Sports appeal most to lower-income households

It’s early 2023. The NFL playoffs just finished their first week. NHL is mid-season, and the NBA is preparing for its All-Star game next month. What will the 2023 season bring for the top U.S. Sports Leagues? Analyzing 40,000 pieces of feedback left by “The Crowd” of real fans for 14 major sports leagues we cover in 2022, we find:

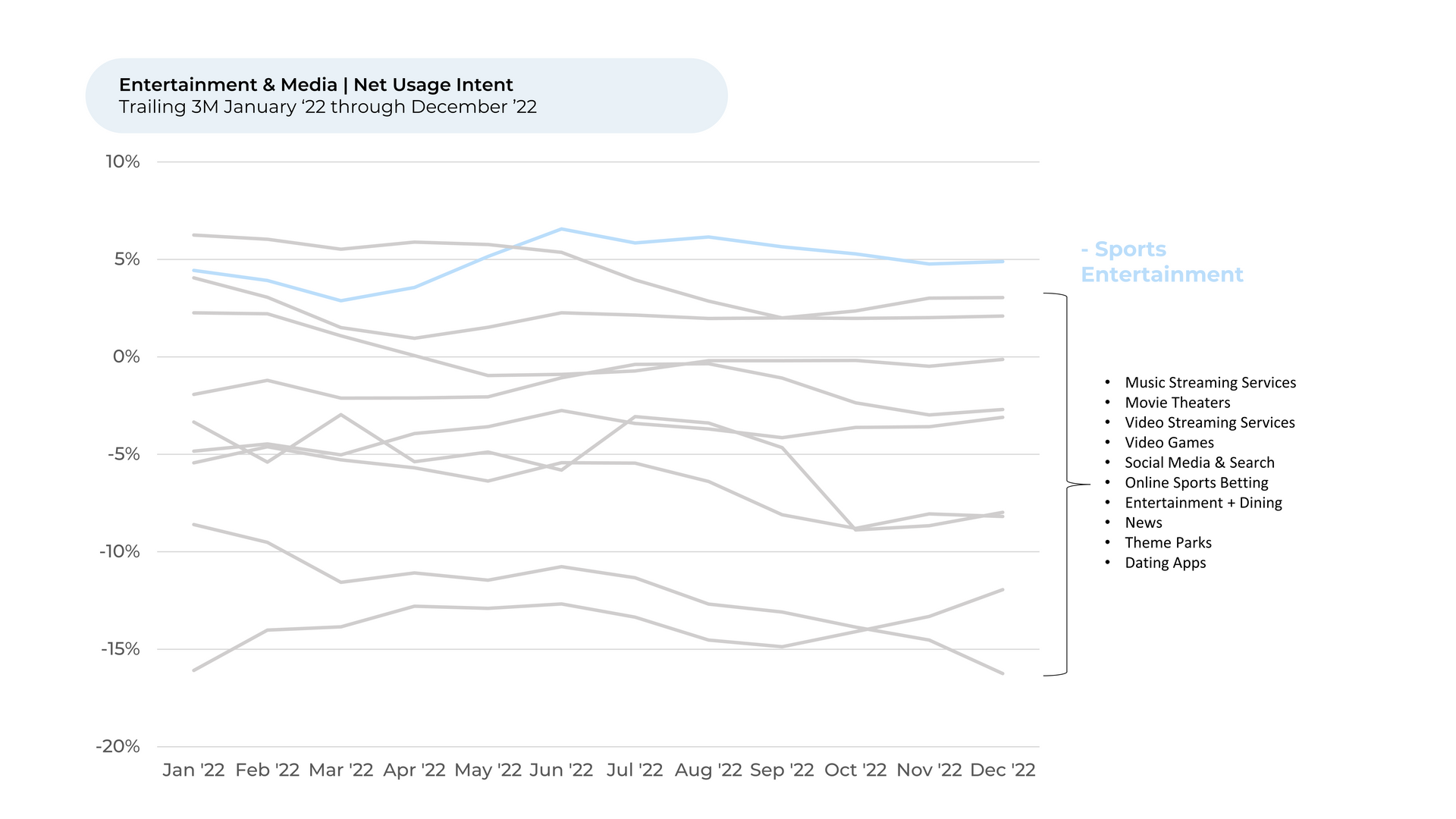

- Sports Entertainment maintains the highest Usage Intent¹ among forms of entertainment and media we cover, but it appears to be slipping.

- More sports fans expect to increase how much they follow the NHL than other top U.S. sports leagues.

- Fans increasingly expect to follow WNBA, even though the 2023 season doesn’t begin until May.

- Lower-income households expect to increase their following of top sports leagues more than higher-income ones.

- Over the last few months, MLB Follow Intent climbed the highest for lower-income households relative to other income brackets and compared to other top sports leagues.

Sports still reign supreme according to The Crowd. As we noted in our past coverage, Sports Entertainment features a higher Usage Intent than all other forms of entertainment and media that HundredX tracks. It is also one of only a handful of industries in the wider entertainment and media sector that has a positive Usage Intent.

Still, we’re seeing a slight downward trend in Sports Entertainment, falling about 1% in Follow Intent over the past three months even as several other forms of entertainment (namely, News, Social Media, and Music Streaming) see improvements.

Usage Intent for most Entertainment & Media industries represents the percentage of customers who expect to use or visit a brand more over the next 12 months, minus those that intend to use or visit it less. For Sports Entertainment, it represents the percentage of customers who intend to follow a sports league in the next twelve months minus those that do not. We refer to this as Follow Intent.

Winners among Sports

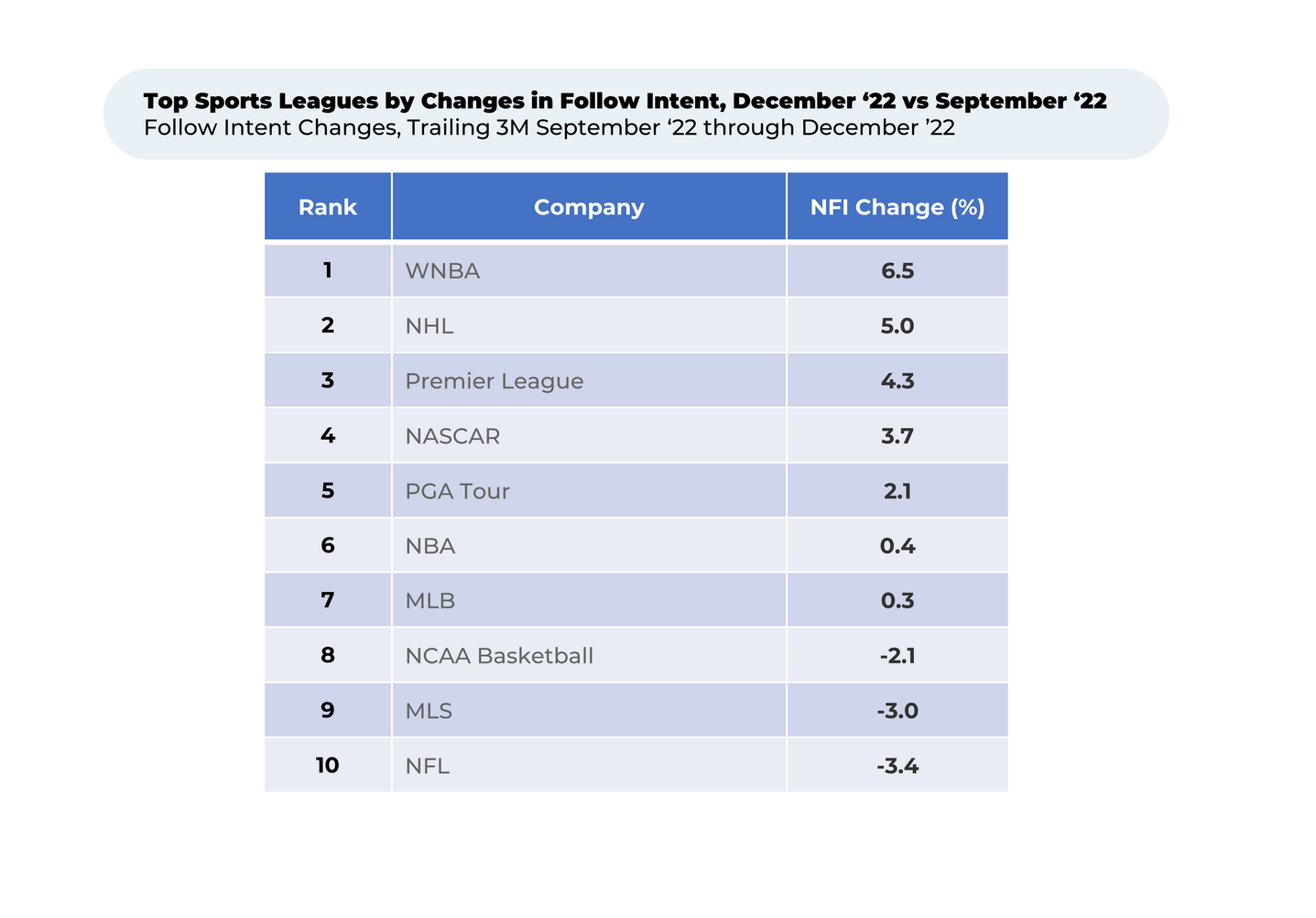

Still, over the past three months, several major sports leagues have had people share their intent to follow more over the next year. Follow Intent for NHL, whose season started in October, increased by 5% from September to December. Premier League saw a 4% increase, likely due to the

World Cup in December.

Interestingly, WNBA saw the biggest increase (7%) over the past three months, despite its 2022 season ending in September and the 2023 season not beginning until May.

The release of WNBA player Brittney Griner from a Russian prison in December, and the political discussions prior to it, received widespread media coverage over the past several months. Griner was originally detained in Russia in February after authorities there found hash oil among her belongings. Since her release, Griner said she plans to continue playing in the WNBA.

WNBA saw significant improvements in all of the factors we track that drive customer satisfaction over the past three months, with the greatest in sentiment towards its Entertainment value, TV Presentation, and Insights and Analysis. The WNBA notably changed its playoff format during the 2022 season, eliminating single-round elimination matches in favor of best-of-three.

“I'm glad to see the WNBA is getting more prime-time coverage and attendance at the games is increasing,” one person told HundredX.

Interest by Income Level

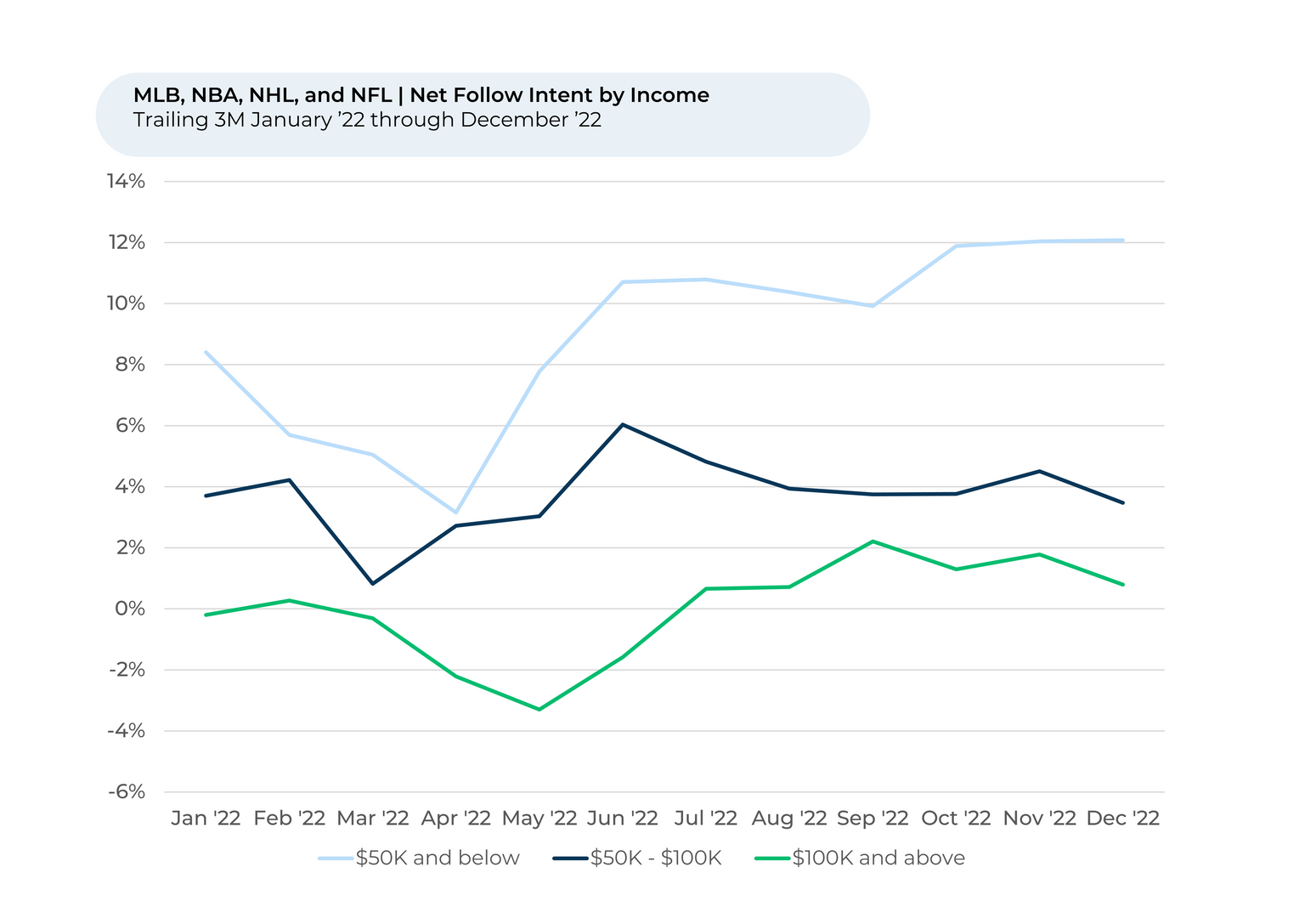

HundredX found lower-income households (those making $50,000 per year or less) have higher Follow Intent for the four major US sports leagues than other income groups and boasted larger gains in the past few months.

Combined feedback on the MLB, NBA, NHL, and NFL, shows the Follow Intent for lower-income households (12%) is notably higher than that of $50K-$100K households (3%) and $100K+ households (1%) for December 2022.

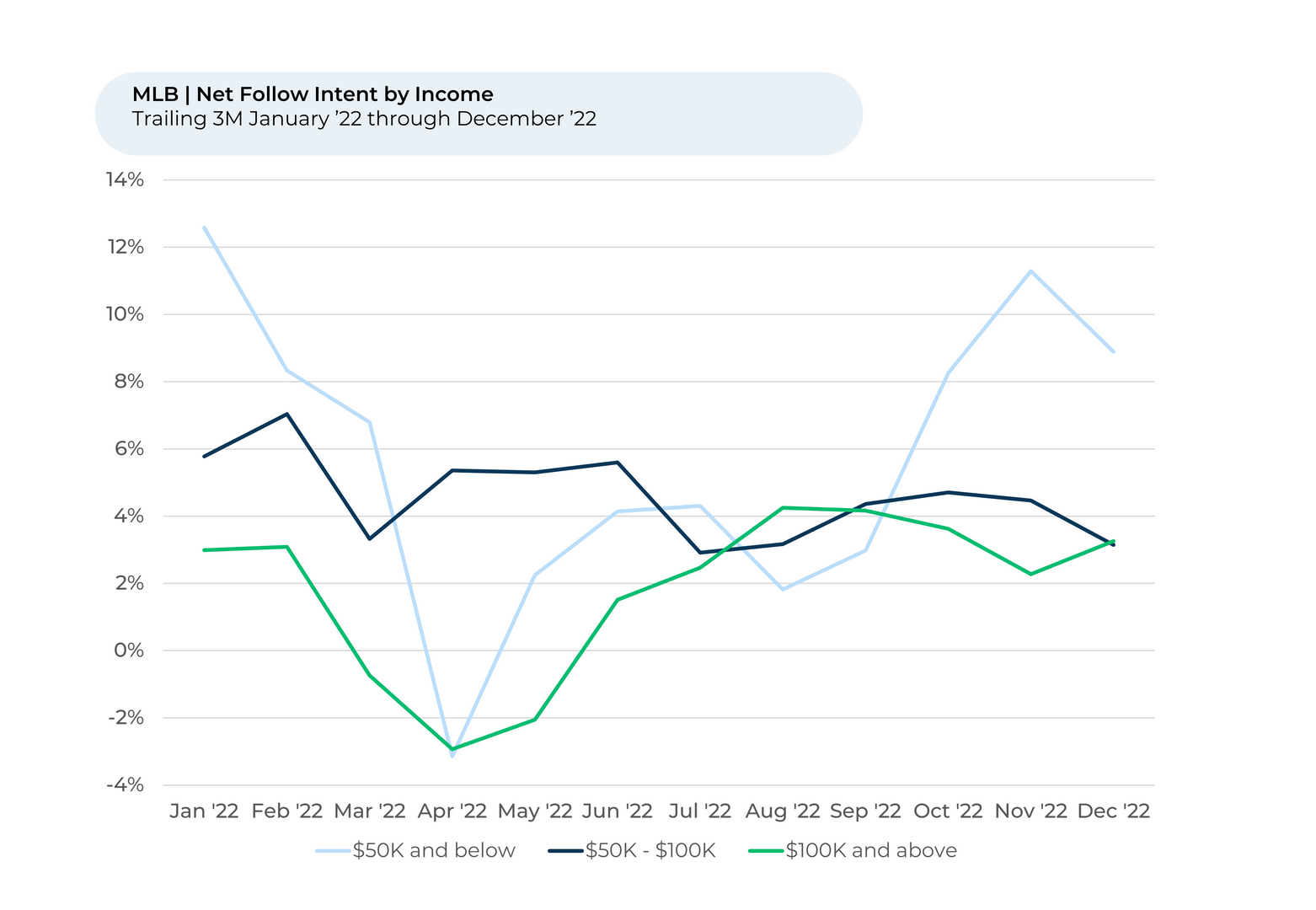

Over the last few months, MLB Follow Intent climbed the highest for lower-income households relative to other income brackets and compared to other top sports leagues.

Follow Intent for that income bracket skyrocketed from August through November, moving up 9%. The Follow Intent for other income brackets remained stable or fell during that same period.

It’s worth noting Apple brought the 2022 MLB season to Apple TV+, allowing users to watch two exclusive Friday night MLB games per week for free, no subscription required.

HundredX will monitor the Sports Entertainment industry throughout 2023 to better understand how economic conditions, season openings, and other major factors affect The Crowd. By following trends in the data, we can better understand how The Crowd will act in the future.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.