Understand how consumers bucket restaurants based on a variety of experience drivers and sentiment.

We all know that consumers think about some restaurants in similar ways. If you want a burger, you’ll go to a burger joint. And if you want a salad, you’ll go somewhere that makes good salads. But what if we want to understand how consumers bucket restaurants based on a variety of experience drivers and sentiment?

The HundredX data science team maintains proprietary models to identify associations among restaurant brands based on a suite of HundredX data from consumers.

These models answer questions such as:

- Do consumers view McDonald’s similarly to Burger King? How about Chipotle or Dominos? If so, how?

- How does Taco Bell compare to a company from another industry like Nike in terms of brand and diversity?

- Do people think Del Taco is like Company X, which was off Del Taco's radar? Why?

- How does Shake Shack approach or surpass a competitor in a key driver?

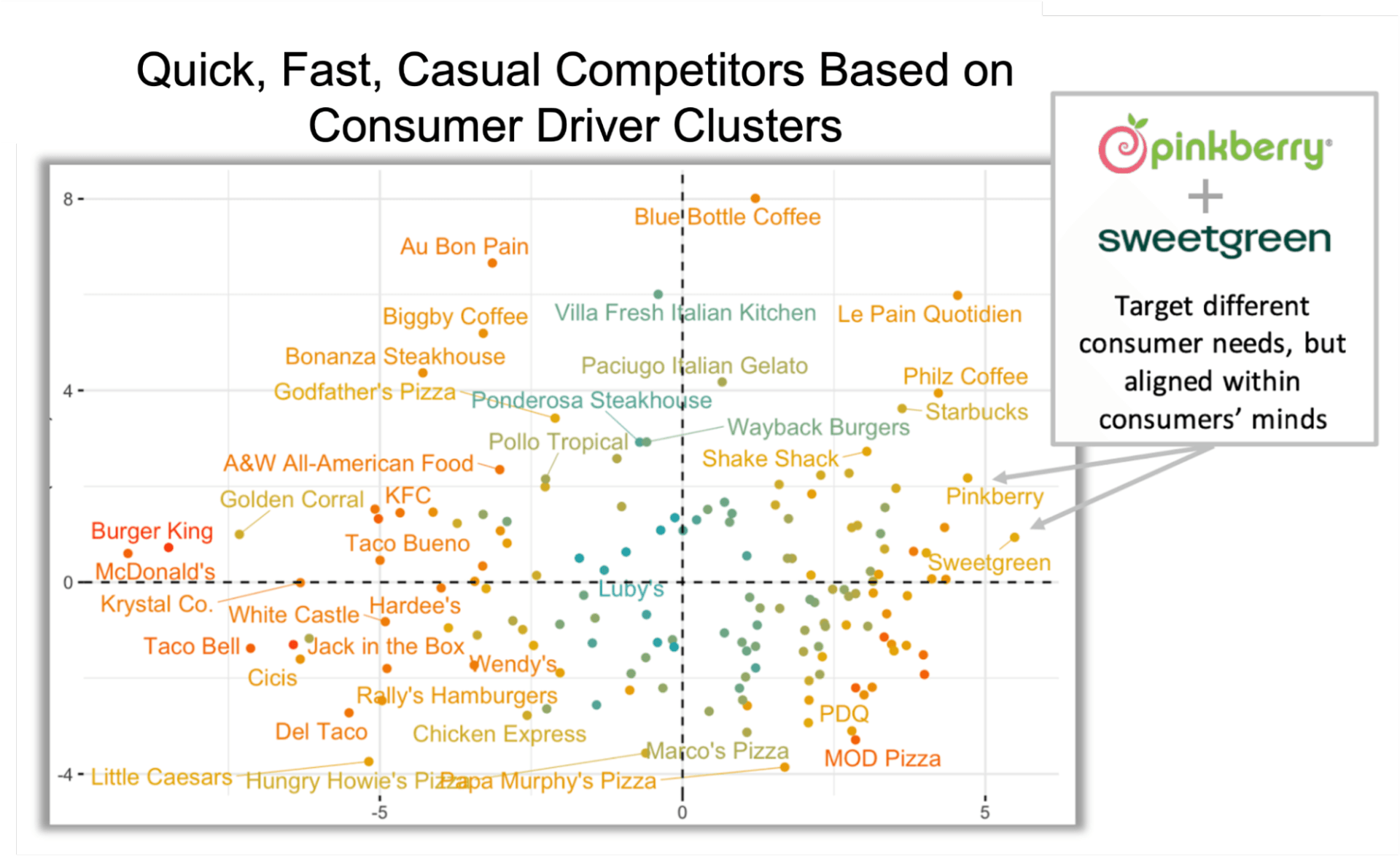

In exploring the question of consumers’ mental restaurant associations, we ran a model to cluster Quick, Fast, Casual competitors based on consumer drivers. In the process of doing so, we identified a variety of interesting and unexpected results. One of these compelling associations is the fact that consumers view Sweetgreen, a restaurant chain that serves salads, similarly to Pinkberry, a frozen yogurt chain. While these restaurants target different consumer needs (meal vs dessert), they are aligned with a common outcomes-based value proposition within consumers’ minds.

Understanding the relationships between brands like Sweetgreen and Pinkberry in the minds of consumers opens up many possibilities. The two companies could explore partnerships such as co-locations in select markets. There is also an interesting case for exploring M&A between the restaurants or similar chains. Other restaurants could look at the value propositions of each brand to target acquisition of customers who match the profile of Sweetgreen / Pinkberry customers. These are just a few of many possibilities, and the, and the strategic implications are significant and widely applicable.

This analysis is based on HundredX's proprietary data, developed from consumer feedback collected through the

HundredX Causes Program. Nothing in the HundredX data constitutes professional or investment advice on the part of HundredX.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.