As parts of the country contend with late winter snowfall, HundredX takes a closer look at how travelers view certain travel industries after a tumultuous holiday season that saw poor weather ground thousands of flights. Some industries and companies deftly navigated the holiday travel rush, while others struggled.

By analyzing feedback across the entire Travel sector, we can better understand where travelers are planning to spend their money and why. HundredX looks at more than 270,000 pieces of customer feedback on more than 125 companies across six sub-sectors of Travel from January 2022 through January 2023 and finds:

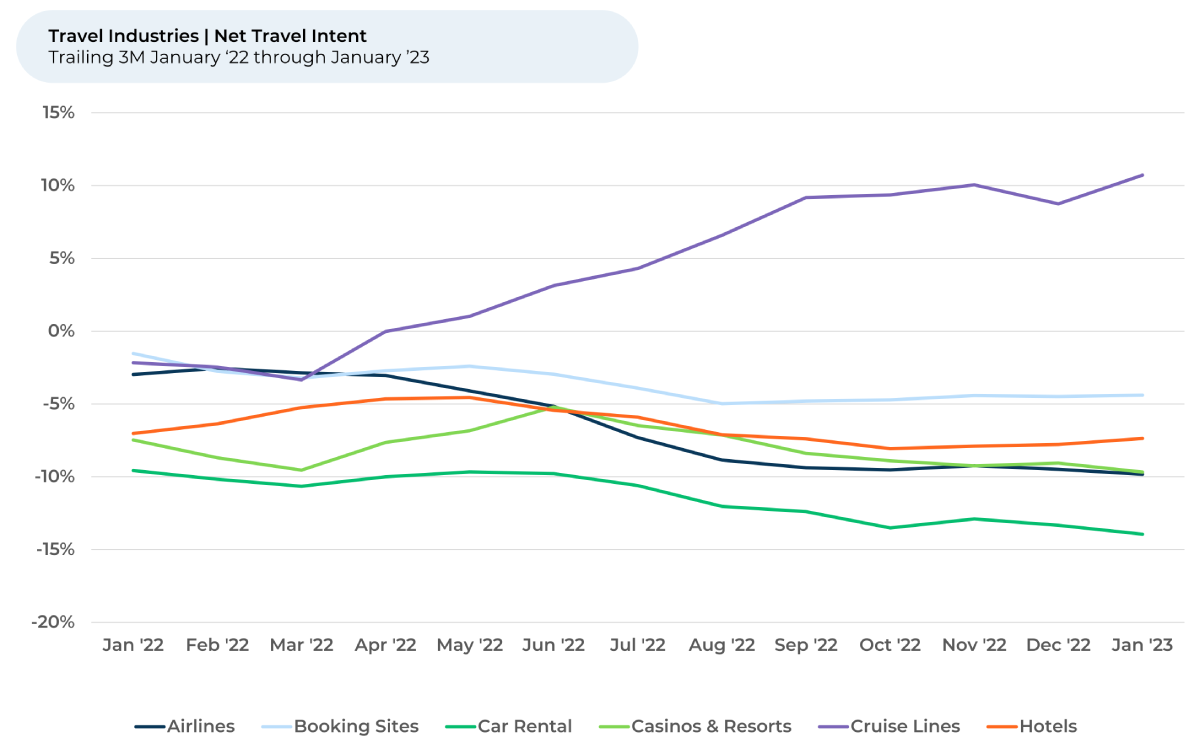

- Travel Intent is still negative for most travel industries. While stable during the last three months, Intent is down for all but one sector this year. Cruise Lines, once again the only positive industry, sees Travel Intent increase in January. It’s now the highest it has been in more than a year.

- Most major cruise brands are up in Travel Intent the past month, with Holland America Line posting the biggest jump. The move appears driven by increased sentiment towards Ship Cleanliness, Staff Attitude and Rooms .

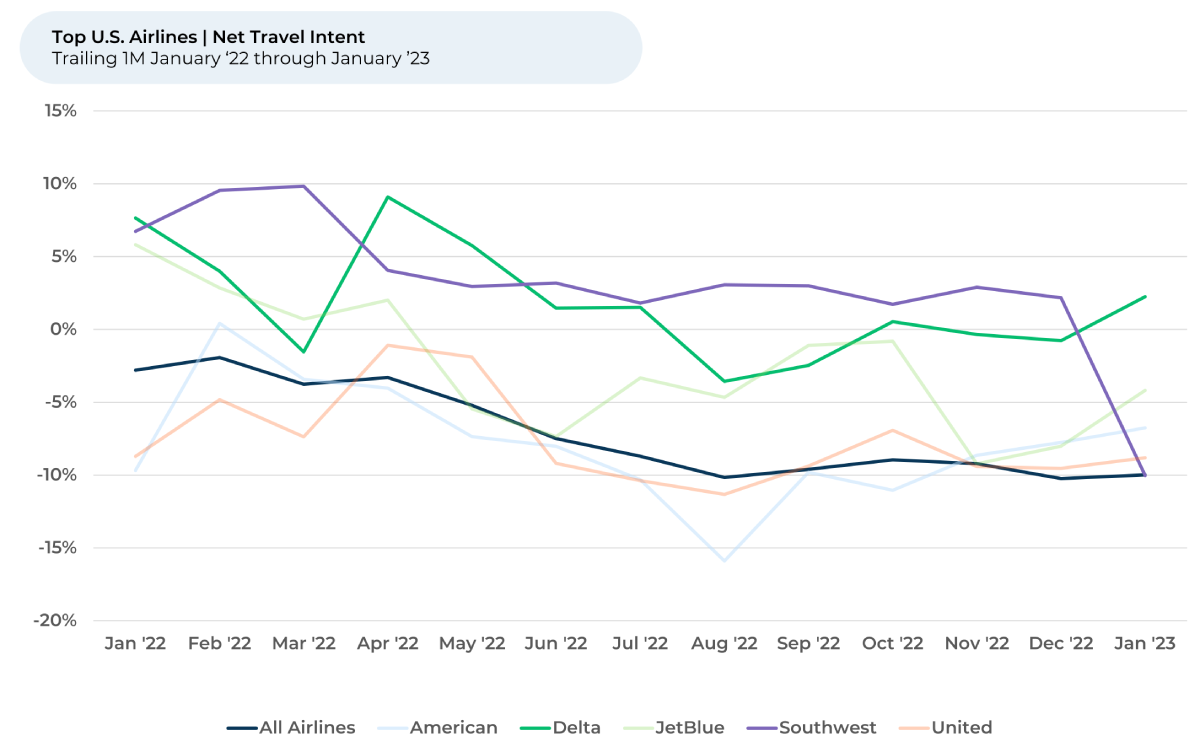

- Holiday travel disruptions appears to have caused a drop in Travel Intent and sentiment towards On-Time and Flight Options for some airlines.

- HundredX found Delta appears to be the relative winner, with a significant increase in Travel Intent for January and Sentiment scores from "the Crowd" indicating it dealt with the disruptions the best. We will continue monitoring relative winners and losers to see if recent changes in sentiment persist into 2023 and if they translate into lasting shifts in market share.

Over the past few months, while Travel Intent was relatively stable, Airlines, Car Rental, and Casinos & Resorts saw slight declines. Cruises saw the biggest increase, followed by Hotels and then a slight incline for Booking Sites. After a dip in December, Cruise Travel Intent rose to 11% Travel Intent in January – the highest it’s been since late 2021.

Travel Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less. For cruises, it represents the percentage of customers who intend to take another trip with the brand in the next twelve months, minus those that do not.

We find that Travel Intent for an industry improving (or weakening) versus other industries has been an indicator of an increase (or decrease) in future market share for that industry.

Down in the Water

As we have been writing since last summer, the surge in Travel Intent for the cruise industry continues to align with the strength observed in overall industry fundamentals. Royal Caribbean Cruises, which reported its full-year results in early February 2023, noted its load factors hit 110% during the holidays and experienced its seven strongest bookings weeks in company history in December 2022 and January 2023. Load factor refers to how many passengers are on board compared to the capacity available. It can exceed 100% if more than one person is in a room. The company says it expects to 2023 Adjusted EBITDA (a profitability measure) to beat its previous record in 2019.

Royal Caribbean’s results are impressive. Its 20% Travel Intent for January 2023 is the highest of any cruise brand we cover, and up more over the last year (+15%) than any other brand except for Carnival (+23%). However, over the last three months, both are relatively flat while Holland America Line, a subsidiary of Carnival Corporation & plc, actually saw the biggest gain in Travel Intent – from -13% in October 2022 to +1% in January 2023. The company enjoyed a surge in bookings over the past few months, noting recently that bookings for the third week of January 2023 were the highest ever on record.

Customer sentiment towards Ship Cleanliness, Staff Attitude and Room, all top five drivers of customer satisfaction, rose by 18%-20% over the last six months. Staff Knowledge and On-Ship Technology were also up 13% and 10% respectively.

The cruise has been investing in its ships and services, including the rollout of facial recognition software for faster check-in in early 2022. Meanwhile, parent company Carnival Corporation & plc, started rolling out faster internet powered by SpaceX's Starlink across all of its brands in December 2022.

“I would go on a cruise with this cruise line again in the future. They have lots of terrific offerings in terms of length/duration of cruise, destinations, and price points. The staff are friendly and very helpful and courteous,” one Holland America Line customer told HundredX.

Another excited customer said, “Next month I am going on a Smooth Jazz theme Cruise on Holland America. I am so excited!!! All Adult guest! No children! Wonderful atmosphere!!! Top Notch Entertainment!!!”

HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

Up in the Sky

While cruise lines seemingly benefited from holiday travels, airlines were a mixed bag. Harsh winter weather and scheduling technology issues in the days around Christmas led to thousands of flight cancellations across the U.S. The holiday travel disruption, the worst the U.S. has seen in years, cost some airlines hundreds of millions of dollars and tarnished their reputations.

Travel Intent for the Airline industry fell by about 1% in December vs. November, and moderated further by about 0.3% in January. The industry decline was largely driven by Southwest, which was the only major US airline to see a decline in Purchase Intent in January. While every airline had to ground planes due to the poor holiday weather, additional scheduling problems forced Southwest to cancel most of its flights before the holidays, resulting in more than 16,700 canceled flights and Q4 pre-tax loss of $800 million.

Southwest had the highest Travel Intent of the largest US-based airlines prior to the holidays. Purchase Intent for JetBlue rose by the most in January (+4%), followed by Delta (+3%). It remains to be seen whether these shifts will persist through 2023 or efforts by Southwest will lead it to recover to its prior leading position. Southwest plans to spend $1.3 billion in 2023 to maintain and enhance its technologies. In a recent interview with Reuters, Chief Information Officer Lauren Woods said Southwest had already rolled out an upgrade to its scheduling software and plans to update it again several more times this year.

For Airlines, we mostly looked at the data on a trailing one-month (T1M) basis (vs. typically on a trailing three-month basis) to best capture the immediate outcome of the holiday travel disturbances.

In January, sentiment towards being On-Time, the 2nd most selected driver of customer satisfaction, was down slightly for the overall Airline group but up the most for Delta, which rose by 11% to 50%, the highest in the industry. United and American also posted significant improvements in sentiment.

Compared to major US competitors, American, Delta, and United canceled fewer flights during the poor holiday weather. Those airlines also capped fares in many locations to help accommodate passengers from other airlines who had their flights canceled. Travel data company OAG revealed Delta closed out 2022 as the most on-time airline. In its 2022 full year earnings report, Delta noted another travel data company, FlightStats, called Delta the most on-time airline from October 2022 through December 2022.

A happy Delta customer told HundredX, “Thanks for getting me home safely and on time over the holidays.” Two others shared in early January right after the holidays, “Delta has always been the airline that I trust. It has always been accountable for time, baggage, quality employees and safety for me and my family;” and “We fly more frequently with Delta because we trust that we will arrive on time at our destination. Have never had an issue with this airline before.”

Delta, United and American also posted improvements in sentiment towards Flight Options, the 3rd most selected driver of customer satisfaction for December and January, up modestly from 4th or 5th for all of 2022.

“Stranded in LAS, (United) had a flight available for me to purchase to get home in time for Christmas,” someone told HundredX recently. Another person wrote of United, “I have had other airlines cancel my flights and not offer options to be placed on new flights that are convenient. That was not the case with United.”

HundredX will continue monitoring the travel space to watch how economic factors, including recession fears and inflation, impact travel plans throughout 2023. We will also keep a close eye on airlines to see if those that struggled can win back customer trust in the coming months and whether those that saw boosts to Purchase Intent can translate those into permanent share gains.

By analyzing feedback from real customers in real-time, HundredX can better predict which brands customers like the most, plan to travel more with and why.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.