Instacart is set for its first earnings report as a public company later this week. The company’s stock price has lagged since its high-profile IPO, as focus on potential for weakening consumer spend and slower revenue growth for Instacart heading into 2024 has increased.

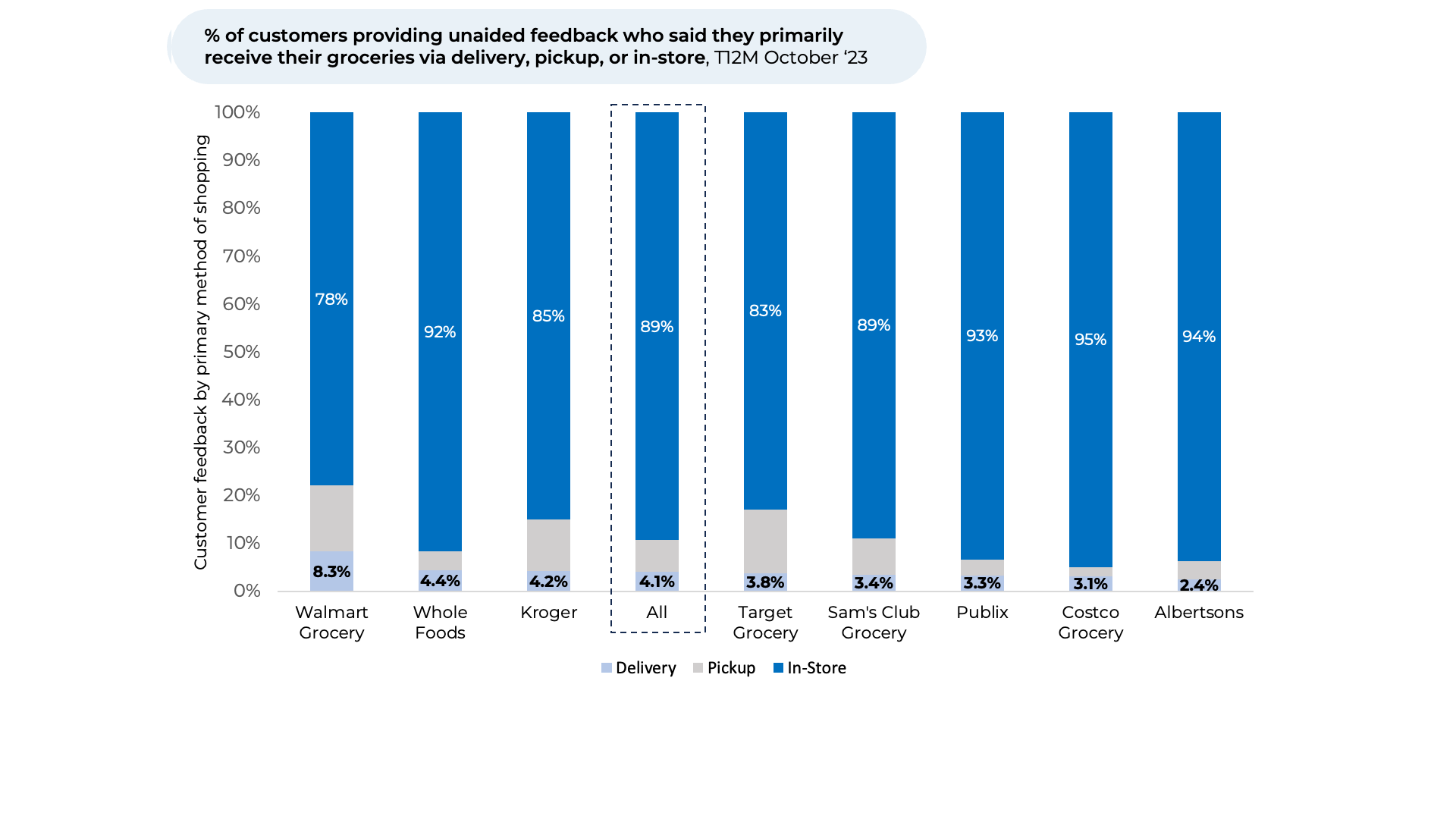

Insights from “The Crowd” of real Instacart and food delivery customers supports the view growth rates are likely to slow over the next 6-12 months. However, our analysis of over 280,000 pieces of feedback on grocers leads us to believe Instacart has a huge opportunity to gain market share and re-accelerate growth by targeting the nearly 96% of grocery customers we find primarily pick up groceries in store instead of getting them delivered. That percentage is unchanged from a year ago, implying online delivery platforms are not shifting grocery customer’s primary shopping habits. However, there is a lot for delivery platforms to gain from even modest success making progress.

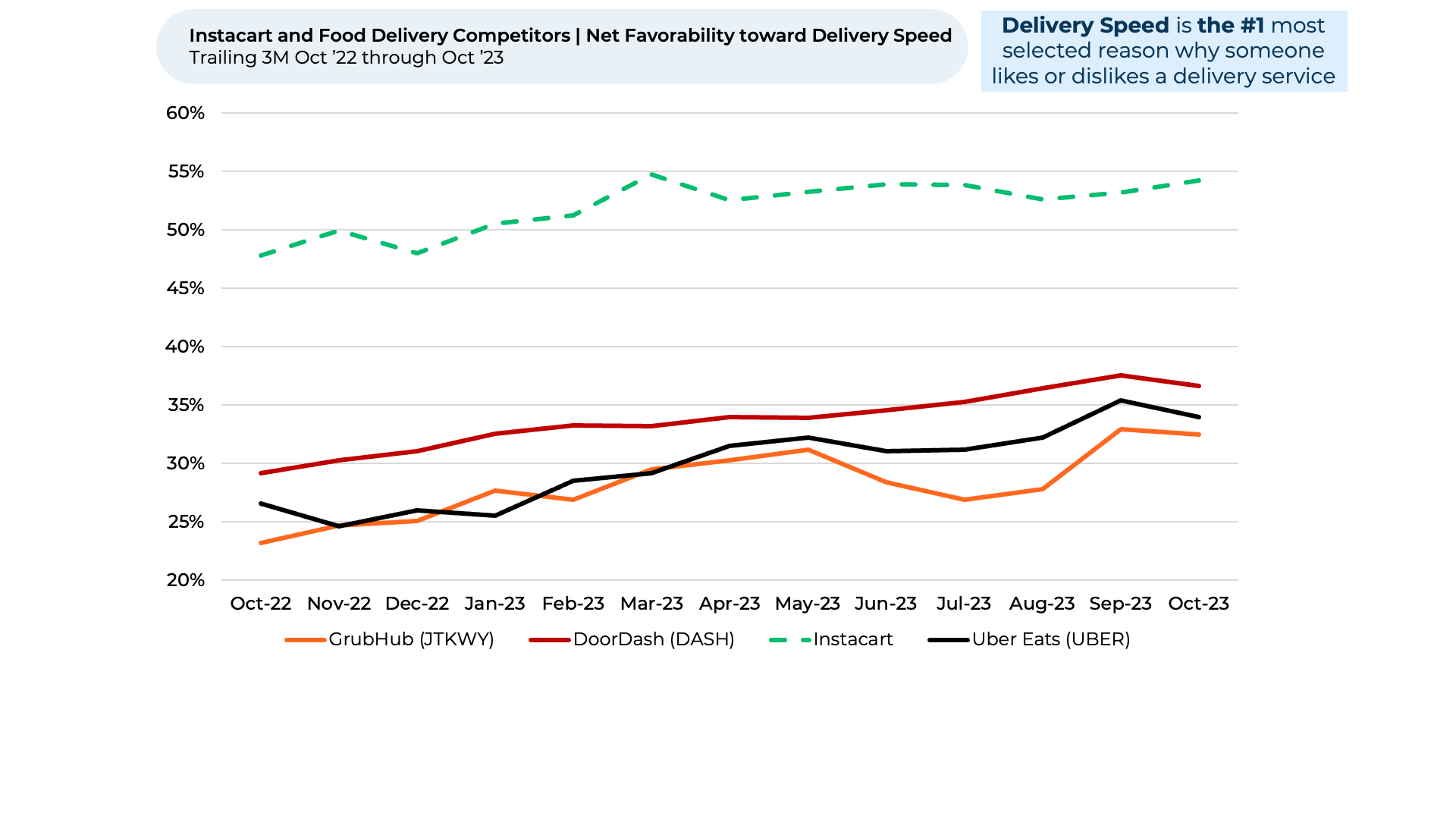

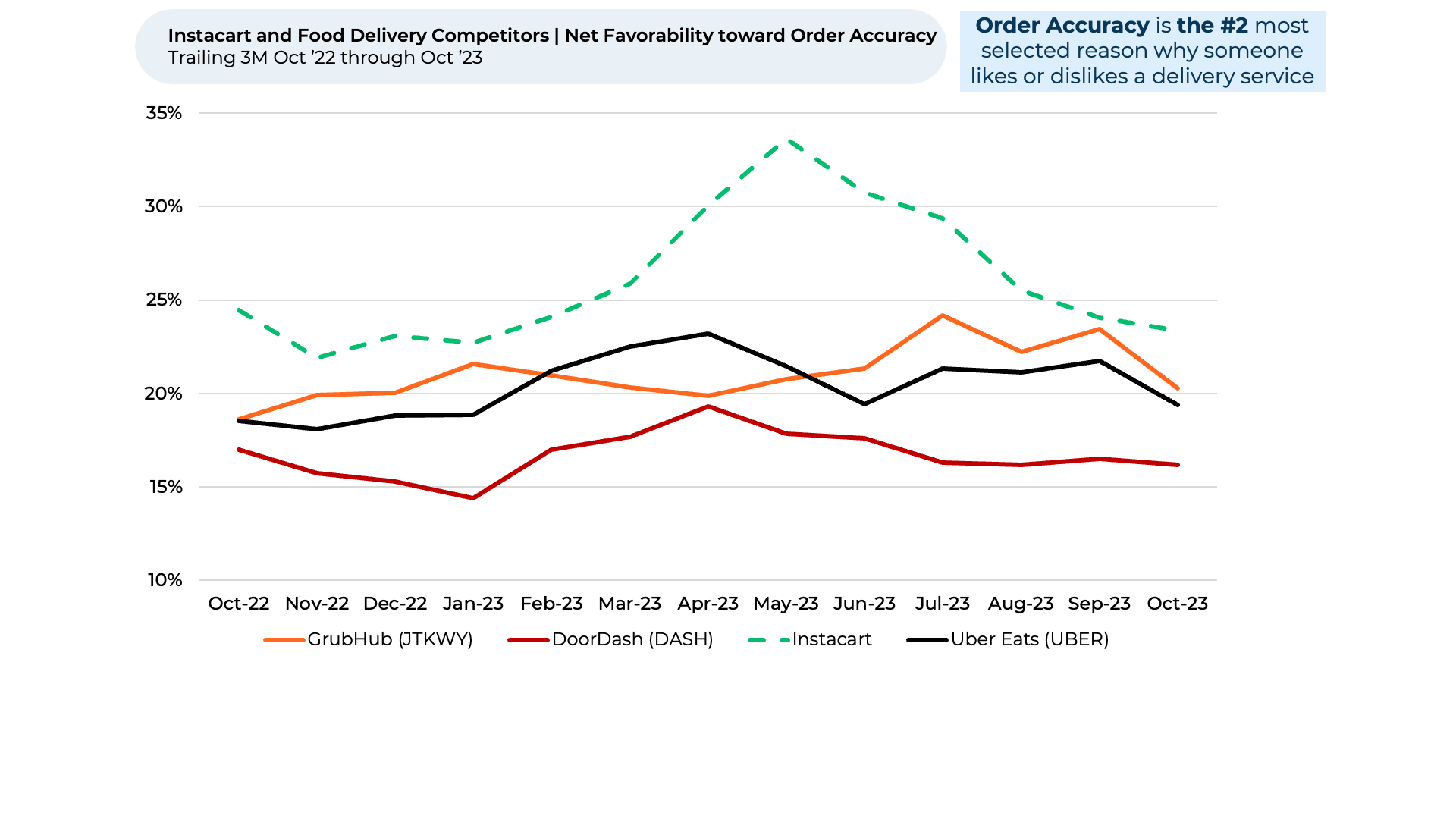

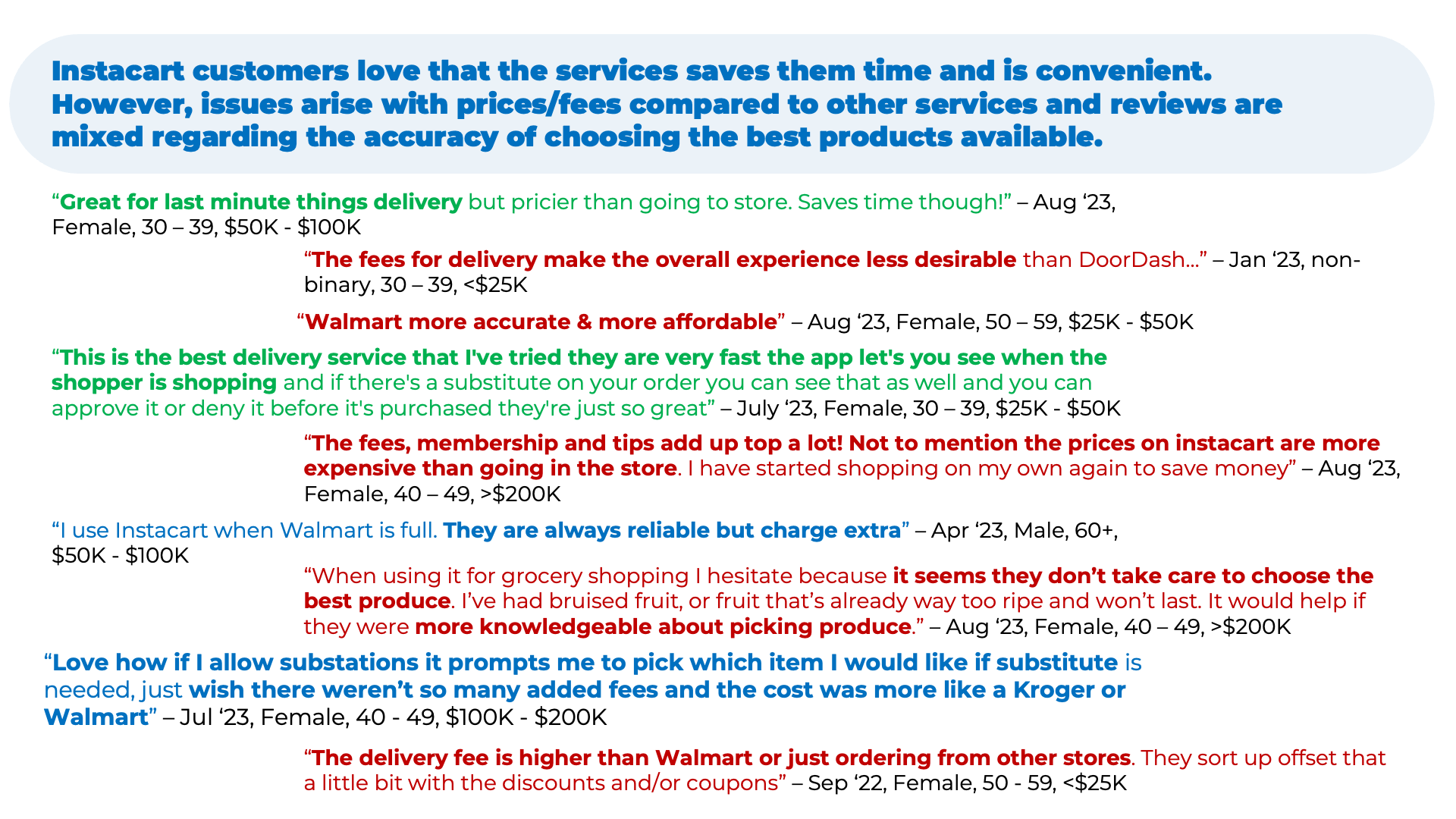

We take a close look at Instacart, traditional grocers like Walmart and Kroger that have been increasing their attention to online delivery services and food delivery platforms like Uber Eats and DoorDash who have recently expanded their services into the grocery delivery space. We find Instacart has an opportunity to tap into a huge market of in-store grocery customers, but this will require continued excellence on delivery speed and order accuracy and increased focus on quality of produce and product substitutes.

Analyzing more than 375,000 pieces of feedback across the grocery and food & product delivery industry since January 2022, including more than 12,000 on Instacart, we find:

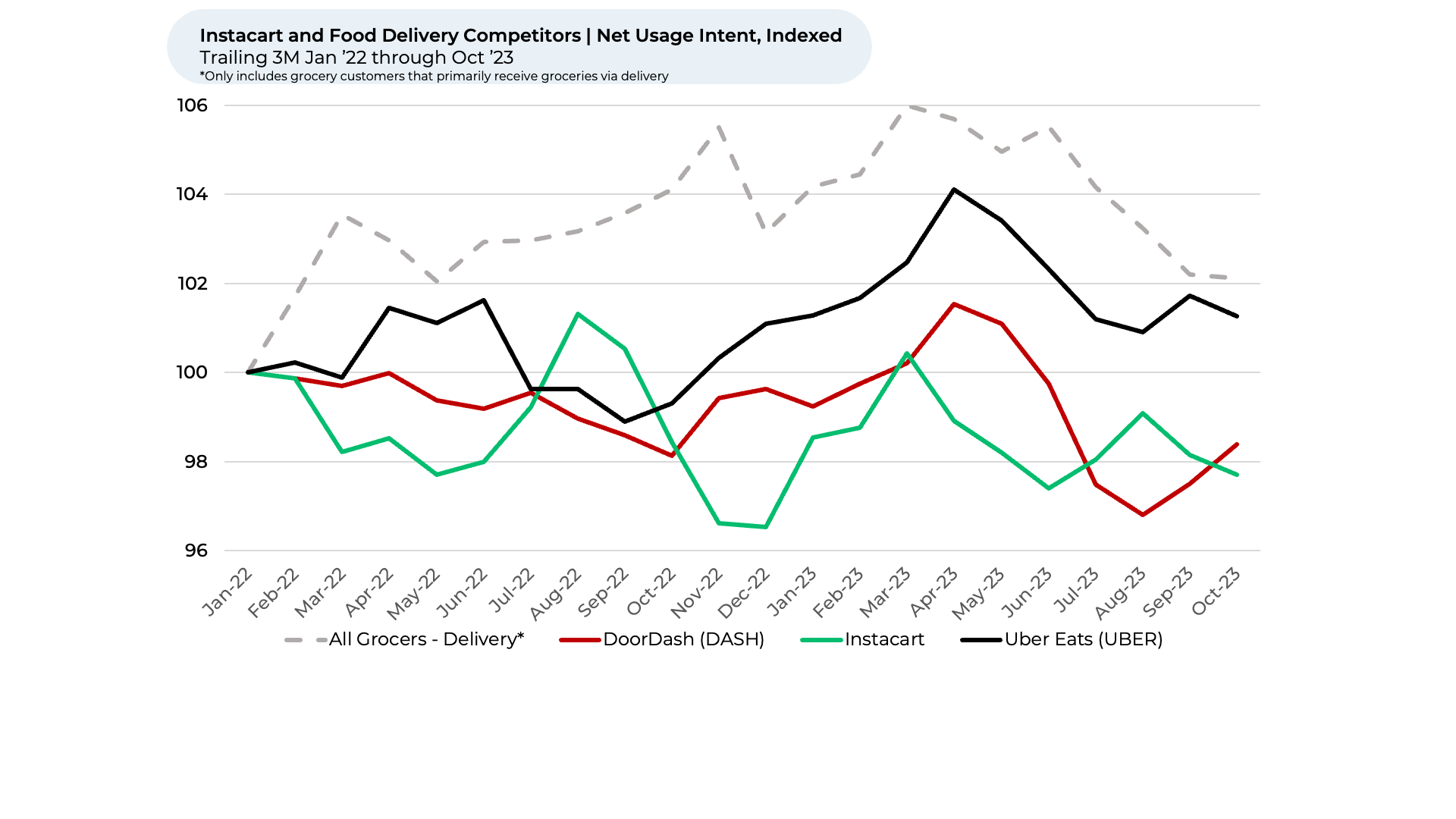

- All food delivery has experienced a slowdown in demand outlook this year. Instacart has seen Usage Intent¹'² fall 3% since March, more than Uber Eats (1%) and DoorDash (2%). Purchase Intent for grocery customers that primarily shop via delivery was down 4%.

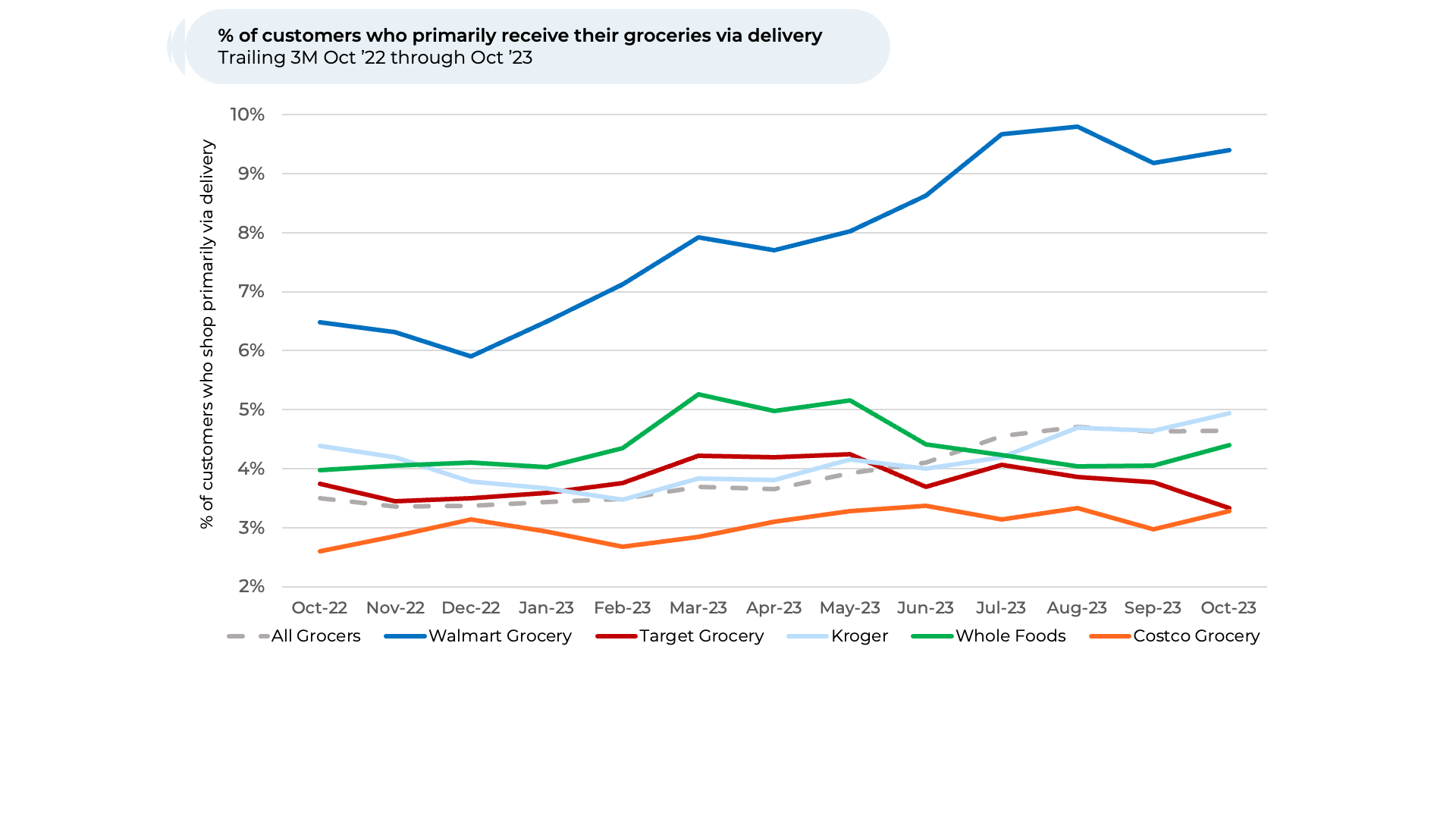

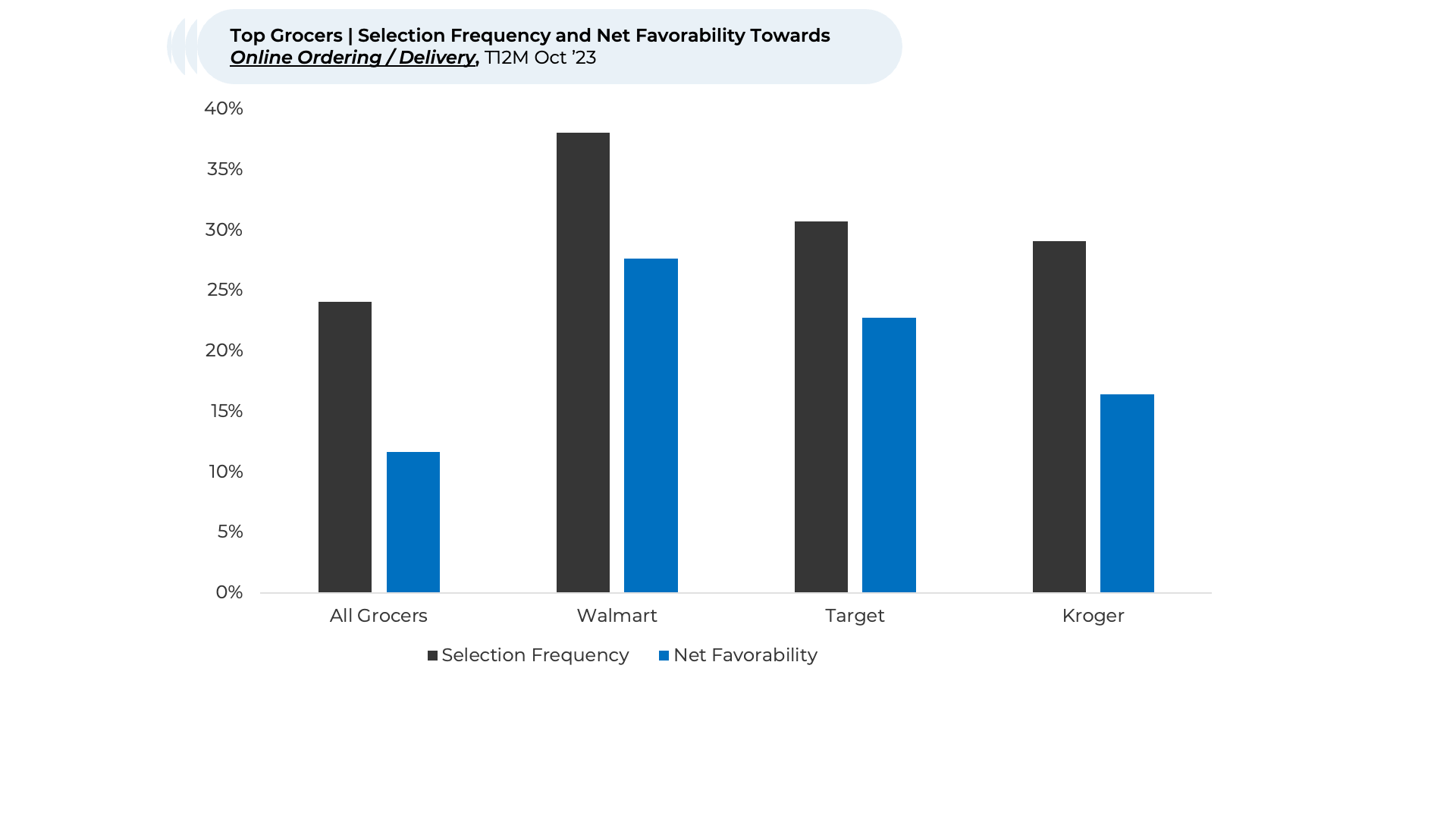

- A review of the leading traditional grocers shows that Walmart is the clear leader in home delivery.

- Over 8% of its grocery customers in the last year said they primarily use delivery, 4% higher than the industry average.

- As of October 2023, Walmart increased the percentage of people primarily using delivery by 3% while others were flat. Walmart had the highest customer net favorability³ towards online ordering/delivery of the major grocers we track, beating the average grocer by 16%.

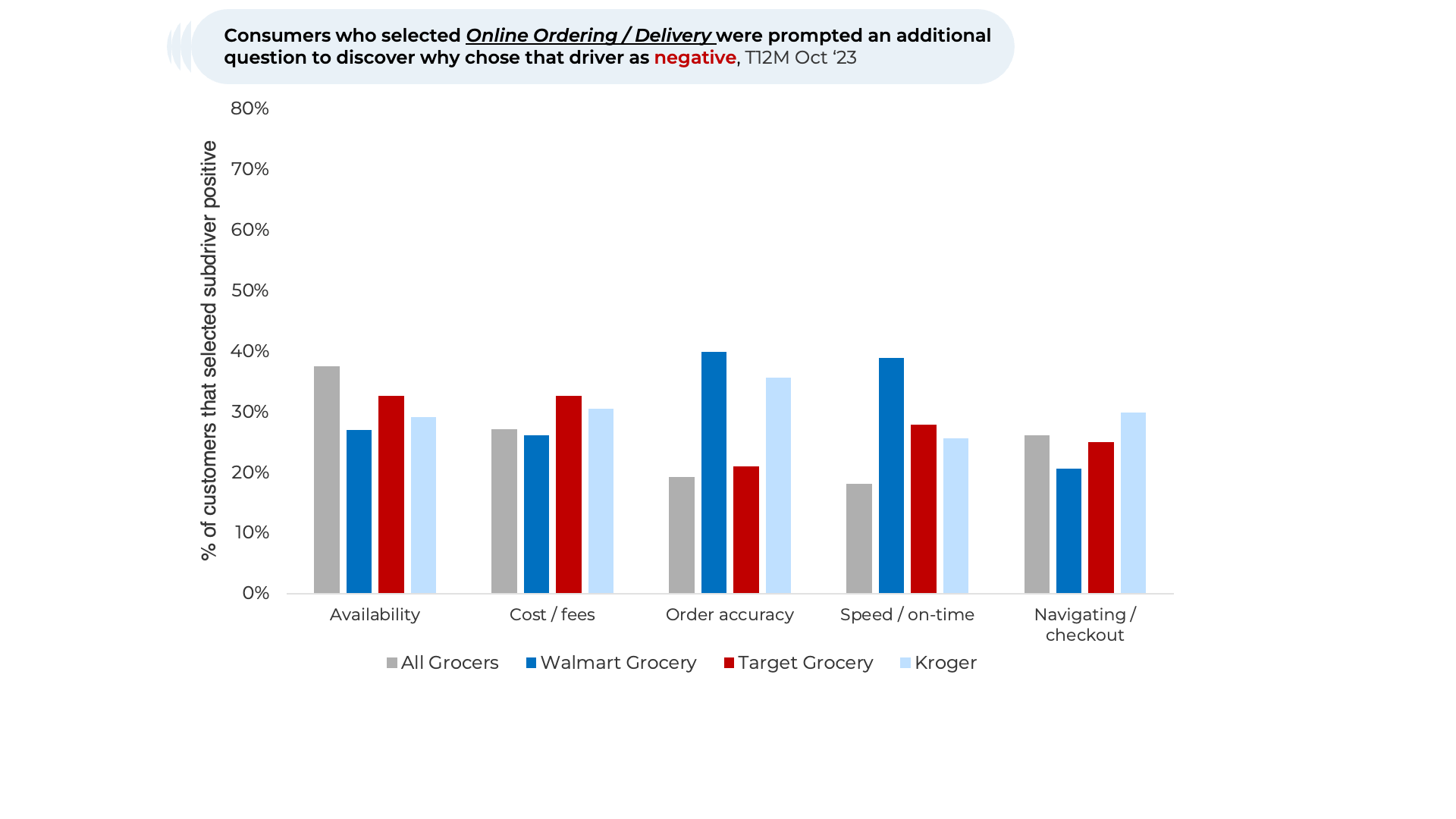

- For Instacart to win share, it should focus on delivery speed, order accuracy and good products available at a reasonable price. Speed and checkout were the top reasons grocery customers who primarily shop online said they were positive on their experience. Availability and cost/fees were their top weaknesses.

- A review of customer comments about both leading national grocers and Instacart highlights an opportunity to gain share by doing a better job with the quality of produce delivered and the product replacement choices.

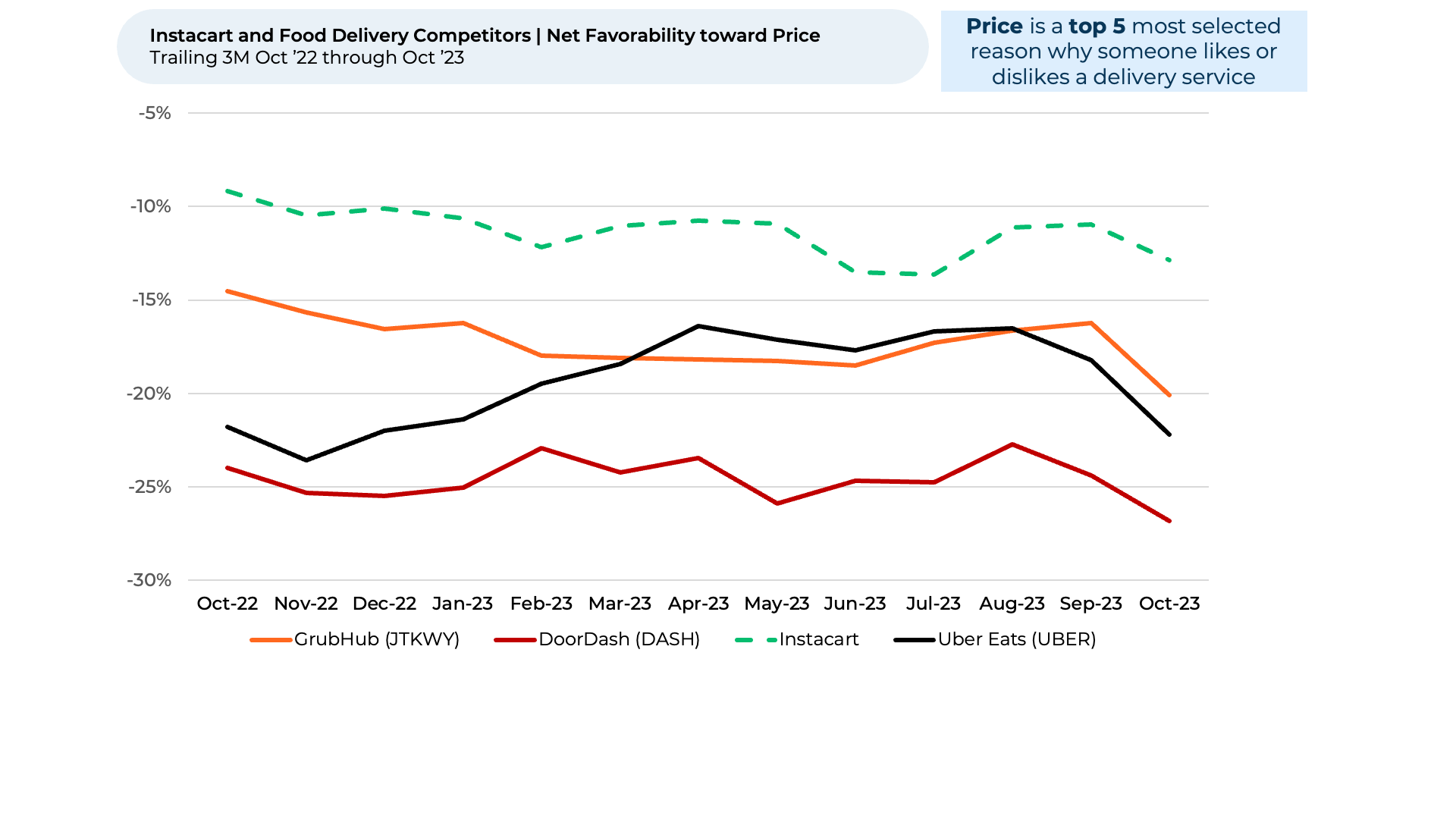

- Instacart remains well ahead of Uber Eats and Doordash on Speed and Order Accuracy. However, its net favorability toward Order Accuracy has rapidly declined since May (-10%), causing its lead over Uber Eats and Door Dash to contract significantly.

Please contact our team for a deeper look at HundredX's Restaurant and Food Delivery data, which includes more than 1,500,000 pieces of customer feedback across over 350 companies within the sector.

- All metrics presented, including Net Usage (Usage Intent) and Net Positive Percent / Favorability, are presented on a trailing three-month basis unless otherwise noted.

- Usage Intent represents the percentage of customers who expect to use more with that company over the next 12 months, minus those that intend to use less. We find businesses that see Usage Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.

- HundredX measures Net Favorability towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: hundredx.com/contact.