A choppy economic outlook that varies significantly by industry, an evolving mix of people working from home versus in person and many other factors continue to shift the fashion landscape.

After examining 250,000 pieces of customer feedback on 221 fashion and apparel companies collected from April 2022 to April 2023, we find:

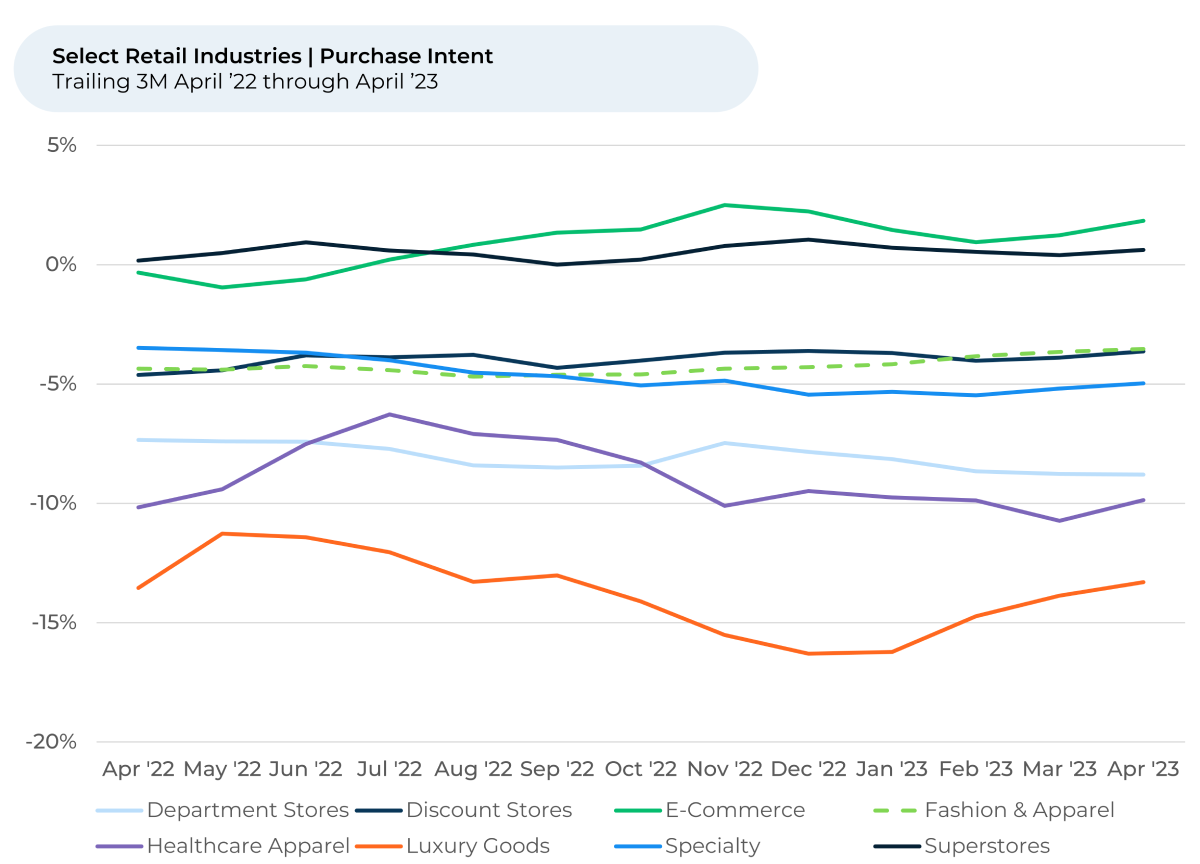

- While many areas in retail saw slight upticks recently, Purchase Intent¹,² for fashion and apparel remained steady.

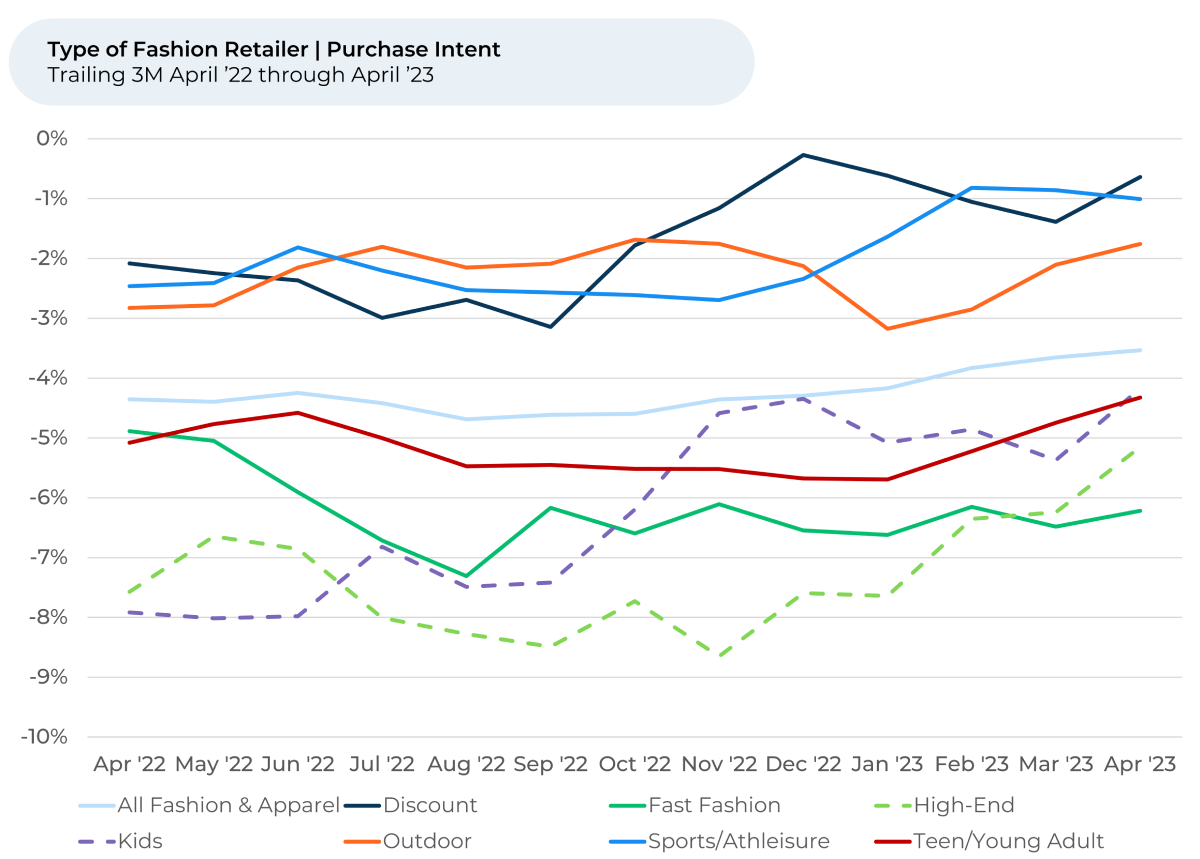

- Kids fashion brands experienced the most significant Purchase Intent growth over the past year, while high-end fashion brands were up the most over the last three months.

- Brands executing turnarounds such as Kids Foot Locker, Abercrombie Kids and Tommy Hilfiger had the largest Purchase Intent increases in their respective groups.

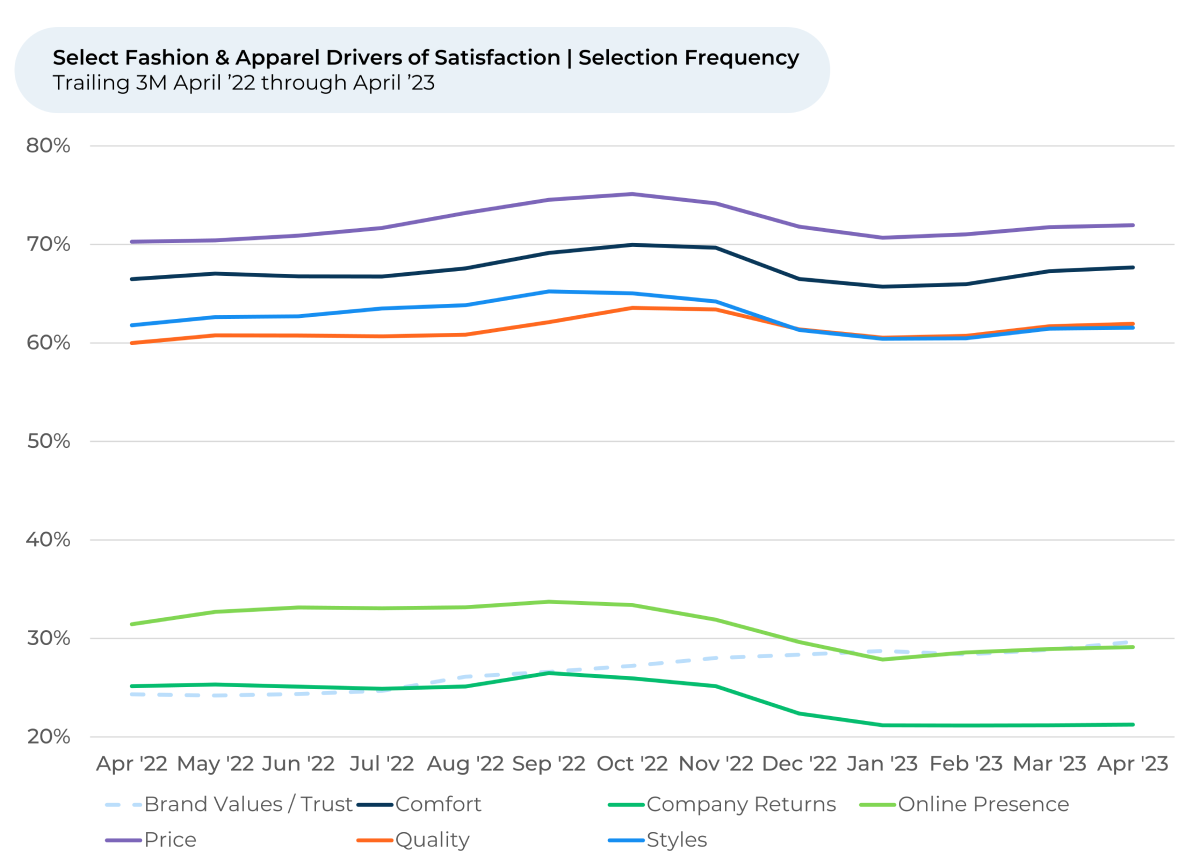

- Consumers seem to be caring more about fashion brands’ values and trustworthiness over the last year. It is still not chosen as a reason that customers like or dislike brands as often as many others, but its selection frequency³ increased more than any other factor in the last year.

- Sustainability saw the biggest increase in selection frequency as a reason customers like the brand values of a fashion business. It is the second most selected reason for fashion brands, behind Treatment of Customers.

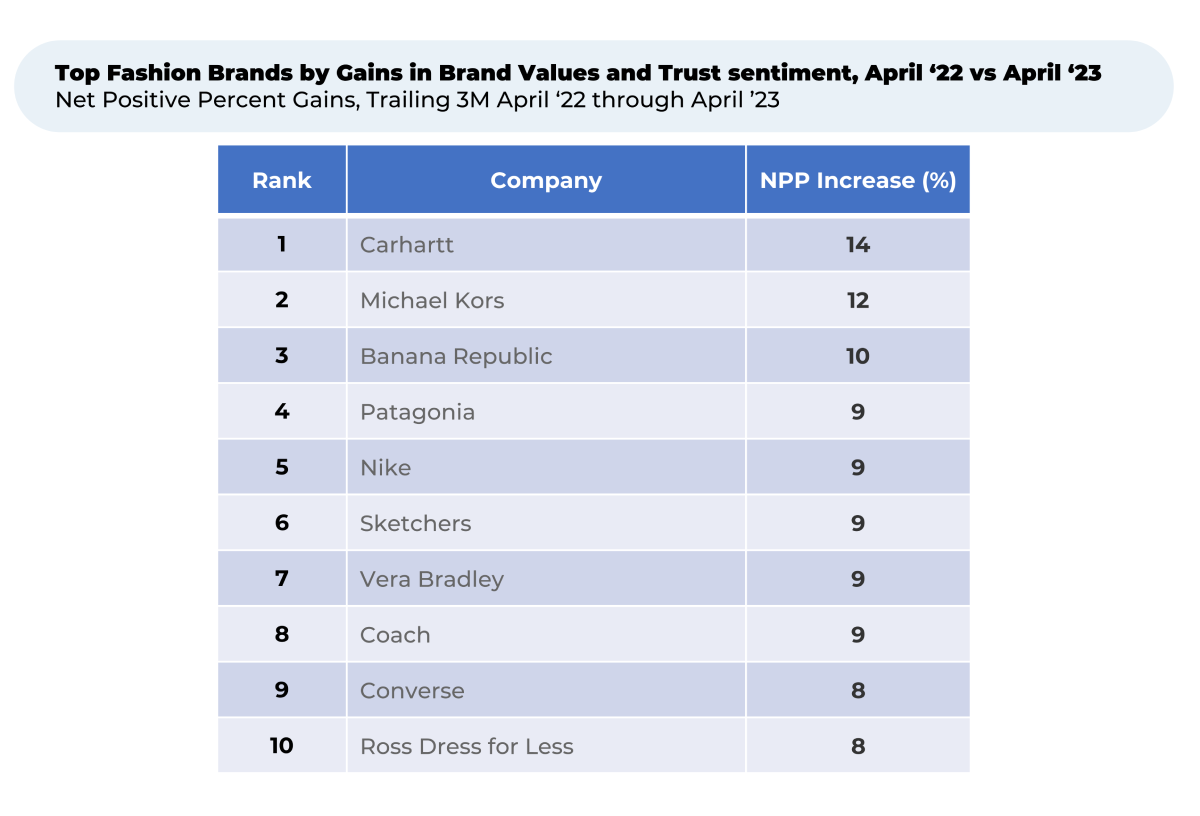

- Both Patagonia and Carhartt saw significant improvements customer sentiment⁴ towards Brand Values & Trust over the last year, with Patagonia having the highest overall sentiment and Carhart rising the most.

While the fashion and apparel industry maintained pretty stable Purchase Intent over the last year, other retail sectors experienced some shifts. Department stores fell last fall and winter before remaining pretty stable this year. E-commerce —a key channel in the apparel market— has been rising most of this year after a pullback to finish last year.

The e-commerce industry, along with the discount sector, which includes stores like Big Lots, Dollar Tree, and Five Below, has shown higher Purchase Intent scores than traditional retail industries. These sectors have been successful in catering to budget-conscious consumers, offering affordable products amidst still high inflation and declining consumer confidence.

Surprisingly, Luxury Goods, which includes very high-end brands like Louis Vuitton, Chanel and Versace, has seen a pickup in Purchase Intent as well this year, though it continues to lag other parts of retail and is slightly below levels a year ago. As we discussed in our

February update, the nostalgia movement that has been resonating with Gen Z appears to be the biggest reason for the uptick.

Kids and Higher-end brands executing turnarounds seeing surge in Purchase Intent

In the continuously evolving landscape of the fashion industry, distinct segments present unique dynamics and growth trends. All fashion segments we track, except for fast fashion, saw a growth in Purchase Intent over the last year.

Fast fashion⁵, which includes brands like H&M, Old Navy, and The Gap, saw Purchase Intent dip by 1% over the last year as online competitors like Shein have taken the world by storm. Our recent profile on Shein details how it appears to be taking share from legacy competitors.

Meanwhile, Kids fashion, which includes stores like Carter’s and Kids Foot Locker, outperformed by the most over the past year, rising 4% in Purchase Intent. In this group, both Kids Foot Locker and Abercrombie & Fitch Kids have shown significant increases in Purchase Intent in the last three months in particular.

- After dipping in winter 2022, Kids Foot Locker has seen Purchase Intent surge by 8% in the last three months. Sentiment towards its Prices, Sizes & Fit and Store Layouts have jumped 13%-19% in the last three months. The company is in the middle of executing a turnaround plan, focused on remodeling stores and investing in digital.

- Abercrombie & Fitch Kids has also seen Purchase Intent jump, up 8% in the last three months and 12% from its lowest point in June 2022. Sentiment towards its Prices and Sizes & Fit were up 9% and 7% respectively in the last three months. The company has been executing its turnaround strategy, with customers seemingly giving them credit for more comfortable, looser-fitting clothes.

The higher-end mass-market brands, including Tommy Hilfiger, Ralph Lauren, and Calvin Klein, are up the most as a group in the last three months (+3% in Purchase Intent). Tommy Hilfiger particularly stands out for being up 6% in the last three months and 15% from its September 2022 low. The brand executed an impressive turnaround by year-end.

The surge aligns with the 12%-15% improvement in customer sentiment towards its Quality, Comfort, and Prices that we saw. It appears customers are beginning to give it credit for investments made by parent company PVH Corp. as part of a turnaround plan. Many customers commented on quality and comfort. One told HundredX, “The quality of product is great. I have always enjoyed the TH brand, and plan on purchasing more.” Another said, “Here I find my best blazers. The quality of the garments is extremely good as well as being pretty and comfortable.”

Earlier this year, Tommy Hilfiger

announced a partnership with Depop that will see the fashion retailer sell clothes from its take-back programs and damaged clothes from its stores on the reseller online platform. This appears to be aimed to help Tommy Hilfiger’s price perception, as well as better appeal to younger audiences and those interested in sustainability.

Consumers are starting to care more about brands’ values and trustworthiness

Like Tommy Hilfiger, several other fashion retailers have incorporated reselling capabilities into their online stores. Late last year, fast fashion brand Zara began allowing customers to resell Zara clothes on its online store. Meanwhile, PacSun recently expanded its reselling options and American Eagle recently partnered with thredUp as did Francesca’s and H&M.

All these retailers are part of a broader movement to use resale platforms to promote sustainable consumption and reduce their carbon footprint. Promoting these practices is not only good for the environment. It is good for business as well. We have found consumers increasingly care about the brand values of their favorite clothing stores. Compared to a year ago, HundredX respondents have chosen to highlight Brand Values & Trust as a reason they like or dislike a fashion brand 5% more often. It’s still not chosen as often as most other reasons, including Price, Quality, and Comfort, but its selection frequency did increase more than any other factor relative to a year ago. Further, when it is selected, it was viewed as positive 89% of the time.

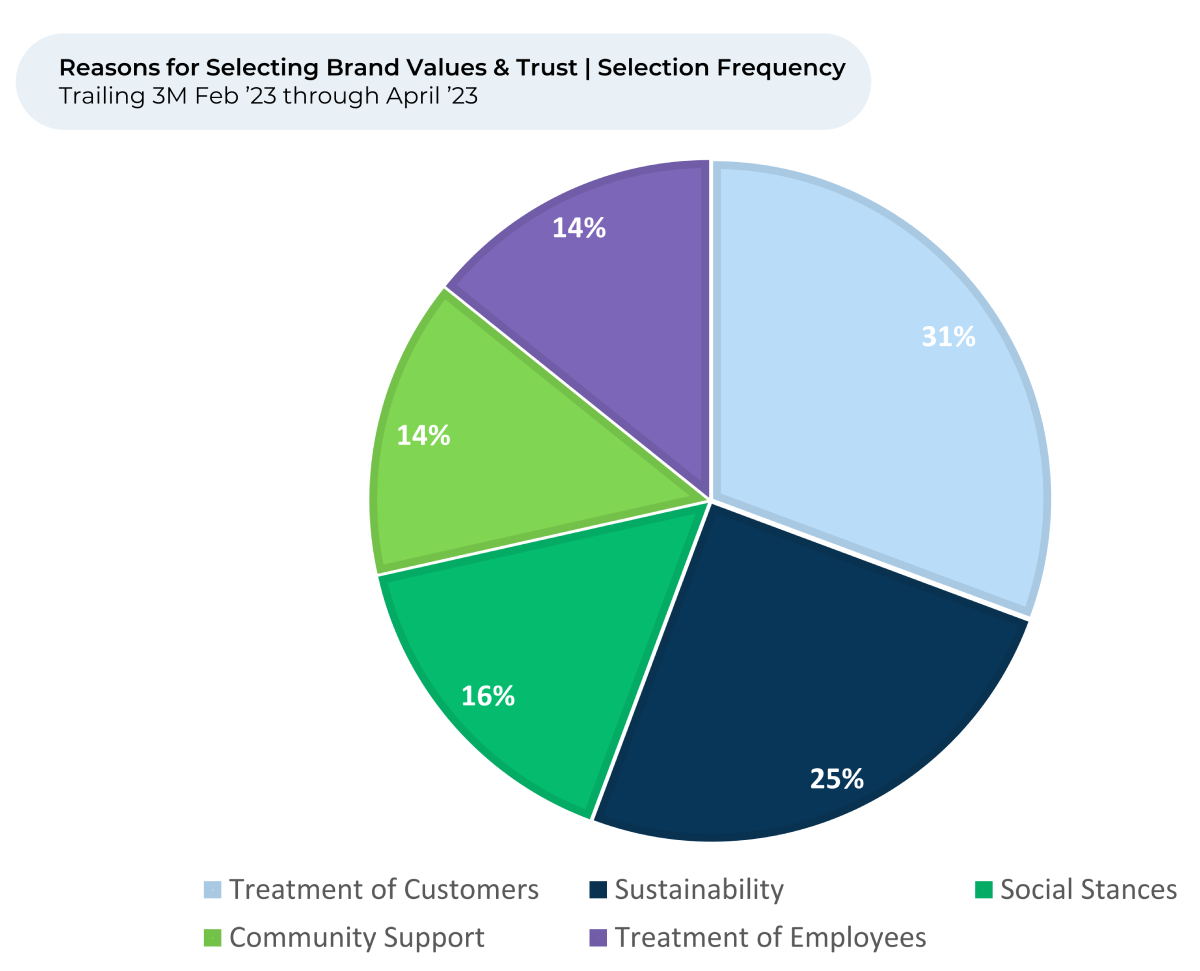

After selecting Brand Values & Trust as a reason they do or don’t like the brand, customers providing feedback are able to specify the reason they said the Brand Values & Trust was positive or negative. We’ve found that customers seem to care most about how fashion companies treat their clientele, followed by their sustainability practices.

Over the past year, customers have seemingly become more focused on the sustainability practices of fashion and apparel companies. Sustainability has been selected 3% more often for the three months ended April 2023 than it was the three months ended July 2022. Selection frequency for Treatment of Customers was up by 1% over the same period, while all other reasons were down.

Some fashion brands have done better at pleasing their customers with their brand values than others. Patagonia, a longtime sustainability champion, has consistently pleased its customers with its brand values. That said, sentiment towards Brand Values & Trust increased 9% over the past year. As of April 2023, its sentiment of 52% is the highest of any fashion brand we cover, way ahead of the industry average of 24%. A good part of that seems to be driven by the customer’s view of its sustainability practices, with about 85% of Patagonia customers who say they like the company’s brand values selecting its sustainability practices as a reason they like it.

Patagonia's commitment to sustainability and quality is often referenced by its customers. One customer's feedback to HundredX underscores this sentiment: “When I purchase a Patagonia product I know it will be a quality piece that will last and love their commitment to social and environmental issues.”

Another commented, "Please keep leading the way on sustainability in the clothing industry.”

Patagonia pledges 1% of sales to environmental nonprofits. Since 1985, it has given more than $140 million to environmental groups around the world.

Carhartt, another outdoor apparel company, saw a 14% increase in customer sentiment towards brand values over the past year, the highest of the major apparel companies we follow. Again, its sustainability practices seem to be the reason.

Out of the customers who said they like Carhartt’s brand values, the amount of people that said they like Carhartt’s sustainability skyrocketed by 15% from May 2022 through April 2023. As of April 2023, 50% of them say they like its sustainability practices.

Like many other fashion companies, Carhartt recently launched a resale platform. Customers can trade in their used Carhartt clothing for a gift card, and, after Carhartt cleans and repairs the items, buyers can buy them on Carhartt’s new dedicated webpage, Carhartt Reworked.

It helps that Carhartt’s products are viewed as extremely durable by its customers. Customer sentiment towards Carhartt durability is 30% higher than that of the average apparel company. Sustainability, in a way, is built into the products, and puts its reselling program in a strong position.

The outlook for the world of fashion and apparel is the result of a complex weave of changing consumer preferences, economic conditions, and evolving brand values. The brands that listen and adapt to changing customer sentiments are likely to come out on top. The journey towards a more sustainable, customer-centric fashion industry has begun, and it will be fascinating to watch how brands like Patagonia, Carhartt, and others lead the way in the coming years.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Purchase Intent for retail subsectors represents the percentage of customers who expect to spend more with that brand over the next 12 months, minus those that intend to spend less.

- Our “listening” methodology allows customers to select the brands that matter to them and then summarize their usage, experience, and future spending intent. Selection Frequency represents the percentage of customers who decided to provide feedback on a brand and then select a given “driver” of customer satisfaction (such as Price, Speed or Brand Values & Trust) as a reason they think the product or service is good or bad. Selection frequency is an indicator of how important a driver is in determining how customers as a whole feel about the brand.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Our fashion groupings include the following brands:

Fast Fashion: H&M, Forever 21, Zara, Old Navy, Express, The Gap;

Outdoor Fashion: Columbia, The North Face, Patagonia, L.L. Bean, REI (Apparel), Merrell, Timberland, Keen, Carhartt, Under Armour;

Kid's Fashion: Carter's, The Children's Place, Abercrombie & Fitch Kids, Kids Foot Locker;

Discount Retailers: Ross Dress for Less, TJ Maxx, Marshalls, Burlington Stores, dd's Discounts;

Teen/Young Adult Fashion: Hollister Co., American Eagle Outfitters, Abercrombie & Fitch, Pink, Tillys, Hot Topic, Aerie, Vans, Journeys, Urban Outfitters;

High-End Fashion: Coach, Michael Kors (Store), Polo Ralph Lauren, Tommy Hilfiger, Calvin Klein, Banana Republic;

Sports/Athleisure Fashion: Nike, Adidas, Reebok, New Balance, PUMA, Converse, Saucony, Brooks Running, Skechers, Hoka, Champion, Champs Sports

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.