The Latest Restaurant Insights from 'The Crowd'

Each month, the HundredX team will release a regular report on trends we see across the Restaurants industry, inclusive of Quick, Fast Casual and Sit Down Dining businesses. This report breaks down the latest insights gleaned from thousands of real customers (we refer to as 'The Crowd') who provide feedback to HundredX via our proprietary listening model. Monthly, we dig into metrics that highlight future purchase and usage intentions, the drivers behind changes in intent and customer satisfaction, and anomalies detected in the data. In addition, we highlight select businesses or brands winning with customers in those industries. Where possible, macro trends are also highlighted related to inflation, growth changes, and competitive share shifts. Here’s this month’s update.

This Month in Restaurants: July 2022 Update

• Demand growth outlook for

Quick Fast Casual remains stable, better than other restaurant and dining industries

• Consumer sentiment towards prices continues to favor Quick Fast Casual

• Brand Highlight: Arby’s is notching gains on the Industry

Quick Recap

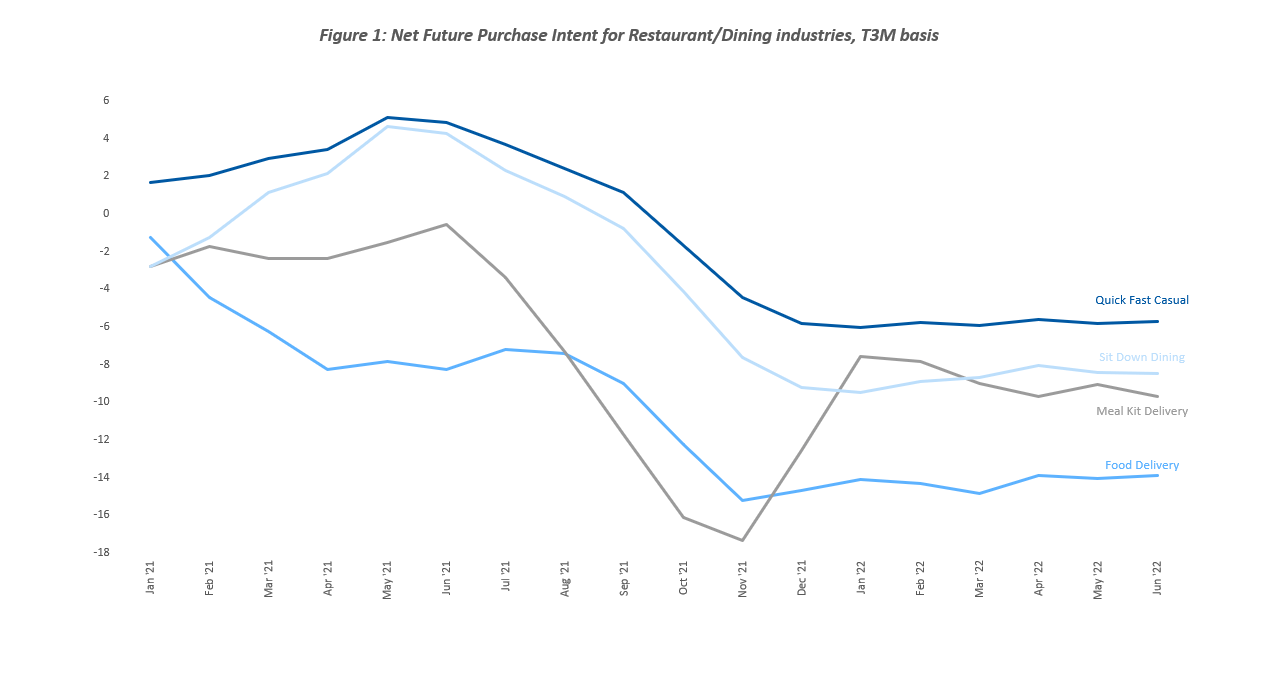

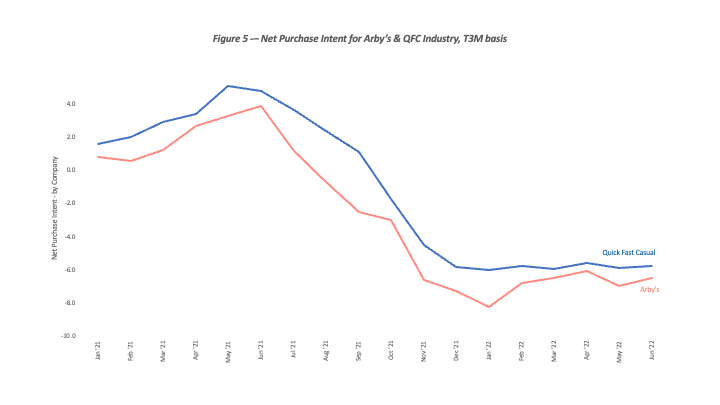

Consumer spending on dining out was up in 2021 thanks to several factors like stimulus payments, vaccine availability, and relaxed covid restrictions, but that changed abruptly in 2022, in part due to rising energy and food costs for restaurants and consumers alike. HundredX data reflected this shift as well, specifically across Quick Fast Casual (QFC) where future net purchase intent towards dining out essentially dropped off a cliff beginning summer 2021 and stabilized by winter 2021, remaining rangebound the last six months. Net purchase intent (NPI) reflects the percentage of customers who plan to visit the restaurant more over the next 12 months minus the percentage that plans to visit less. Our analysis of a subset of companies shows a 66% correlation between NPI and the companies’ YoY growth metrics (with a 30-day lead time) for QFC and 68% for Sit-down restaurants.

Interestingly, spend intent for QFC dropped at the same time as Sit Down Dining and Meal Kit Delivery, but Food Delivery services held up until Fall 2021. In April we reported the growth outlook declining the most across several categories related to food, as consumers told us they were tightening their wallets in response to rising food prices.

Appetite Loss Amid Rising Prices Continues

With food prices up another 1% in June vs. May and up 12% overall for 12 months ending June 2022 vs. a year ago, consumers aren’t feeing particularly hungry for what QFC is serving. Revisiting crowd sentiment to understand what if anything has changed relative to their future purchase intentions, HundredX examined 800K+ pieces of consumer feedback on almost 300 businesses across dining categories since January 2021, with 400K+ for QFC and 300K+ for Sit-Down Dining. All the data is captured by our proprietary listening methodology.

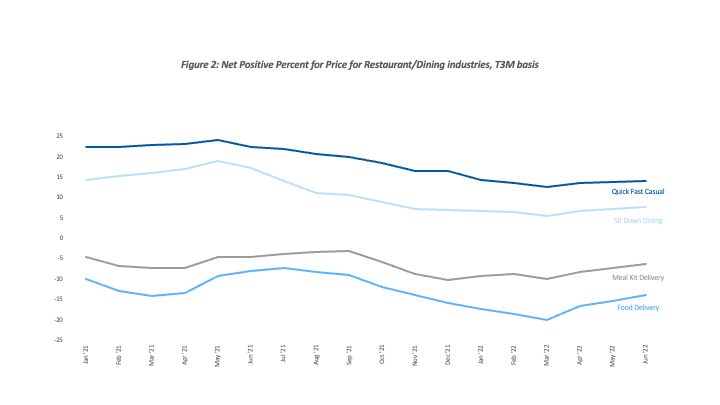

A review of consumer sentiment towards prices shows that sentiment for all the dining categories has weakened since the summer of 2021, with the

QFC industry holding up better and maintaining a more favorable position than the other dining categories. Interestingly, all the categories have begun to see a recovery since the Spring of 2022. The HundredX measure for sentiment on a given factor is the Net Positive Percentage (NPP), which captures the percentage of people that selected that factor (or driver) as a reason they like the product or service minus the percentage that selected it as a reason they do not like it.

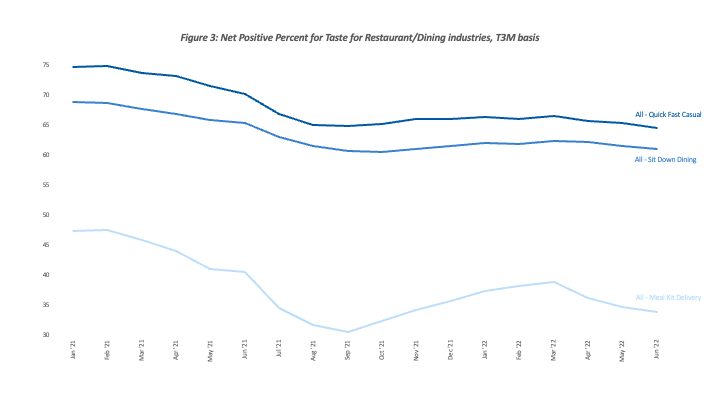

Taste Tames Price

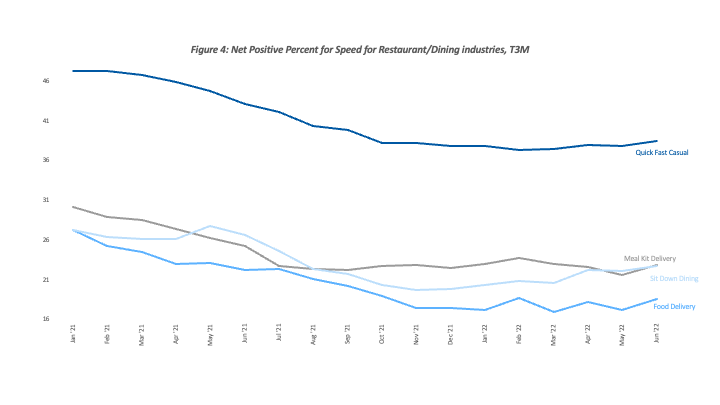

While costs seem to be putting a damper on dinner, customers still signal a willingness to spend on QFC in feedback shared with HundredX. Across the larger QFC category, HundredX notes certain factors outrank price as a driver of customer satisfaction and future purchase intent for QFC – specifically, Taste, Order Accuracy, and Speed. Interestingly, while it is not surprising the QFC industry maintained a sizable lead on other dining categories on sentiment towards their speed, it is notable that it also maintained a more modest lead over Sit Down restaurants in terms of their ability to delight customers’ taste buds.

Brands that listen by catering to the crowd (not only the loud) win when they curate dining experiences customers value most. Case in point for QFC, food that tastes good, is delivered quickly, and prepared accurately can persuade consumers to dine out more often, even when overall industry spending is down. Suffice to say, working to improve the purchase drivers that matter most to consumers could help better deter inflationary headwinds. Currently, HundredX works with clients to better understand what their customers care about most and continues to monitor these and other trends to empower better connections between businesses and consumers.

‘The Meats’ Make a Comeback

HundredX also looks to highlight areas where recent trends in feedback for a given company stands out versus their industry. Recently, we noted a positive inflection for America’s most beloved Roast Beef purveyor -- Arby’s. While it has had weaker future purchase intent than the industry for the last two years, 2022 has shown Arby’s narrow the gap. There was a modest dip in customer sentiment across many of its metrics in May 2022. We believe this may be due to negative press related to personnel issues and a class action lawsuit alleging misrepresentation surrounding the amount of wagyu beef in its new burgers accounting for the drop. However, Arby’s future purchase intent bounced back compared to the industry in June.

Arby’s Delivers on Crowd Delights

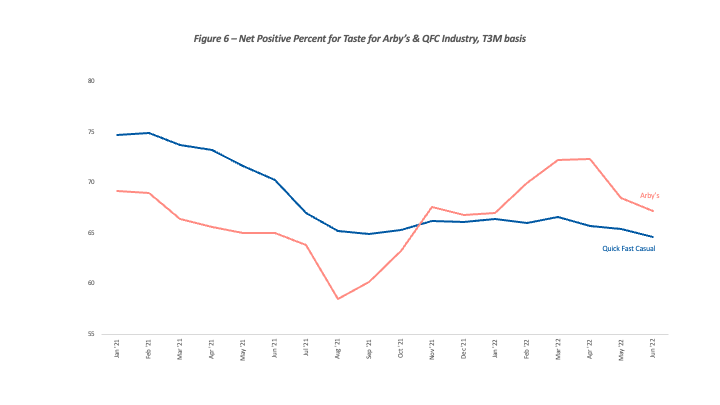

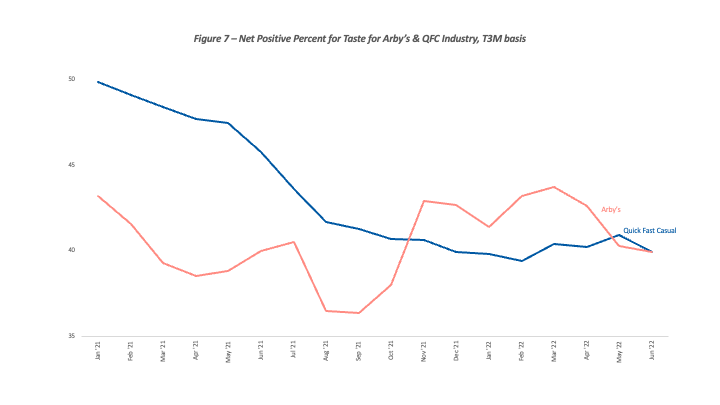

We examined Arby’s performance on 16 drivers of customer satisfaction we track for the broader QFC industry. Taste, Speed, Price, and Order Accuracy rank as the most selected and most important factors for QFC diners according to our data. Arby’s wins on some of these, delighting the crowd by receiving better marks than the broader industry on both Taste and Order Accuracy.

Arby’s surged above the broader industry on sentiment towards Taste, beginning with an improvement in summer 2021, passing the industry in winter 2021, and then peaking well ahead of the industry in April/May of this year. We believe this aligns with Arby’s introduction of a number of new menu items over the last twelve months, including new chicken sandwiches in January 2022 and its first ever burger in May 2022.

Over the same timeframe, sentiment towards Arby’s Order Accuracy has also surged – rallying from significantly lagging the industry for most of 2021 to shifting ahead of the industry for most of 2022. If Arby’s can improve its position on the other top drivers noted by QFC diners it may succeed in closing the rest of its gap on Future Purchase Intent. Arby’s has had poorer consumer sentiment on Speed versus the QFC industry over the entire 2021-2022 period, but it has improved compared to the industry over the last few months. Arby’s has also had sentiment improve on price for all of 2021-2022. The spread versus the industry has remained stable.

The HundredX team continues to watch Arby’s relative to other Quick, Fast Casual favorites to see whether recovery in various drivers and future purchase intent indicates Arby’s can continue building on its double-digit 2021 same store sales growth in 2022.

####

For a deeper dive on Quick Fast Casual eats or any others within the restaurant and dining industries, please reach out to us at: https://hundredx.com/contact

Learn more about HundredX and our solutions by requesting a demo.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.