Update regarding Apple's official Apple Vision Pro reveal

Apple revealed its much-anticipated AR/VR headset, the Apple Vision Pro, at its June 5th WWDC event. Enabling seamless transitions between AR and VR environments, Vision Pro introduces an innovative way for users to interact with apps through eye, hand, and voice commands. The supposedly simple controls should resonate with Apple customers, who value usability.

Designed to be lightweight and geared to reduce motion sickness, the Vision Pro serves as both a consumer and productivity device, extending its utility beyond entertainment. Its advanced technology and presumed comfortability should appeal to Meta Quest fans, who prioritize design and comfort in their VR devices. However, these innovative features come with a substantial price tag of $3,499, presenting a potential barrier for consumers when it launches next year.

Original Text

Amid a potential watershed moment for the VR industry, insights gleaned from over 100,000 pieces of consumer feedback HundredX has gathered over the last year shine a light on the competitive landscape facing Apple and Meta.

As Apple potentially prepares for its virtual reality (VR) and augmented reality (AR) hardware debut and Meta updates its Quest series, we look at product and brand positioning to see how Meta is currently positioned in the VR market and what strategies Apple could utilize to win.

Our insights from “The Crowd” of real consumer electronics users find:

- The broad suite of Apple products we track are the leaders in customer satisfaction across every age group, although outperform broader consumer electronics most with middle-aged adults. They are poised for the most growth with 18-29-year-olds. Meta Quest products appear to resonate most, and are poised for the most growth, with middle-aged customers.

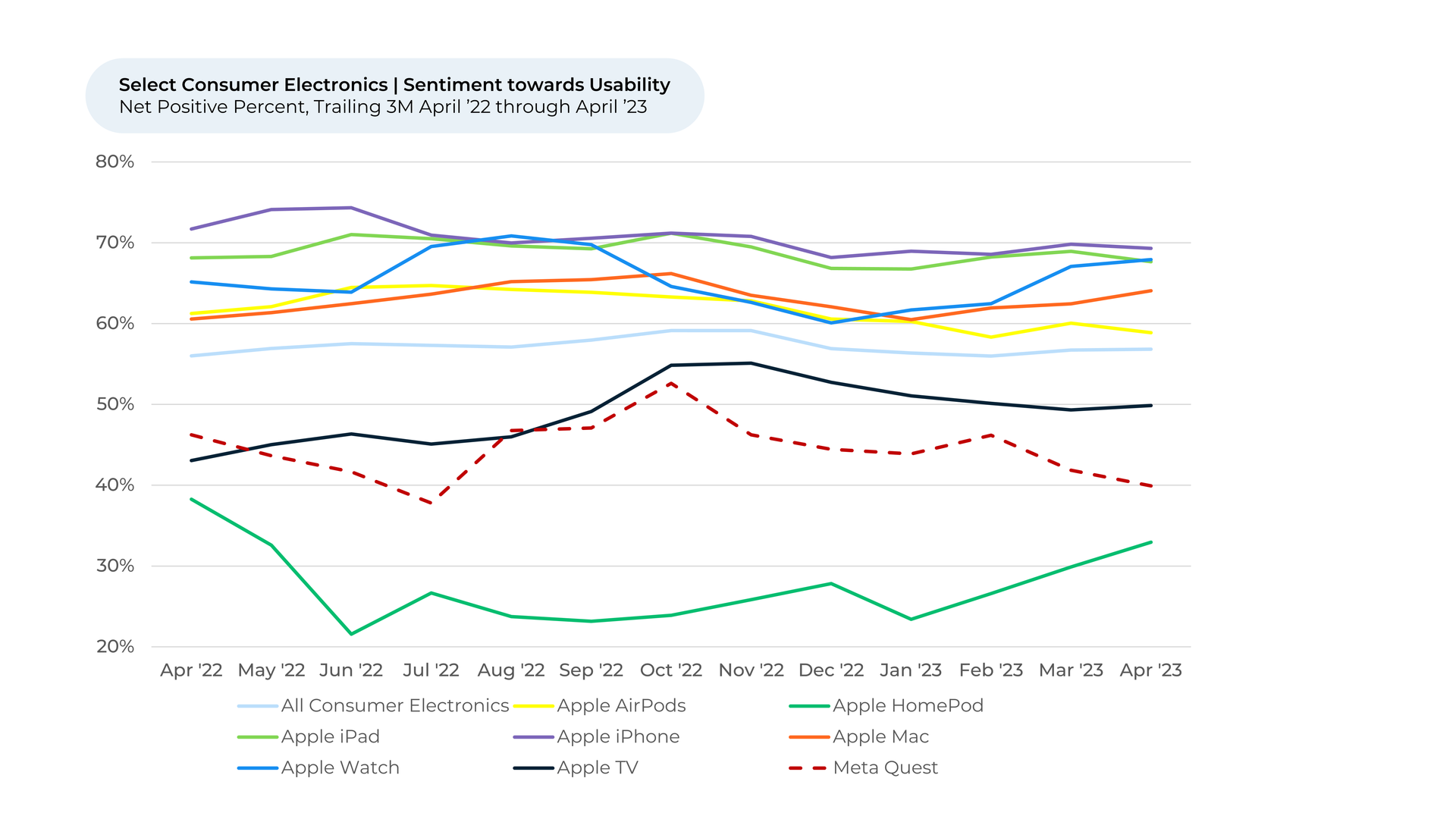

- Apple customers, especially its older customers, care more about the usability of their products than the average consumer electronics customers. The Apple AR/VR headset will have to be easy to use – something competing VR headsets are not known for – to resonate well with the average Apple customer.

- On the other hand, “The Crowd” views Meta Quest devices as harder to use than the average consumer electronic product. If Apple can produce a headset that’s easy to use, they’d be better positioned to dominate the VR market.

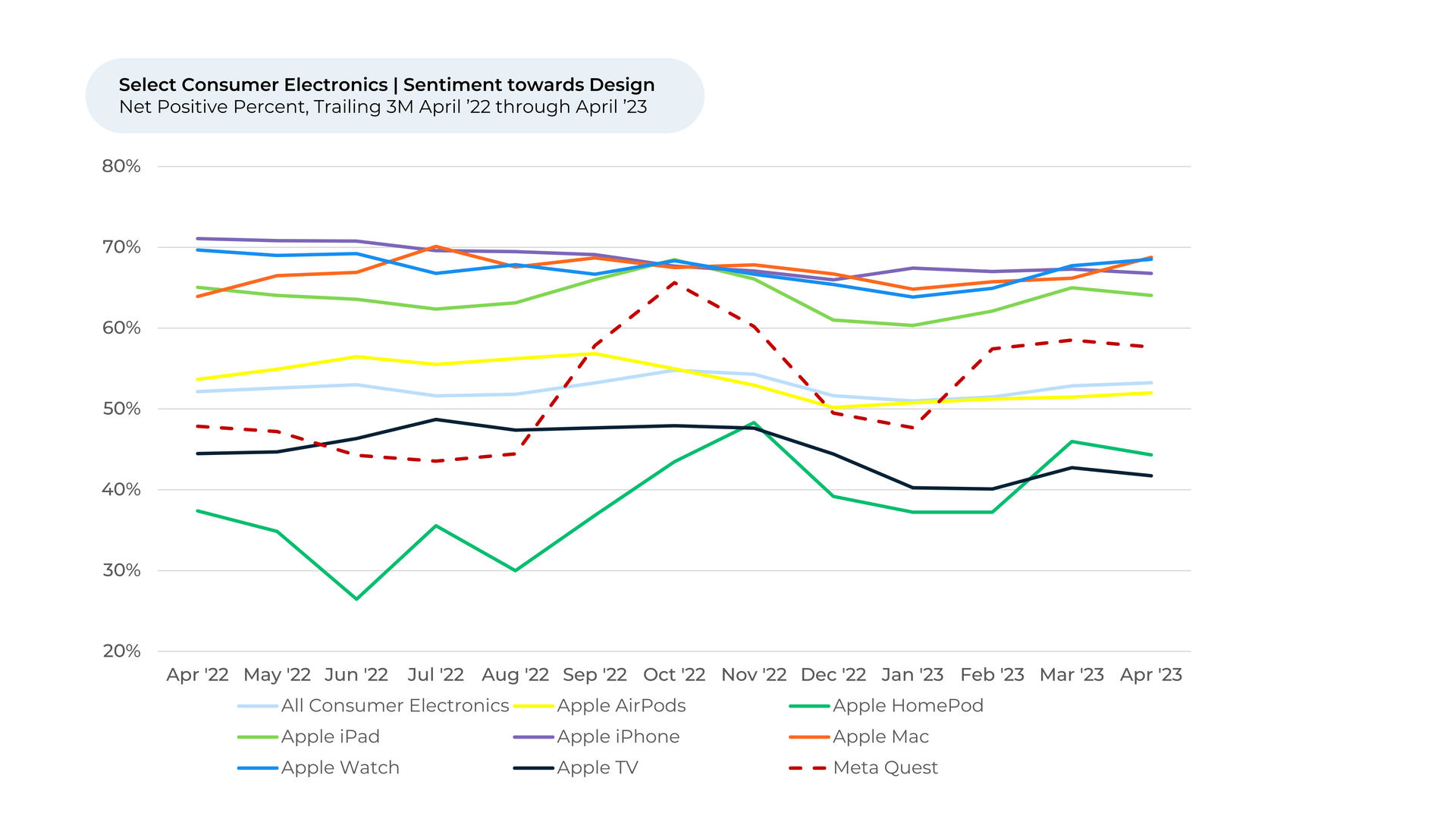

- Design and comfort are important to Meta Quest customers. Customers became significantly happier with Meta Quest’s design around the release of the premium-priced Meta Quest Pro in October 2022.

- Apple will need to be careful how high it prices its AR/VR headset. The headset is expected to be more expensive ($3,000) than any competing headset and will be announced at a time when “The Crowd” is generally unhappy with the price of other Apple products. Apple will need to deliver on ease of use, comfort and advanced technology for customers to see value.

- Still, the audience might be there for Apple’s AR/VR headset. Meta Quest customers leaving feedback with HundredX also leave more than 3x more feedback on iPhone and AirPods than the average respondent, indicating they may use some Apple products more than the average person.

According to Statista, about 27% out of nearly 7 billion global smartphone owners around the world use an iPhone. The iPhone spans age, geographical, and income ranges, capturing users from vastly different backgrounds and circumstances.

That said, HundredX data indicates Apple’s suite of products, which include iPhone, AirPods, iPad, Mac, Apple TV, and HomePod, are liked by customers of all ages, but they outperform most with middle-aged adults. The Customer Satisfaction1,2 and Net Promoter Scores ® (NPS®)3 for these products relative to the overall consumer electronics industry are highest with adults between 30-49. This age group also likes Meta Quest more than other groups.

It’s likely that this age group is drawn to Apple products because of how easy they are to use. Apple customers overall view usability as the second most important feature4 of Apple products, behind their underlying technology. This differs from users of other consumer electronic devices we cover, who view the installation and setup as the most important factor, followed by technology, then usability and price.

Apple customers are generally happy5 with the usability of Apple’s consumer products, with the usability of all of them except for the HomePod and Apple TV viewed more favorably than the average consumer electronic device we cover.

Will Apple focus on video games to pull in their high growth potential 18-29 demographic?

For Apple to keep momentum going with its 18-29 age group where its Usage Intent6 is highest across products, it may want to focus on building out the headset’s gaming capabilities and library.

VR is still an emerging field that doesn’t have a lot of practical uses. On the consumer front, it has resonated most with gamers – proven by the relative success of PlayStation VR, HTC’s headsets, and the Valve Index VR, all headsets designed specifically for gaming. Meanwhile, AR headsets, like Microsoft's HoloLens, have largely been confined to industrial use cases, although some smartphone entertainment apps and games, like Pokémon Go, have long incorporated basic AR technology.

As one of the only other major companies to release a standalone headset, as opposed to one that requires connection to a PC or console, Meta will likely emerge as Apple’s biggest competitor in the VR space. It has steadily brought new games to its Meta Quest platform, including hit games like Beat Saber, PowerWash Simulator VR, and Resident Evil 4 VR.

Gamers tend to skew younger, which has worked well for VR headsets. The devices are still largely tricky to navigate as companies continue ironing out the kinks in VR technology. Sentiment towards Meta Quest’s usability is 17% lower than that of the average consumer electronic device. It’s 29% lower than that of Apple’s iPhone and 17% lower than other Apple products we follow. The sweet spot for Meta Quest in terms of NPS® and Customer Satisfaction is middle-aged users between 30-49. HundredX respondents that leave feedback on Meta Quest are 8x more likely to also leave feedback on Xbox or Nintendo Switch, suggesting a significant overlap7 between Meta Quest users and console players.

It’s unclear if Apple will promote gaming on its headset – analysts offer different reports. It is clear, though, that when it launches, it likely won’t have the amount of premium games Valve Index or PlayStation VR have. This could present a problem for Apple, which has long shied away from the premium game market, if it wants to steal away some of its competitors VR customers.

Apple will need to deliver on usability and comfort, two areas VR sets are weak historically, to win

At the same time, if Apple wants to appeal to its core group of usability-focused customers, Apple will need to make the AR/VR headset easy to use and navigate, likely keeping the deep integration with its other products that Apple is known for. That’s a tall ask, given that many new VR users can have difficulty adapting to the immersive environment. People can experience dizziness or sickness while using VR, and it can take users hours to understand the limits of their 3D environments. Still, if Apple can address those issues, while making its device easy to use, its headset will be in a good position to compete with Meta and other VR hardware creators.

Apple will also have to make its headset comfortable – something other VR creators have long struggled to do. The typical VR headset, consisting of screens, cameras, sensors, and processors, weighs more than a pound. That sounds light, but many users have found that leaving a bulky, 1lb device strapped to their faces for an hour or more at a time can be uncomfortable. Users still want comfort, though – Meta Quest customers say design is one of the most important factors they consider when liking or disliking their product. One user told HundredX, “The head piece is flimsy and easily broken. It’s also not very comfortable.”

Meta succeeded in making its Meta Quest Pro more comfortable with a more secure fit and better weight balance. Users noticed – around the time it was released in October 2022, HundredX respondents began feeling significantly happier about Meta Quest’s design. Sentiment towards design jumped 14% from August 2022 through April 2023.

In terms of comfort and design, Apple should prioritize the comfort and ergonomic design of their headset. They might want to consider lightweight materials, adjustable fitting mechanisms, and heat dissipation techniques to increase user comfort.

“My son just got the (Meta Quest Pro) and says it is much more comfortable and doesn’t shift as much,” one HundredX respondent said in May 2023.

Apple will have to emulate this success if it wants to best compete with Meta and keep its customers using its headset for more than short bursts at a time.

Price may play an important role in the headset’s success

While Apple’s AR/VR headset is set to feature premium technology – a positive, as electronics customers select technology as the #1 reason they like or dislike a product – it’s also predicted to have a premium price tag.

Analysts and leakers have predicted the headset will cost $3,000, While it looks like it will feature premium features including combined 8K display, high-tech cameras and sensors, and a portable battery pack, the price is still higher than any of its competitors.

However, it's worth noting that Apple's reputation for high-quality, design-centric products often justifies their premium pricing for many consumers. Users choose Apple not just for the particular product but also for its seamless integration with its ecosystem, which can enhance the overall user experience. Apple's consistent delivery on these fronts has built a loyal customer base that is often willing to pay more.

Meta Quest Pro, released in October 2022, starts at $1,000. Meta Quest 3, set to debut this fall, will start at $500. Other competitors, like PlayStation VR, Valve Index, and HTC Vive Pro 2, range from $550 to $1,300. It's worth noting that these headsets lack the AR capabilities Apple's is rumored to have. Meta is reportedly in talks with AR headset maker Magic Leap to license its technology, setting Meta up to better compete with Apple.

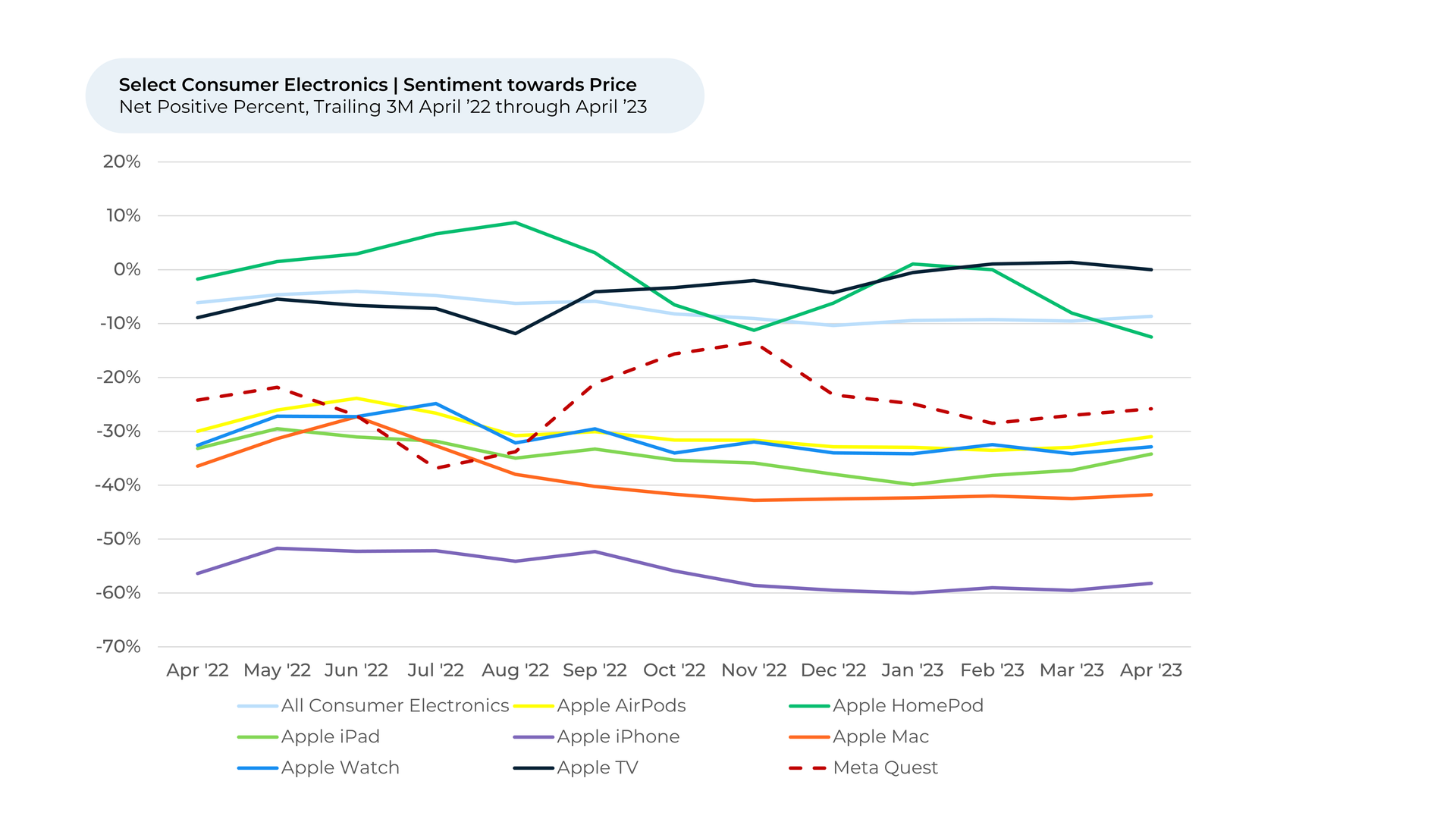

Despite the lower costs of Meta Quest devices, customers still aren’t pleased with their price. Sentiment towards Meta Quest’s price is 20% lower than that of the average consumer electronic product.

Apple, known for its high-quality but expensive, products, already has customers with pretty negative feelings about price. Price sentiment for the iPhone is 49% lower than that of the average consumer electronics product, and 32% lower than that of the Meta Quest.

Given the Apple AR/VR headset is set to cost about three times the amount of the Meta Quest Pro and double the cost of the most expensive iPhone, it’s likely customers won’t be pleased with its price either.

While Apple’s AR/VR headset is set to feature premium technology, it's vital for Apple to justify the product's value. They could do this by highlighting its premium features, seamless integration with other Apple products, and offering flexible payment or upgrade options.

Most analysts agree that this first headset will price out many consumers, and instead will target developers and power users. Apple will likely develop cheaper models over the next few years. But it will likely have to drop its price significantly to not turn off its broader customer base.

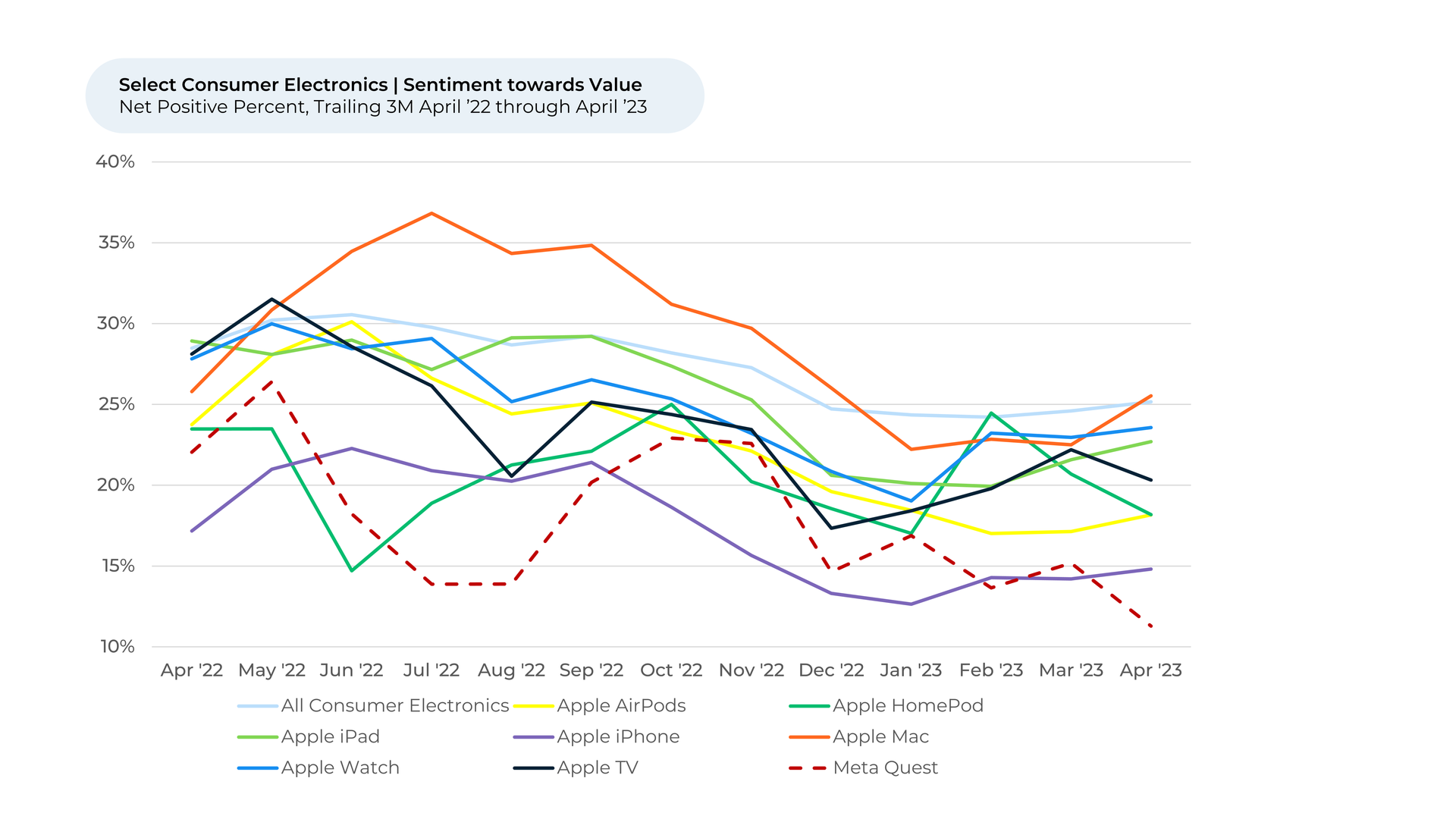

Despite their relatively high prices, customers are happier with the value of any of Apple’s products than Meta Quest products. If Apple’s AR/VR headset is easy-to-use, technologically advanced, and comfortable, its users could see the value in its reported $3,000 price tag. For example, some Mac models are priced at a similar or greater premium to peer products as the rumored price of the headset, yet its value sentiment is still in line with our broader consumer electronics coverage.

Feedback overlap highlights a possible existing customer base

We’ve found Meta Quest customers leave way more feedback on Apple products than the average respondent, showing that they are more likely to own them than the average person. Meta Quest customers leave 3x more feedback on iPhone and AirPods than the average person who shares feedback across the 2,500+ brands we track. If they own a Meta Quest device, and already own an Apple device, it may not take as much convincing for Apple to get Meta Quest users to switch to an Apple VR device, especially if it already integrates well with their existing Apple products.

To further appeal to these users, the AR/VR headset should aim to integrate seamlessly with these devices. Features that allow users to easily sync, control, and share content across devices could be particularly appealing. This deep integration would offer a level of usability and functionality that would potentially distinguish the Apple AR/VR headset from its competitors.

It becomes clear that Apple's entry into the VR scene must focus on providing an experience that matches its brand identity: intuitive, user-friendly design, high-quality products, and seamless integration with its existing ecosystem.

With its history of groundbreaking innovations, Apple now stands before a new frontier to conquer. It must, however, listen to its consumers, meet their needs, and stay true to its brand, ensuring that its AR/VR headset doesn't just turn heads, but truly resonates with its audience. Keeping a continuous flow of communication with its users will help Apple understand the evolving needs and preferences of its customer base, allowing Apple to make necessary adjustments and improvements to its headset.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures Customer Satisfaction, or CSAT, on a 5-point scale.

- Net Promoter Score® measures a customer’s willingness to recommend a given brand to a friend, on a scale of 1 to 10. The metric represents the percentage of customers who are promoters (answering 9 or 10) minus the percentage who are detractors (answering 6 or less). NPS® is a registered trademark of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld.

- Our “listening” methodology allows customers to select the brands that matter to them and then summarize their usage, experience, and future spending intent. Selection Frequency represents the percentage of customers who decided to provide feedback on a brand and then select a given “driver” of customer satisfaction (such as Price, Speed or Brand Values & Trust) as a reason they think the product or service is good or bad. Selection frequency is an indicator of how important a driver is in determining how customers as a whole feel about the brand.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Usage Intent reflects the percentage of customers who plan to use a specific brand during the next 12 months, minus the percentage who plan to use less.

- HundredX evaluated overlap on a trailing twelve-month basis.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.