New Data Reveals Potential Smoother Sailing for the Cruise Industry.

Does “the crowd” know more than the investment and business communities? The latter has been concerned about the cruise industry, expecting the record-setting summer surges in bookings to be a short-lived reflection of “COVID-revenge” purchases with many anticipating a substantial reversal as fears of a recession loom. However, recent analysis of our double-blind feedback from over 35,000 cruise consumers suggests that the industry’s current recovery is likely to be more sustainable.

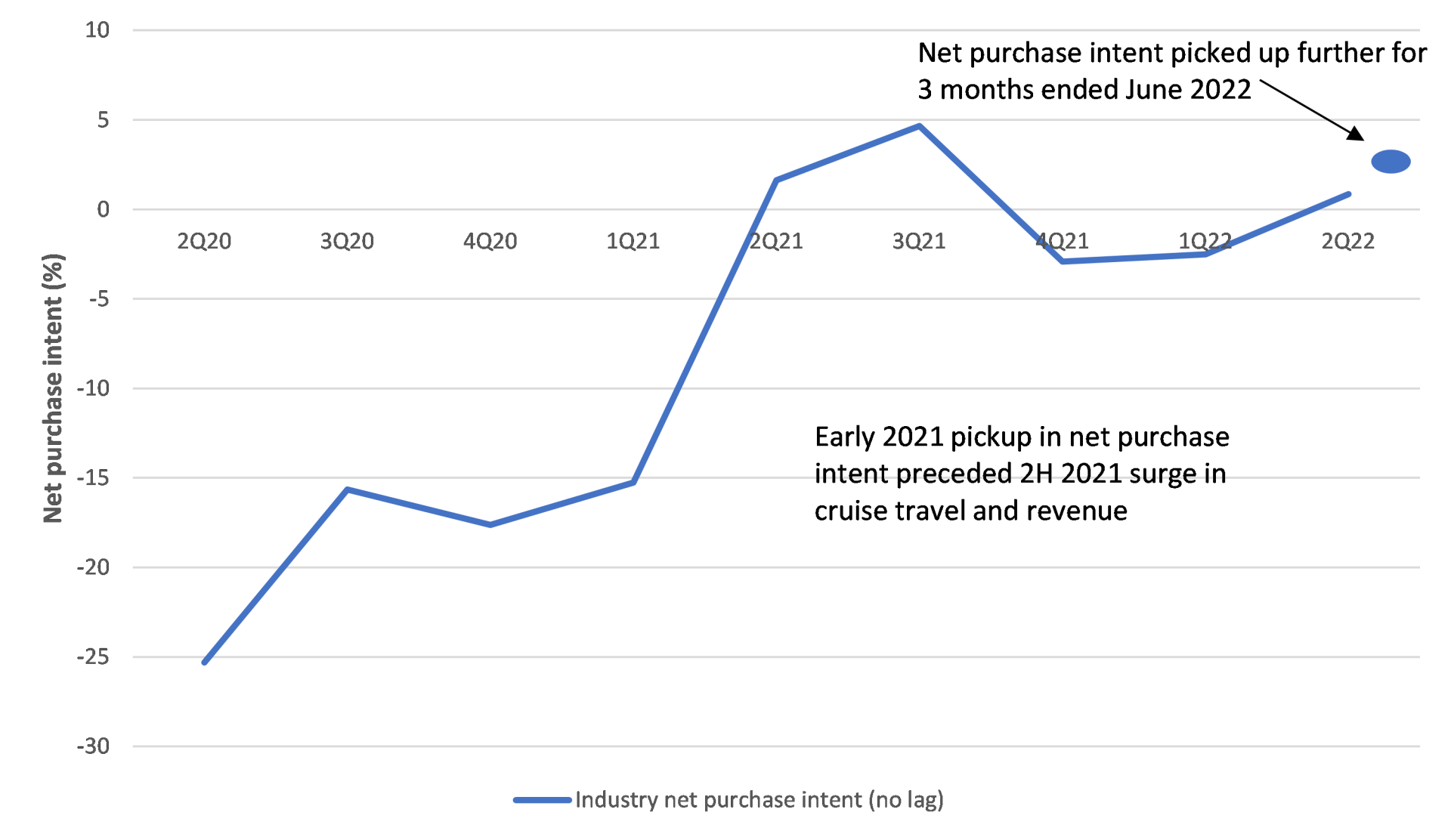

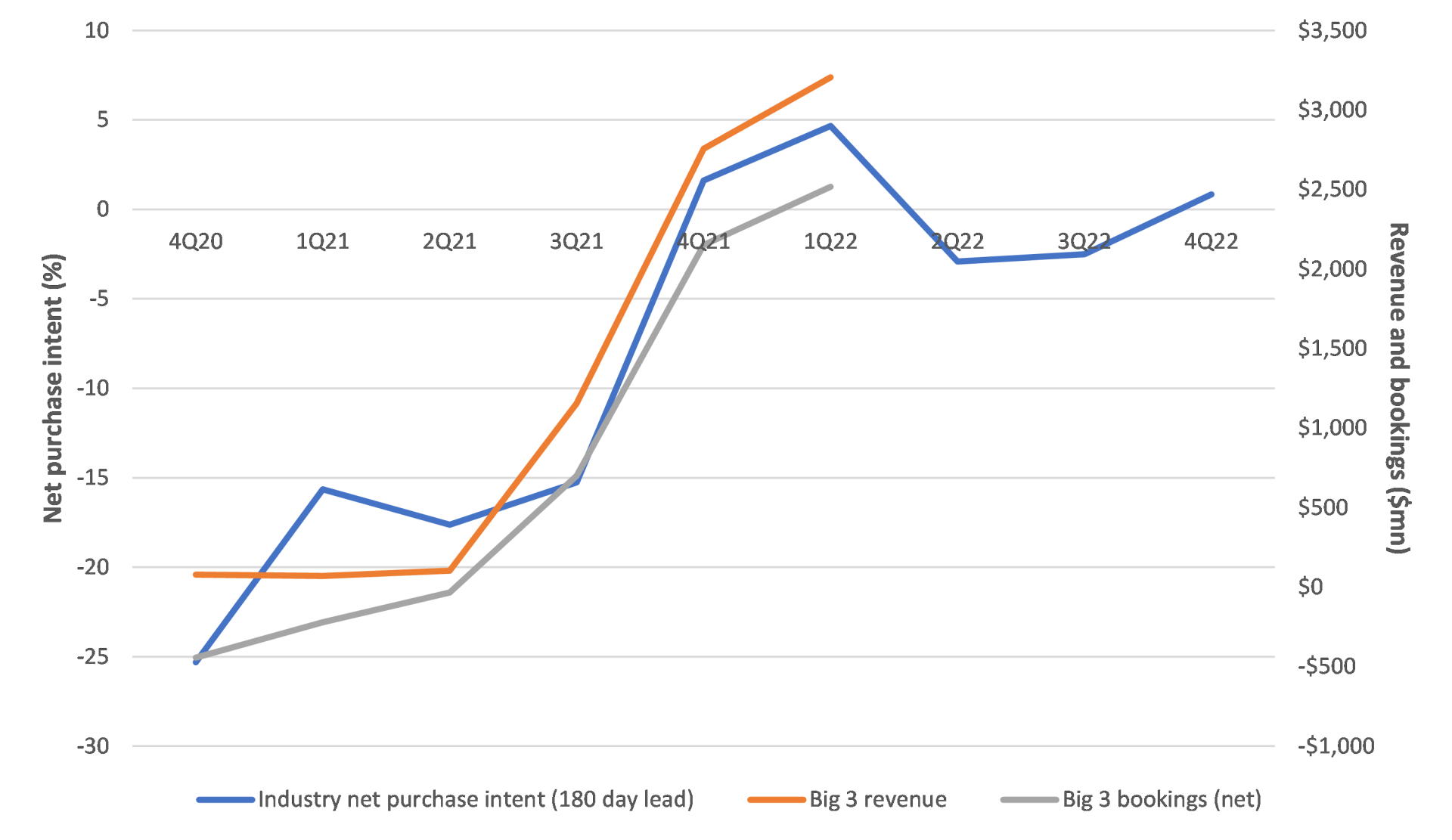

As with other travel related industries coming out of COVID, consumers started indicating in the Q2 of 2021 that they intended to meaningfully increase their future travel on cruise lines. In a series of curated questions using HundredX’s proprietary listening tools, each consumer was asked whether they plan to book another cruise over the next 12 months. In evaluating these real-time responses, HundredX looked at a key metric relating to Future Net Purchase Intent, meaning the percentage of consumers who said yes, they do plan to purchase another cruise, minus the percentage who indicated they do not. Results showed that this metric began to spike by +20% from 1Q21 to 3Q21. Given that HundredX’s data has shown a 95%+ correlation between that metric and real-world results six months later, the record levels of growth this summer shouldn’t have been surprising as “the crowd” was making it clear that they planned to keep cruising.

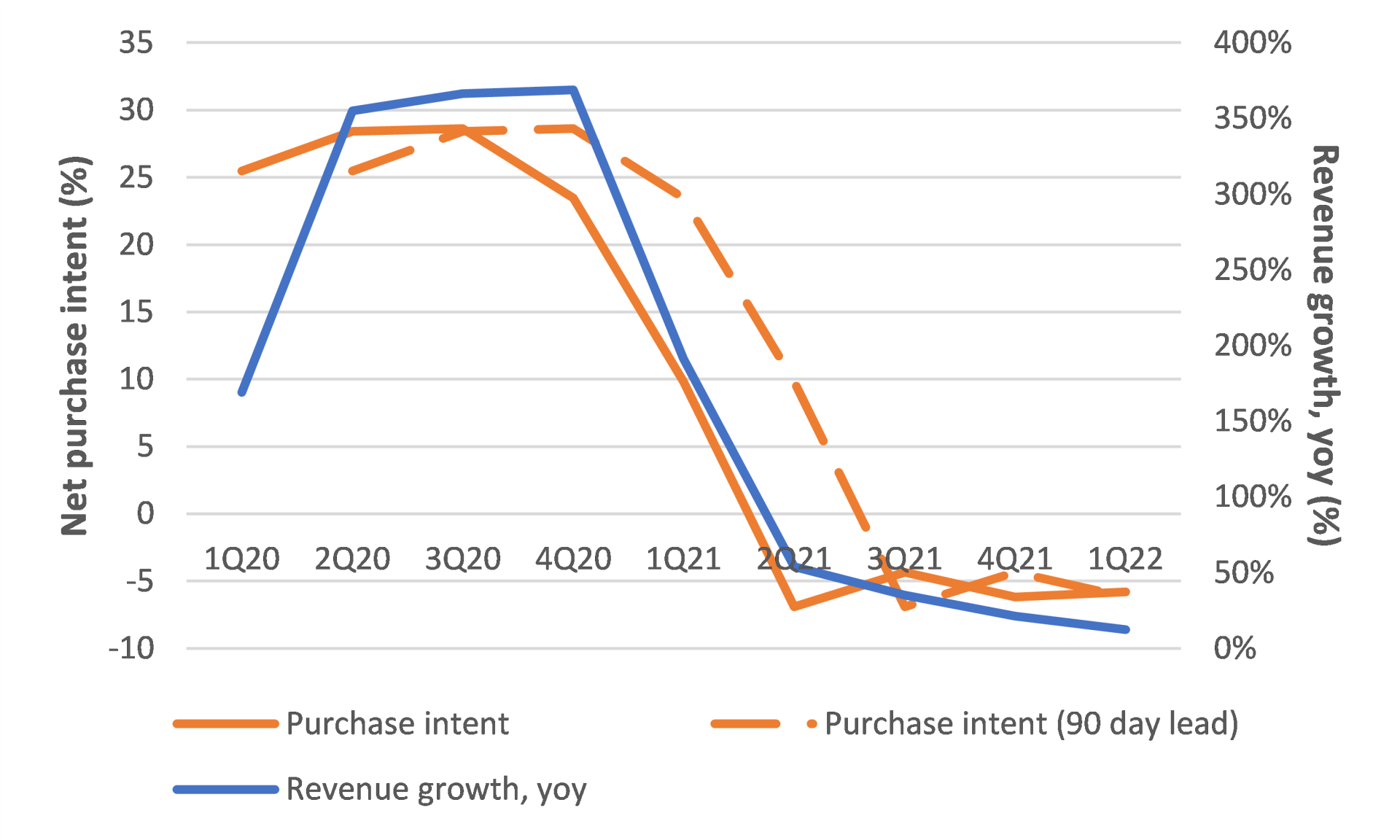

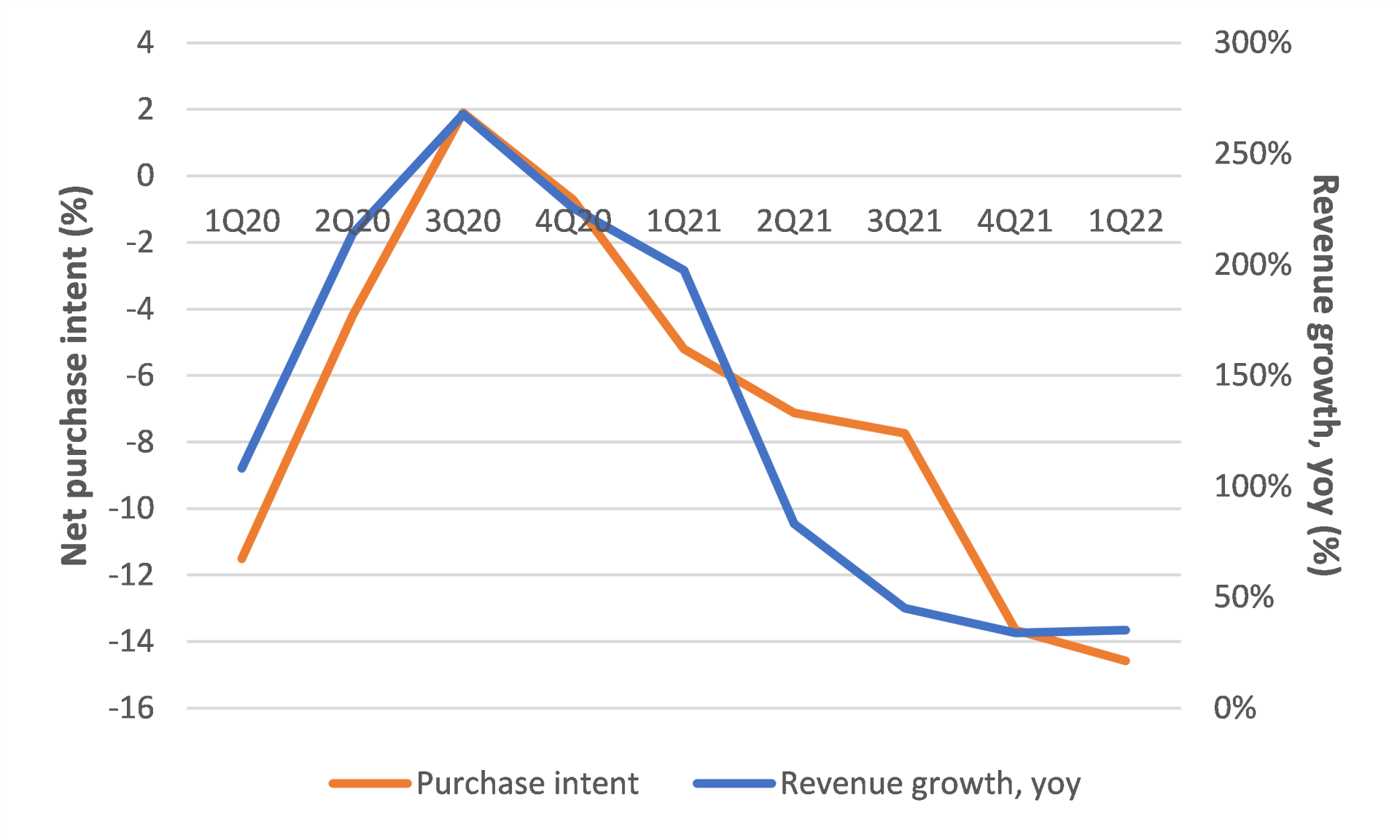

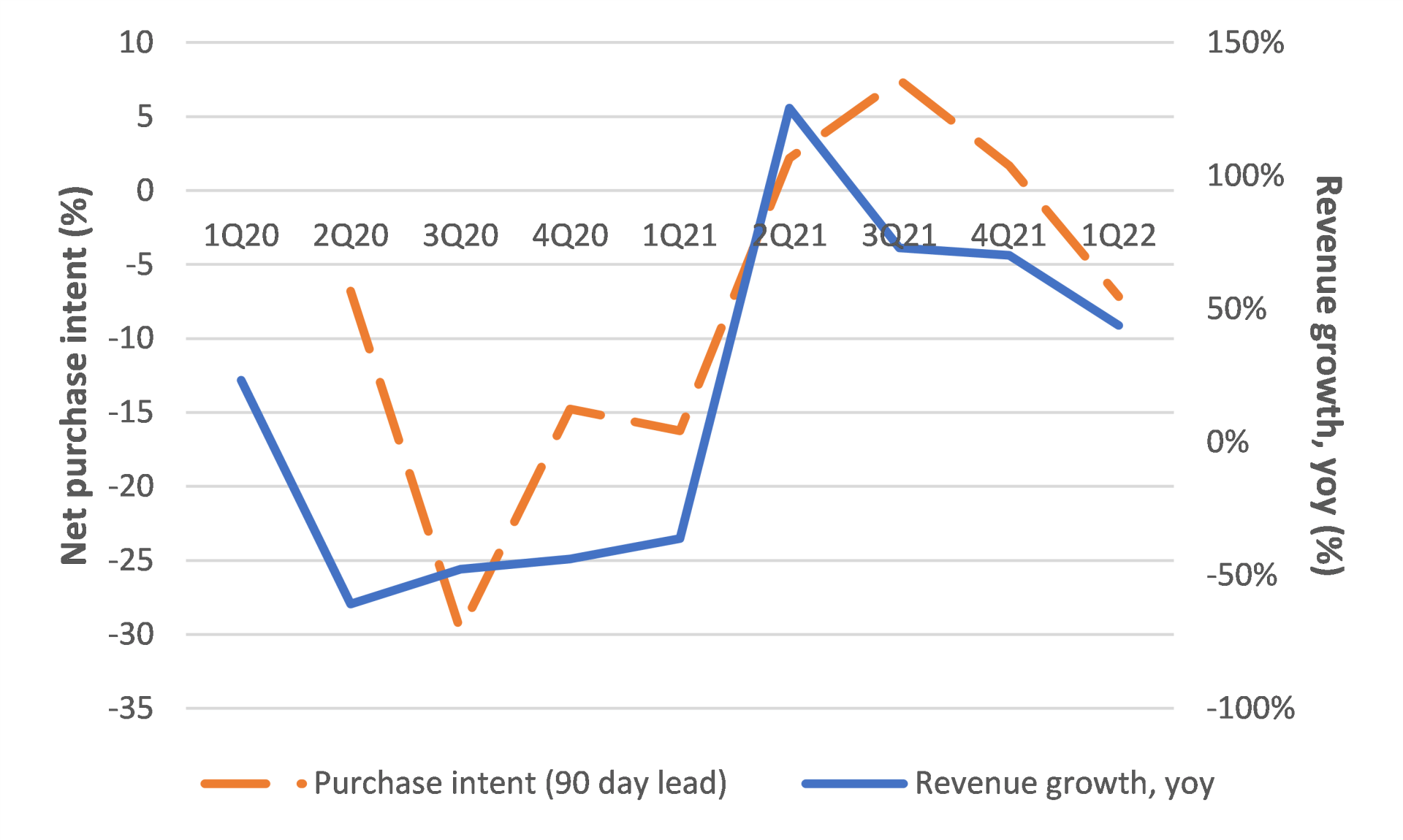

The key question has been whether the recent positive fundamentals for the cruise industry will hold up, or if it will it suffer a similar fate that others like Zoom, DoorDash and Lyft have experienced with a sharp drop in demand. All three of these “COVID winners” experienced dramatic slowdowns in growth. Indeed, HundredX’s analysis of customer feedback on Net Future Purchase Intent predicted slowdowns for Zoom Video, DoorDash and Lyft. According to HundredX’s analysis, Future Net Purchase Intent data has shown a 92%, 90% and 78% correlation with year over year revenue growth for Zoom Video, DoorDash and Lyft, respectively. These metrics have demonstrated that consumers’ feedback on purchase intent can be an incredibly reliable predicator of future performance.

Future Purchase Intent vs. Revenue Growth for Zoom

Source: HundredX, Inc

Future Purchase Intent vs. Revenue Growth for Doordash

Source: HundredX, Inc

Future Purchase Intent vs. Revenue Growth for Lyft

Source: HundredX, Inc

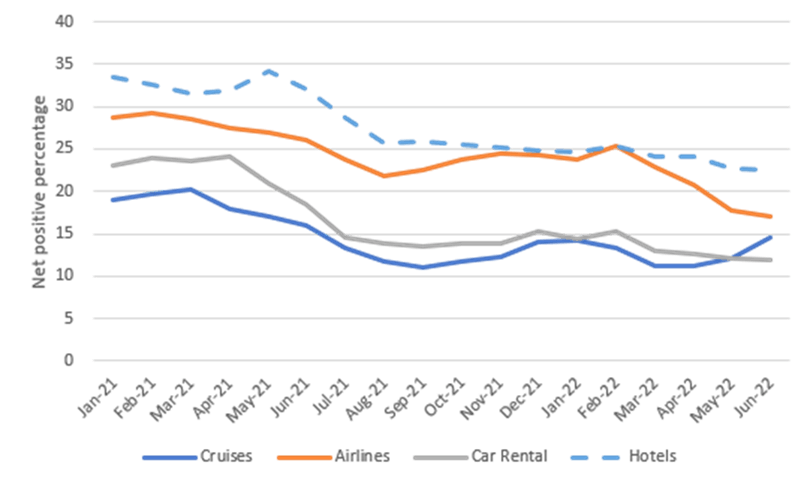

A Resilient Industry

The cruise industry is resilient, often keeping its prices low to stimulate demand. Notable though, is that HundredX’s data shows the cruise industry is one of the only travel segments to see an increase for the Net Positive Percentage (NPP) related to price in recent months. NPP represents the percentage of customers who saw price as something they liked about the companies minus the percentage who saw it as something they did not like. In a summer where travel woes have been widely reported and costs have been at the forefront of those complaints, consumers seem to still report a level of comfort when it comes to cruises.

Source: HundredX, Inc

As it turns out, data is showing that consumers don’t seem to be waffling about their intent to cruise the way they have been about maintaining their takeout schedule or prioritizing Zoom meetings. A recent review of HundredX’s forward-looking Net Future Purchase Intent data shows consumer demand for the cruise sector is likely to be much more sustainable than many were anticipating it to be. In fact, HundredX saw that Net Future Purchase Intent showed three consecutive months of improvement through June 2022 after bottoming in March 2022. If the historical correlation between HundredX’s consumer data and subsequent 6-month future sales holds, “the crowd” seems to be indicating potential smoother sailing for the sector for months to come.

Source: Company Data, HundredX, Inc

Source: Company Data, HundredX, Inc

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform outlook for businesses and industries. For more info and metrics on the cruise sector as well as 75+ other industries, or if you'd like to understand more about using Data for Good, please email info@hundredxinc.com.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.