As people finish their holiday shopping for the year, we look to the Retail brands posting the biggest gains in Purchase Intent¹ and sentiment towards prices. Analyzing more than 600,000 pieces of feedback from The Crowd, real people who shop at retailers across the U.S., we better understand how customers are shopping now and will shop in 2023. We find:

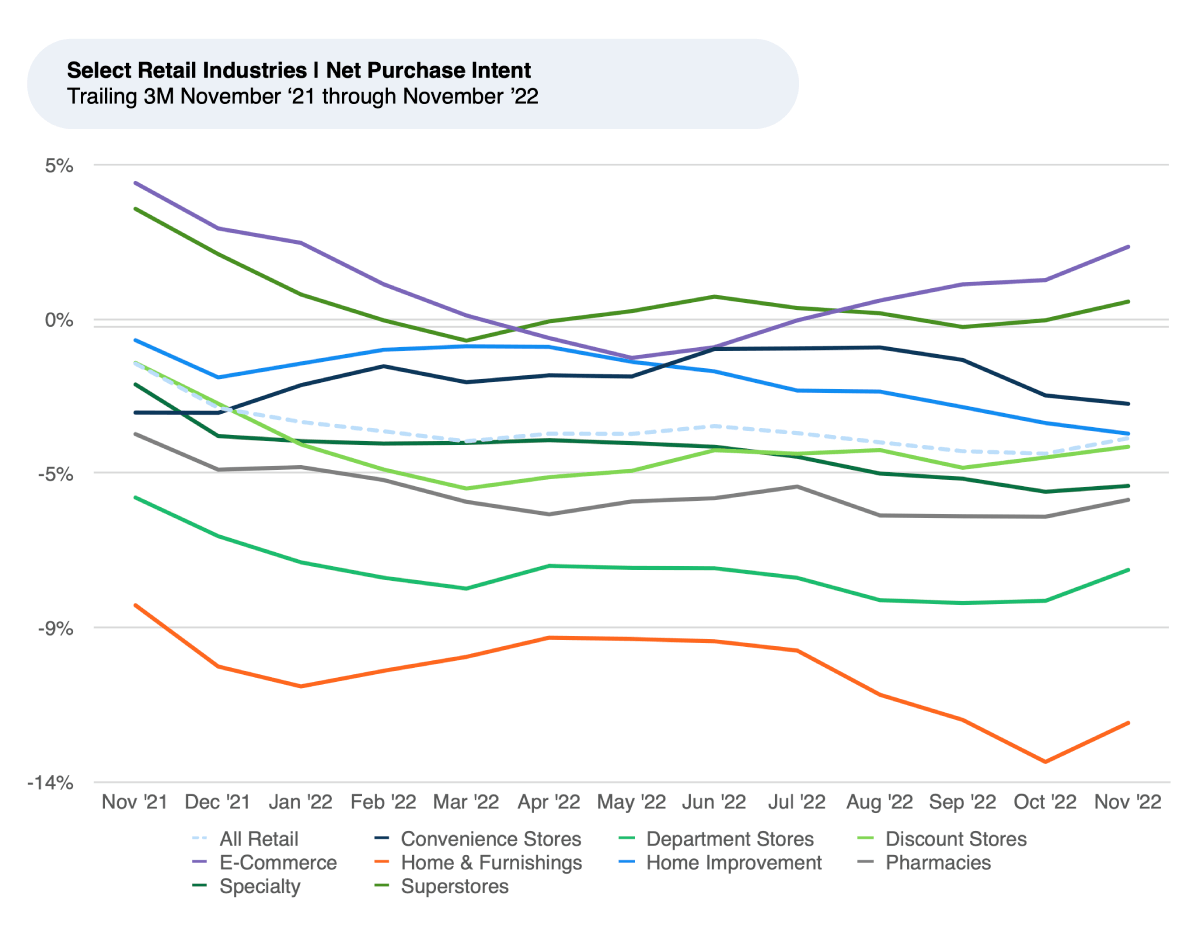

- Over the past three months, Purchase Intent has been relatively stable across Retail, with E-Commerce showing a slight increase.

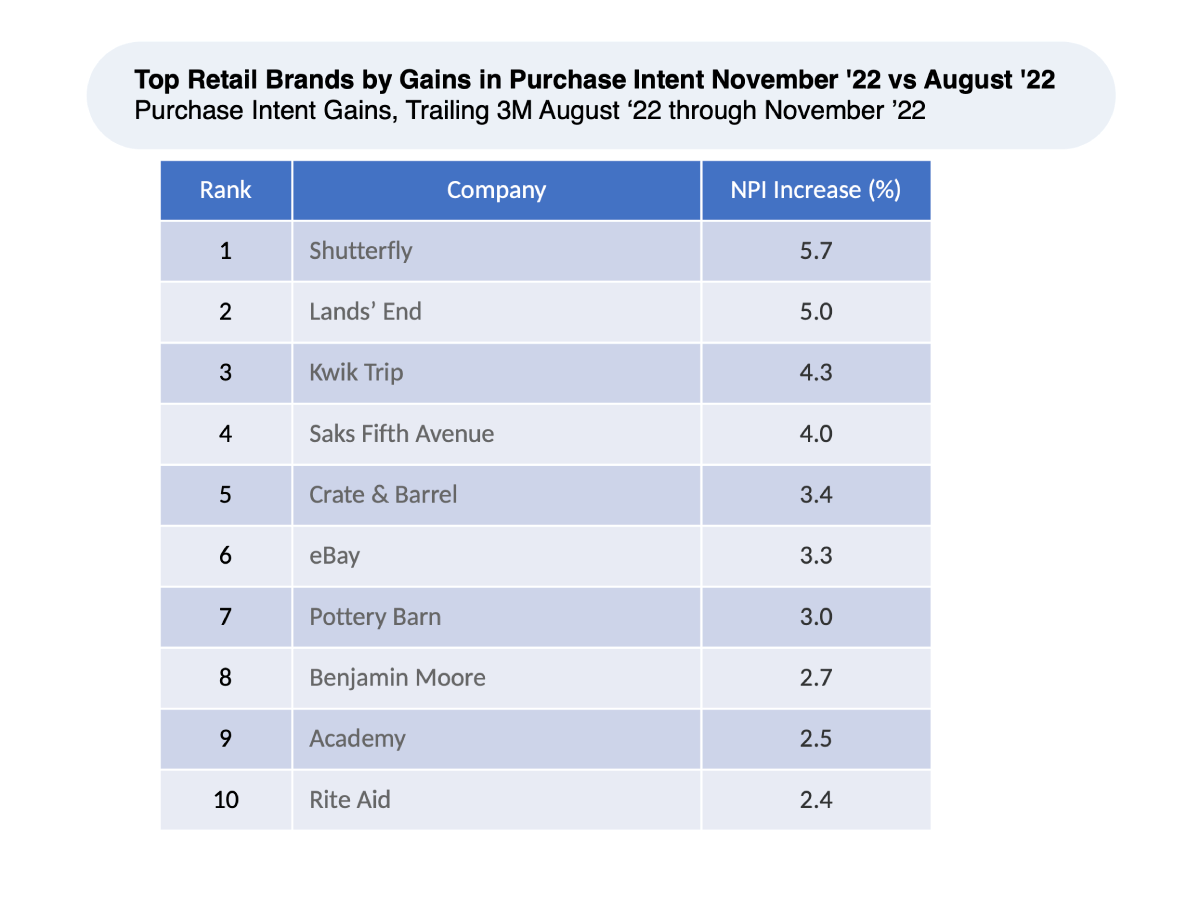

- Shutterfly boasts the biggest increase in Purchase Intent as people send out holiday cards.

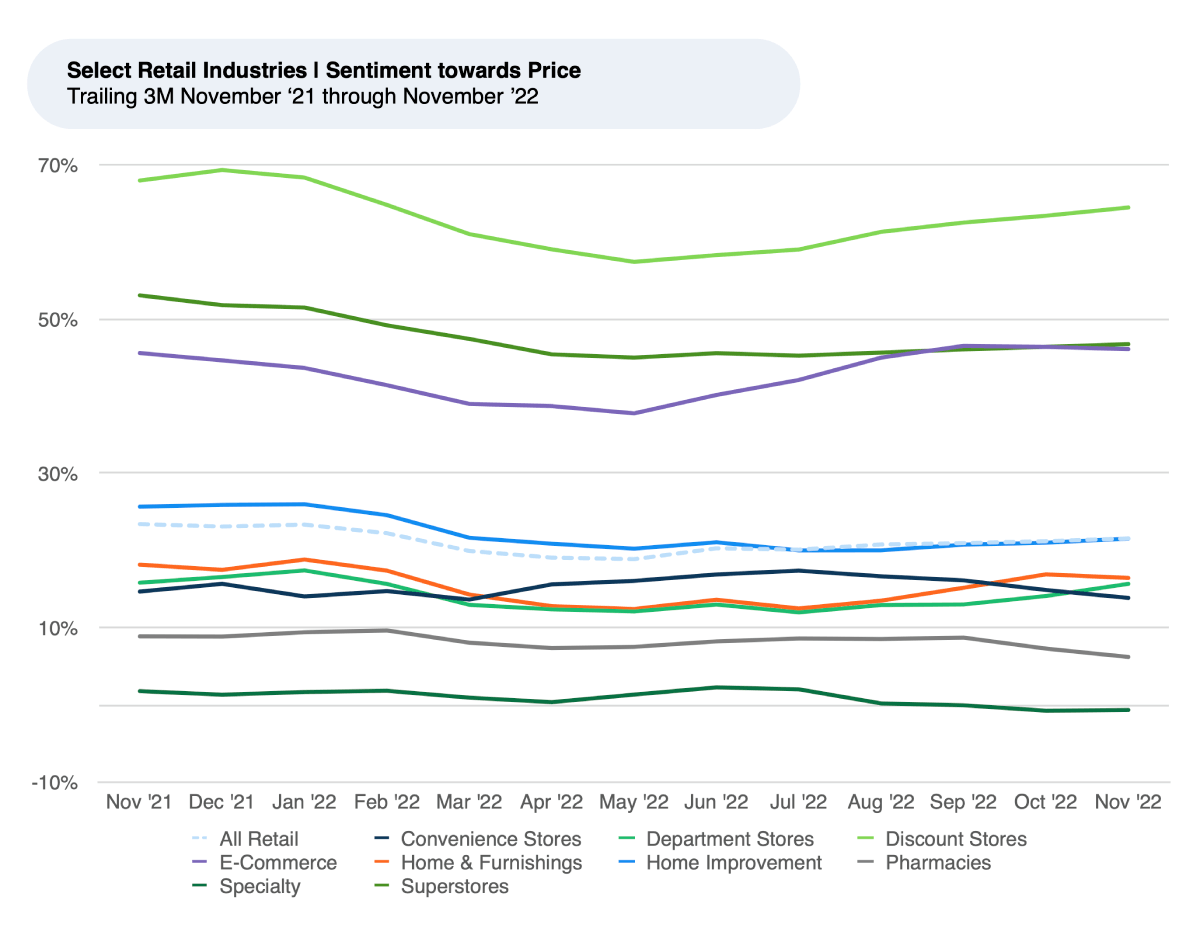

- Customers’ feel somewhat positively about Retail prices, but most positively about prices at Discount Stores, followed by Home & Furnishings and Department Stores.

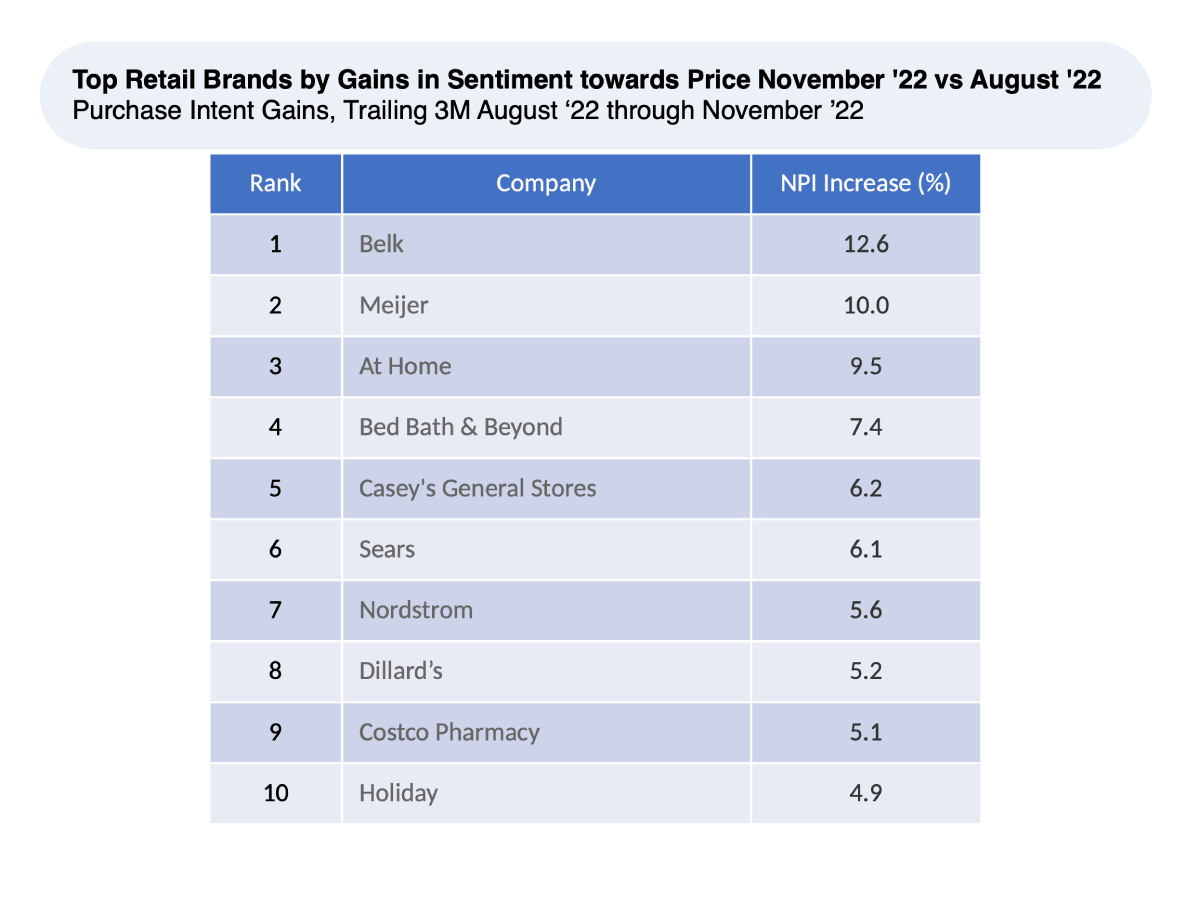

- Department Stores Belk, Nordstrom, Sears, and Dillard’s saw some of the biggest recent gains in sentiment towards Price.

Purchase Intent remained relatively stable across Retail over the past three months. The sector sees slight upward movement (less than a percentage point) from October to November, possibly as people shopped for the holidays and took advantage of Black Friday deals. Home Improvement and Home & Furnishings saw some of the biggest declines since August, with both down about a percentage point. Homeowners typically start outside home improvement projects in the Spring or Summer due to weather considerations. Rising interest rates are also likely dampening demand for big projects. We have seen a 60%-80% correlation between Census Bureau sales data and Purchase Intent for covered sectors of retail over the last 18 months.

Purchase Intent for Retail reflects the percentage of customers who expect to spend more at a retailer over the next 12 months minus the percentage who plan to spend less. We find brands that see their spread in Purchase Intent improve vs. peers tend to see stronger growth rates and market share gain.

E-Commerce posted the biggest increase in Purchase Intent over the past three months and has been on an upward trend since May 2022. As we noted in our

HundredX report on E-Commerce, popular brands Chewy and Etsy also posted modest gains and helped contribute to the overall industry’s gains.

Biggest Retail Purchase Intent Improvers

Warming to Prices

The Crowd often chooses Price as top driver of satisfaction when leaving feedback for a retail brand. Overall, customers’ sentiment on Price remained positive and relatively stable over the past year, despite a slight dip in the spring. HundredX measures sentiment¹ as the percentage of customers who view a factor as a reason they like the brand minus the percentage who see it as a reason they don’t like the brand.

Unsurprisingly, customers view Discount Stores’ prices most favorably compared to other retail sectors, with E-Commerce and Superstores coming in a close second. Customers view the prices of Specialty Stores most negatively. In our coverage, Specialty Stores includes certain sporting stores, craft stores, mailing centers, bookstores, pet stores, and toy stores. Typically, due to their niche audience, these stores tend to sell their unique merchandise at higher prices compared to similar products at superstores or department stores.

Over the past three months, Discount Stores made the biggest improvement (+3%) in customers’ sentiment towards Price. Department Stores (+3%), also known for their reasonable prices, saw improvements as well. Interestingly, Home & Furnishings (+3%) and Home Improvement (+2%) also saw some of the biggest increases since August, despite showing some of the biggest dips in Purchase Intent. Notably, the price of lumber, a staple in home improvement stores like Lowe’s and Home Depot, is near a yearly low for 2022, having come down more than 60% since the start of the year.

We see the top ten Retail brands with the biggest gains since August in customer sentiment towards Price are:

Department stores appear to be the clear winners here, with four brands – Belk, Sears, Nordstrom, and Dillard’s – making the list. Belk shows the largest gain overall, moving up in customers’ sentiment towards Price 12.6% over the past three months.

Many people that leave feedback with HundredX on Belk comment positively on the company’s prices.

“I love when they have sales and the discounts they offer. I continue to go to the store hoping to find things I need especially for work now since I have to dress dressy casual,” one person said to HundredX. Another noted, “There prices are great and that makes a difference when you have 5 children like I do.”

Over the past three months, Belk also increased notably in Value, Attitude, and Sizes & Fit.

In the summer, Belk premiered a partnership with home goods, furniture, and appliance store Conn’s. Belk customers can now purchase Conn’s products in select stores and online.

We will continue to monitor and report on the Retail space in 2023.

₁All metrics presented are on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a

mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact.