HundredX's strategy platform gives business leaders and their advisors an early view into the growth outlook for their business. We begin by gathering feedback on thousands of businesses provided by ‘The Crowd’ - actual customers representing the US Census.

Using advanced technologies, the feedback is transformed into decision-ready intelligence unmatched by legacy solutions. Our powerful suite of products – Scout, Strategist, and Summit – enables you to understand your growth outlook, get ahead of competitive trends, and make smarter decisions.

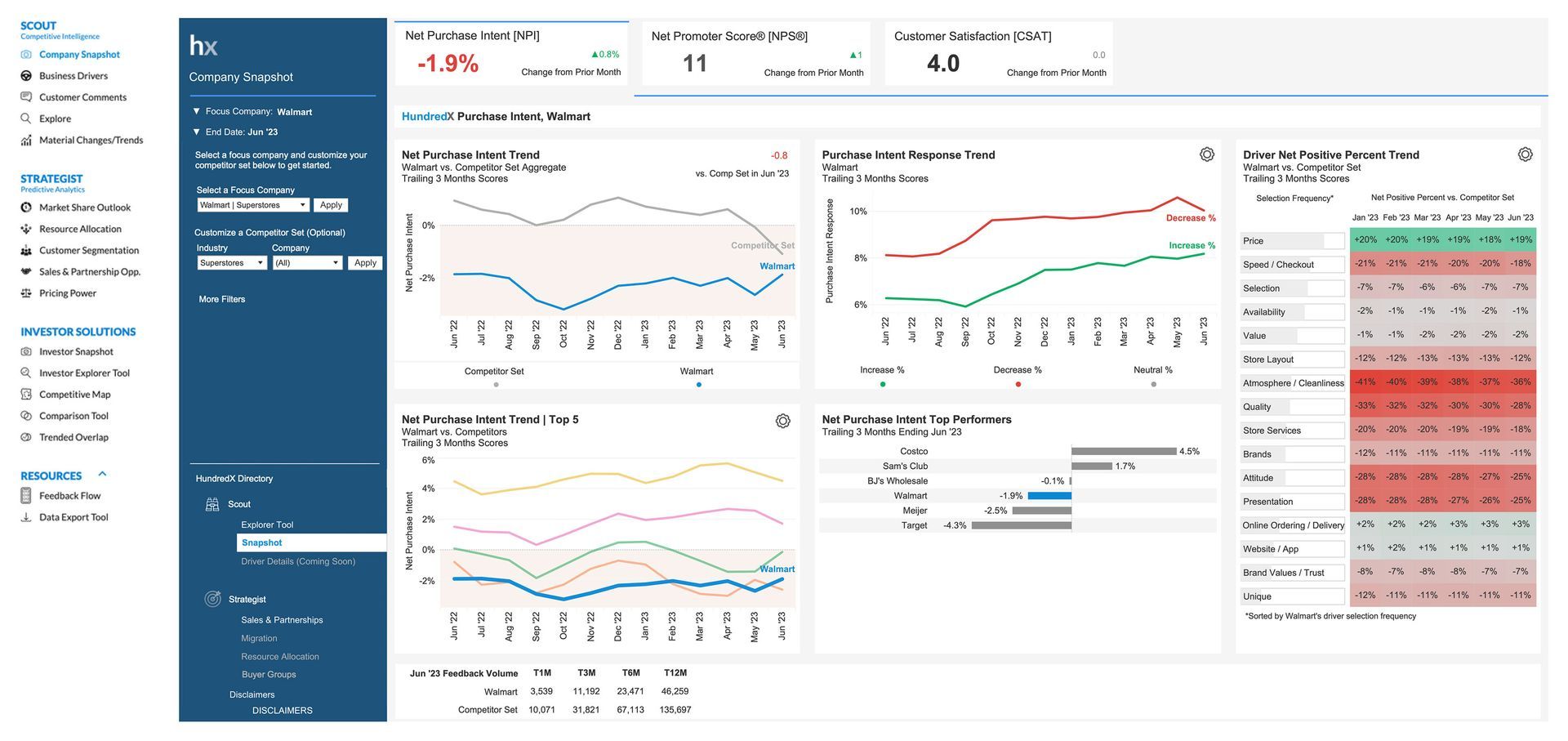

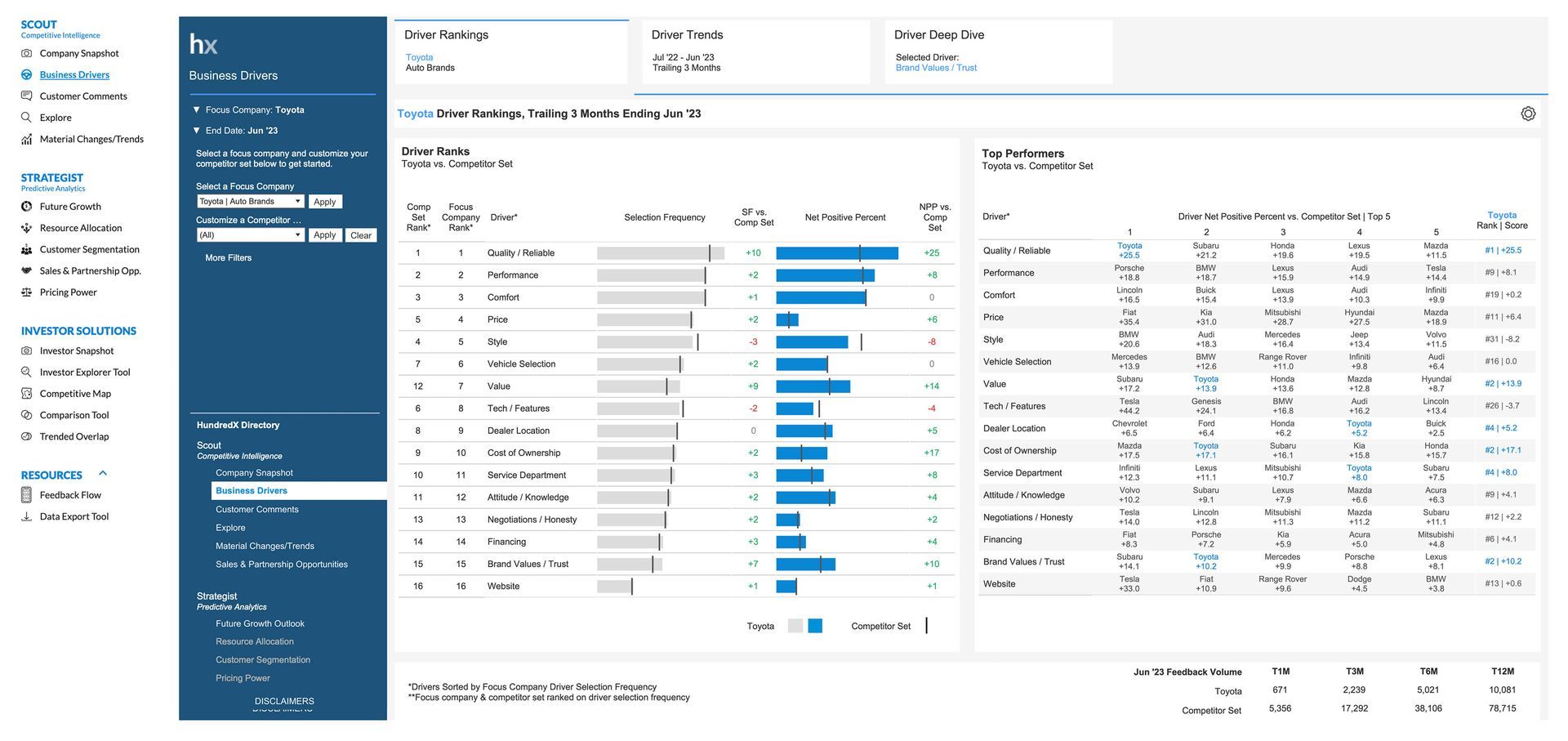

Scout

Competitive Insights needed to outperform

Stay on top of the evolving landscape with real-time insights across 90 industries and over 5,000 brands. Leverage more than 20M real customer experience summaries to understand what is driving future purchase intent, CSAT, brand relevance, NPS® and more.

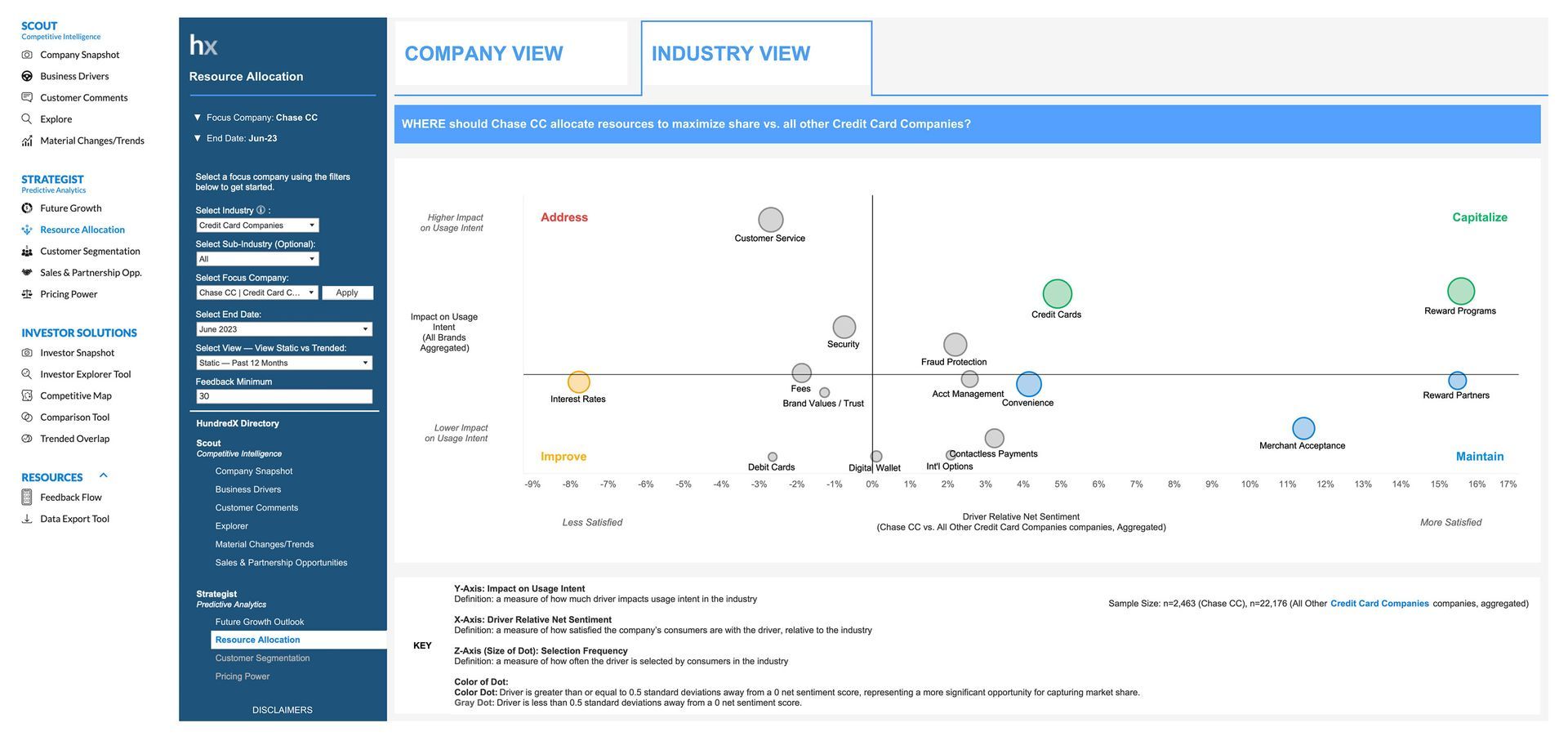

Strategist

Predictive analytics to grow market share

Strategist redefines traditional strategy projects by delivering decision-ready, predictive insights to maximize market share. As your intelligent market guide, Strategist reveals future growth outlooks for thousands of brands, segments customers by what matters most to them, reveals your pricing power, and highlights the areas for investment to accelerate growth.

Summit

Transform your business

Elevate your organization with our exclusive end-to-end operating system that unifies the voice of your customers, employees, and stakeholders to drive growth. Summit combines expert advisory services, listening programs tailored to your needs and dedicated support to deliver customized insights that elevate your business for peak performance.

“HundredX has been one of the most impactful partners we’ve ever had at the Padres.”

Erik Greupner

CEO, San Diego Padres

Featured insights from The Crowd Report™