Consumers are navigating still-high prices with resilience.

HundredX analysis, based on millions of pieces of customer feedback from July 2021 through April 2023 across 3,200+ companies, indicates inflation remains persistent, but consumers are cautiously hanging on.

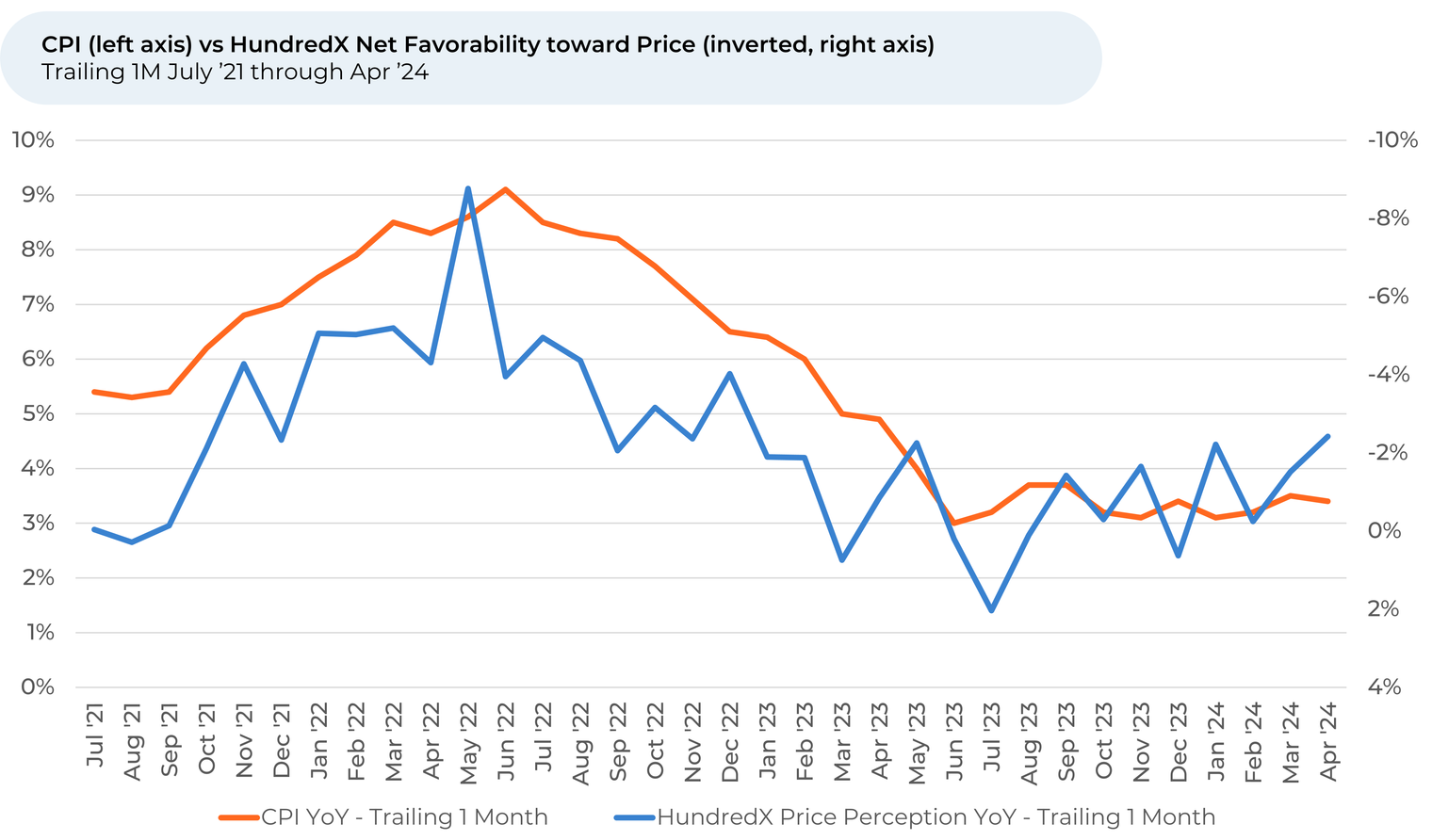

New Consumer Price Index (CPI) data shows prices increased 3.4% in April from a year ago, compared to 3.5% in March, which highlights a slight easing in inflation month-to-month. Still, HundredX data shows that consumers still feel negative about prices in general, pointing to inflation’s stickiness and consumer frustrations over the consistently high prices of everyday goods.

Generally, we’ve seen that changes to HundredX’s Price favorability index are typically inversely correlated with movement in the CPI levels (i.e., inflation) reported by the US government.

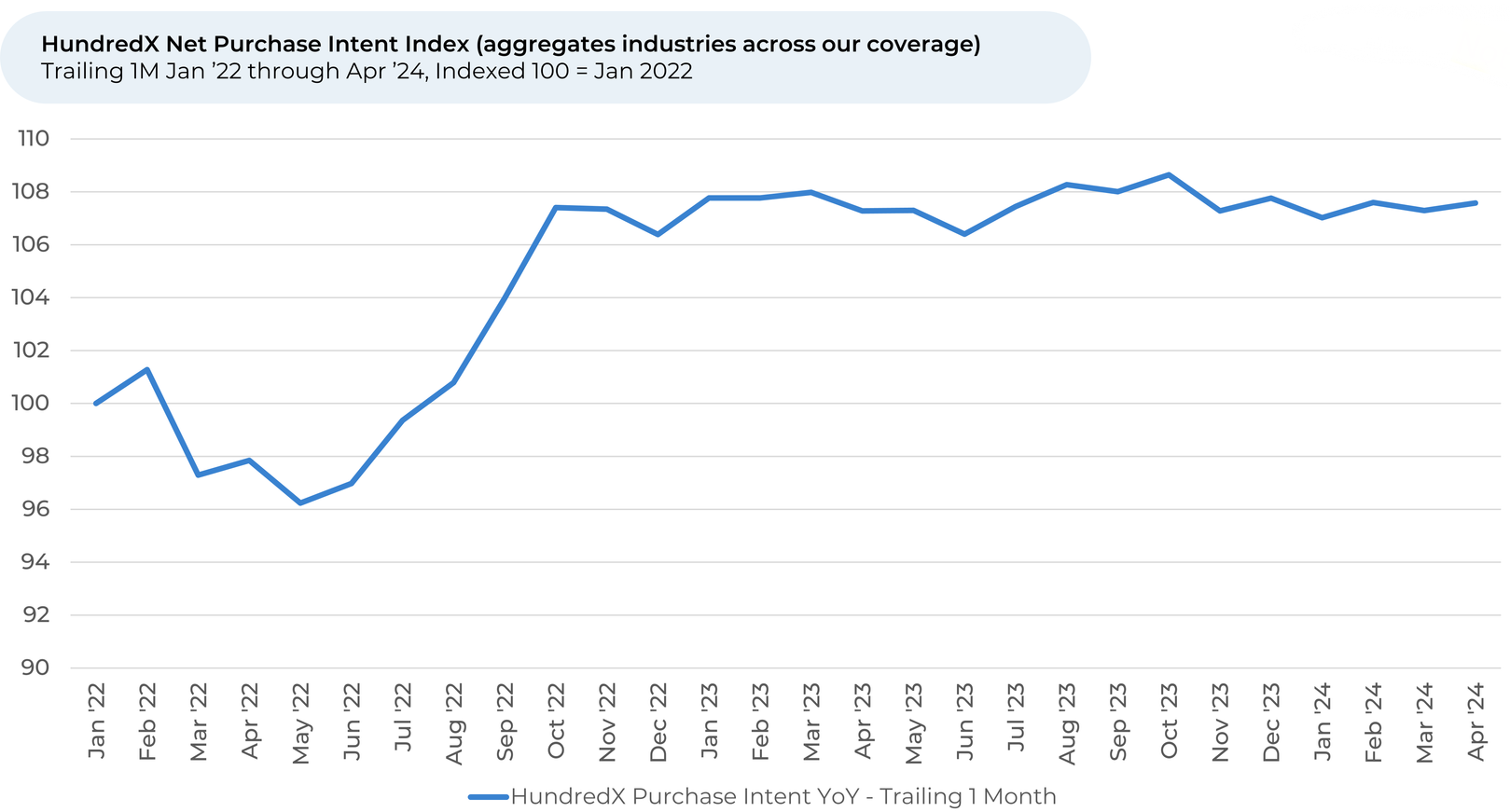

For now, though, consumers are showing resiliency. Net Purchase Intent3 has shown little change over the past few months, fluctuating by only about 0.3% since February. The relative stability indicates that consumers have mixed feelings about the economic future but are holding steady on their future spending plans. They appear ready to maintain their spending levels in the coming months. We’ll continue to monitor this metric closely for any shifts in the trend.

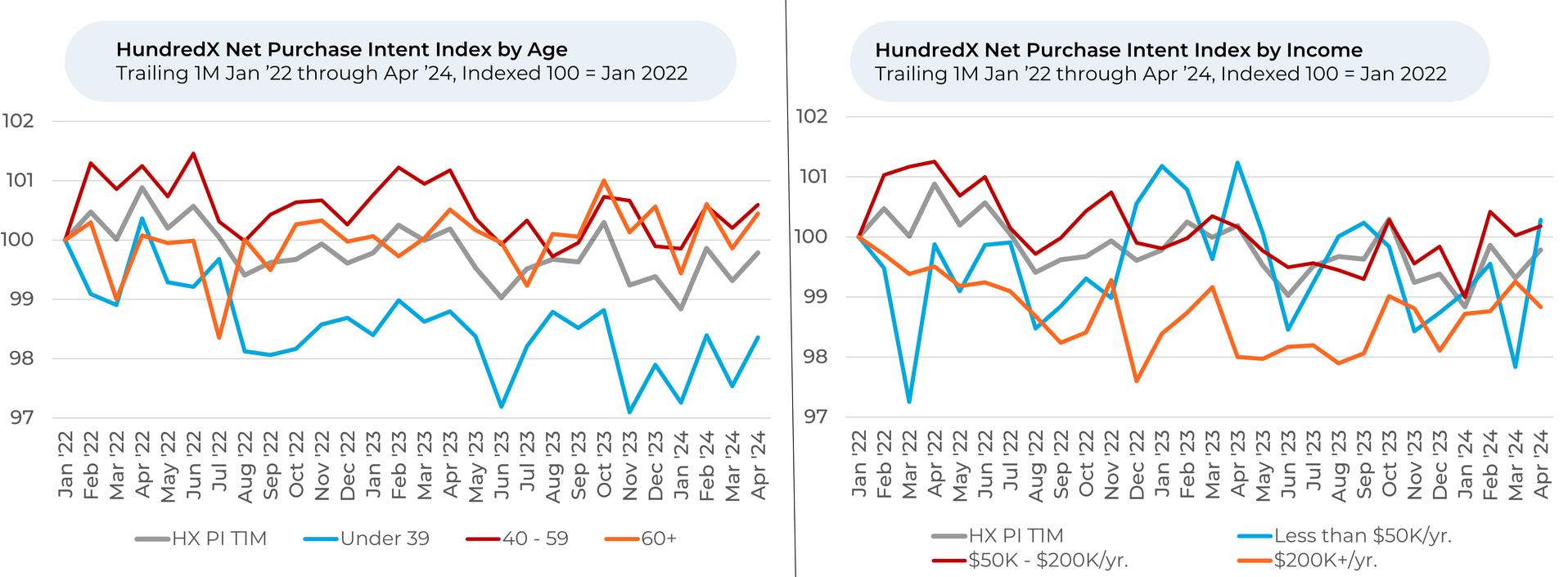

That said, we’re seeing some age- and income-correlated weakening. Over the past month, and the past three months, Purchase Intent rose less among consumers over 40 vs those under 40. It also rose less among consumers making over $200K per year compared to those making less. While the changes have been slight, HundredX data suggests that over the past few months, older, wealthier consumers are considering tamping down on spending more so than younger, poorer consumers.

We'll keep a close eye on the May datapoints as they come in to see if consumers are shifting in a new direction.

Please contact our team for a deeper look at HundredX's data insights into the broader economy or specific sectors, industries, or demographic groups.

- All metrics presented, including Net Purchase (Purchase Intent) and Net Positive Percent / Favorability, are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures Net Favorability towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Purchase Intent is the percentage of customers who plan to buy more from a brand over the next 12 months minus those who intend to buy less. We find businesses that see Purchase Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 80+ industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.