Founder and CEO of HundredX, Rob Pace, speaks with Bloomberg about Tesla's loyalty drop among consumers.

Earlier this week, Rob Pace, Founder and CEO of customer analytics firm HundredX, sat down with Bloomberg to discuss threats to Tesla's market share as competition in the EV industry grows more fierce. The conversation was a continuation of the one he had in August where Pace spoke with Forbes to discuss whether the market had reached "Peak Tesla." HundredX data picked up early signals the brand was losing its charge among Tesla owners.

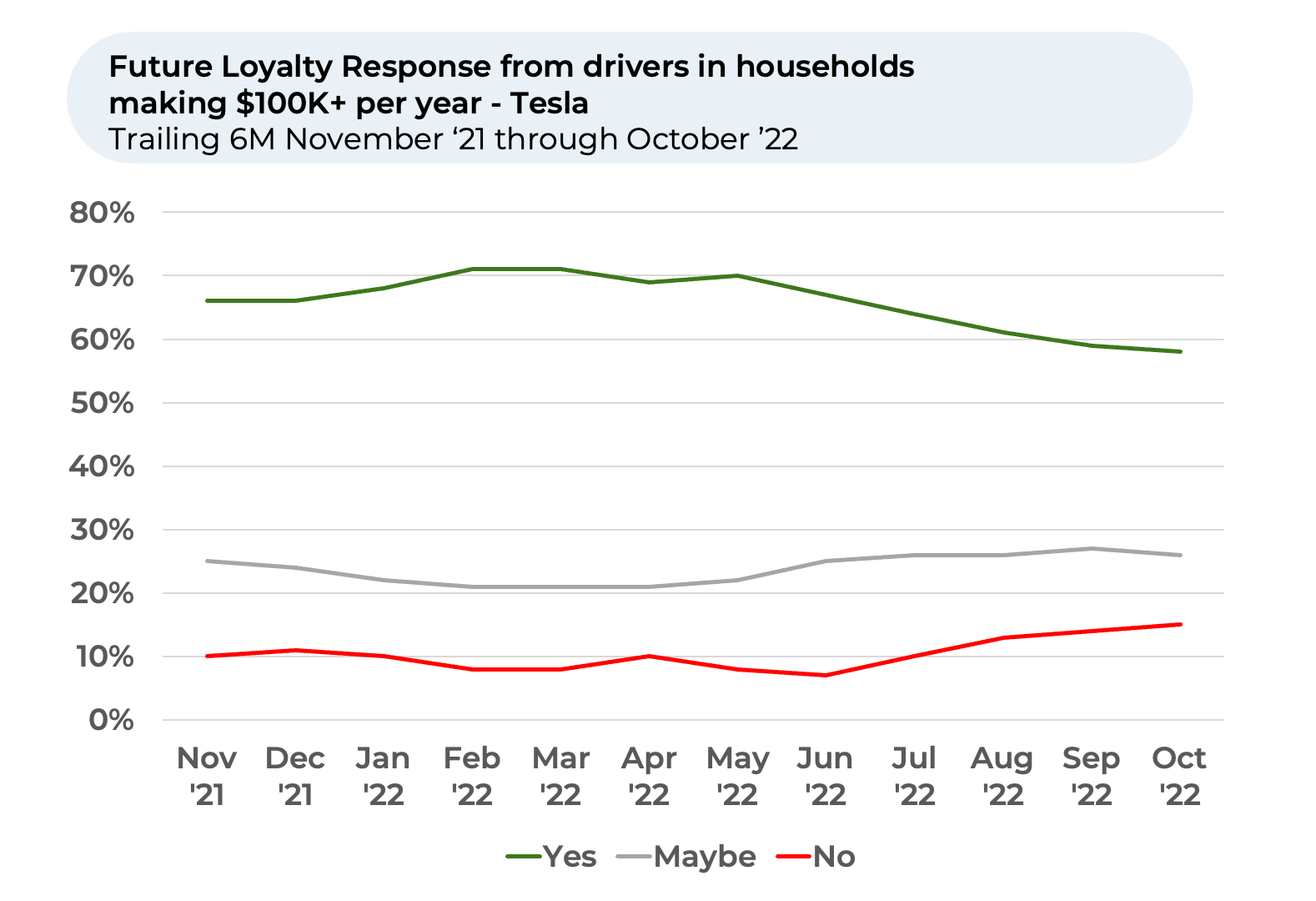

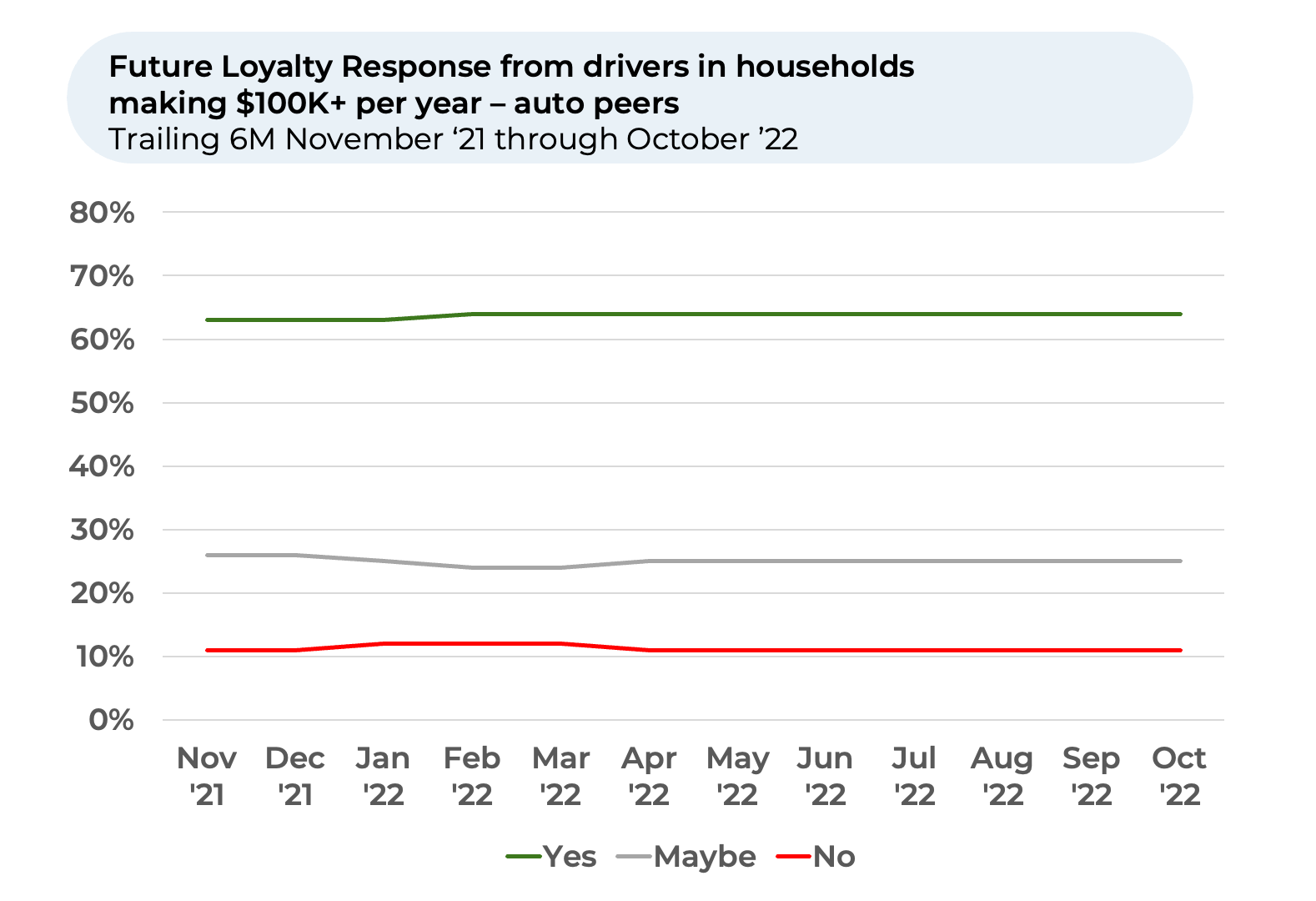

Tesla, one of more than 2500 brands HundredX tracks, is showing signs it may no longer be a crowd favorite among wealthier drivers. The charts below show the percentage of Tesla owners likely to buy from the brand again falling while brand loyalty among the rest of the industry remains flat.

While others are drawing a straight line between this trend and its CEO, HundredX insights are derived from 16 drivers of customer experience which are showing declines in key categories like quality, reliability, service, and brand values over the past few months.

Despite sentiment growing more negative in these areas, Tesla is a brand beloved by many and remains a clear leader in technology and performance satisfaction.

HundredX's Tesla data was also featured this week in coverage by Kelly Blue Book and Crain's Chicago Business.

####

HundredX is a mission-based data and insights provider and does not make investment recommendations. We believe in the wisdom of "the Crowd" to inform the outlook for businesses and industries. For more information on our Tesla data and any of our 75+ other industries, or if you'd like to understand more about using Data for Good, please reach out to our team.