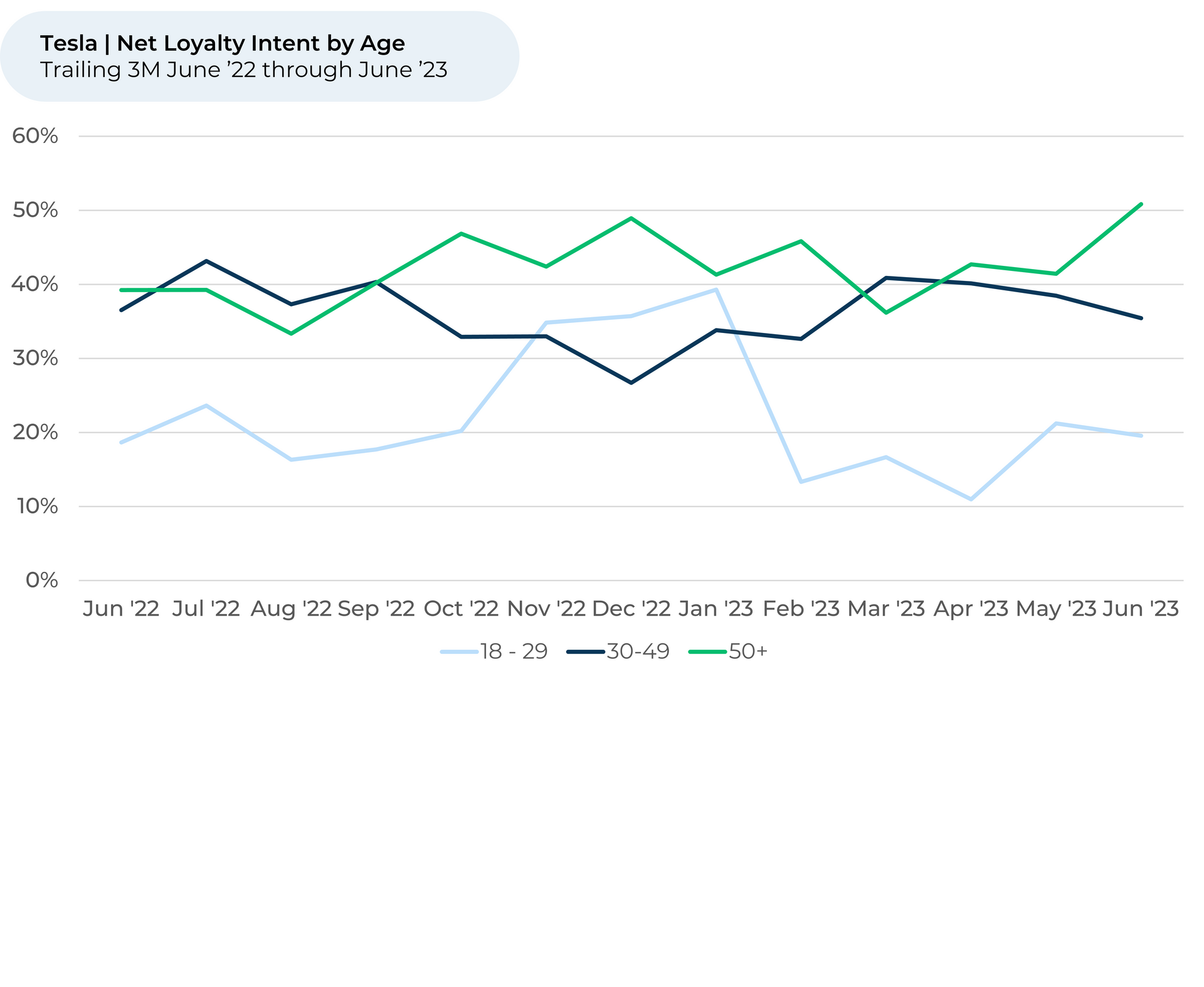

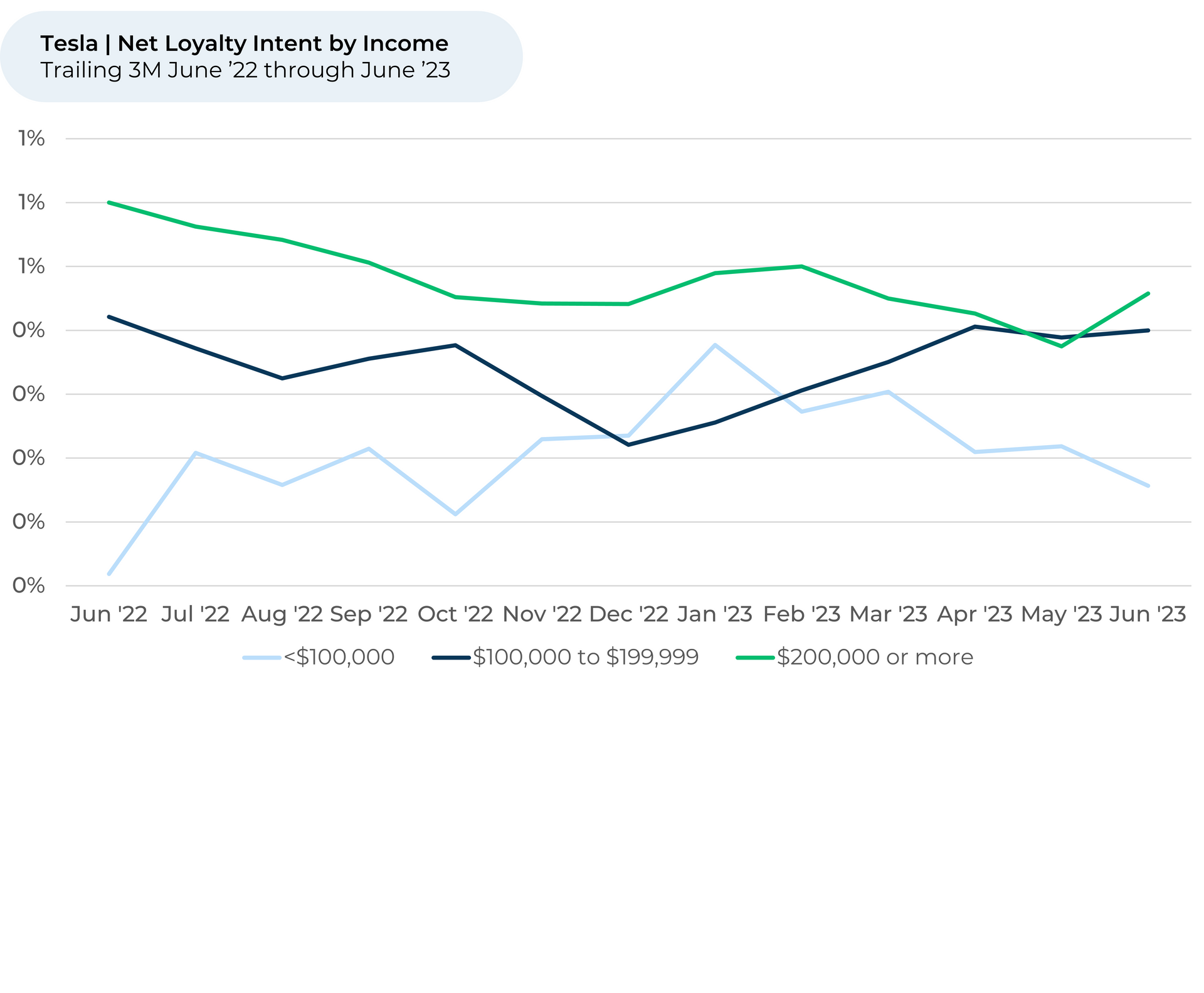

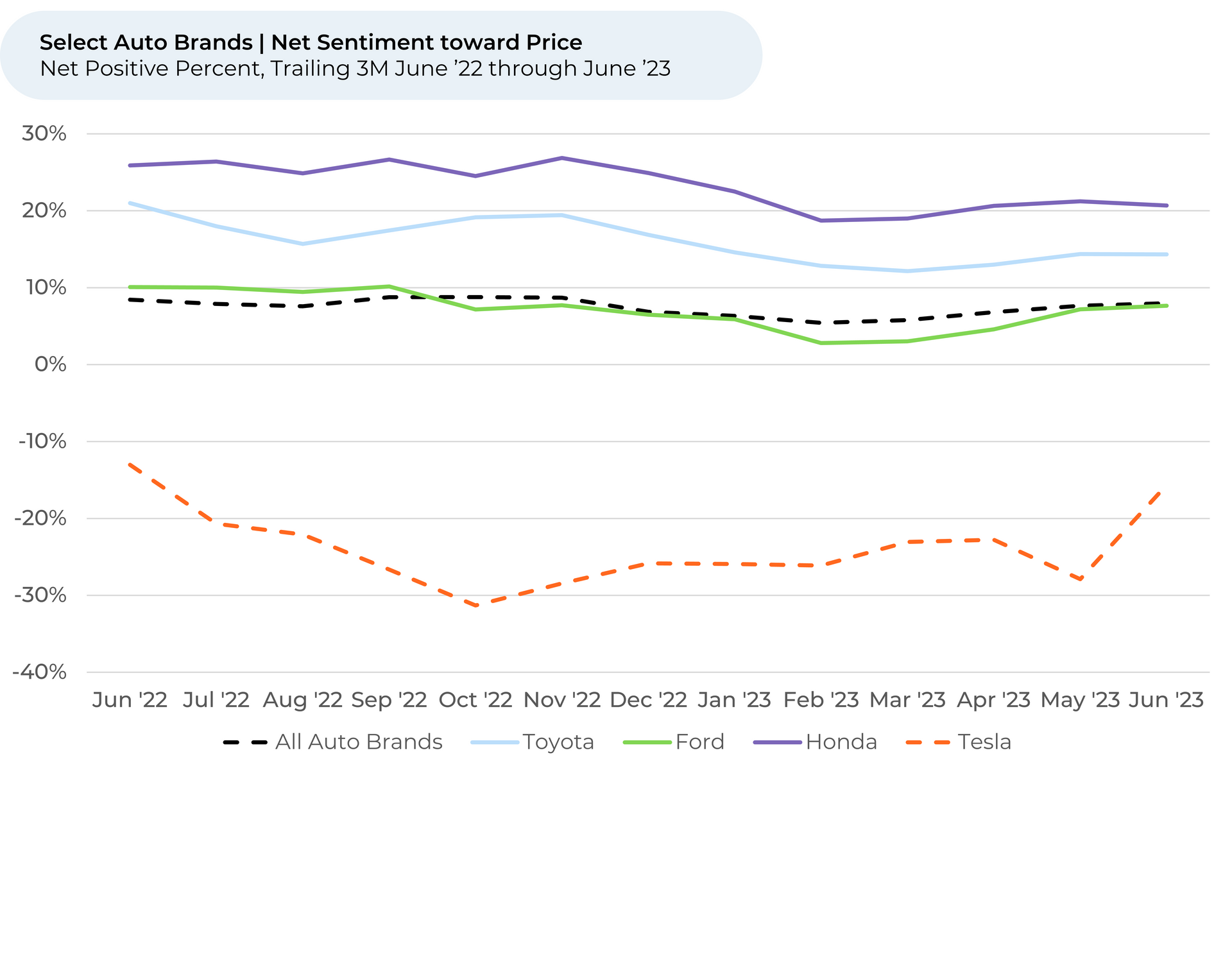

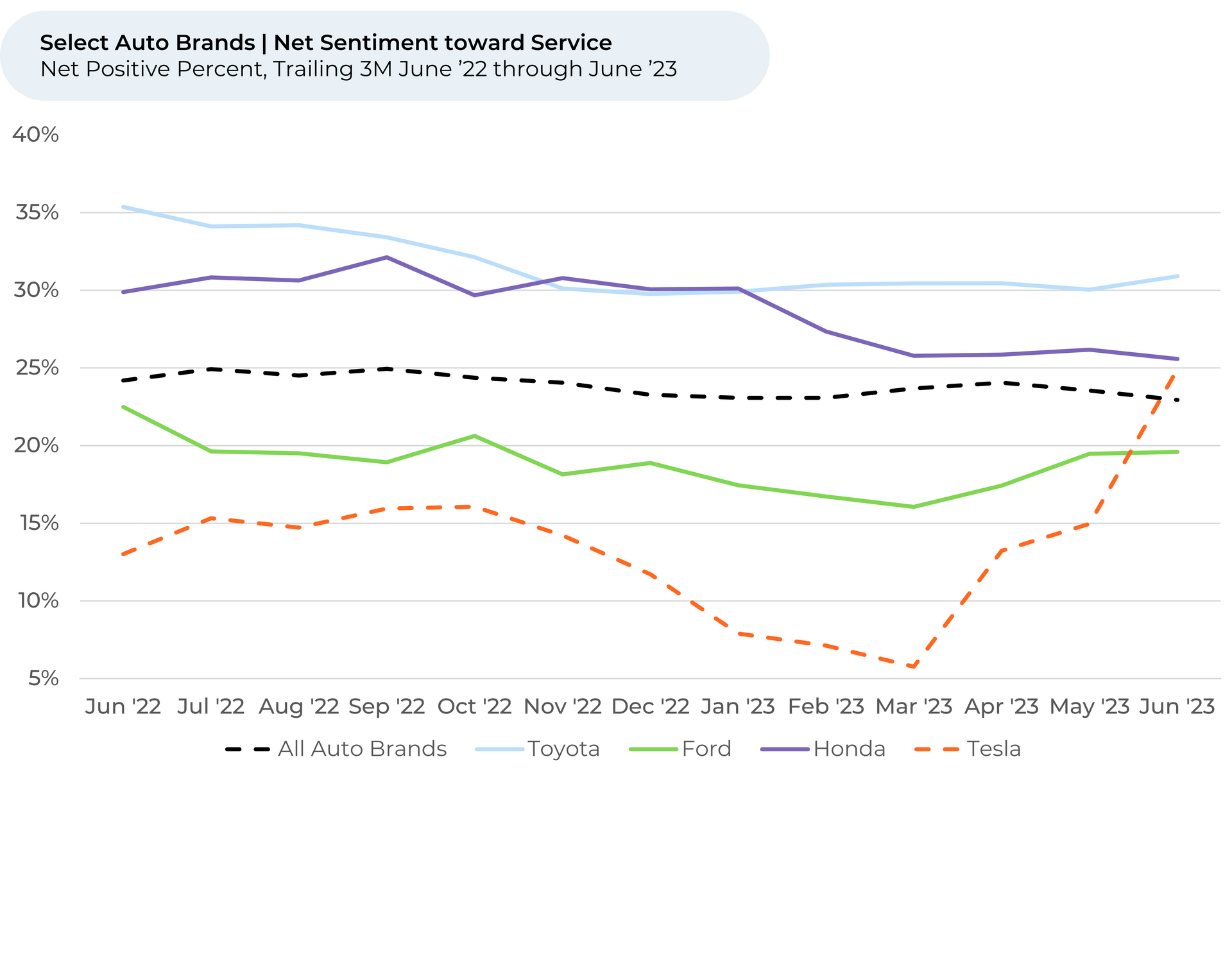

Ahead of Tesla’s Q2 2023 earning results, on July 19, the electric vehicle company revealed it set a deliveries record in Q2. Price cuts (down 16% from January + $7,500 federal tax credits) are most likely behind the demand increases, although we have also seen customers be much happier with Tesla’s service department and associates recently. It appears investments in both are paying off!

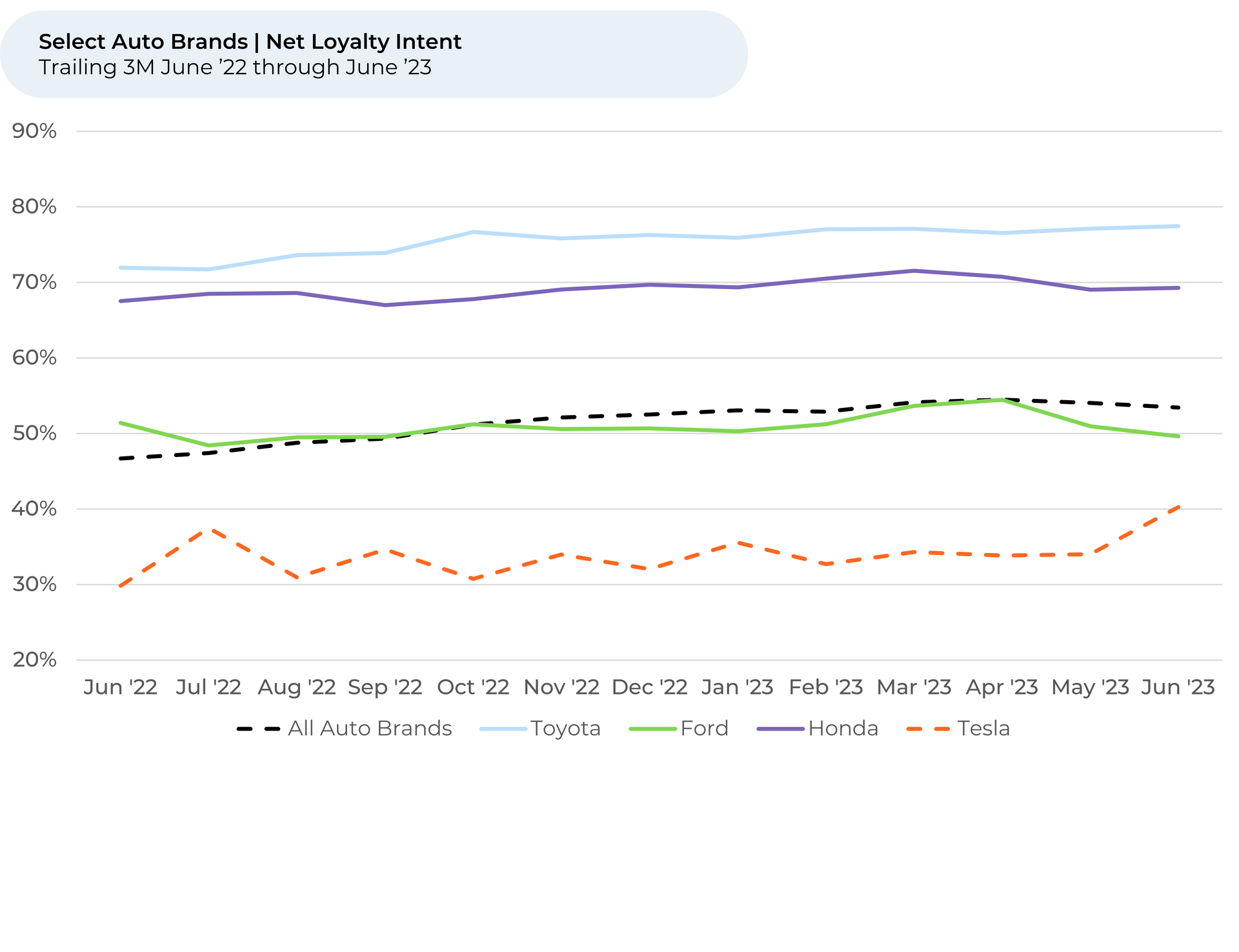

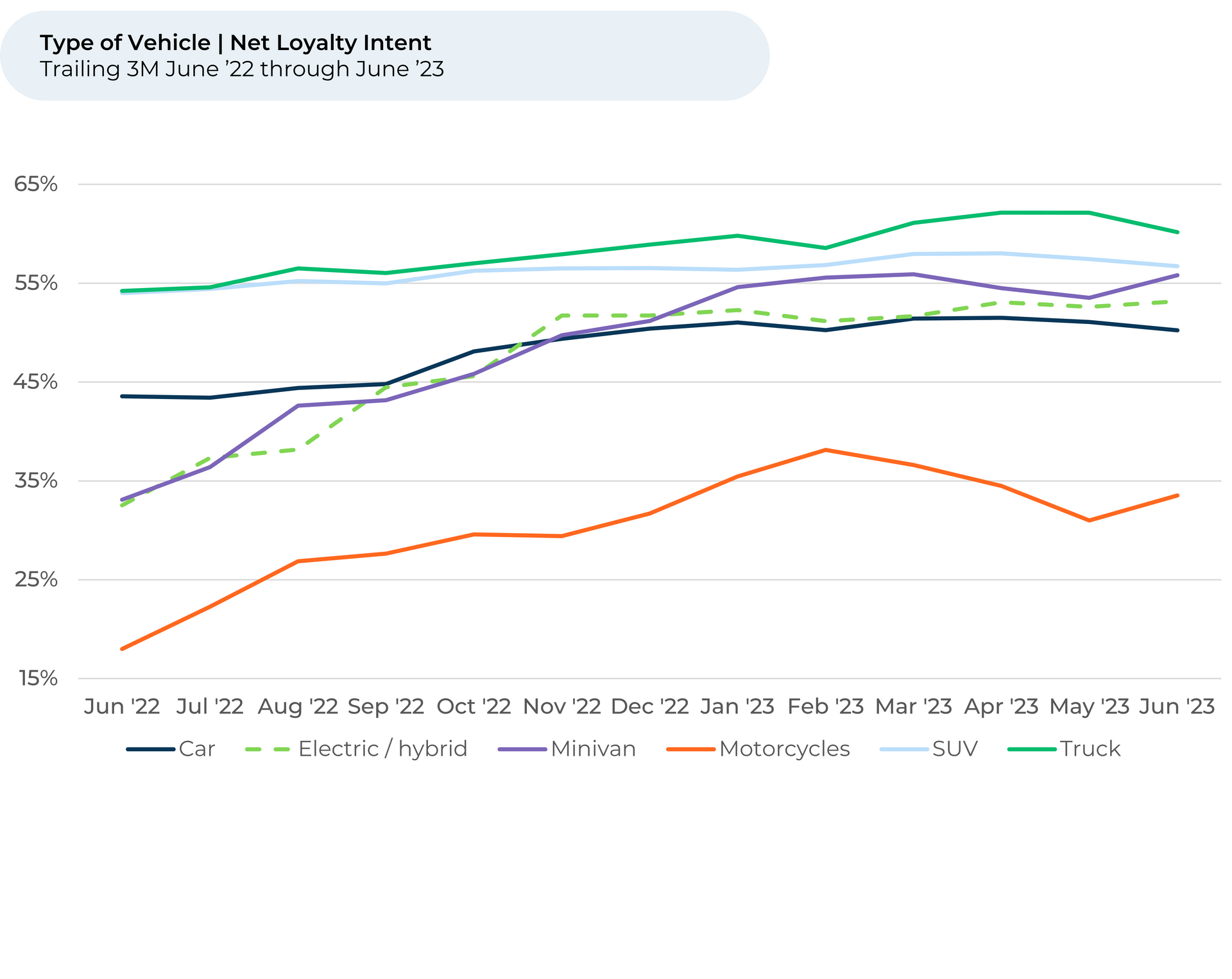

In our auto industry update, we look at more than 80,000 pieces of customer feedback across 44 auto brands over the last year to find the following: