New releases and subscription options driving change

HundredX continues to track consumer Purchase Intent and Price Sentiment across the streaming industry as companies continue to adjust subscription plans and pricing options. For Netflix, we observed drops in Price Sentiment across the board for most of 2022, coinciding with Purchase Intent declines and further deceleration in US net membership growth. We also note that sentiment toward New Releases has seen recent positive movement, in line with Net Purchase Intent (NPI) trends that have been improving after bottoming in June.

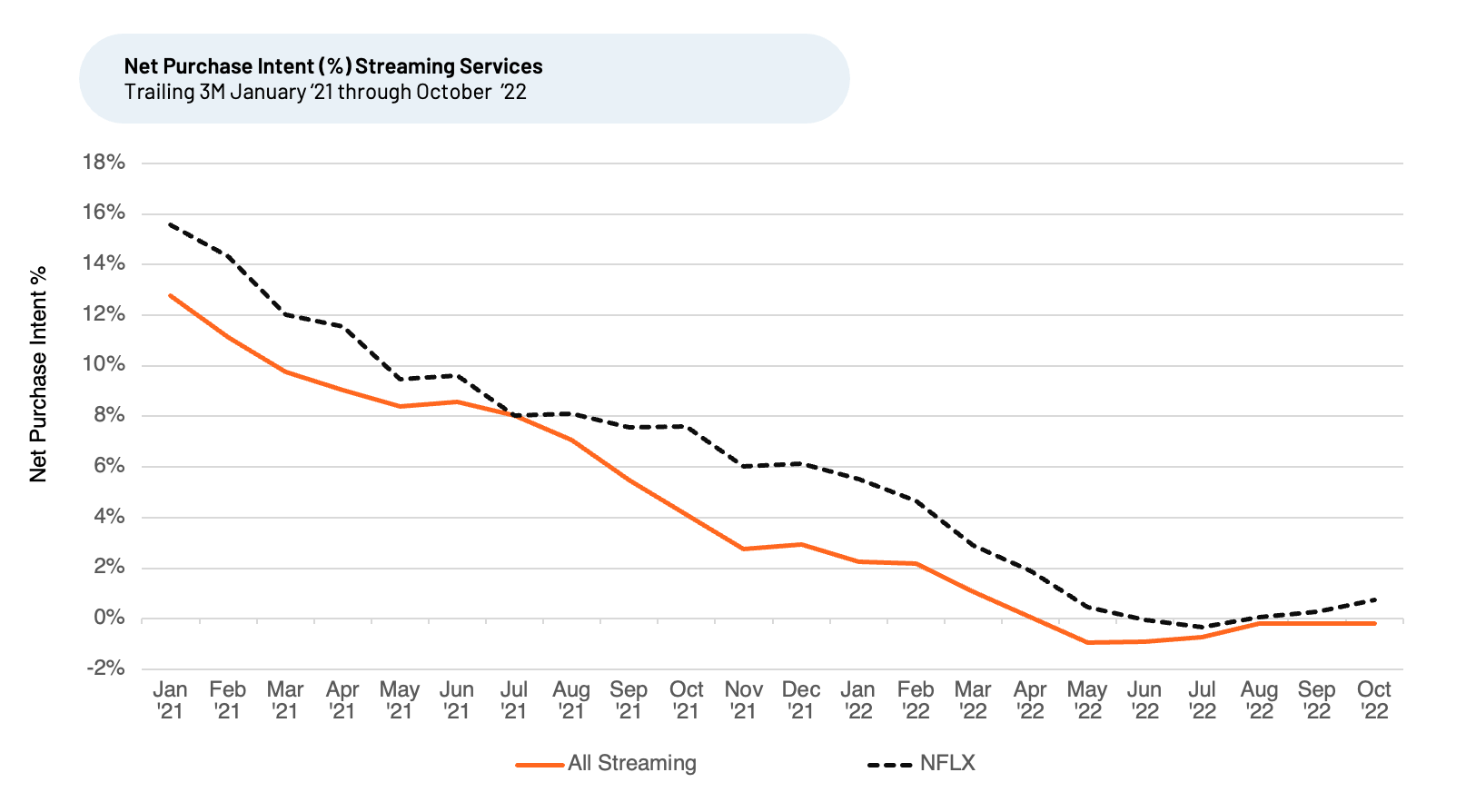

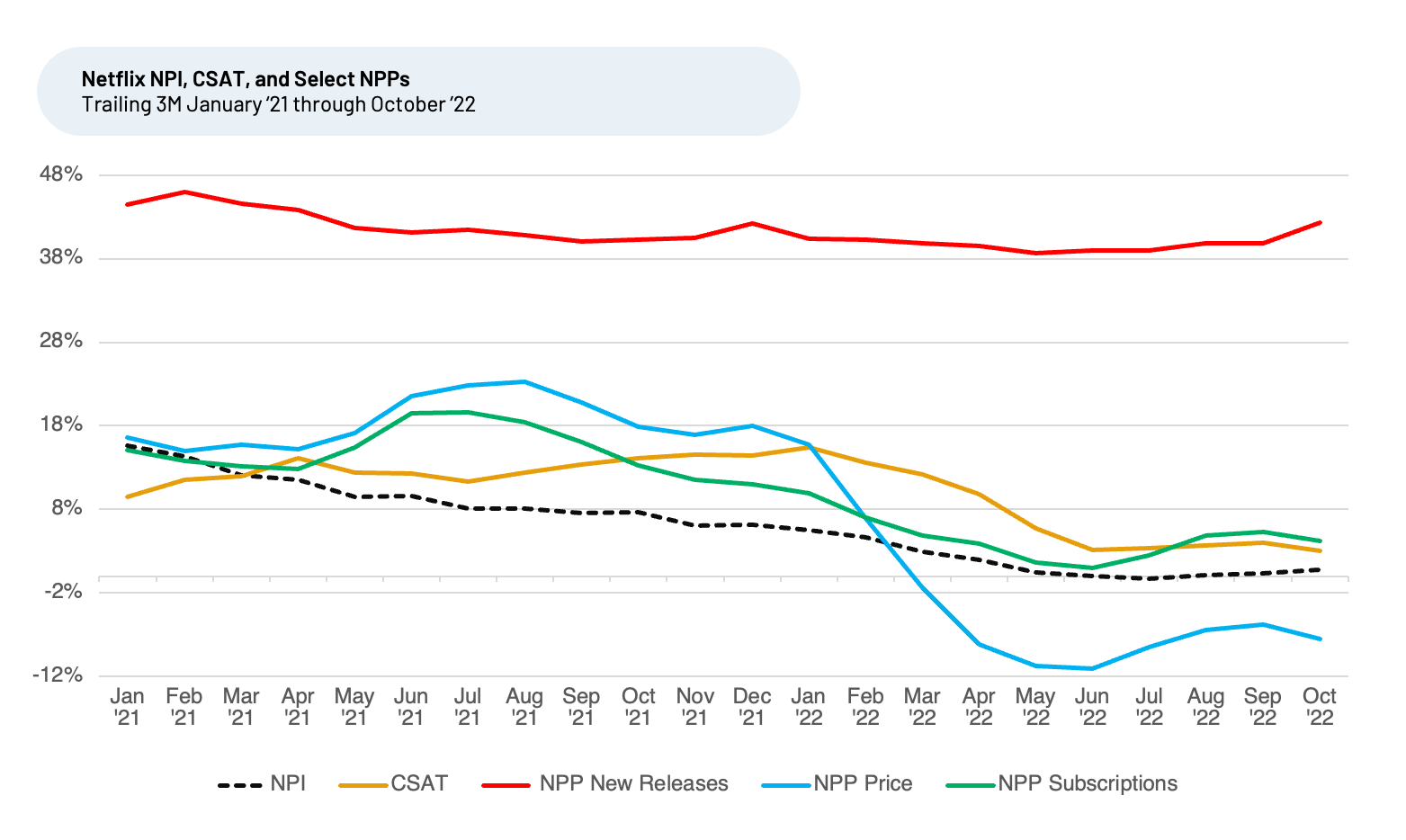

Leveraging HundredX’s proprietary listening methodology, we evaluate more than 115,000 pieces of feedback from real customer experiences across the country to gain insight into future net purchase intent (NPI), the drivers behind changes in intent, and Customer Satisfaction (CSAT). NPI reflects the percentage of customers who plan to use streaming services more over the next 12 months minus the percentage that plan to use less. Sentiment towards a driver of CSAT is measured by Net Positive Percent (NPP), which is the percentage of customers who say a driver (such as Price or New Releases) is a reason they like Netflix’s product minus the percentage who say it is a reason they do not like the product.

- Overall Net Purchase Intent (NPI) declined for Streaming Services and Netflix in 2022.

- Netflix’s NPI climbed back off its lows in June 2022, showing some recent improvements. NPI has started to improve vs. peers during September and October 2022, supported by New Releases satisfaction NPP, increasing from 39% to 42% over the last six months.

- Netflix announced a subscription change effective November 2022, with much lower prices for a new ad-supported model. We continue monitoring the impact of these changes on NPI, Price, and Subscription sentiment, overall CSAT, and other satisfaction measures to see how they affect Netflix’s market share.

- We will continue to see if the relative NPI trend improves and market share in the US grows.

HundredX has highlighted Netflix periodically since January 2022, when we noticed a large decline in Net Purchase Intent (NPI), which aligned with a fall in Price satisfaction on the heels of a subscription price increase.

Overall, Net Purchase Intent declined for Streaming Services and Netflix in 2022. We observe some improvement beginning in June through October 2022, though it still remains below January 2022 levels.

For the trailing three months ended (T3M) October 2022, despite Price and Subscriptions sentiment trending downward slightly, NPI remained stable. Sentiment towards New Releases has increased over the last six months, from NPP of 39% to 42% for T3M October 2022. Sentiment began improving following new releases (Stranger Things Season Four and new shows such as the Dahmer series, The Watcher, and From Scratch).

Overall CSAT, while down for the year, has remained stable during the past five months. The most important customer sentiment drivers for Netflix include Price, Subscriptions, and New Releases.

In January 2022, after Netflix announced price increases that took place in March 2022, Satisfaction with Netflix’s pricing began to show a steeper decrease, continuing until June 2022. These factors have been trending upward since then, in line with Netflix customer’s NPI and announced subscription changes.

Following Netflix’s launch of its ad-supported plan this month, we will continue to monitor how the offering of different price points impacts overall demand and satisfaction marks.

HundredX works with a variety of brands to answer some of their vertical's toughest questions, such as, where are consumers "migrating" to, what are customers saying they are going to use more of in the next 12 months, and what are the key drivers during a consumer’s purchase process. Current clients have received immediate benefits across multiple areas, including strategy, pricing, and marketing.

Our tools can help business leaders define:

- Which brands will gain future market share and why

- How consumers make buying decisions

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on specific motivators of customer satisfaction, other companies within 75+ other industries we cover, or to learn more about using Data for Good, please contact us.