Companies, economists, and investors worldwide continue to debate the health of the US economy, along with the outlook and impact of inflation. One practical gauge is how customers feel about the prices they are paying across all goods and services. Customer sentiment towards pricing can also provide important signals about future demand trends.

HundredX has examined the trend in consumer price sentiment for June 2023, leveraging our proprietary 7.5 million pieces of customer feedback since July 2021 across nearly 3,000 companies operating in over 80 industries. Key findings:

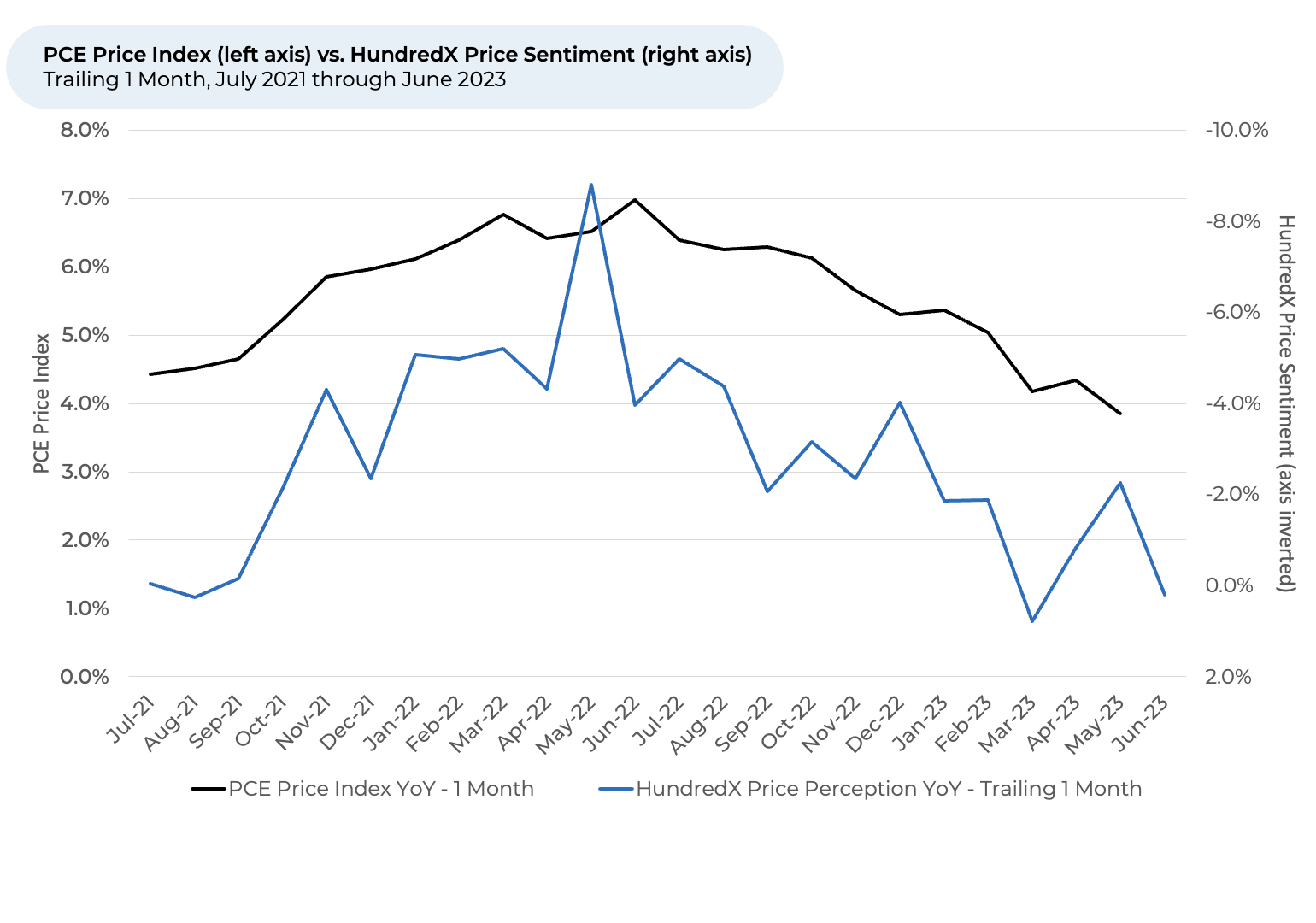

- After declining in April and May, sentiment towards Prices rose in June, indicating inflation at the consumer level is most likely continuing to decline. We have historically seen changes in HundredX’s Price sentiment1,2 index typically inversely correlate with movement in the Personal Consumption Expenditures (PCE) Price levels (i.e. inflation) reported by the US government.

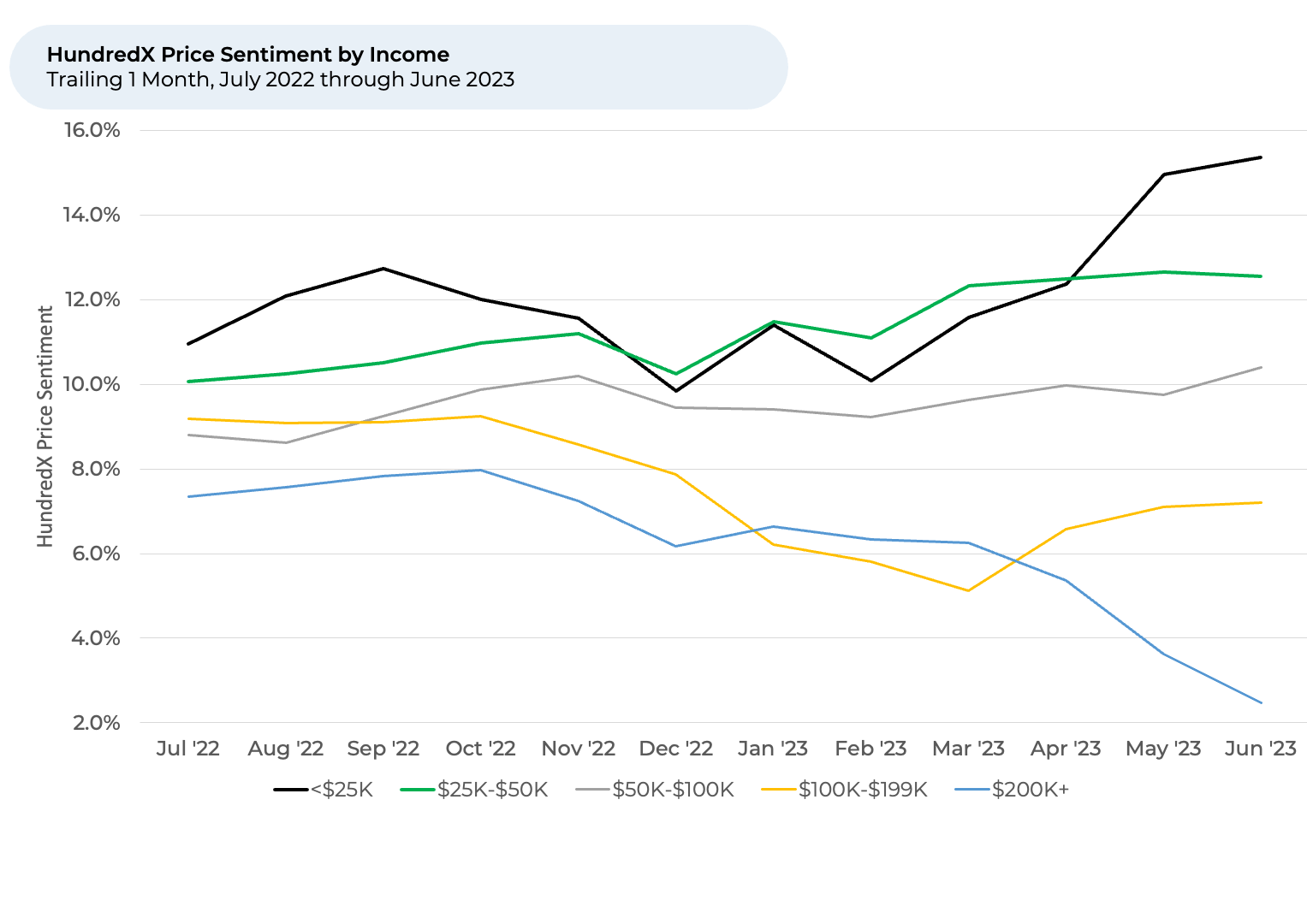

- For June, Price sentiment rose the most for consumers making less than $25K and fell the most for those making $200K+, continuing an interesting trend we have observed since early this year.

- Price sentiment has fallen the most with consumers 60+ over the last month.

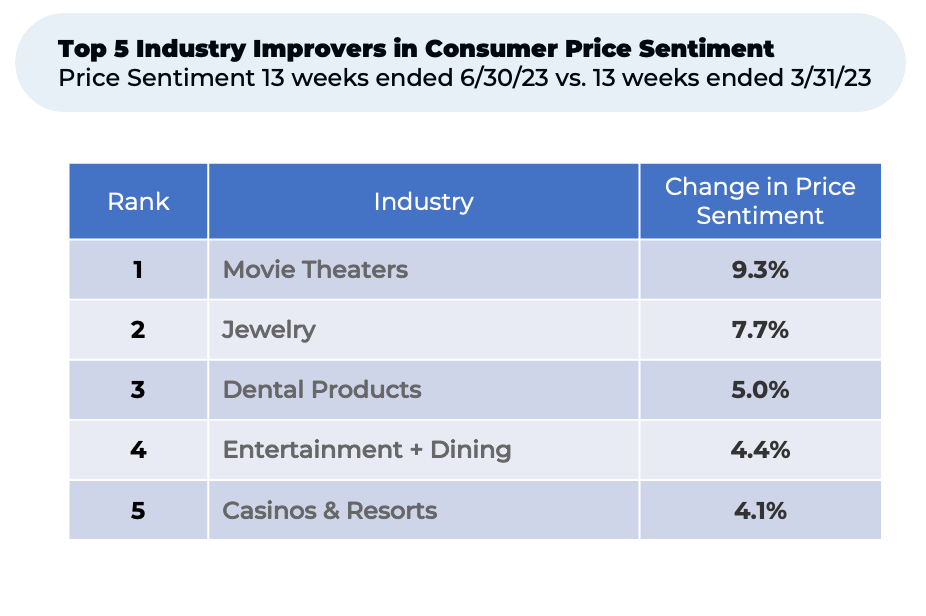

- Industries selling experiences (such as movie theaters and entertainment) and more expensive items (such as jewelry) have seen their sentiment towards Prices improve the most over the last three months versus other goods and services.

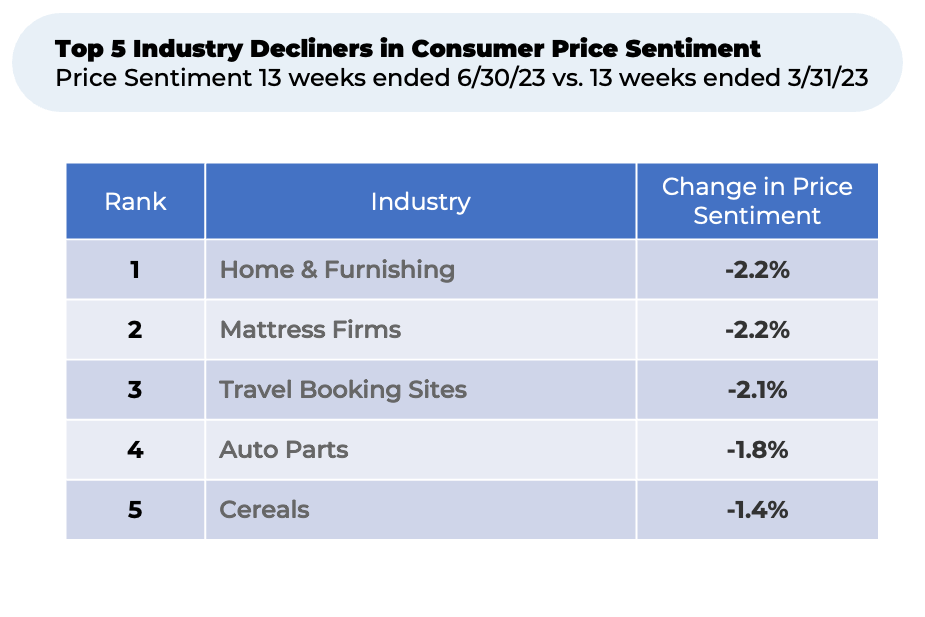

- Industries associated with big-ticket items, such as homes, cars and travel, have generally had the biggest drop in Price sentiment since the end of March.

Discover HundredX insights into recent Price sentiment trends across the US economy:

Please contact our team for a deeper look at HundredX's data insights into the broader economy or specific sectors, industries or demographic groups.

For a more detailed explanation of how HundredX’s price sentiment data has seen movements in price sentiment before inflation is reported over the last few years, please see our report from last month.

- All metrics presented, including Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.