Streaming service providers could benefit by listening to the crowd

First quarter results for streaming services are now in and they proved to be one of the biggest stories among all industries this earnings season.

Despite many experts covering the streaming space, the results shocked markets as Netflix alone declined $60+ Bn in value over the 3 weeks since reporting a decline in US subscribers. But other competitors fared much better creating market share shifts that were not anticipated. What gives?

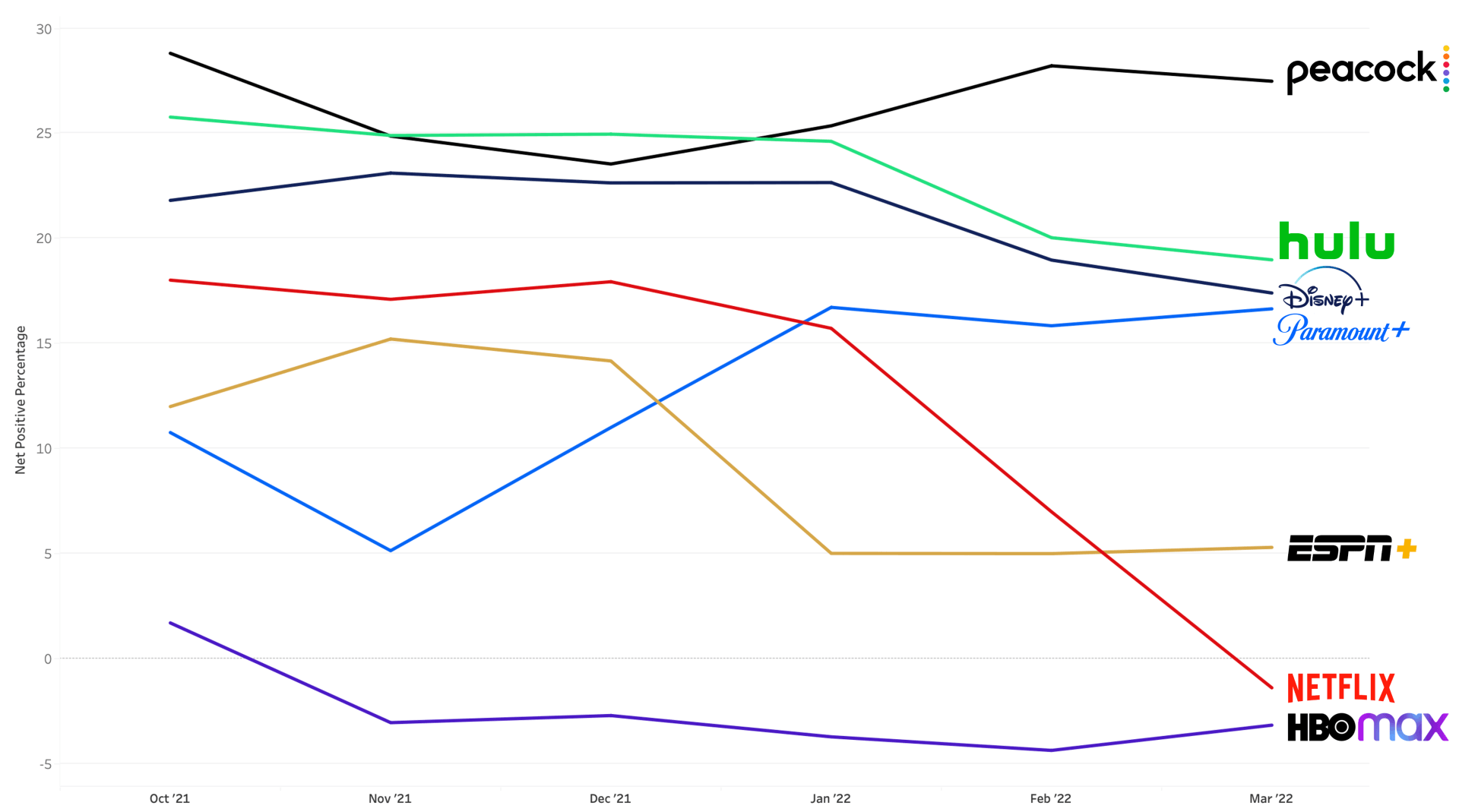

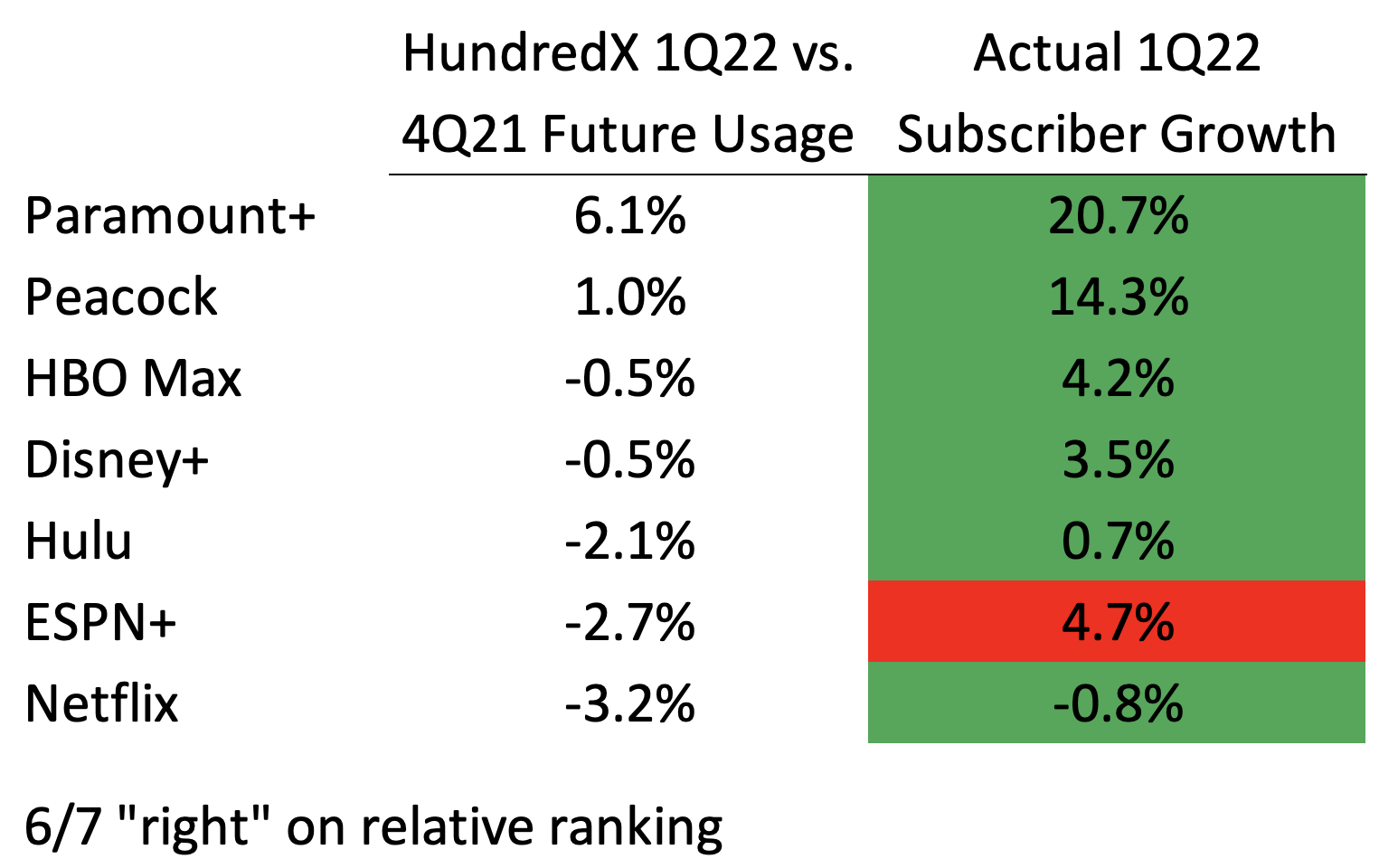

With hindsight, it would have been smart to consult with “the crowd” ahead of these results - that is, listen to actual customers using the various services. In fact, looking at data available ahead of the releases, the crowd even got the expected order of relative growth among key competitors right for 6 out of 7 companies this quarter. The table below shows what HundredX was hearing from over 18,000 consumers about their future usage plans for the various players throughout the quarter.

The crowd also revealed "the why" for us. In the case of Netflix, customers perception of Price plunged within the HundredX data when compared to peers within the January to March timeframe. The painful takeaway - the industry leader didn’t have the pricing power it must have thought they it when it announced price increases during the period.

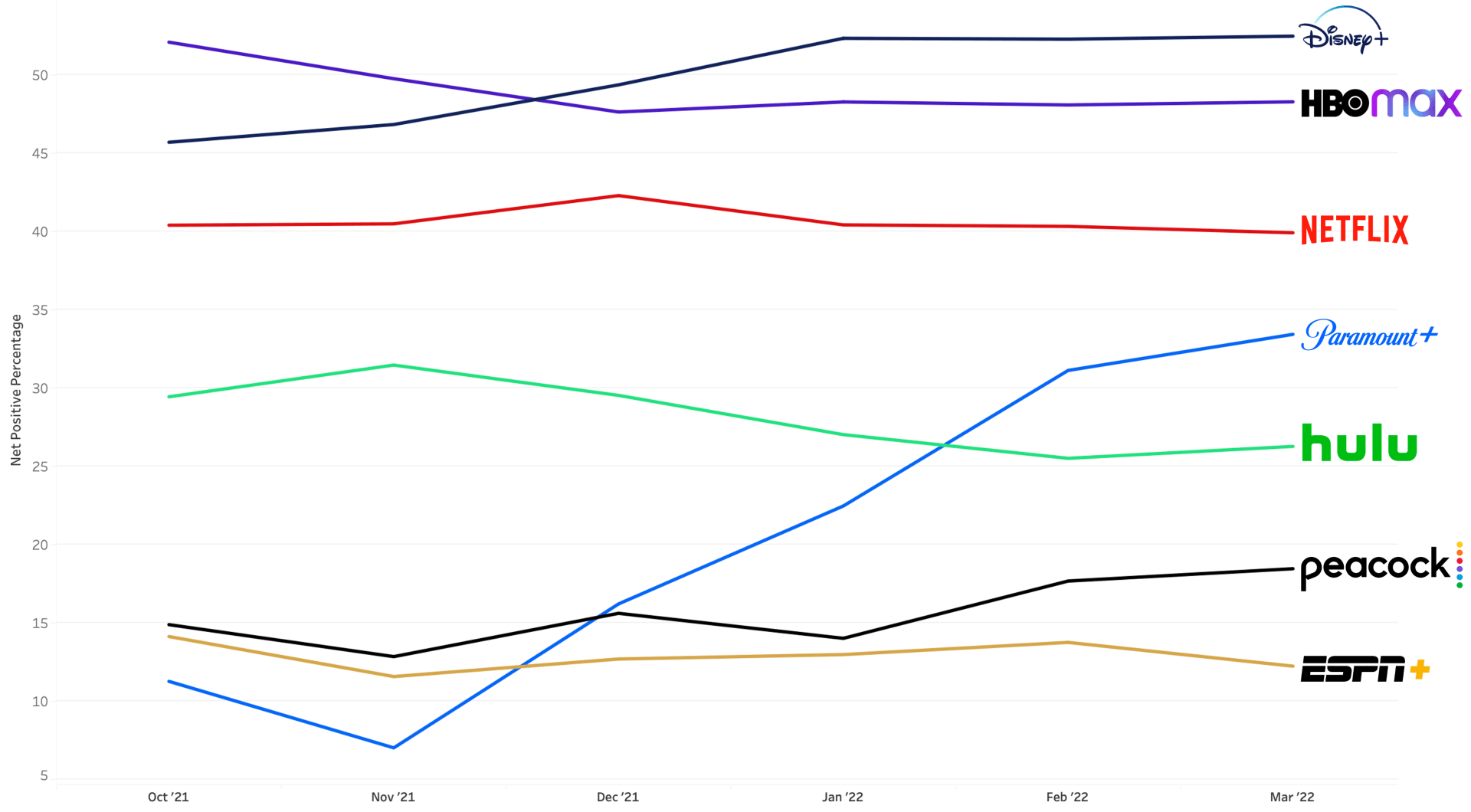

The crowd also provided visibility into why other brands were able to grow subscribers. New Releases, one of the most important drivers of subscription service success, shows Disney+ and HBO Max as clear leaders, and Paramount+ (and to a lesser degree Peacock) gaining steam over recent months.

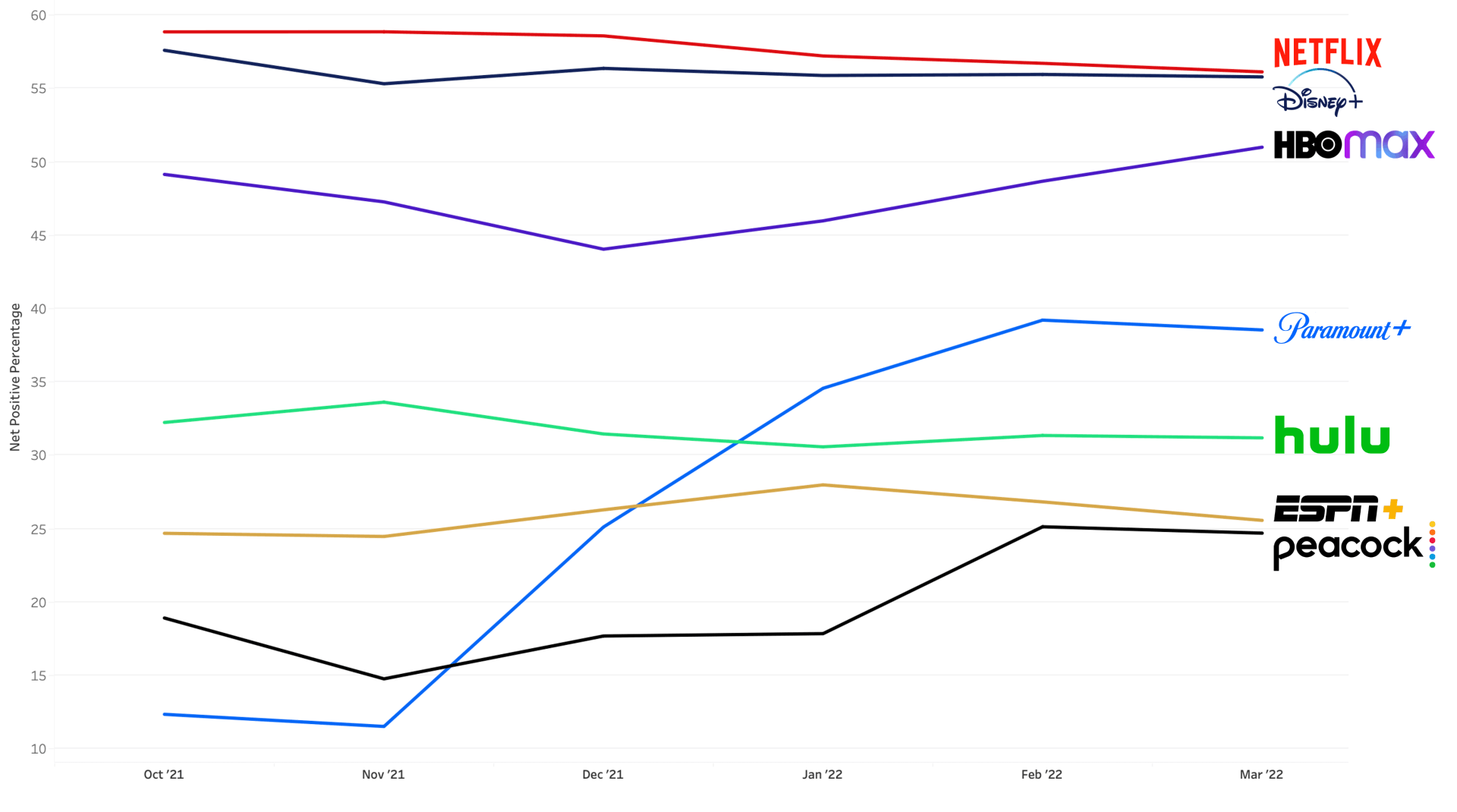

Similarly, HBO Max, Paramount+, and Peacock have all gained significant ground in Original Content since the end of 2021.

The combination of Netflix alternatives gaining ground in the key non-price industry drivers including New Releases and Original Content coupled with growing negative perception of Netflix’s Price tells a key story of the shift in subscriber market share during Q1 2022.

The bottom line - it pays to listen to the crowd - the real experts on the future outlook between competitive businesses.

For a closer look at HundredX's data and what we're seeing so far in 2Q for these companies and others in the streaming and entertainment categories, or if you'd like to understand more about our data solutions, please reach out to us:

info@hundredxinc.com

Learn more about HundredX and our solutions by requesting a demo.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.