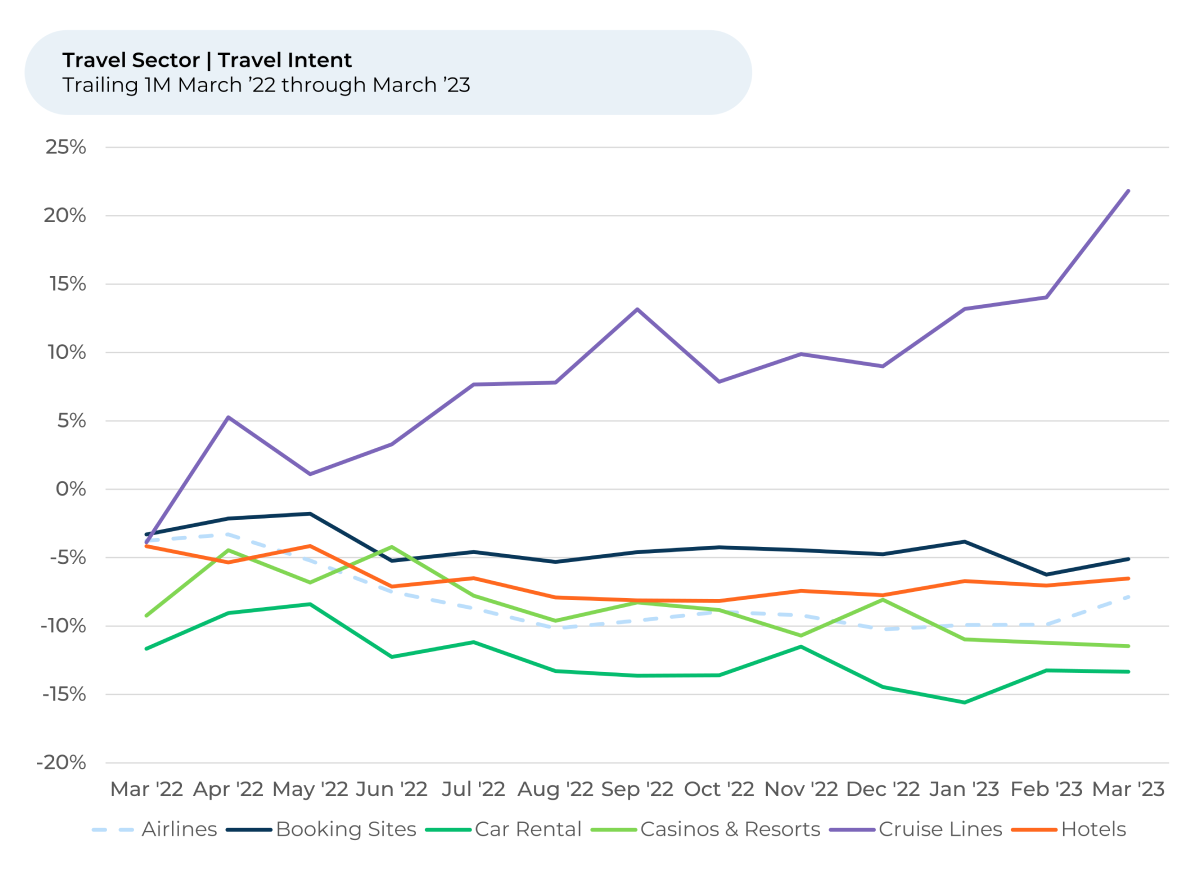

Last month, we provided insights on the cruise industry’s boost from spring break travel. The cruise industry outperformed other travel sectors, with Carnival Cruise Line and Royal Caribbean International seeming to score big with young adults as they heavily advertise spring break deals and activities.

This month, we focus on how airlines are faring on the back of Southwest Airlines experiencing more technical issues on the morning of April 18th, affecting more than 40% of its schedule.

After analyzing more than 280,000 pieces of feedback from “The Crowd” across the entire Travel industry, including 80,000 pieces of feedback across 24 airlines, we find:

- Travel Intent¹,² is generally flat for most travel industries. The airline industry has seen a slight increase since February 2023. The cruise industry is still the only travel industry with positive Travel Intent, rising again in March 2023 to reach new highs.

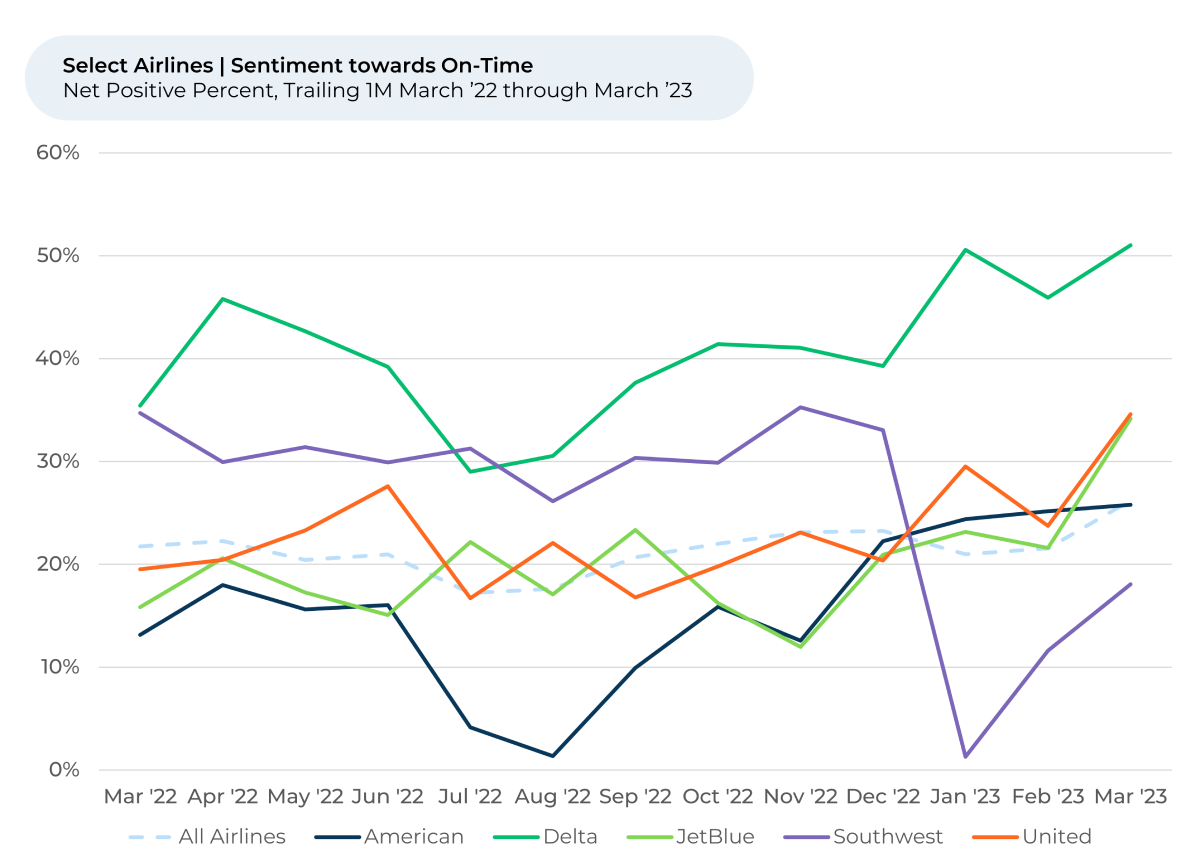

- Southwest has been improving in Travel Intent and sentiment³ towards On-Time after its holiday delays. We will watch to see how the latest round of technical problems, which appear to have been fixed quickly, will impact that.

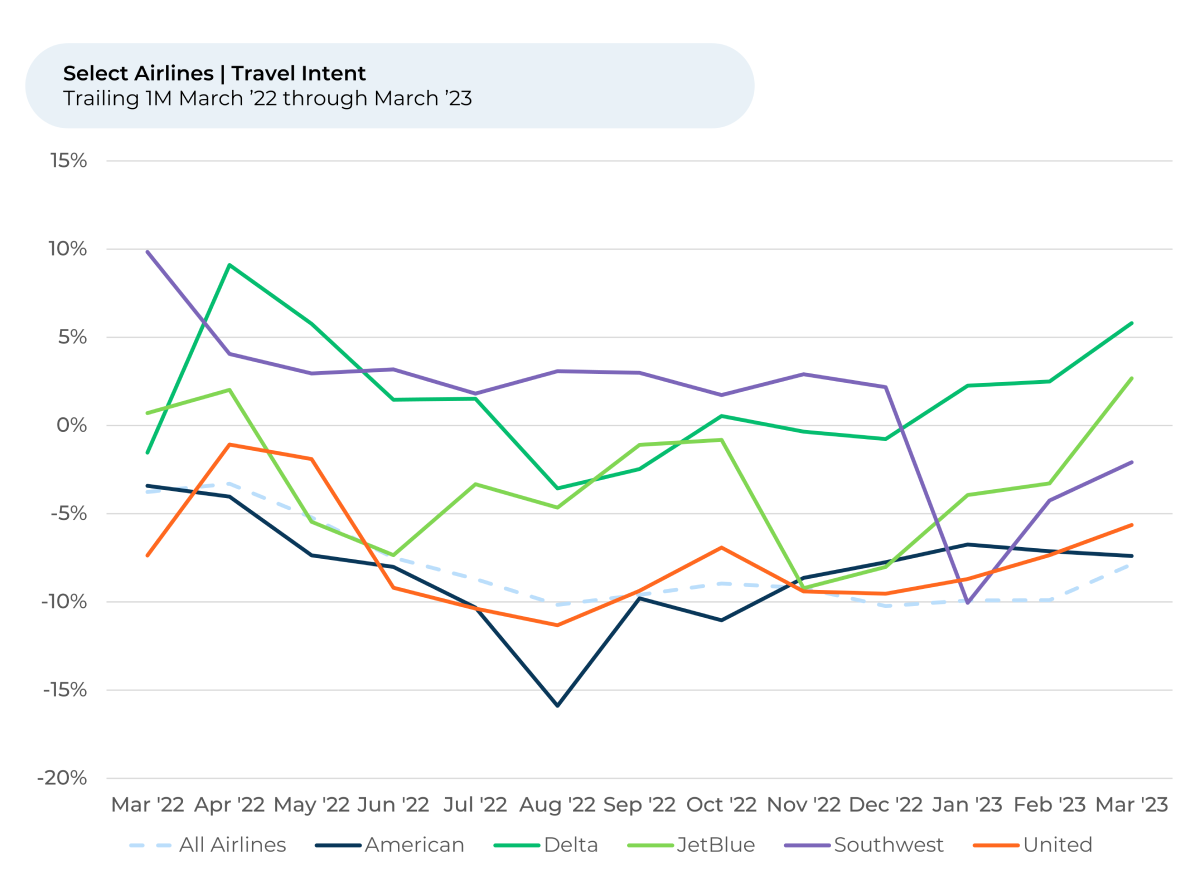

- Delta appears to continue to be the big Travel Intent winner since the winter industry challenges, followed by JetBlue.

Delta appears to continue to be the big winner since the industry’s winter challenges, followed by JetBlue. Many of the biggest airlines saw modest Travel Intent increases in March. Travel Intent increased for JetBlue by 6%, Delta by 3%, and Southwest and United by 2%. Southwest’s increase is notable, given travel intent for the airline had fallen sharply after holiday season travel interruptions (weather plus technical glitches) grounded or delayed thousands of flights.

That Southwest’s Travel Intent increased 2% over the past month and 8% over the past two months seemed to indicate customers had moved past Southwest’s holiday troubles.

That feeling was mirrored in Southwest customers’ view towards the airline’s ability to stay on-time. Like Southwest’s Travel Intent, Southwest’s sentiment towards On-Time had fallen sharply after the holidays. It increased 6% over the past month and 17% over the past two months. While still below the airline industry average, this move, too, seems to show customers are feeling better about Southwest

“Even though I was affected with all the nation-wide holiday flight cancellations (even though we weren't affected by weather), Southwest is still the best,” one customer told HundredX in February 2023.

“They provided excellent customer service by crediting my family with free flight miles, as well as provided reimbursement for rental car, food and lodging. Great job taking care of the customer,” the customer continued.

The key question now is whether the recent technical issues will impact the recovery in Southwest's Travel Intent and on-time performance perception. The airline seemed to resolve the April 18th problem quickly, but it remains to be seen if another round of headlines about Southwest delays will significantly impact customer intentions and behavior.

HundredX will continue to monitor the travel sector, particularly Southwest, to understand how “The Crowd” shifts its travel plans in the wake of potential future technical issues, price changes, labor and capacity shifts and other important strategic decisions. The coming months will be crucial to Southwest’s recovery journey.

- For this piece, all metrics presented, including Net Travel Intent (Travel Intent), and Net Positive Percent / Sentiment are presented on a trailing one-month basis unless otherwise noted.

- Travel Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.