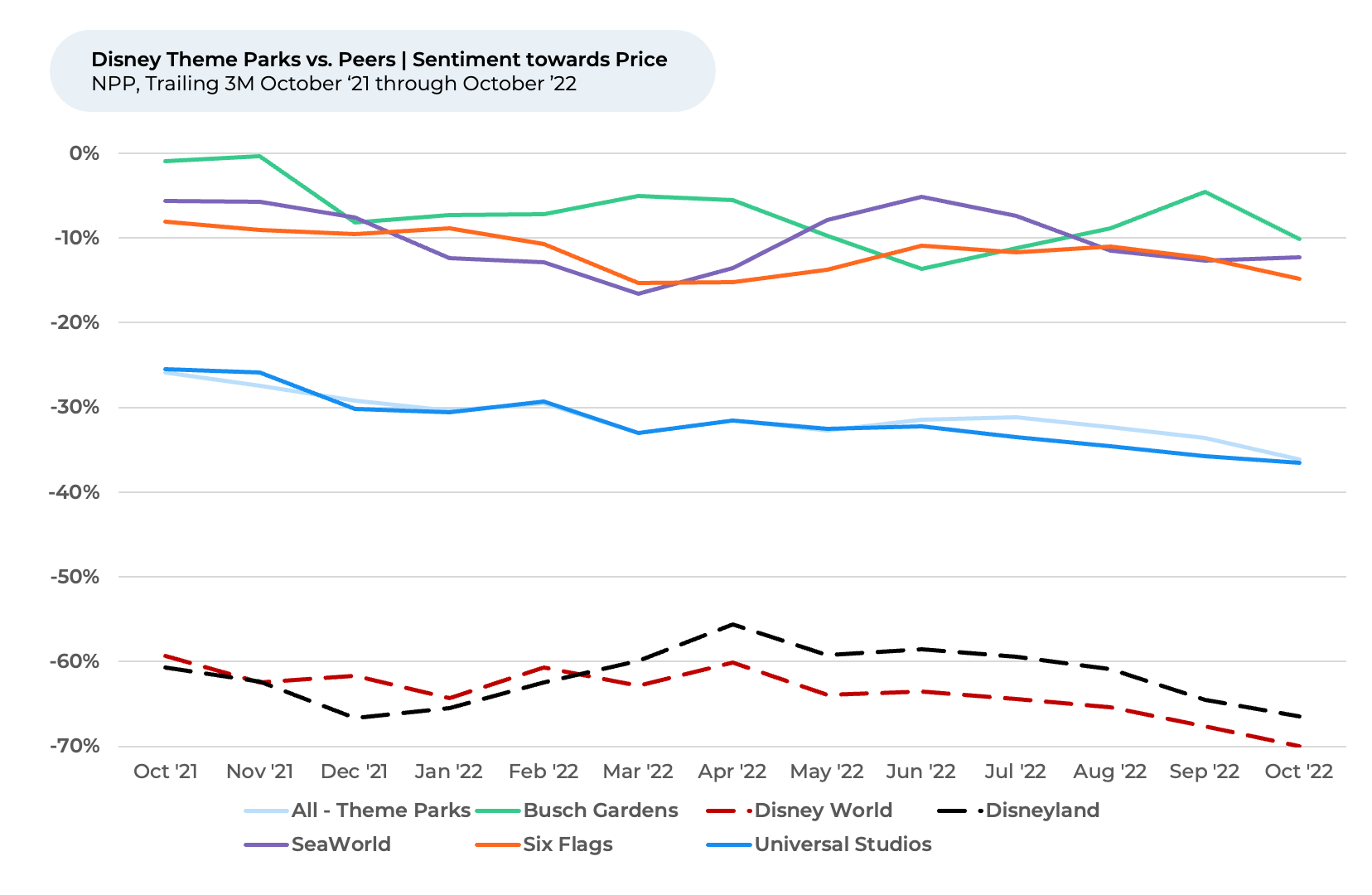

The Crowd says Attractions, Rides, and Pricing are the three most important satisfaction drivers within theme parks, based on how often they are selected as key factors.

Analyzing these factors, we find:

- Both consumer sentiment for Disneyland and Disney World declined for Price and Value relative to peers over the last six months.

- Neither park saw a material improvement in consumer sentiment vs. peers for any other key drivers.

- Weakening pricing sentiment along with no improvement on other drivers vs. peers indicates management should probably not plan any price increases.

- Both Disney World and Disneyland remain ahead of peers on Attractions and Rides.

- Disney World is furthest ahead of peers (ranking #1 or #2 out of 11) on Staff Attitude, Cleanliness, Safety, and Guest Services.

Looking at Attractions, we see both Disney World and Disneyland continue to perform better than the peer group on sentiment. It appears Disney has a strong slate of attractions, with Disney World currently celebrating its 50th Anniversary until March 2023 and the company kicking off the 100th anniversary of Disneyland in January 2023. Disney is also hosting its annual Christmas event from November 8 through December 22, 2022.

Disney parks offer a premium experience, but at a premium price. Both Disney World and Disneyland have seen sentiment on both Price and Value fall further behind covered peers, indicating consumers increasing view Disney parks’ prices more negatively than other parks.

While The Crowd tells us Disney’s parks and streaming service are positioned to remain favored, we only see Disney+ having the leverage to raise prices without customer backlash. We continue to monitor trends within Streaming and Theme Parks to see if any changes emerge as Disney navigates this critical transition for the company.

(1) All metrics presented, including Net Purchase Intent / Purchase Intent, Net Usage Intent (Usage Intent) and Net Positive Percent / Sentiment are presented on a trailing three month’s basis unless otherwise noted.