Customer Analytics for Every Stage of Investing

Better Data. Smarter Decisions.

Enhance your investment process with fresh ideas, increased confidence, and insight into companies and industries having the greatest potential for growth with HundredX. Our syndicated, consumer experience dataset is trusted by leading HFs, asset managers, private equity firms, and corporate strategy groups for proprietary and predictive outlooks.

Idea Generation

Identify inflections in consumer and brand health, weeks before trends emerge in leading alternative data sets.

Due Diligence

Get up to speed quickly on new industries and ideas with insights into winners, losers, brand inflections, and reasons why.

Portfolio Monitoring

Avoid being caught offsides, minimize risk, and have greater confidence in decisions with instant access to brand momentum across dozens of metrics.

Coverage

Consumer

Retail, Restaurants, Grocers, Fashion and Apparel, Food, Beverages, Household Items, Autos

Leisure

Airlines, Hotels, Car Rental, Theme Parks, Cruise Lines, Fitness Centers and Gyms, Casinos, Movie Theaters

TMT

Streaming, Social Media, Media, Video Games, Electronics, Appliances, Dating Apps, Wireless Providers, Cable and Internet, Online Betting, Sports Leagues, Ride Share, Food Delivery, OTAs

Other

AI, Banks, Credit Cards, Consumer Fintech, Insurance, Hospitals, Prescription Drugs, Dental

'Crowd Wisdom' Identifies Market Shifts Months in Advance

January 2023

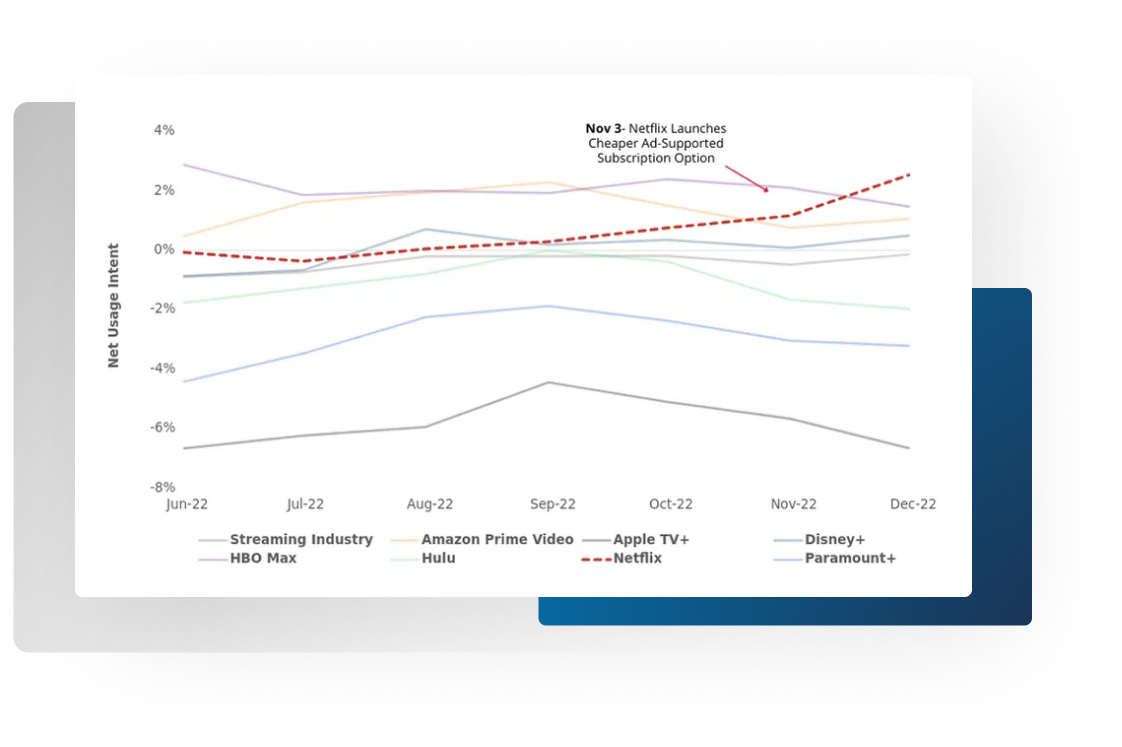

CNBC: Netflix blows away expectations on subscriber numbers

Prior Consensus View

“Netflix shares sink amid report of sluggish start for ad tier, but one analyst says that’s no surprise."

— MarketWatch, December 2022

Wisdom of the Crowd

Usage Intent is now growing quicker for Netflix than for the industry. The only service to post gains in the last two months.

—HundredX, November 2022

January 2023

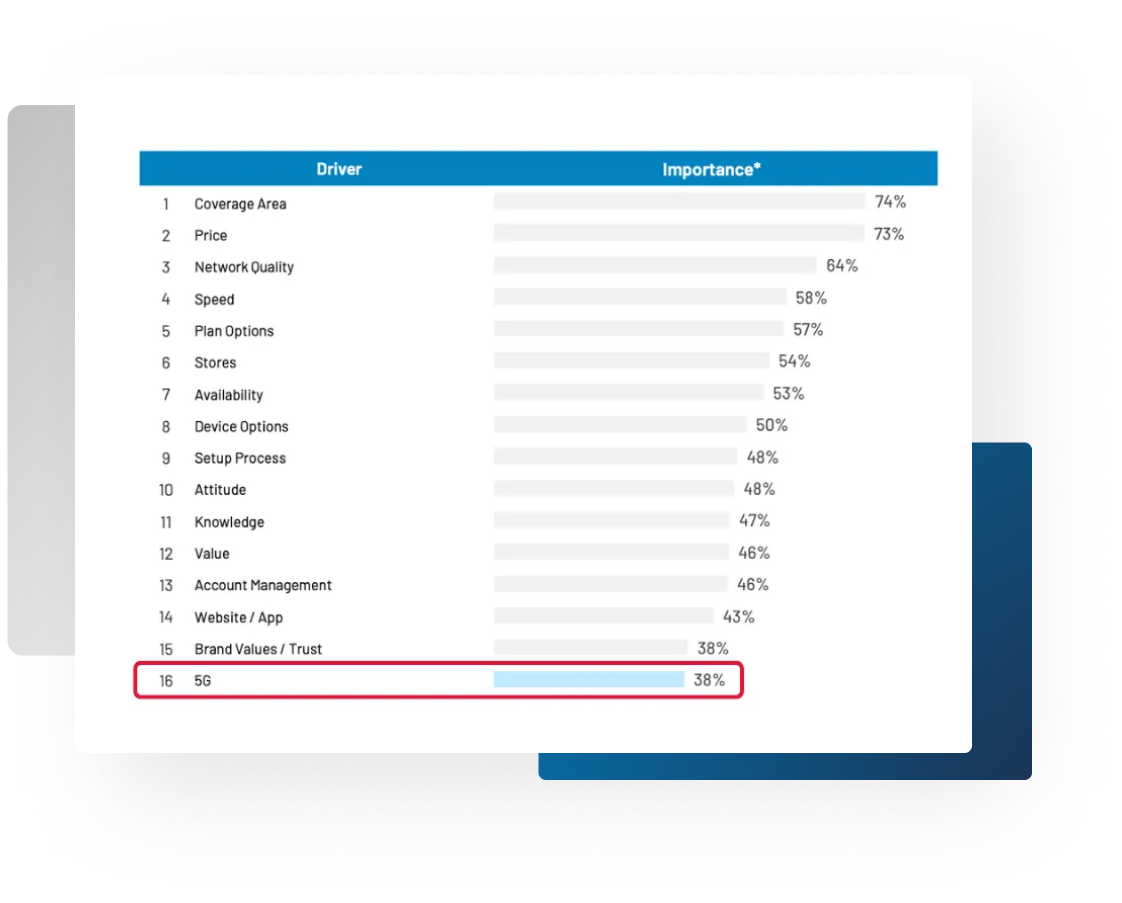

WSJ: "It's not just you, 5G is a big letdown"

Prior Consensus View

"5G technology introduction marks the beginning of a new era in connectivity that will impact almost every element of daily life."

— Deloitte, 2019

Wisdom of the Crowd

"5G is No. 16 out of 16 of what customers are talking about. What customers are talking about is coverage area and price."

— Rob Pace, HundredX CEO, The Dallas Morning News (July 7, 2021)

Featured insights from The Crowd Report™