Amid supply issues and record prices, the overall Automobile sector experienced a slowdown while negotiating a difficult economic landscape in 2022. Positive trends have emerged during the past few months. We currently see customer Future Loyalty continuing to rise, with some auto sectors improving more than others.

- November 2022 overall Future Loyalty1 continues to improve.

- New car prices remain high, but sentiment towards prices has been stable for the sector overall.

- In terms of specific brands, Future Loyalty for the luxury brands has increased the most during the past three months.

- Future Loyalty for electric / hybrid vehicles rose the most dramatically during the past three months, followed by minivans.

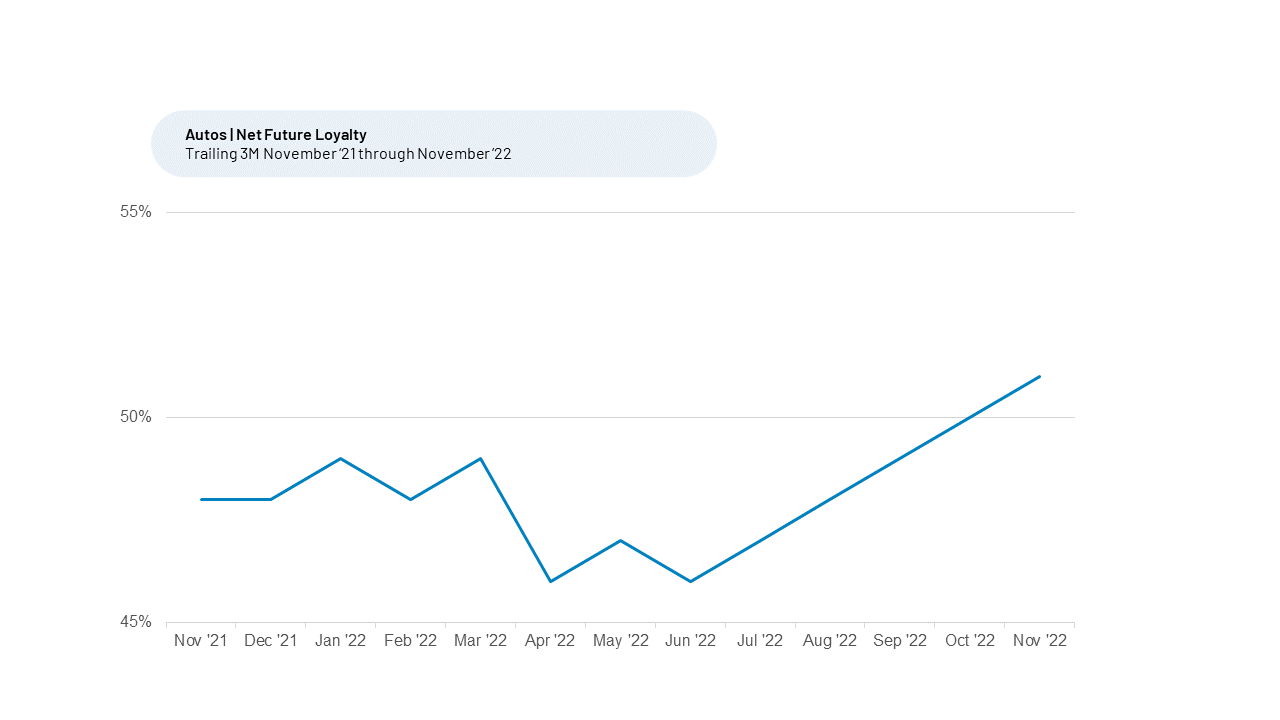

Leveraging HundredX’s proprietary listening methodology, we look at more than 174,000 pieces of customer feedback since November 2021 on Automobile brands. We use that data for insights into customers’ Future Loyalty, changing demands on Auto brands, and which companies look to benefit most. Future Loyalty for Auto Brands overall rose to 51% in November 2022, after hitting a recent low of 46% in June 2022.

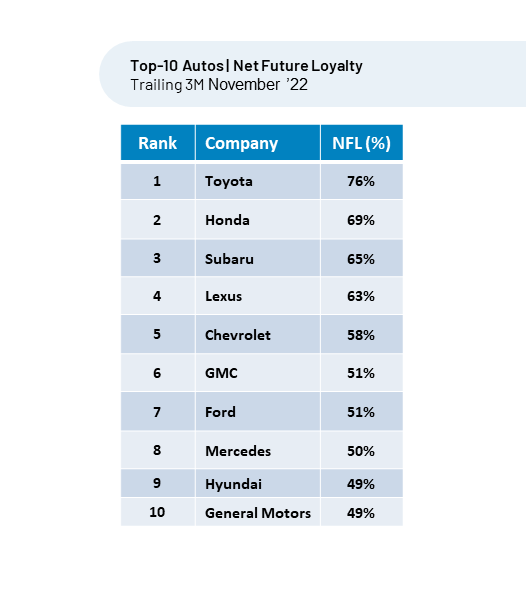

Top Overall Future Loyalty Leaders

According to “The Crowd” — real customers who share immediate feedback with HundredX — people continue to love their Toyotas, Hondas, and Subarus the most. Future Loyalty1 represents the percentage of customers who expect to purchase a vehicle from the brand again minus those that say they do not.

The following Auto brands are likely to see the strongest retention of their valued customers and market share. The three brands at the top outperform peers most on satisfaction with Quality and Reliability, Performance and Price. Some respondents recently commented on their Toyotas to HundredX: “The quality and performance are perfect!” “Outstanding value for the cost; Great vehicles! Expensive up front but worth it because they hold their value so well.”

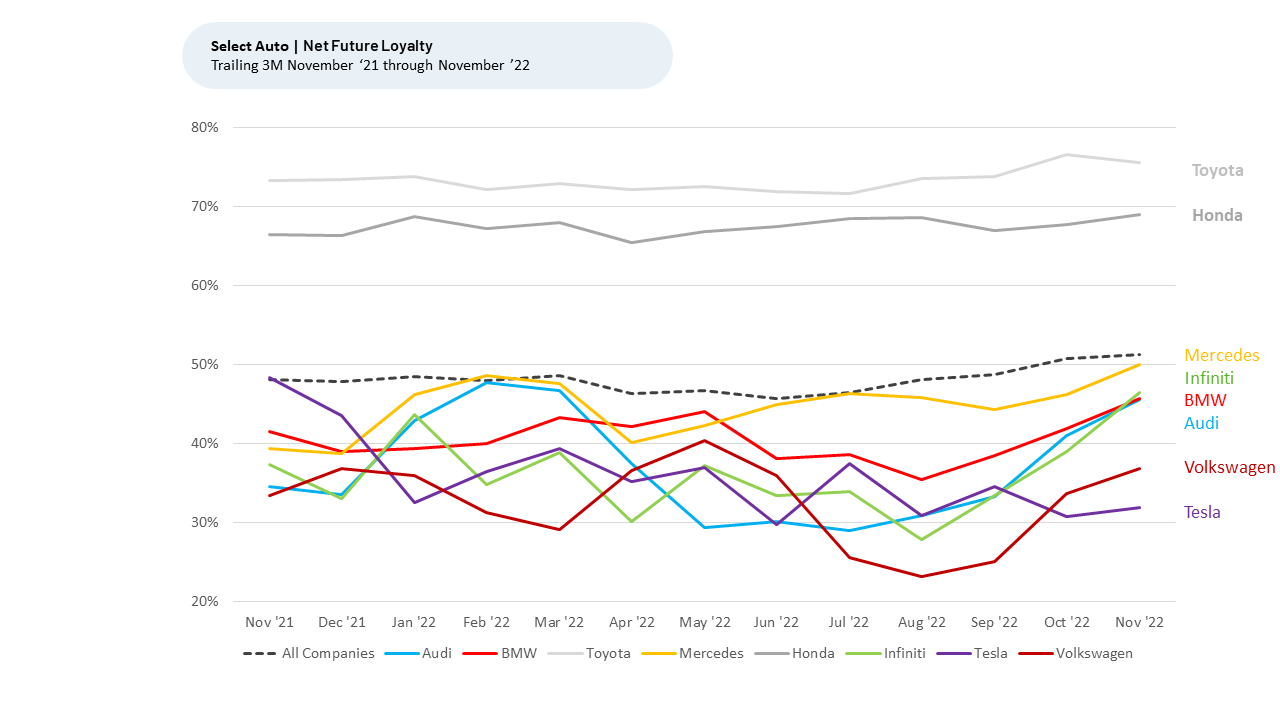

Future Loyalty has been slowly improving for auto brands in general since mid-2022, despite high prices. Inventory has also been improving, helping customers with plans to purchase.

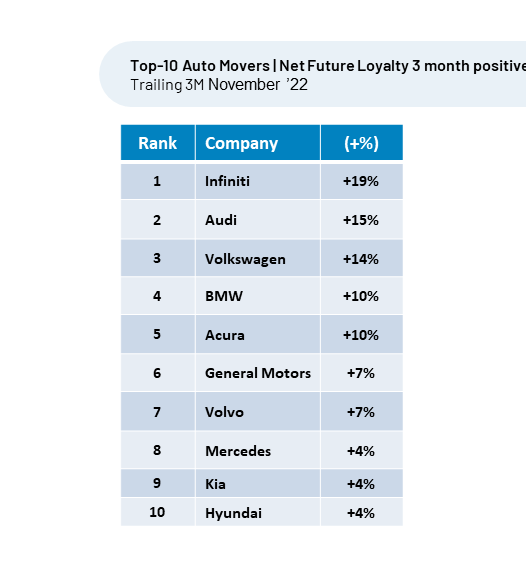

Top Future Loyalty Movers

To get an idea of which Autos appear poised to gain market share, we look at which brands saw the greatest increase in Future Loyalty during the last three months. Loyalty for luxury autos appears to be rising for a number of prominent brands during the past three months, with Infiniti, Audi, Volkswagen, and BMW all up double digits. We separately found Future Loyalty for the electric / hybrid vehicle category overall rose almost 17% over the last three months to 47%, by far the most of all the categories. SUVs and Trucks were up the least, about 2% each.

According to Kelley Blue Book (KBB), strong luxury vehicle sales have been a primary reason for overall elevated new-vehicle prices in 2022. Luxury vehicle share remains historically high, increasing in November 2022 to 18.2% of total sales. The average luxury buyer paid $66,645 for a new vehicle, up $331 from September 2022. Buyers continued paying more than MSRP for new luxury vehicles. The average price paid for a new non-luxury vehicle in November was $44,584—also a record and higher month over month.

Auto brands gaining the most ground for Future Loyalty over the past three-month period showed the greatest improvements in customer satisfaction with the factors customers select as the most important. Quality is selected as the most important factor, followed by Comfort, Performance, Style, and then Price. These factors appeal more to luxury car buyers more than other satisfaction measures.

Infiniti, Nissan’s luxury brand, leads Autos in Future Loyalty improvement over the last three months, up from 28% in August 2022 to 47% in November 2022. Although prices for Infiniti have increased 15%, sales have gone up 5% year over year and incentives have dropped. Infiniti launched a new ad campaign this fall for its QX60 SUV, utilizing influencers such as Kate Hudson to promote its emphasis on luxury and comfort. The customer sentiment improvement implies the brand is getting credit for some of its recent changes. Infiniti saw the greatest improvements in customer sentiment towards its Quality, Comfort, and Performance.

Audi’s Future Loyalty improved from 31% in August 2022 to 46% in November 2022. Audi sales increased 20% year over year for Q3 2022. Boosted by the largest selection of models by any EV manufacturer, Audi saw demand for this class increase significantly. With the rollout of its less expensive Q4 EVs, the company expects demand to grow even more. These efforts have improved sentiment and satisfaction with customers, who now recognize the brand for better Style, Performance, and Comfort.

Volkswagen’s Future Loyalty rose from 23% in August 2022 to 37% in November 2022. The company increased supply of its ID.4 EV, began manufacturing in the U.S., and their deliveries are up 10% year over year. The wait list for ID.4s remains strong, and VW is ramping production to meet this demand. Customer sentiment has improved the most for Style and Comfort.

Autos with the most improved Future Loyalty during the past three months show high customer satisfaction with Comfort, Style, and Performance. These factors, as well as an increasing number of selection options, such as more electric / hybrid vehicles, now 6% of total share, are helping top autos to gain market share from the competition.

We continue to monitor these loyalty and sales trends as economic and pricing uncertainty unfolds.

1 All metrics presented are on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.