Who doesn’t love fast food? It may not be the healthiest meal, but it sure tastes good.

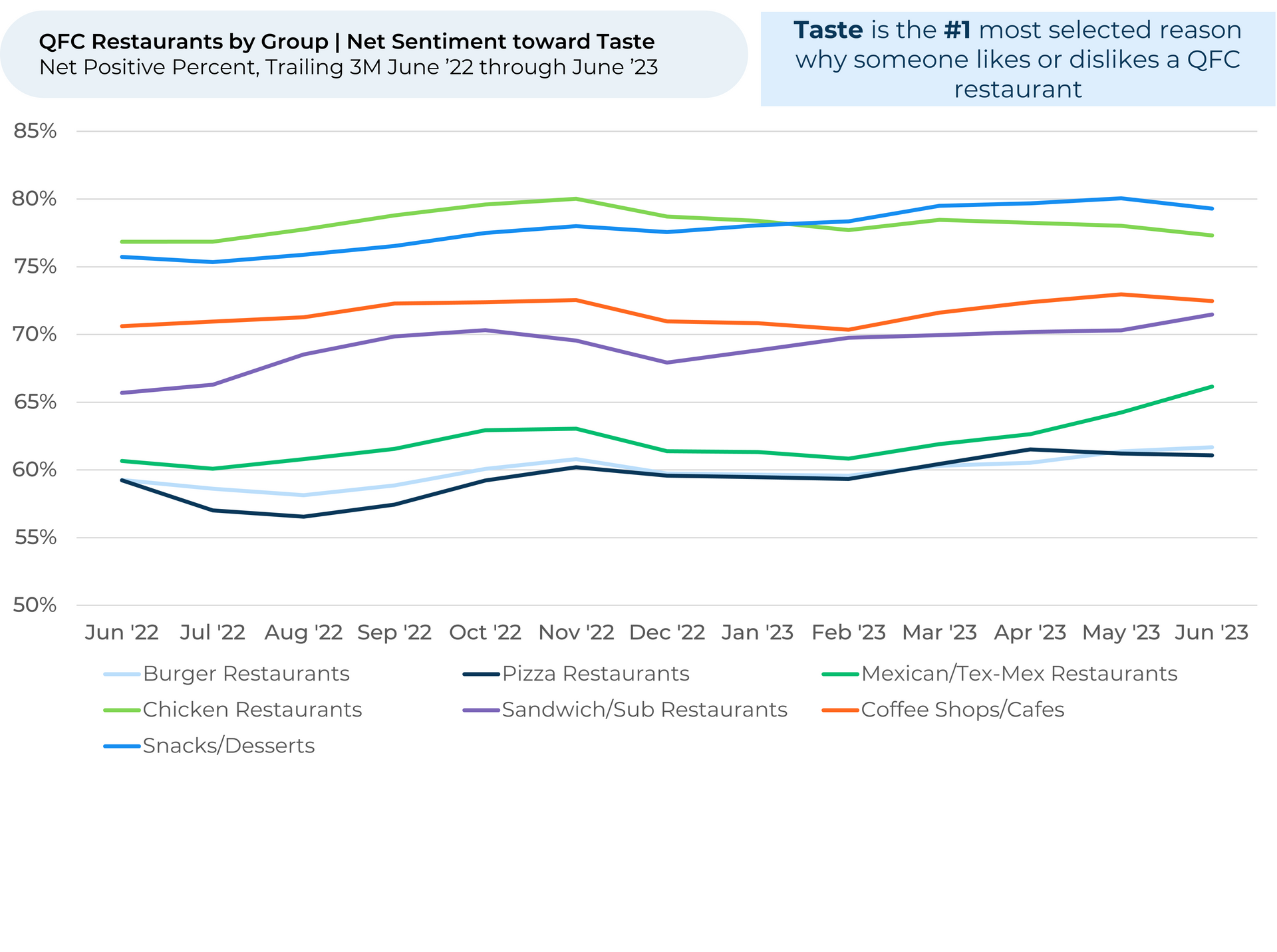

Looking to “The Crowd” of Quick, Fast, Casual (QFC) restaurant goers, HundredX examines which types of fast food customers think taste best. Examining 400,000+ pieces of customer feedback, June 2022 through June 2023, across over 180 QFC brands, we find:

Key Takeaways

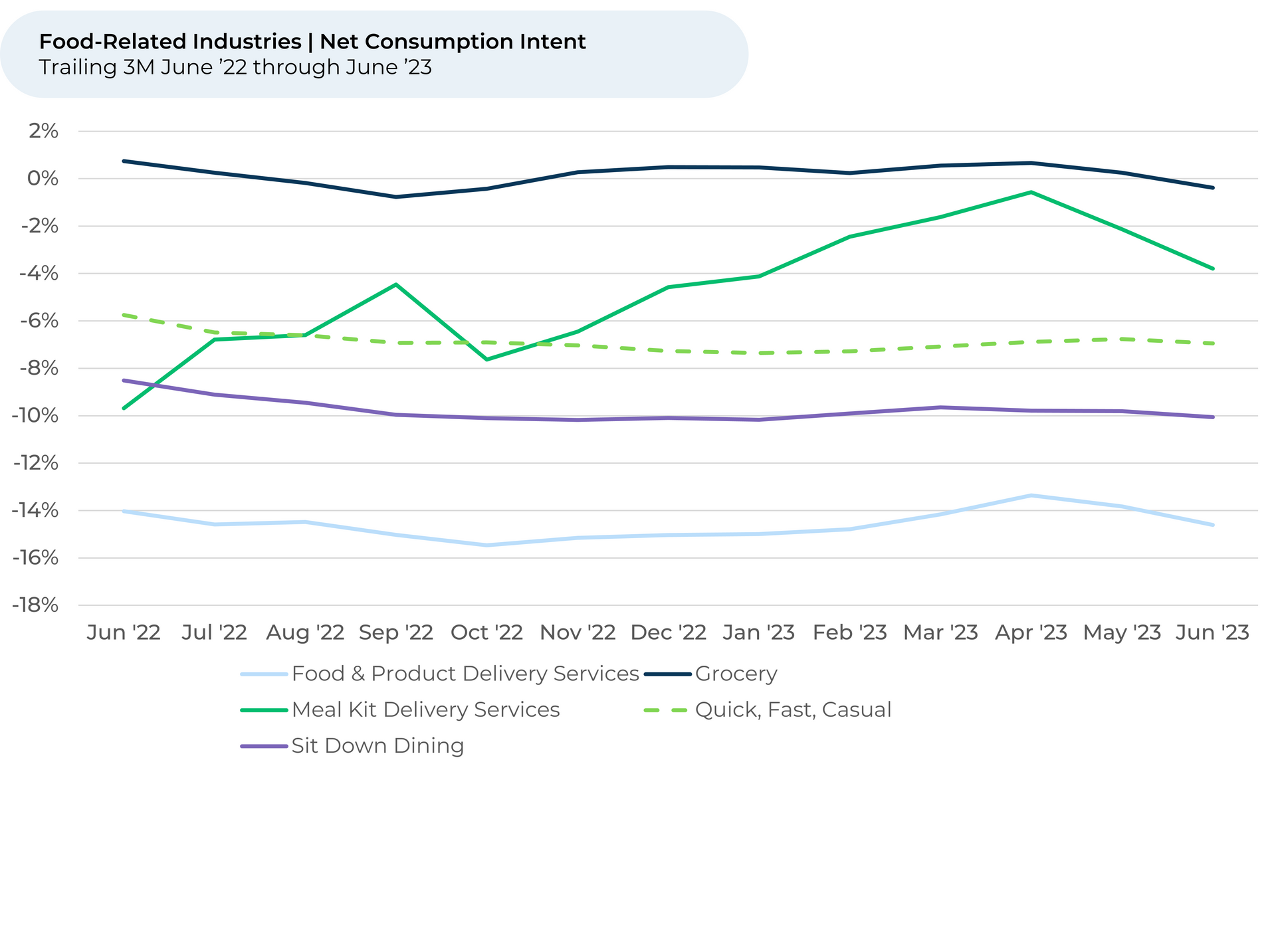

- Customers’ intent to eat at QFC restaurants has remained unchanged over the past three months. Consumption Intent1,2 for grocery stores and meal kits dropped slightly.

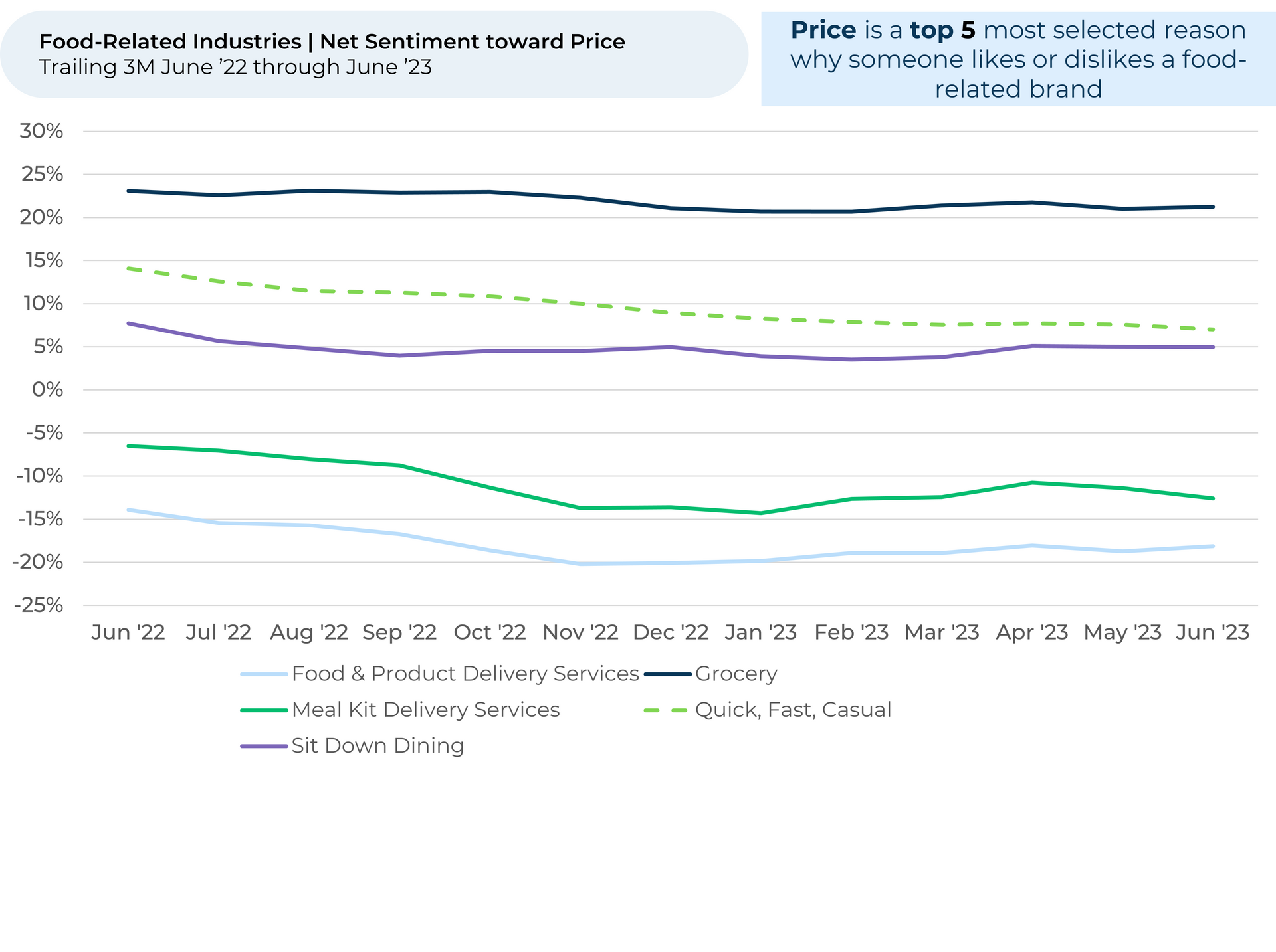

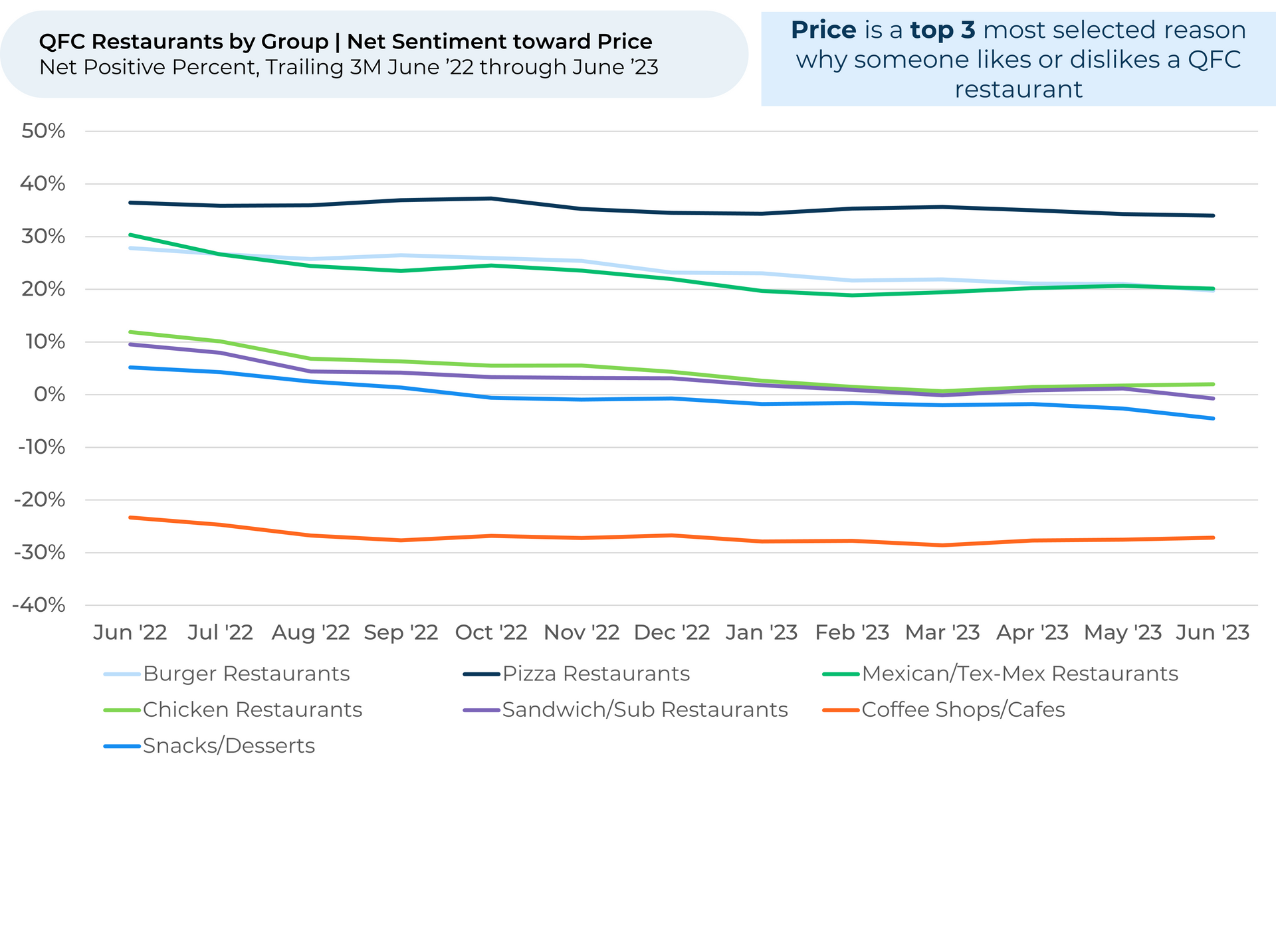

- However, customers have soured on QFC restaurant prices. Net sentiment3 toward Price fell 1% over the past three months and 7% over the past year, more than any other food-related industry. This corresponds with a relatively high inflation rate for fast-food restaurants.

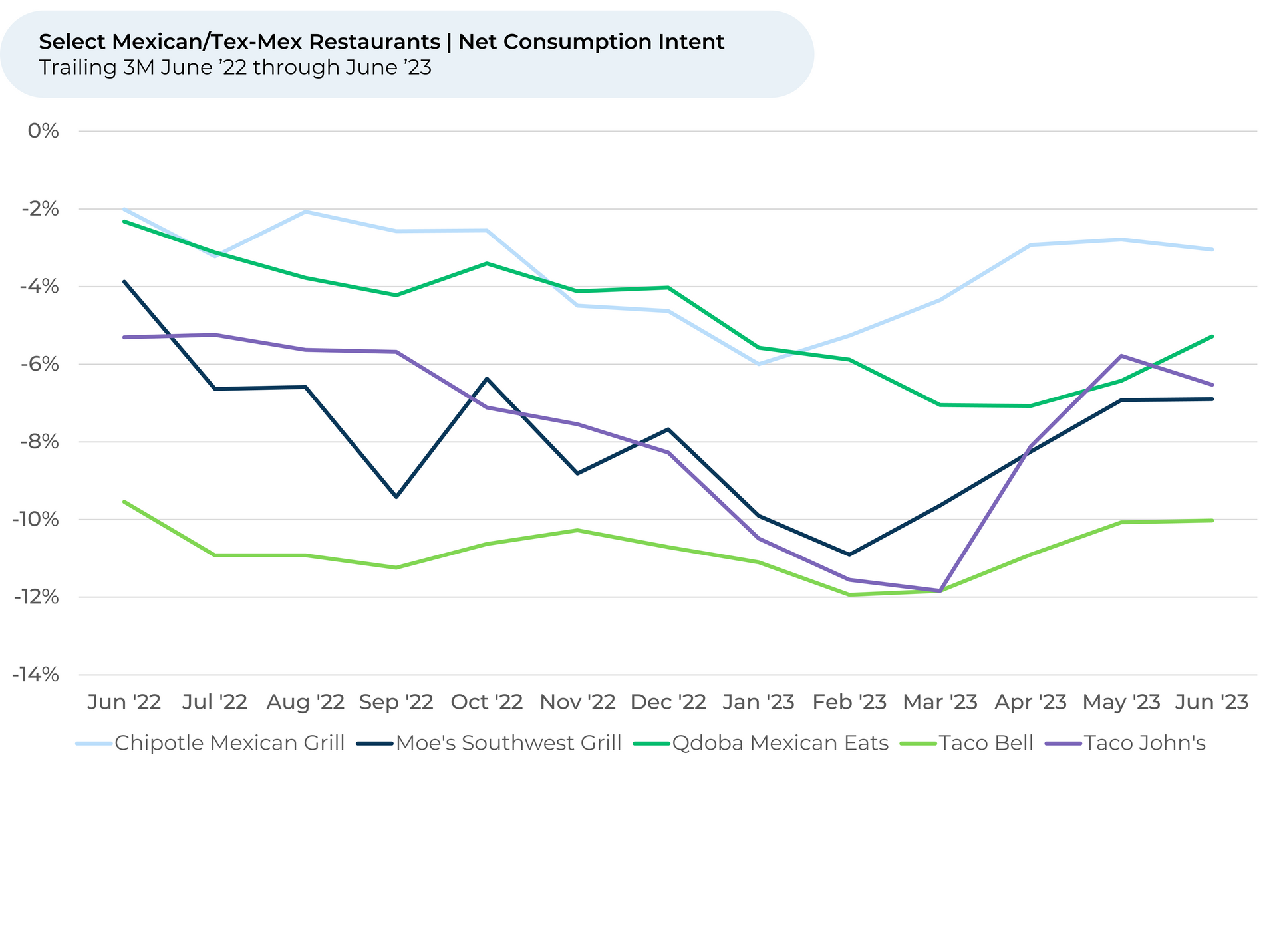

- Grouping QFC restaurants by the types of food they serve, we find Mexican/Tex-Mex restaurants are positioned to gain share of stomach. Consumption Intent grew 2% over the past three months, narrowing the gap with chicken, coffee shops and sandwiches, which were flat to down 1%.

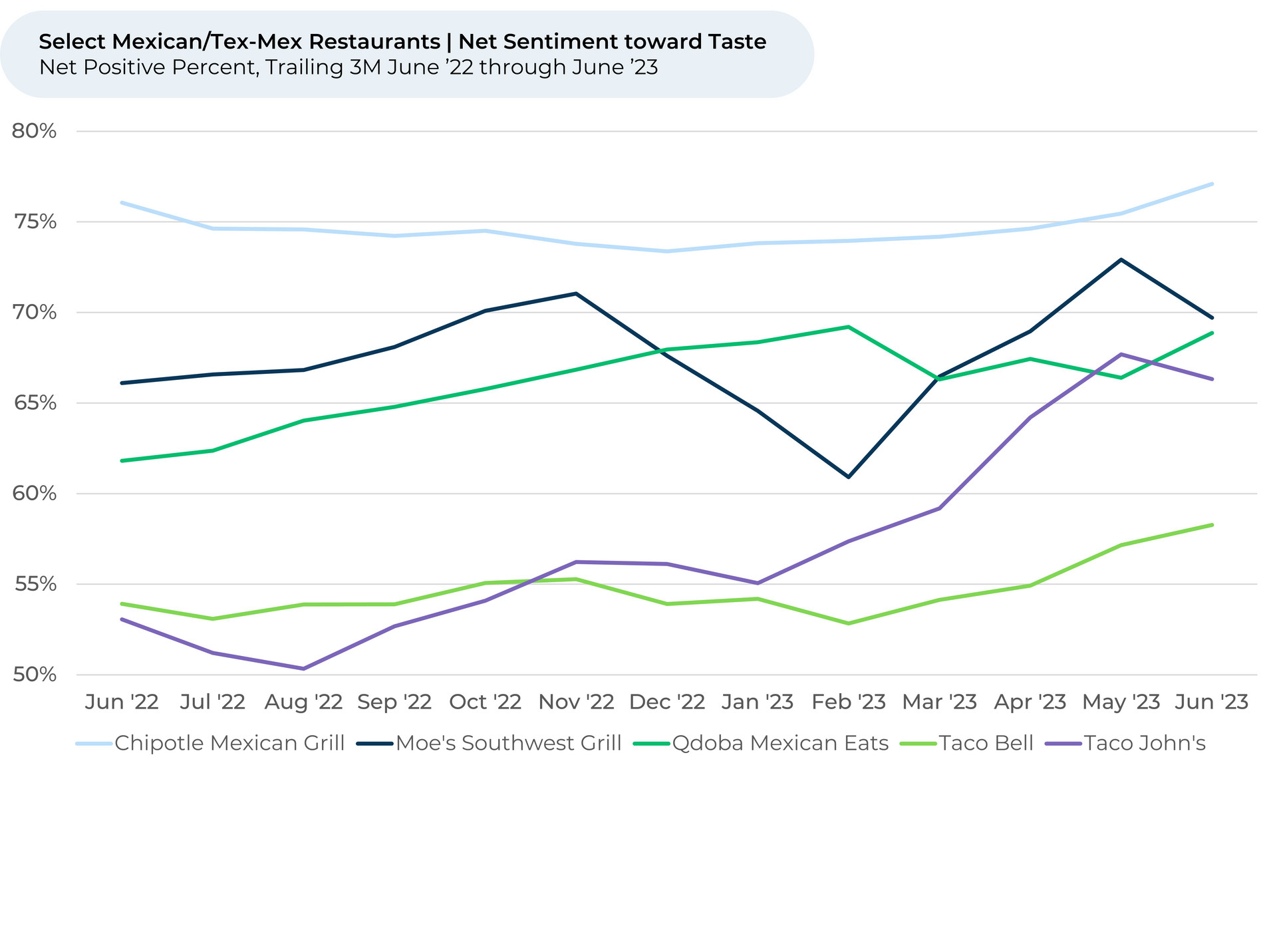

- The future growth in Mexican/Tex-Mex restaurants appears to be driven primarily by taste, followed by price. However, customers say snack/dessert chains and fast food chicken restaurants still taste the best.

- Taco John’s, despite its legal issues with Taco Bell, is gaining the most customer appeal. It seems eaters are responding well to its new/renewed menu items. Still, Mexican/Tex-Mex eaters say Chipotle tastes the best.

Discover HundredX insights into QFC Restaurant Trends:

Please contact our team for a deeper look at HundredX's QFC data, which includes more than 900,000 pieces of customer feedback across over 180 restaurant brands.

- Consumption Intent reflects a way to compare the future intentions of customers across various food-related industries. It captures:

- Loyalty Intent for Meal Kit Delivery Services, which is the percentage of customers who plan to keep using the service minus the percentage who intend to cancel. It also captures Visit Intent for Groceries, Usage Intent for Food Delivery, and Purchase Intent for the dining industries, which all represent the percentage of customers who expect to visit, use or spend more on a brand minus those who intend to visit, use or spend less.

- We find businesses that see customer Intent trends gain versus the industry have often seen revenue growth rates, margins and/or market share also improve versus peers.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Net Sentiment are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.