Average U.S. gas prices have dropped a resounding 33% during the past six months, from their peak in June 2022 ($4.93) to December 2022 ($3.30). Throughout this historically high-priced period, Americans made significant changes to their habits, including driving fewer miles, combining errands, searching for “cheap” gas, postponing summer road trips, and shopping less at Convenience Stores (C-Stores). Despite the recent drop in gas prices, feedback from “The Crowd,” real convenience store customers, indicates gas prices remain very important, but lower prices are surprisingly not helping the demand outlook for C-Stores as a group.

We look to The Crowd to get a recent read on C-Stores trends and which brands customers favor most.

- Future Purchase Intent trends continued negative and declined further for Convenience Stores in December, despite cheaper gas.

- Gas prices have fallen in importance to customers since August 2022, as prices declined.

- Satisfaction of customers across the industry with Food and Store Prices declined, potentially a reflection of businesses passing through higher costs to customers.

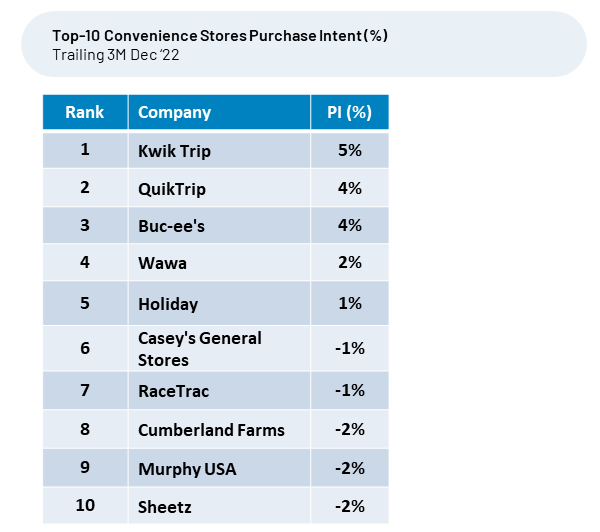

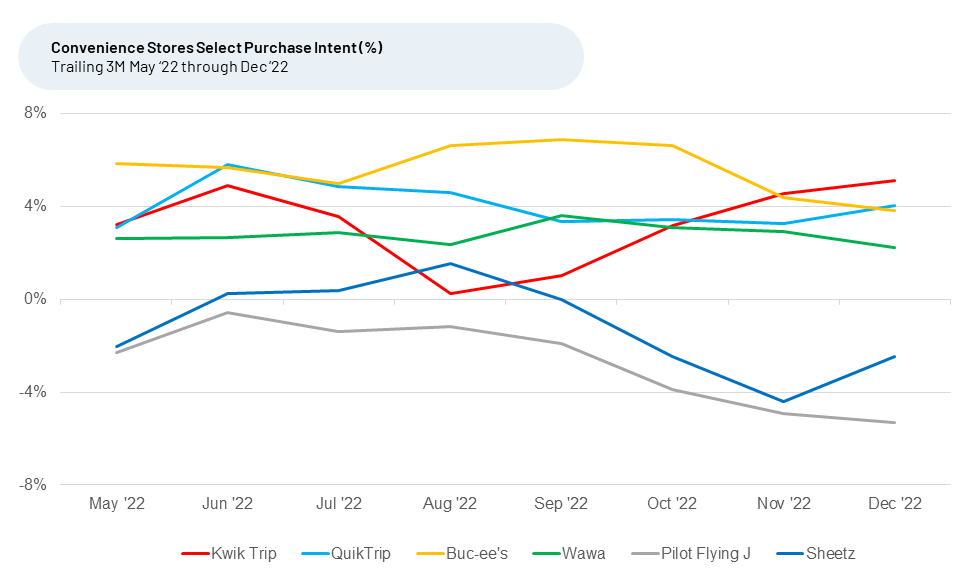

- Kwik Trip and QuikTrip enjoyed the best combination of the highest and recent increases in Purchase Intent. Buc-ee’s and Wawa are also among the leaders in Purchase Intent.

- Regional outlets such as TravelCenters of America showed some of the highest recent improvements.

- Favored C-Stores do a better job of pleasing customers with their Convenience, Cleanliness, Gas Prices, and Speed

Leveraging HundredX’s proprietary listening methodology, we evaluate more than 64,000 pieces of feedback from real customer experiences at 26 Convenience Store Retailers across the country to gain insight into future purchase intent, the drivers fueling demand growth, and Customer Satisfaction (CSAT). We use that data to analyze insights into customers’ future Purchase Intent¹ for the C-Stores sector, focusing on which companies look to benefit most.

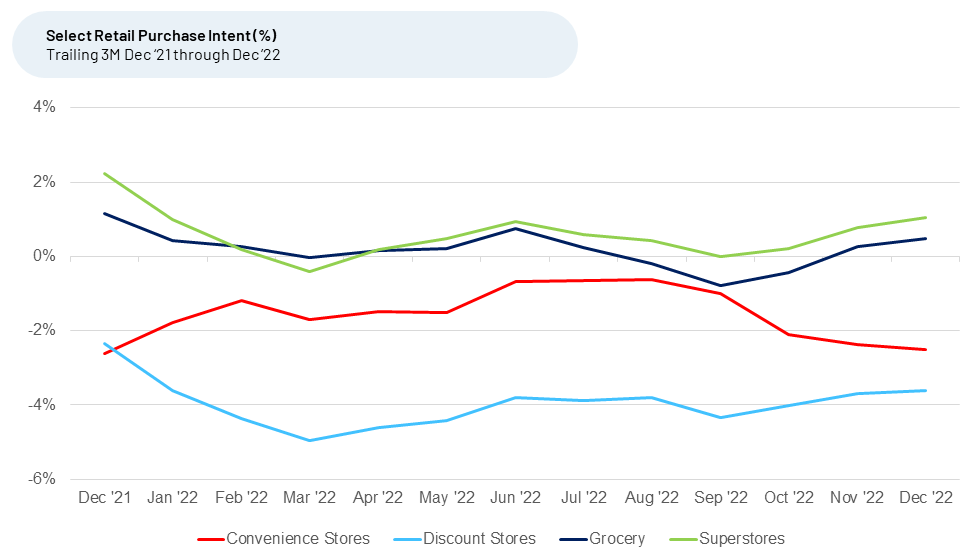

Purchase Intent for Convenience Stores has remained negative throughout 2022 after being positive for most of 2021. After a bounce for the first half of 2022, it has been declining since August 2022. This trend continued into December 2022, despite falling gas prices over most of the same timeframe.

Food prices and other operating costs increased for most C-Stores, and they have passed these costs onto customers. Consequently, customer satisfaction with Food and Store Prices fell during the past six months, along with Quality and Speed.

Interestingly, gas prices declined in importance to customers as prices dropped, slipping from the second most selected driver of customer satisfaction (selected 62% of the time) in August 2022 to the third most selected (55% of the time) in December 2022.

Customer future purchase intent for C-Stores decreased during the last three months, while intent for the other sectors of retail that sell food, gas, and everyday items (including Grocery, Superstores, and Discount Stores), has actually increased since October 2022.

Kwik Trip and QuikTrip are the top overall C-Stores Purchase Intent leaders

We utilize Purchase Intent to measure customers’ plans for spending again at a particular store brand over the next twelve months. Purchase Intent reflects the percentage of customers who plan to spend more with the brand in the future minus the percentage that plan to spend less. The Crowd tells us they are most positive on spending with Kwik Trip, QuikTrip, Buc-ee’s, and Wawa in the future.

Kwik Trip, the current Purchase Intent leader, has posted Purchase Intent increases every month since August 2022, defying the sector’s negative trend. The company’s Purchase Intent rose from 0% in August 2022 to 5% in December 2022. In terms of the drivers of customer satisfaction, sentiment for Kwik Trip’s customers is 15% to 30% ahead of peers on Cleanliness, Speed, Selection, Quality, and Store Prices. It has improved the most recently with Speed, Attitude, and Value. The Midwestern chain prides itself on customer service and friendly worker attitudes. It is also vertically integrated with a focus on high-quality food and its own bakery, kitchens, dairy, and distribution, which enable it to deliver meals and items that outpace the competition. One satisfied customer commented, “I absolutely love the employees positive attitudes and love that I am able to find majority of my grocery items there.”

QuikTrip, based out of Tulsa, also showed positive purchase intent trends to close the year, up from 3% in September 2022 to 4% in December. QuikTrip has improved the most on customer satisfaction with its Speed, Gas Prices, and Attitude. One recent customer noted, “Love the speed and friendliness of staff at every store.” Another said, “Best gas prices around! I’ll go out of my way because they are significantly lower than other gas stations.”

Kwik Trip and QuikTrip are the top overall C-Stores Purchase Intent leaders

QuikTrip and regional brands are the largest C-Store Purchase Intent recent movers

A mix of large national chains (Kwik Trip and QuikTrip) and smaller ones (Petro Shopping Centers and TravelCenters of America) lead the list of brands posting the largest three-month increase, December 2022 over September 2022. We find that companies with purchase intent rising faster than the overall industry tend to indicate they’re gaining market share.

Two of the top three risers in Purchase Intent over the last three months are Petro Stopping Centers and TravelCenters of America, small to mid-sized chains owned by the same parent company. Petro Shopping Center increased from -11% in September to -3% in December 2022. TravelCenters intent rose from -7% in September to -5% in December. Customer satisfaction with Selection, Restrooms, and Cleanliness improved most for Petro Stopping Centers. Those factors, along with Quality, Attitude, and Beverages improved for TravelCenters. One happy TA customer recently mentioned, “Always clean bathrooms and convenient locations.”

Holiday Stations, a chain based in Minnesota, is the last of the C-Stores with positive purchase intent at 1%. It is flat over the last three months, but up from a bottom of -2% in August 2022. Holiday is part of the Circle K family of stores. Customer satisfaction with Holiday’s Speed, Cleanliness, Food, and Store Prices have all improved during the past few months. One recent customer commented, “Like going to Holiday as I know what I will get: clean store, good prices, great selection and friendly helpful employees. Holiday also does a great job researching perfect locations to be in. Very well done.”

We will continue to monitor the impact movement in gas prices on the C-Store market and Purchase Intent going forward. Given the lower gas prices at the end of 2022 coupled with overall C-Stores Purchase Intent declines, it appears that gas prices will not benefit C-store demand overall, though it will remain important to the particular stores customers prefer. The most successful stores will continue delivering excellent experiences with the top drivers of satisfaction: Convenience, Cleanliness, Gas Prices, Speed Gas Pumps, and Selection.

HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

While The Crowd tells us that the overall loyalty outlook will most likely continue its trend, select C-Store brands making strides in the areas customers care about the most are poised to gain market share relative to the broader sector. We continue to monitor trends to see what changes emerge in 2023.

- All metrics presented, including Net Loyalty Intent (Loyalty Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.