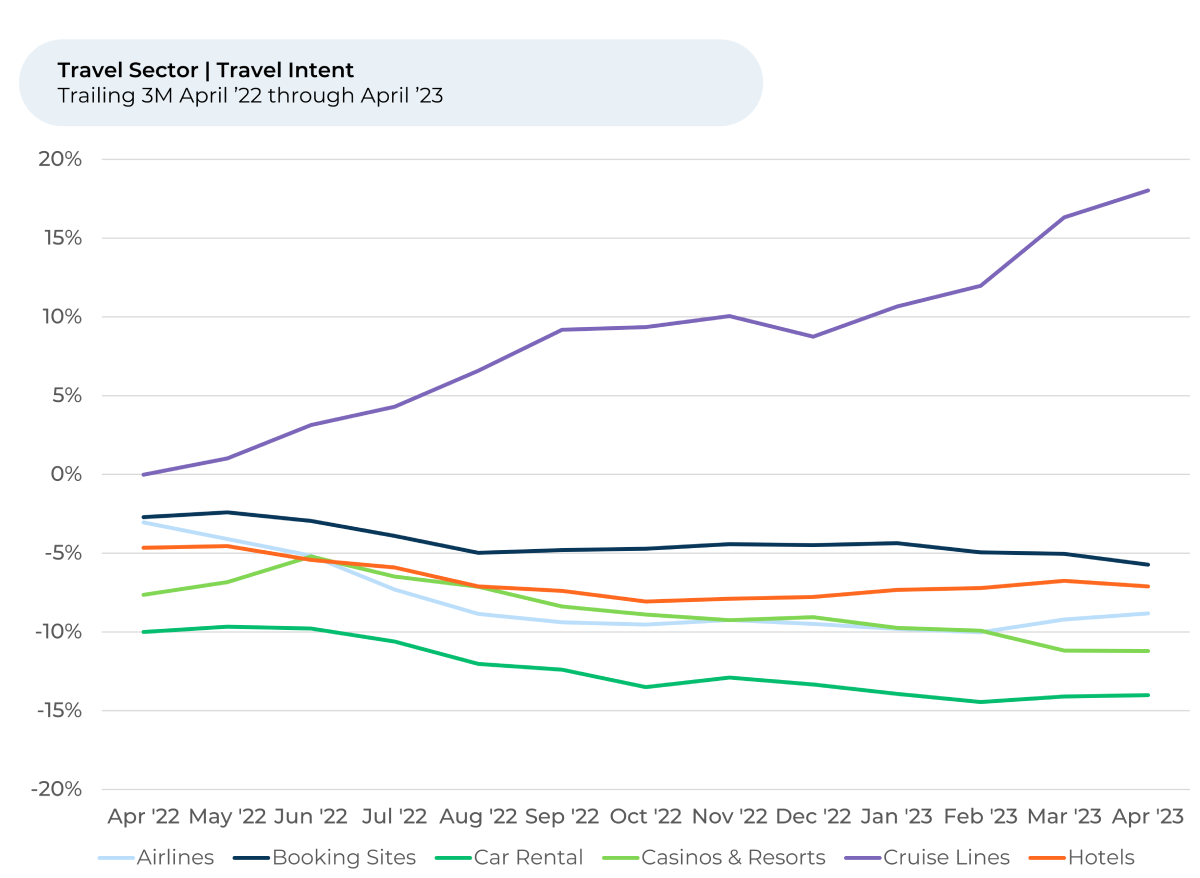

In recent months, our analysis of feedback from “The Crowd” of real traveling customers unveiled the surge in interest in cruising, early stages of Southwest Airlines' rebound in Travel Intent¹,² and Delta's gains in the wake of the industry's winter challenges.

This month, we look at how Southwest's most recent technical issues are affecting its demand outlook and a pickup in interest in the more affordable brands of the hotel industry. As we monitor the sector's flux, we pay particular attention to how customer sentiment responds to economic conditions and strategic decisions by management teams, molding customers’ intent to travel more or less.

Looking at almost 300K pieces of feedback on the broader travel sector over the last year, we find:

- Cruise has continued to outperform the rest of the travel sector in terms of Travel Intent. It rose the most in April (2%) and year-to-date (9%). Travel Intent was up the most for households making $50K or less per year.

- Southwest Travel intent improved further in April, despite technical hangups that grounded planes last month. Though it was flat in April, Delta still maintains a firm lead in Travel Intent compared to its competitors.

- The more affordable motels/hotels saw the biggest Travel Intent increases of the broader hotel industry over the past three months, indicating consumers are going into the summer travel season with a focus on price. Travel Intent for hotels was up the most for households making less than $50K per year. The biggest risers were Candlewood Suites, Econo Lodge and Wyndham Garden, all up 8%-10%.

- Price is one of the most selected reasons why a person likes³ or dislikes a hotel brand. Over the past three months, it has become increasingly important to travelers.

Cruises: Riding the Rising Tide of Travel Intent

In the sea of the travel sector, cruise lines are sailing high. Over the past several months, Travel Intent for cruises has consistently been the highest among travel subsectors, reaching 18% in April 2023.

Travel Intent for cruise lines has also consistently moved higher over the past year, even as other travel industries stayed stable or edged downward. From January 2023 through April 2023, cruise Travel Intent increased 7% as

travelers head to the seas for school breaks and summer vacations.

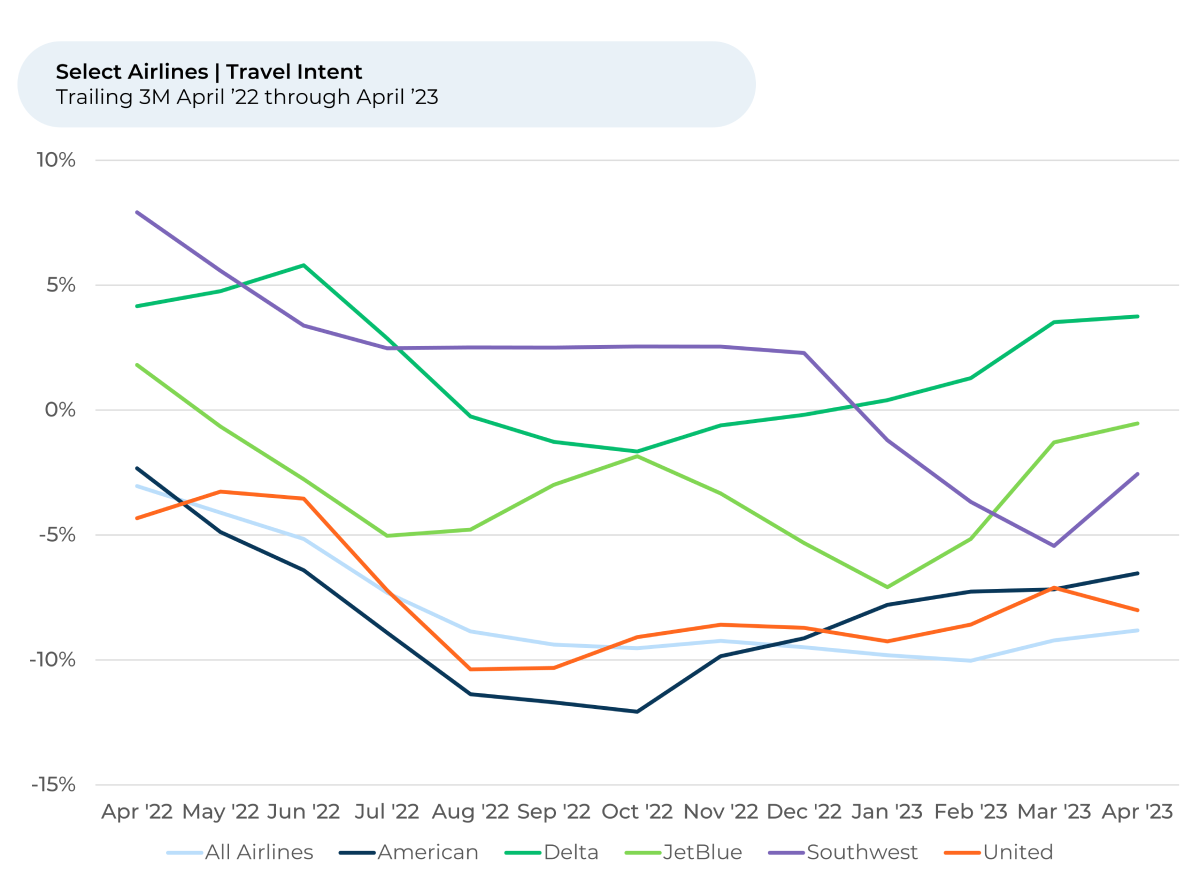

Airlines: Navigating Turbulent Times

Airlines are the only other travel industry that saw positive Travel Intent movement over the past three months, moving up by 1%. Travel Intent for airlines is still far lower than that of cruises.

Last month, we noted Southwest Airlines managed to keep its Travel Intent above water despite a significant hiccup on April 18th when an outage grounded planes. In April 2023, Southwest saw Travel Intent increase by 3%, faring better than the average of flat for all airlines. It could signal a bottom in Southwest’s Travel Intent, which began to fall in January 2023 after the airline faced significant technical issues over the holiday season.

“I like Southwest overall. They’ve had a rough year but I’ll try them again. I like the 2 bags to check-very helpful,” one Southwest traveler recently told HundredX.

Delta is still dominating the space in terms of Travel Intent. It rose 4% over the past three months to sit 13% higher than the airline average. Its customers continue to love it most for its punctuality, cleanliness and safety of its aircraft and its crews.

We will continue to look for signs airline Travel Intent can continue to rise,

especially as reports indicate the majority of adults plan to travel this summer, which experts say is pushing up the price of plane tickets.

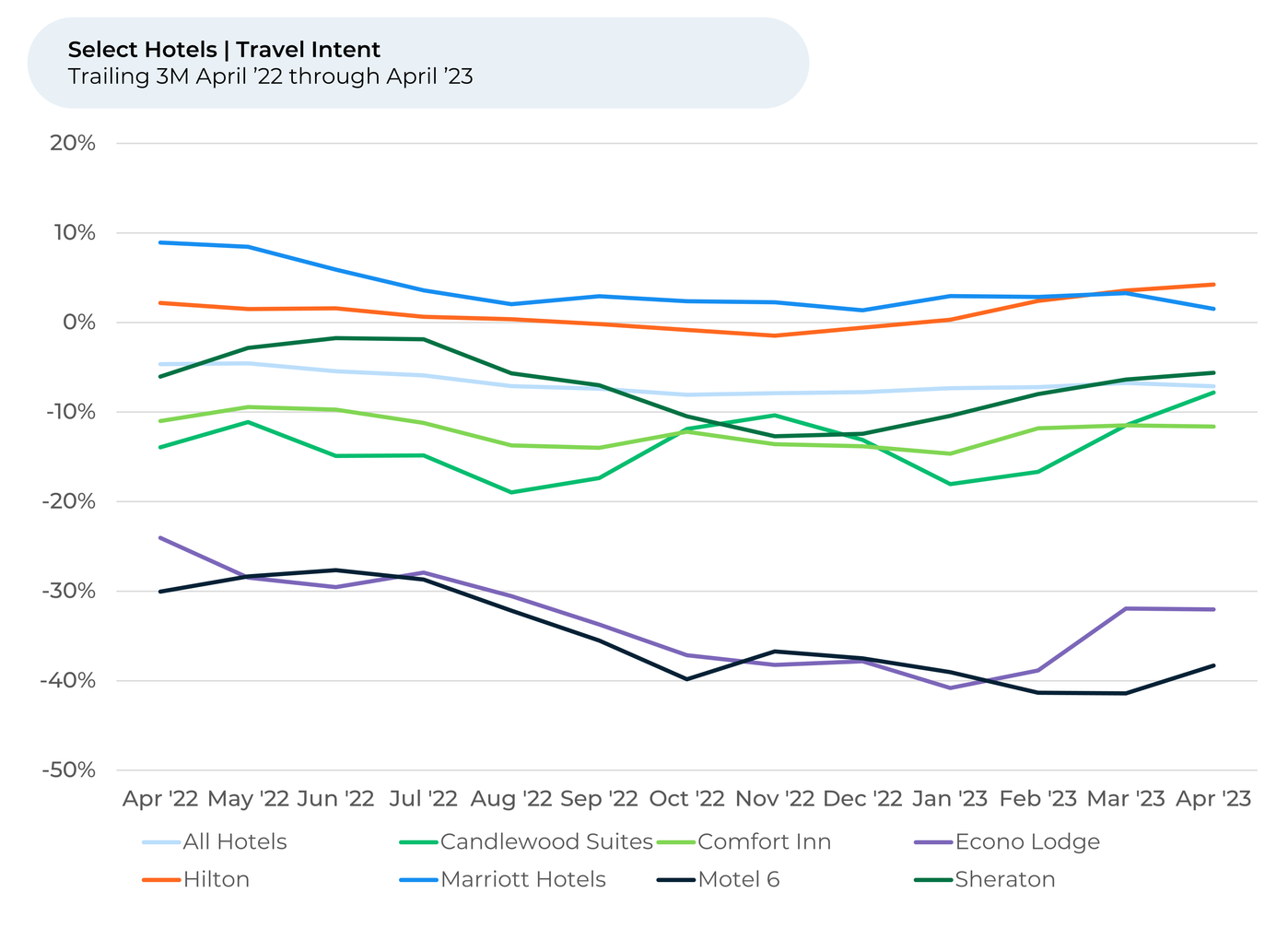

Hotels and Motels: The Rising Importance of Price

Those higher plane ticket prices, along with the worry from U.S. consumers about impending economic trouble, may be pushing travelers to turn to cheaper places to stay.

Many of the hotels that have seen the most improvement in Travel Intent from January 2023 through April 2023 offer more affordable room options, especially for extended-stay travelers.

Since January 2023, Travel Intent for Candlewood Suites, an InterContinental Hotels Group (IHG) brand aimed at extended-stay travelers on a budget, rose 10%, the most of any hotel brand we cover and far outpacing the hotel average, which stayed stable.

The key driver of the surge is a pickup in customer sentiment towards price and value in the last three months, followed by the check-in process, associate attitude and quality overall.

“I frequently visit this chain when I travel for business. The check-in/out process is always smooth and the rooms are clean,” a Candlewood Suites customer told HundredX. Another shared, “Had to stop during a snowstorm, very pleased with the service, quality and price.”

Other top movers in the last three months include the economy motel chain Econo Lodge (+9%), the business-traveler focused Wyndham Garden Hotel (+8%), Staybridge Suites (+8%), and Best Western (+7%). Travel Intent for several ultra-budget hotels and motels, including Super 8, Comfort Inn, and Days Inn, rose 2% - 3% over the past three months as well.

It’s no coincidence that customers like the price of many of these top Travel Intent movers more than other hotels. Among the top ten hotels in terms of customer sentiment on price are Super 8, Econo Lodge, Comfort Inn, Best Western, and Candlewood Suites.

“Good value for the price. Clean and modern,” one Comfort Inn customer told HundredX.

We’ve found price is the third most-selected reason why a person likes or dislikes a hotel brand. Along with check-in, price has increased the most in selection frequency⁴ over the past three months, indicating its increasingly top of mind for travelers.

As travelers continue to navigate uncertain economic conditions, companies in the travel sector are forced to adapt. Cruise lines continue to enjoy buoyant popularity, airlines are gradually recovering from turbulent times, and hotels and motels are witnessing a growing focus on price competitiveness.

The constant thread running through these insights is the customers’ increasing emphasis on perceived value. As we move forward, it will be crucial for leaders in the travel sector to stay attuned to these shifts in customer sentiment and intent, ensuring that they not only meet but exceed the travelers’ expectations in this ever-evolving landscape.

- All metrics presented, including Net Travel Intent (Travel Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Travel Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Selection Frequency represents the percentage of customers who decided to provide feedback on a brand and then select a given “driver” of customer satisfaction (such as Price or Speed) as a reason they think the product or service is good or bad. Selection frequency is an indicator of how important a driver is in determining how customers as a whole feel about the brand.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.