In

our June analysis, we found customer sentiment toward the Bud brands had plummeted, and some beer brands positioned to gain market share from Bud following Bud Light's Dylan Mulvaney marketing controversy.

Months later, Bud appears to be in the early stages of a rebound, albeit very slow for now. Examining 25,000 pieces of feedback across 13 popular beer brands, including more than 4,000 for Bud Light and 2,000 for Budweiser, we find:

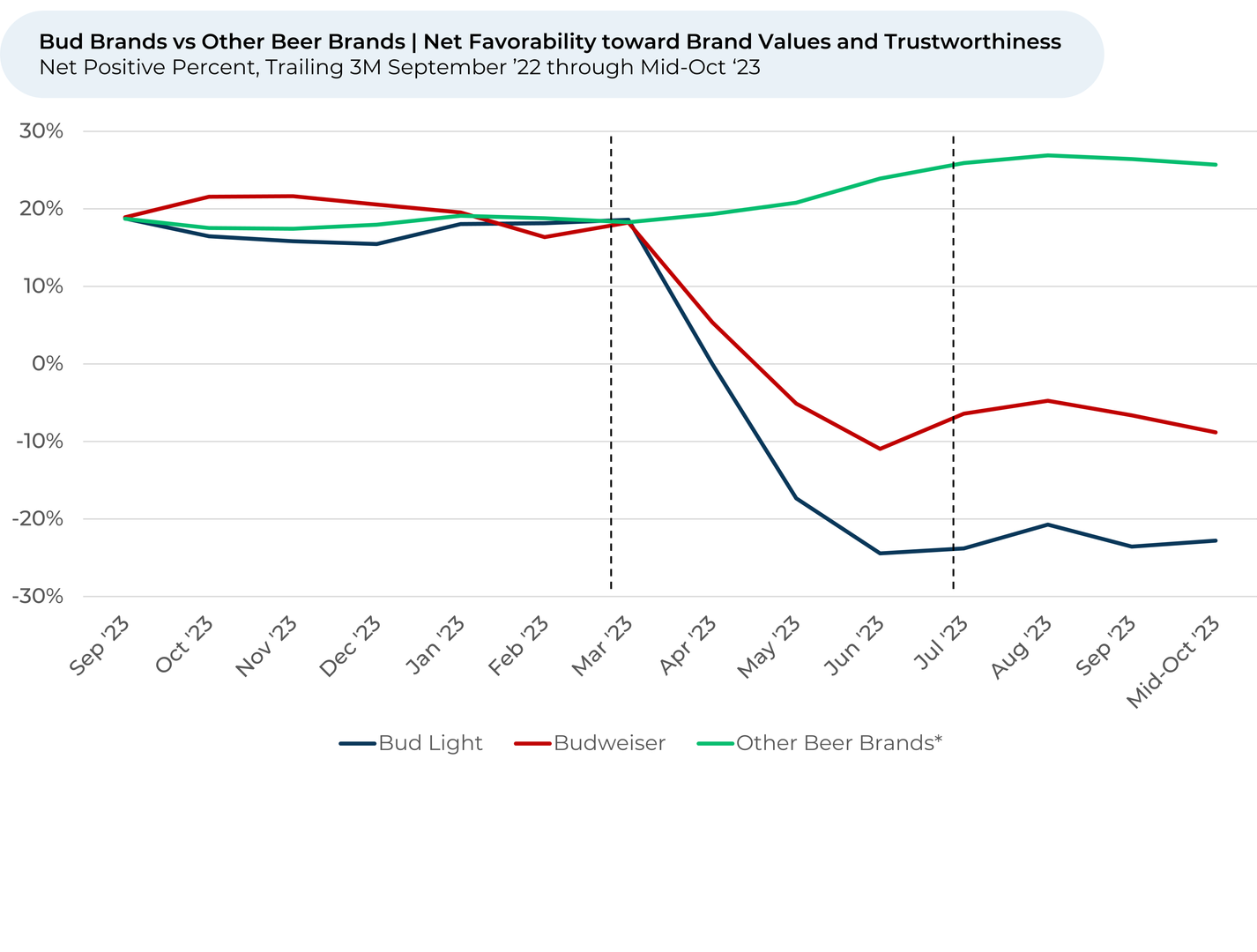

- Beer drinkers are very slowly starting to warm to Bud brands’ values and trustworthiness again. After falling more than 30% from March through June, customer perception¹'² toward Bud brands’ values grew 1% - 2% since June; a small step, but a step nonetheless.

- Budweiser in particular is starting to please with its famous Clydesdale ads again. Customer perception towards Budweiser’s ads clawed back 11% since falling over 50% from March to June.

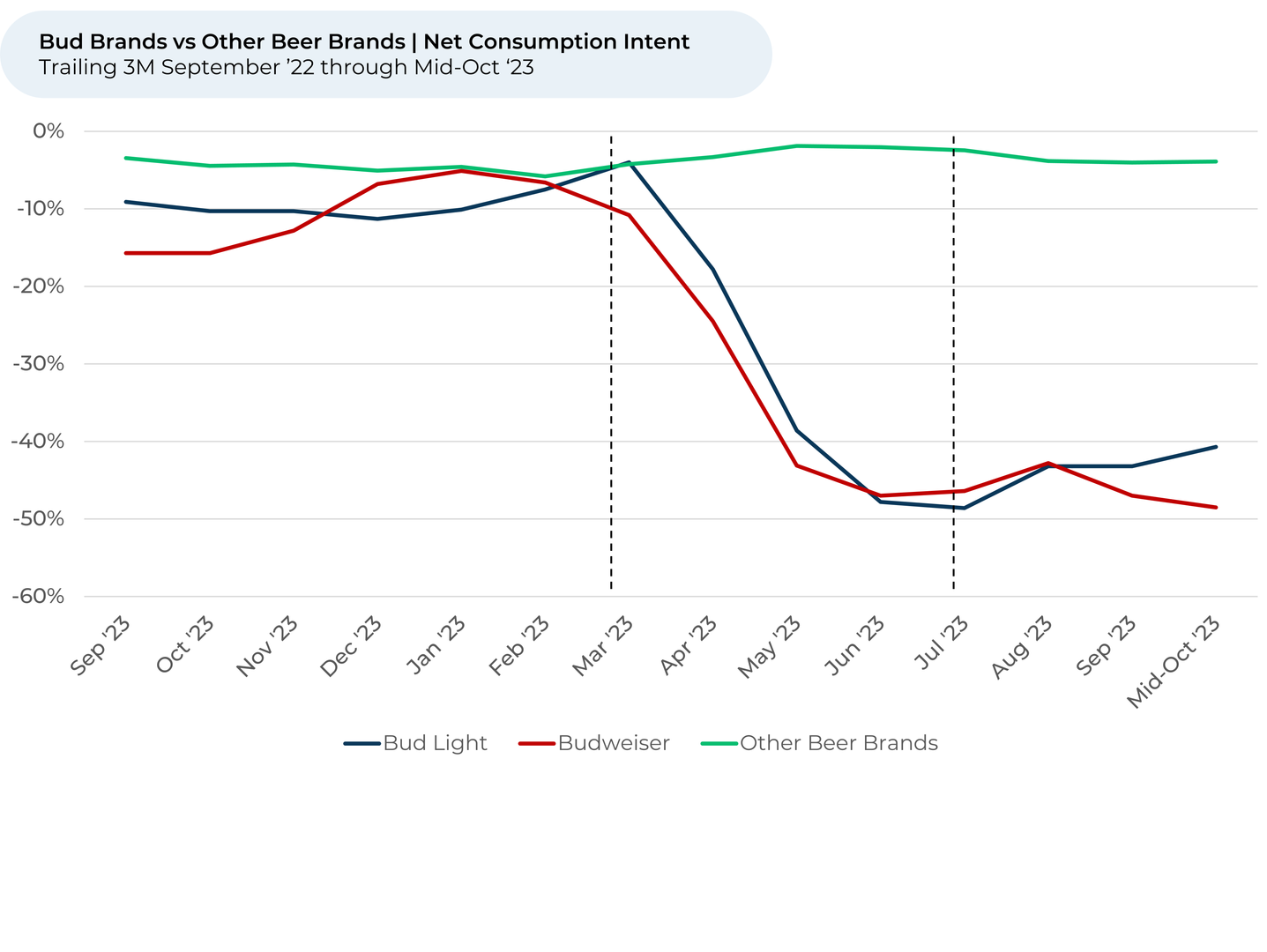

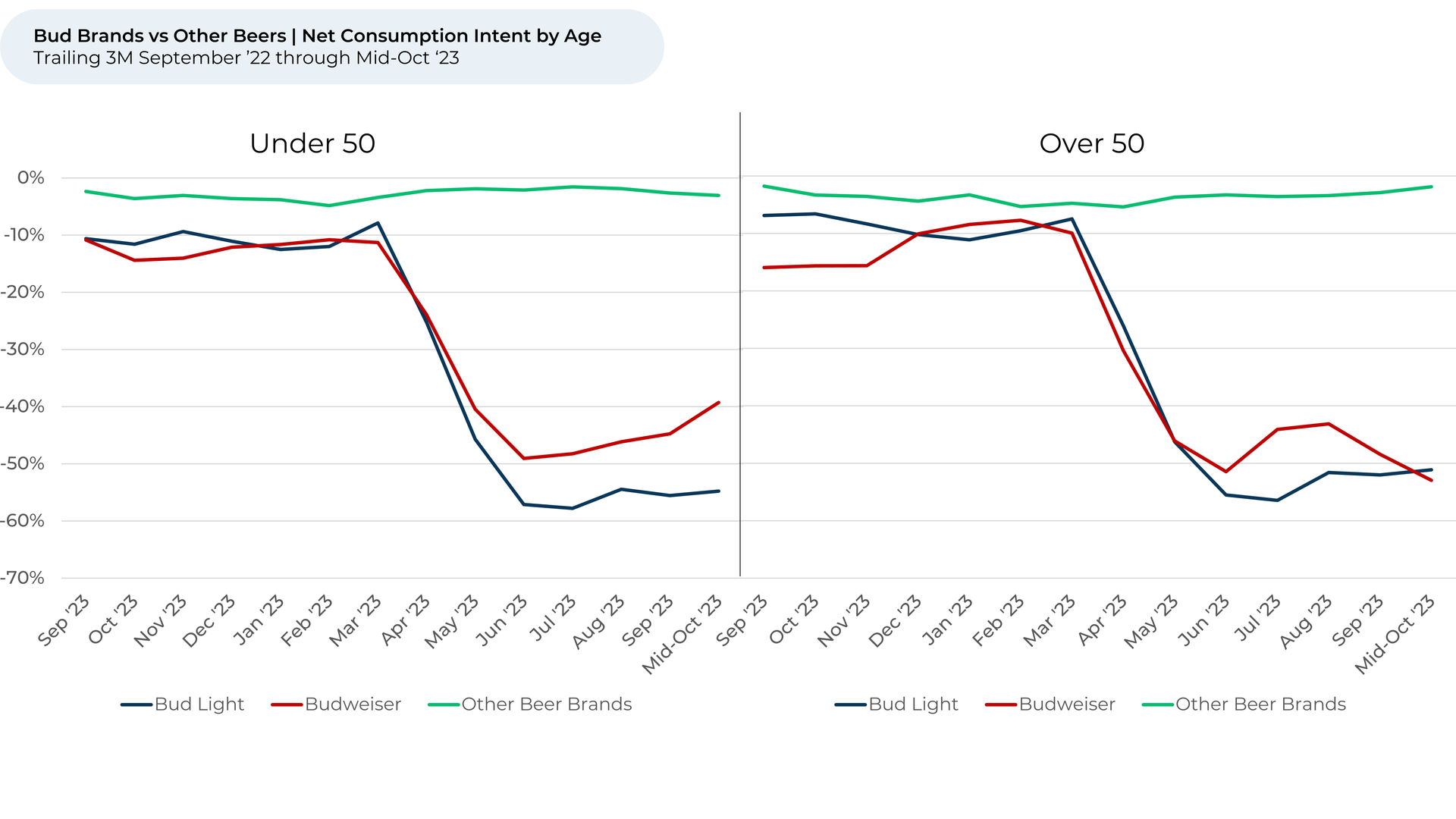

- Customers are thinking about drinking more Bud as they put its recent marketing challenges behind them. Consumption Intent³ bottomed out around July and has since grown 5% for Bud Light and 1% for Budweiser. Still, Bud and Bud Light’s Consumption Intent have significant ground to make up after falling 45% and 36% respectively from March to July while other beer brands⁴ were up 2%.

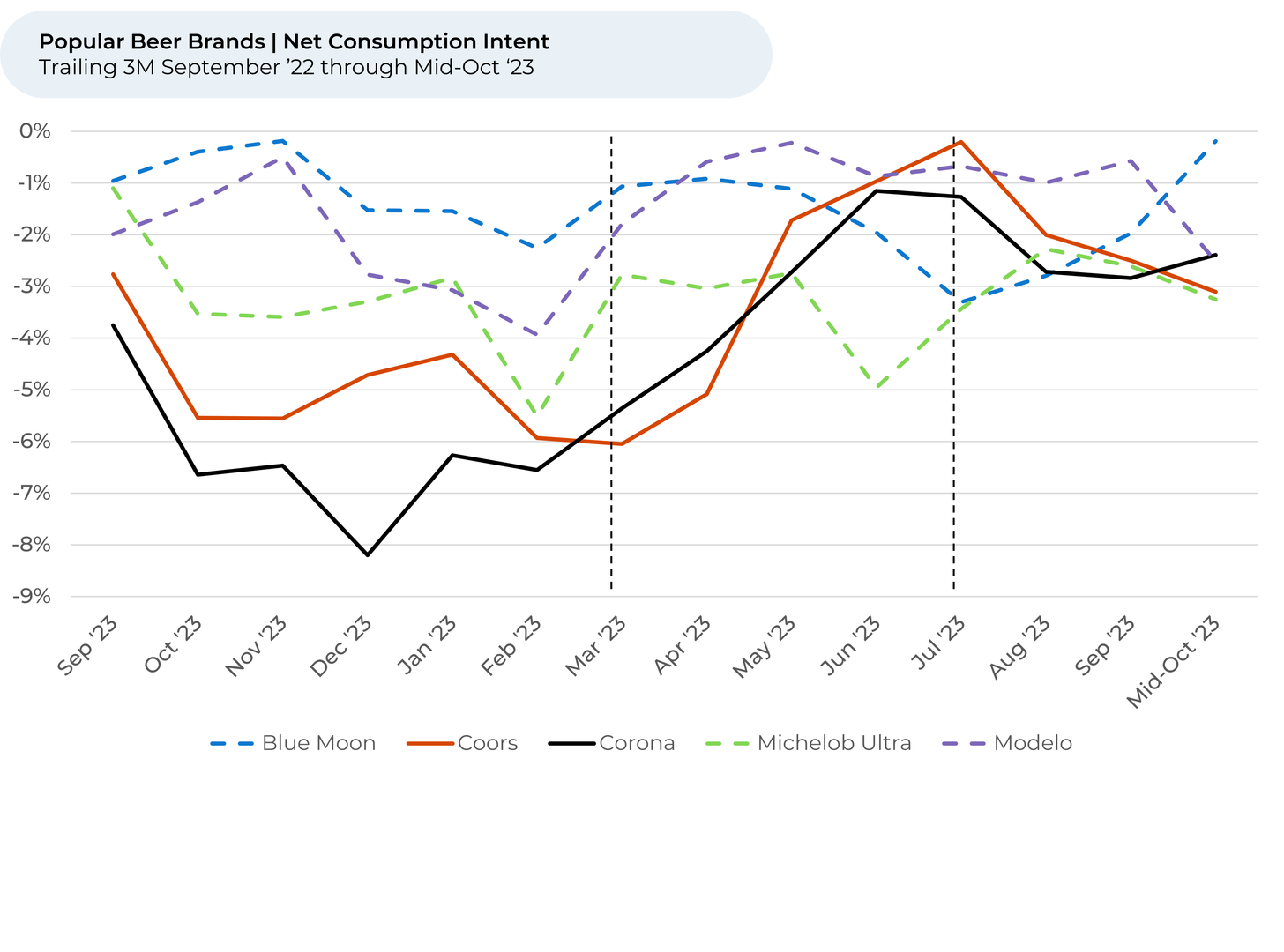

- Coors and Corona seemed to benefit the most from Buds’ decline. The brands gained moderate Consumption Intent (6% and 4% respectively) from March through July. But, those gains are in reverse as customers are turning back to Bud.

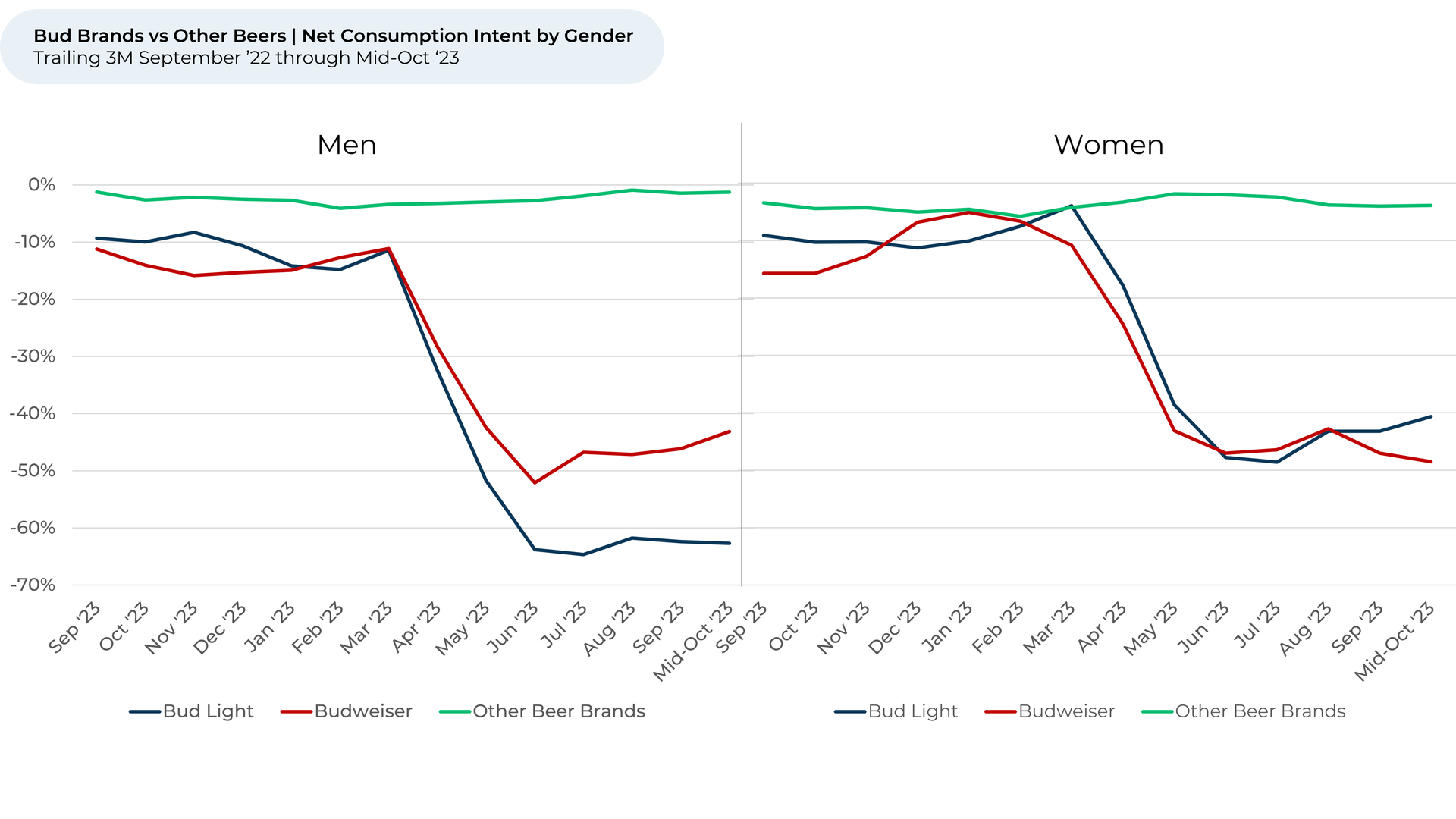

- Bud Light Consumption Intent fell far more for male and white customers compared to females and customers from other races. Interestingly, there wasn’t much of a difference between under-50- and over-50-year-olds.

Please contact our team for a deeper look at HundredX's data on Alcohol and Spirits, which includes more than 130,000 pieces of customer feedback across 68 alcohol brands.

- All metrics presented, including Net Consumption (Consumption Intent) and Net Positive Percent / Favorability are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Consumption Intent for alcohol represents the percentage of customers who expect to consume more of that brand over the next 12 months, minus those that intend to consume less. We find businesses that see Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.

- Other beer brands include: Blue Moon, Coors, Corona, Guinness, Heineken, Michelob Ultra, Miller, Modelo, Pabst Blue Ribbon, Samuel Adams and Stella Artois

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: hundredx.com/contact.