Earlier this week CNBC released an article after Stitch Fix’s earnings release with the following headline: “Stitch Fix shares crater as retailer cuts forecast, despite topping earnings estimates”.1 Below are some key points from the article as well as Stitch Fix’s FQ1 2022 Earnings Call (Dec 7th).2

“The number of active customers using its services fell short of expectations, hinting at slowing demand. Specifically, a recent promotional offer resulted in a wave of new customers who briefly joined Stitch Fix but didn’t stick around.” - CNBC

“We launched a high dollar value referral program for new customers, which ultimately brought in clients who did not remain active as long as we had hoped… We have since ended the program. However, our net client adds were impacted by this in the first quarter, and we expect to continue to see the effects of this into the second quarter.” - Dan Jedda, CFO

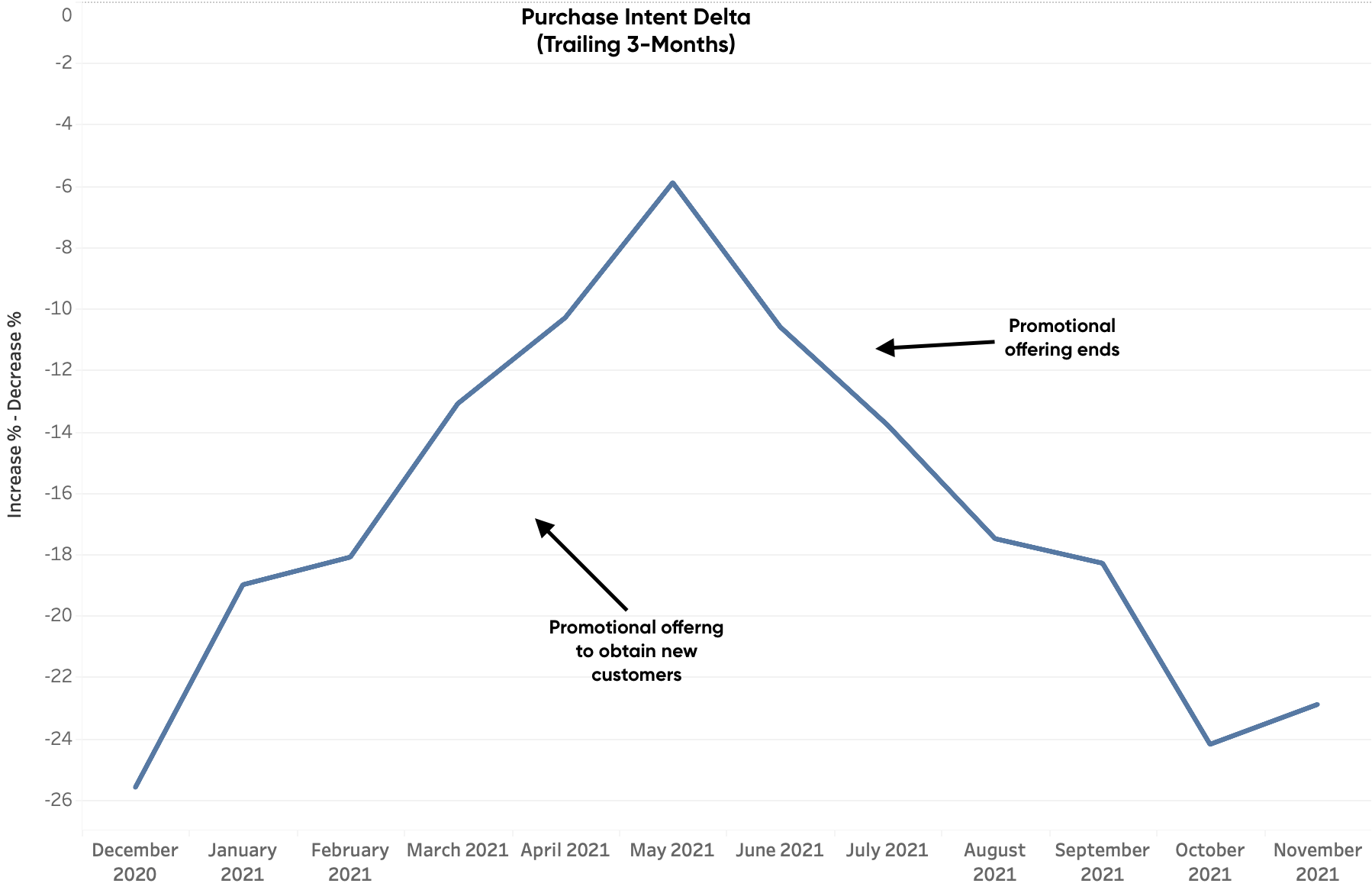

Below is the chart with HundredX Stitch Fix Future Purchase Intent (Trailing 3 Months)

HundredX future purchase intent data from Stitch Fix consumers caught both the upswing in consumer purchase behavior associated with the promotional offering as well as the downswing that followed. This capture provided early insight into the initial success and transitory nature of the promotion.

Additional Stitch Fix Insights from HundredX Data

Future Purchase Intent vs E-commerce Competitors

HundredX data for Stitch Fix shows future purchase intent lags behind the rest of the e-commerce industry; however, a small uptick from October to November could be an early sign that new strategies by company management might be starting to pay dividends.

Drivers

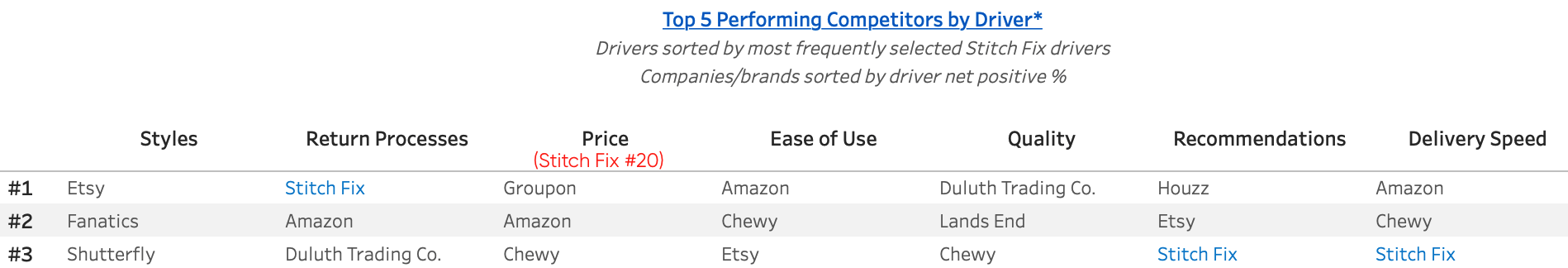

HundredX data shows the top 7 most frequently selected drivers for Stitch Fix. The company generally performs well in its most important drivers, but consumers overwhelmingly dislike Stitch Fix’s prices.

Enterprise Narrative and Migration

How consumers are migrating to and from a company is a key data input into the enterprise narrative as it directly impacts a company's top line growth trajectory.

Consumers that plan to spend/use more or about the same

in the next 12 months

Consumers that plan to spend/use less

in the next 12 months

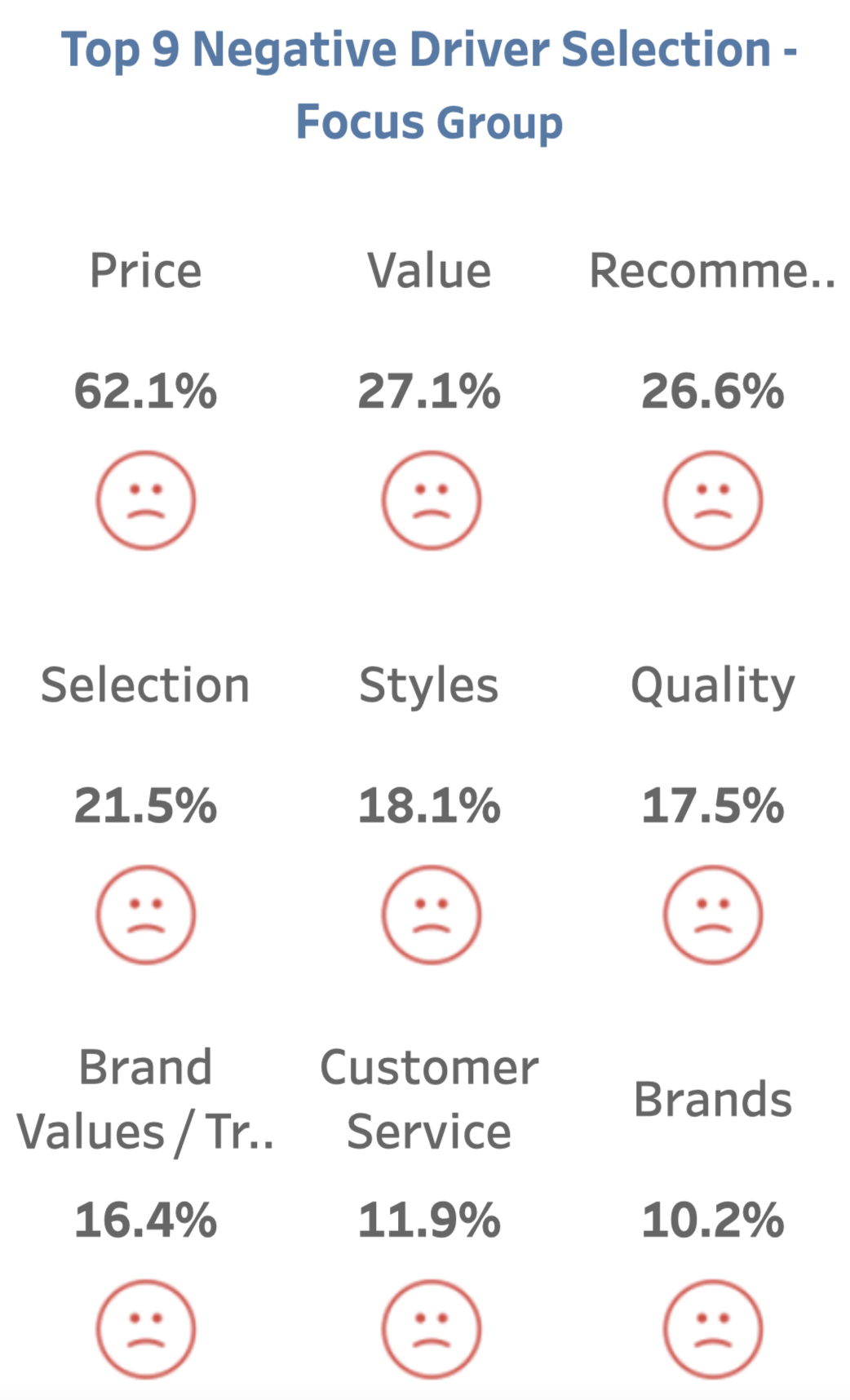

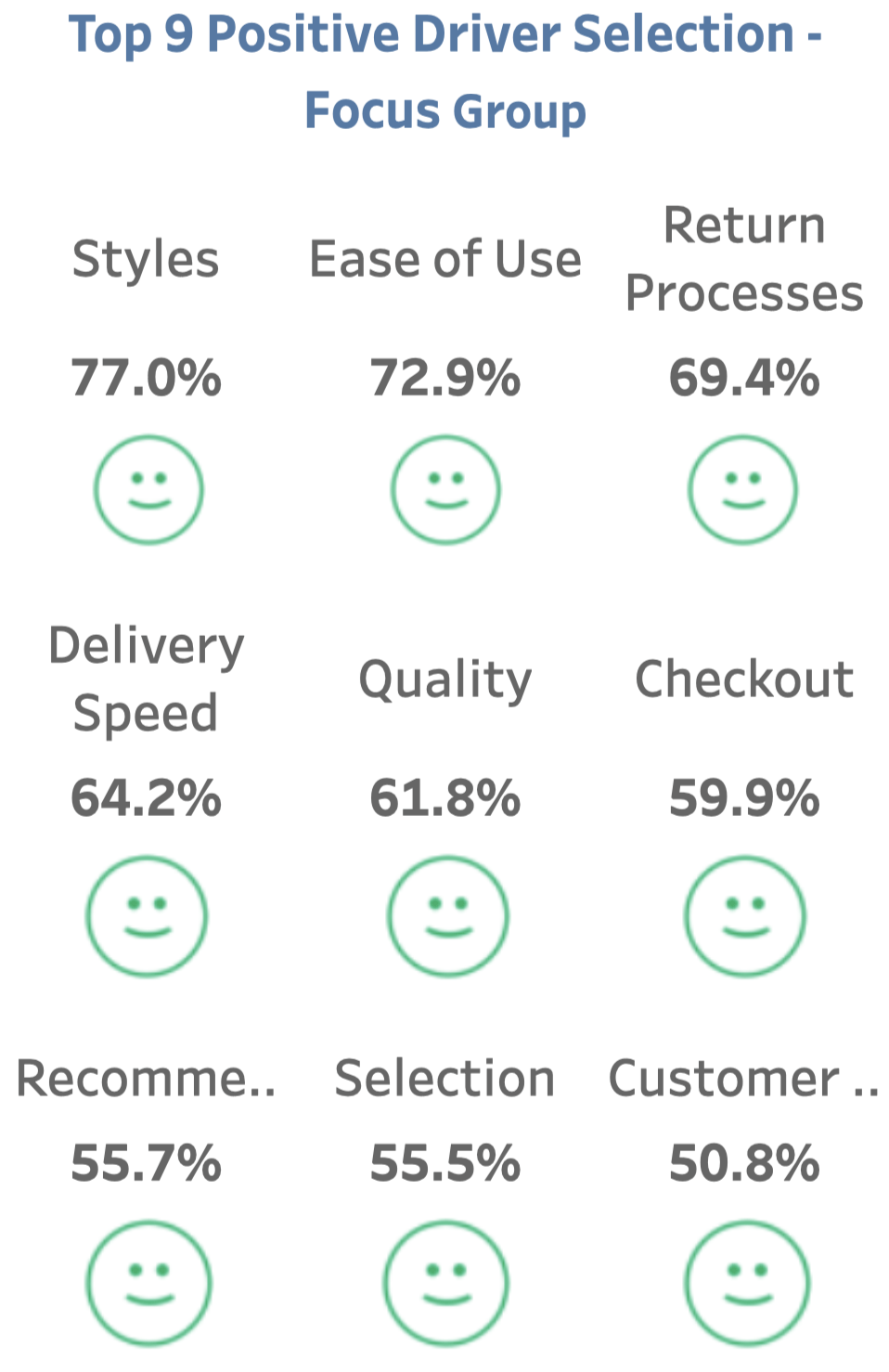

HundredX data indicates the top positive drivers for customers planning to spend more or about the same at Stitch Fix in the next 12 months as well as those who plan to spend less at Stitch Fix in the next 12 months. For those who plan to continue or expand their usage of Stitch Fix’s products, the core value proposition of Styles and Service (Ease of Use, Return Processes, and Delivery Speed) drive their usage. However, for those planning to spend less, Price drives their decision process.

------------------------

1CNBC:

Stitch Fix shares crater as retailer cuts forecast, despite topping earnings estimates

2Stitch Fix, Inc. (SFIX) Q1 2022 Earnings Call Transcript

This analysis is based on HundredX's proprietary data, developed from consumer feedback collected through the

HundredX Causes Program. Nothing in the HundredX data constitutes professional or investment advice on the part of HundredX.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.