Quick, Fast, Casual Restaurants

Sure, cooking is a great skill to have, and it’s often cheaper to buy ingredients at the local grocery store and make a meal at home. Sometimes, though, it’s nice to splurge to sit down at a nice restaurant and get served hard-to-make dishes. Or sometimes it feels right to stop at a fast-food joint on the way home to pick up a quick burger or chicken nuggets.

With food prices continuing to be up 8%-11% from a year ago in January, we look to the Crowd, real people who leave feedback on grocery stores and restaurants with HundredX, to understand how Americans are dealing. HundredX examines 750,000 pieces of feedback on 296 brands in Grocery, Quick, Fast, Casual (QFC), and Sit Down Dining and finds:

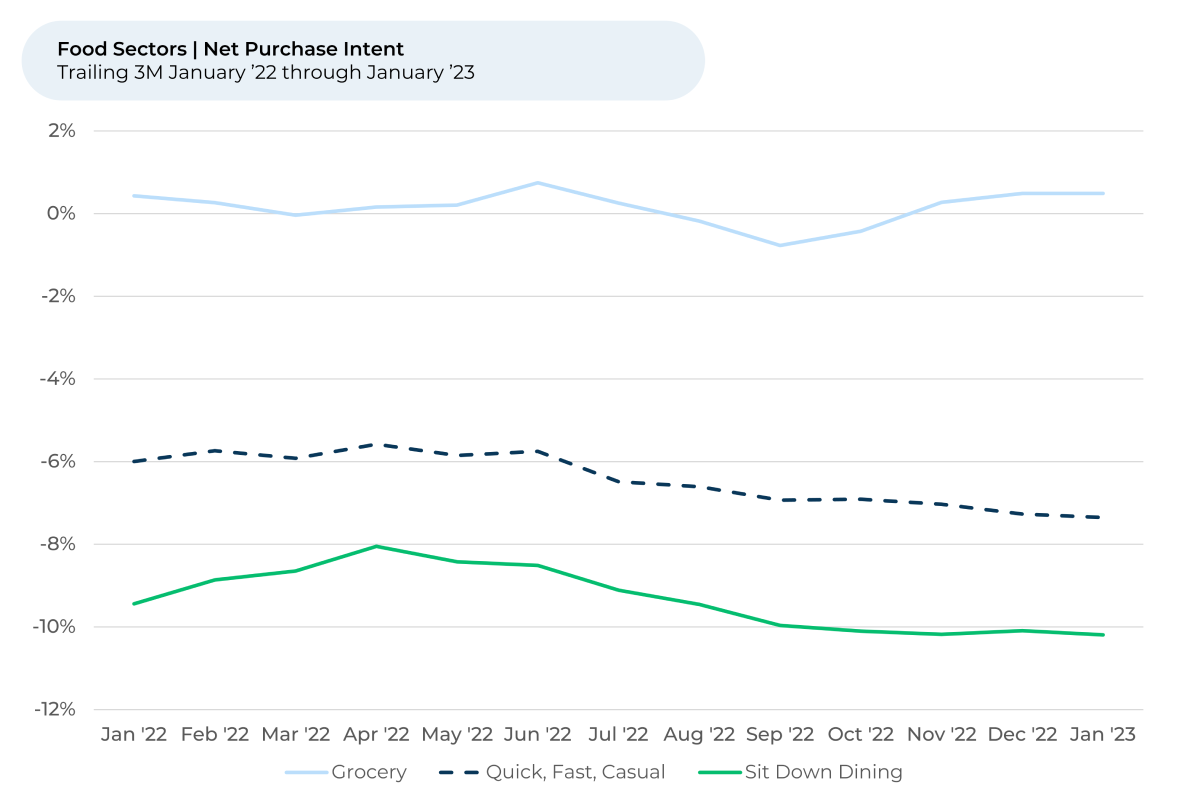

- Purchase Intent¹ is up the last three months for the grocery sector, but down modestly for restaurant sectors.

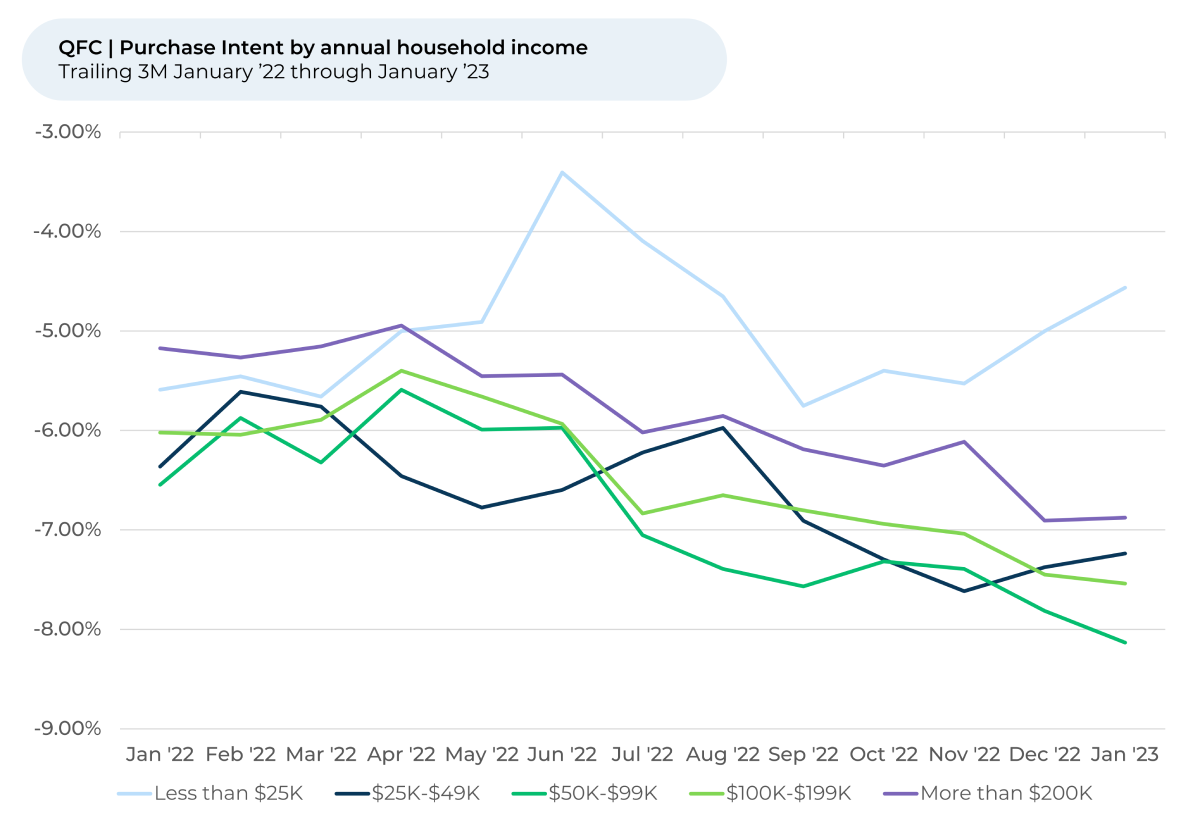

- The lowest income households (<$50K per year) generally saw the strongest trends in Purchase intent across food sectors in the last three months, while middle-income households ($50K-$200K) were the weakest.

- Grocers had the most favorable Purchase Intent trends across the board, generally followed by Sit Down Dining.

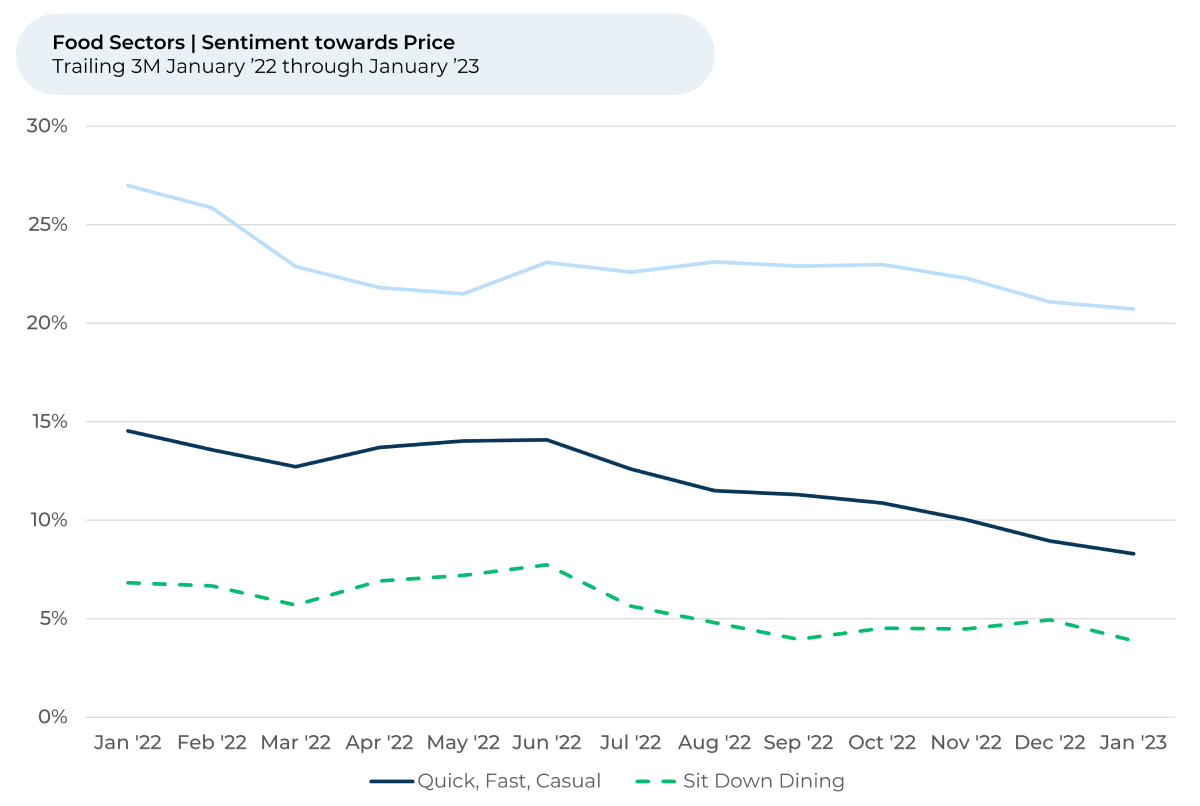

- While customers feel positively about grocery and restaurant prices, those feelings have been slipping in recent months. Sentiment remains highest and most resilient for Grocery, followed by QFC (dropped the most in the last six months) and Sit Down Dining the weakest.

- Many QFC brands that invested in their menus/taste and speed while managing price (the three things customers care the most about) saw Purchase Intent improve in the last three months.

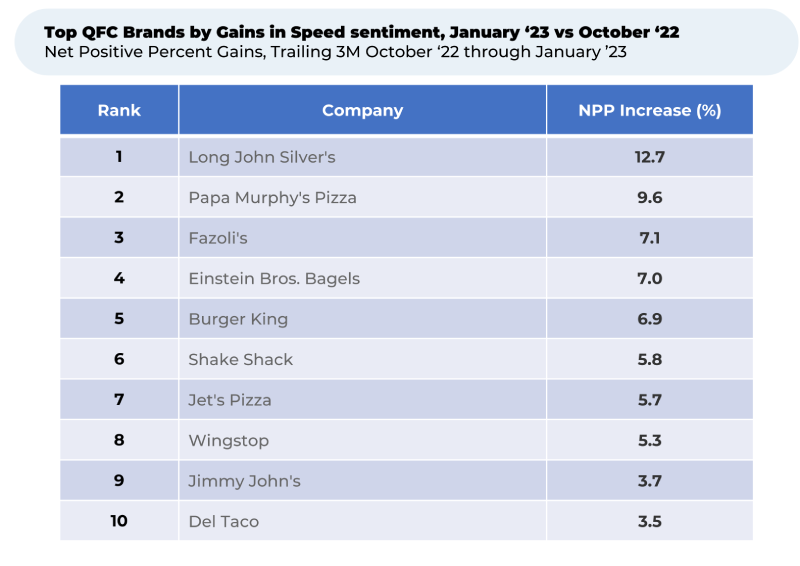

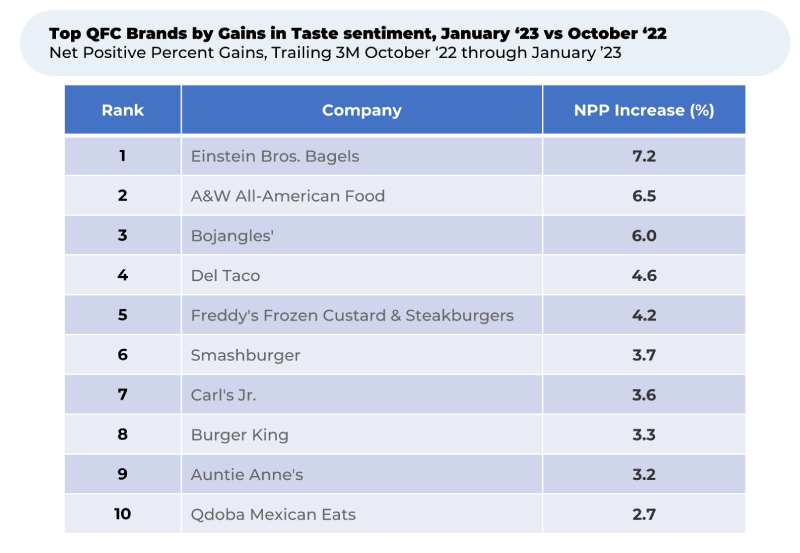

- Papa Murphy’s Pizza saw improved sentiment on Price and Speed, while Einstein Bros. Bagels and Burger King saw big gains in Taste and Speed. All three have seen gains in Purchase Intent.

- Wingstop had increases in Sentiment towards Speed and Price in the last three months, potentially indicating Purchase Intent may follow in the coming months.

Purchase Intent for food sectors didn’t move much during 2022. Grocery was in a tight range around 0%, but both QFC and Sit Down Dining sunk 2% since the spring. Over the past three months, HundredX has seen Grocery trending upwards by 1%, QFC is down slightly by about 0.5%, while Sit Down Dining has remained flat.

Interestingly, the lowest income households generally saw the strongest trends in Purchase intent across food sectors in the last three months, while middle-income households were the weakest. Grocery had the most favorable trends across the board, generally followed by Sit Down Dining.

- Households making less than $25K were the only ones with Purchase Intent up across the board over the last three months, with the biggest jump by Grocers (+3%), followed by Sit Down Dining (+1%) and QFC (+1%).

- Households making $25K-$50K had the next most favorable trends, up for Grocery and Sit Down Dining, while QFC was flat.

- From there the divergence widens, with Grocery flat to slightly up for consumers $50K-$200K while it was down for both restaurant categories.

- The wealthiest consumers ($200K+ annually) saw Grocery up the most (+1%), followed by Sit Down dining (+1%) and down for QFC (-1%).

Purchase Intent reflects the percentage of customers who plan spend to more at a grocer or visit a restaurant more over the next 12 months minus the percentage that plan to buy or visit less. We tend to focus most on the sequential trends and relative spreads between businesses or demographic groups when interpreting Purchase Intent. We find that Purchase Intent for a business, industry or group improving (or weakening) versus others has been an indicator of an increase (or decrease) in future market share for that business, industry or group.

Pricing may explain some of the Purchase Intent decline for the Restaurants. Price is one of the most important reasons people choose for liking or disliking a brand across all the food sectors. While customers on balance remain positive on grocery and restaurant prices, HundredX sees Price sentiment falling for all three sectors in the last three months: -3% for QFC, -2% for Grocery, and -1% for Sit Down Dining. This continues a trend that began during the summer of 2022, after a slight improvement in the spring.

HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a reason they liked the brand or product minus the percentage who see the same factor as a negative.

The Bureau of Labor Statistics found that restaurant menu prices increased by more than 8% in January 2023 versus the prior year. Grocery store prices increased by almost 12%. Both growth rates are down from peaks over the summer and fall, but are still very high and higher than the overall U.S. inflation rate of 6%.

The Price sentiment movements show that the gap between QFC and Sit Down Dining is narrowing, possibly because some fast-food chains raised prices more than the restaurant average. Financial advice and news website

MoneyGeek recently reported that some of the average meal costs at some of the biggest fast-food chains increased between 11% - 21% in 2022 compared to 2021.

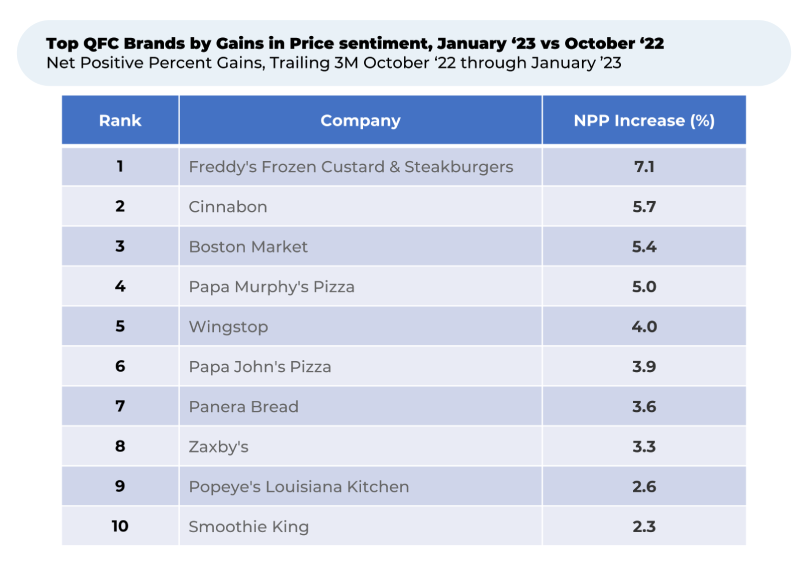

Still, not all QFC brands are telling a negative Price story. From October 2022 through January 2023, several QFC brands rose notably in Price sentiment.

While it didn’t increase the most in Price sentiment over the past three months, Papa Murphy’s Pizza is notable here as it was the only top mover that also saw an improvement in Purchase Intent while the peer group fell. Based in Vancouver, Washington, Papa Murphy’s Pizza operates more than 1,300 locations globally selling customers “Take ‘n’ Bake” pizzas. The franchise posted both notable gains in Price and Speed sentiment since October.

HundredX finds Taste, Speed, and Price are the top three reasons QFC customers choose when rating why they like or dislike a QFC brand.

Over the past three months, Papa Murphy’s Pizza saw Purchase Intent rise 1%, supported by an increase of 5% in Price sentiment and 10% in Speed sentiment.

At 41%, Papa Murphy’s Pizza holds one of the highest ratings for Price sentiment as of January 2023 among QFC brands (8% average). While Price sentiment dipped into the 30%s in the fall, the company’s issuance of coupons in recent months, which slashed prices as much as 35%, seemingly brought it back up.

“My favorite pizza because it's fresh, delicious, and priced well. They have good coupons too,” one person told HundredX.

The pizza chain is also ranked relatively high in Speed sentiment compared to its fast-food peers, with a score of 65% vs. 37% for the group. Its “Take ‘n’ Bake” business model sees customers pick out ingredients for their pizza in-store but cook the meal in their oven at home.

Earlier this year, Wingstop took several measures to improve an unexpected drop in sales in Q2. While its Purchase Intent has not shown improvement over the last several months, it has seen improvement in sentiment towards Price and Speed, indicating we may see signs of its customers giving it credit for its investments in the future. Wingstop, headquartered in Texas, specializes in wings and boneless tenders across more than 1,400 locations worldwide. It rose 4% in Price sentiment and 5% in Speed sentiment over the last three months.

Over the past several months, the company launched several new combo deals aimed at providing better value for larger orders. The company partnered with Uber Eats, increased marketing spend, and introduced several new menu items. The moves, according to customer feedback, appear to be paying off.

“Very clean. They have great deals for your money and good for parties. The employees are kind and helpful,” someone recently told HundredX.

While Speed and Price are the 2nd and 3rd most selected drivers of customer satisfaction, Taste remains the clear #1! So it is telling that Einstein Bagels, the top riser in customer sentiment towards Taste over the last three months (+7%) also has enjoyed a 4% increase in Purchase Intent over the same period. Einstein also saw sentiment towards Speed rise by 7% over the same three months. Both improvements appear to reflect credit from its customers for the significant investments it has made in its customer experience.

Einstein Bros. Bagels, the Colorado-based breakfast joint that recently merged with Panera Breads and Caribou Coffee, released several new menu items over the past few months. The company launched an “All-Nighter” breakfast box, made for a group of people, in October, and a separate box in December. Prior to that, it launched a new breakfast burrito, a well-promoted departure from its regular bagel fare.

The bagel company also partnered with Walmart in October to put five types of packaged bagels on more than 3,500 stores’ shelves.

“(Einstein Bros. Bagels) is a fun place to go on the weekend and enjoy a yummy breakfast sandwich. I also love picking up a doggie bagel for my sweet pups. I love the little coffee bar to serve yourself while you wait for your sandwich,” someone recently told HundredX.

While it saw smaller gains over the last three months than Einstein, Burger King still gained in Speed and Taste sentiment. As a result, its Purchase Intent was up 4%, still lagging the QFC coverage universe but narrowing the gap. Like Einstein Bros. Bagels, the global fast-food chain released several new menu items recently, including new vegan bacon, cheese, and chicken nugget options. Despite the recent challenges some plant-based meat alternative brands have faced recently, Burger King customers seem to like the company’s new vegan options.

“I love the vegan options on the menu,” one person recently said of Burger King. Another person commented to HundredX that they are “Glad for new vegan options.”

Burger King also made several changes in 2022 to increase ordering and serving speed, including eliminating paper coupons in lieu of mobile ones and slashing under-ordered items from its menu. The company announced in the fall that it’s investing $200 million to remodel thousands of restaurant locations and an additional $50 million to upgrade locations’ kitchens and technologies.

HundredX will continue to provide updates on the grocery and restaurant industries throughout 2023, sharing how they all appear to be dealing with economic uncertainty, cost pressures, new technologies, and other opportunities to drive (or lose) market share. By analyzing feedback from real customers in real-time, HundredX can better predict which brands customers like the most, plan to spend more at and why.

- All metrics presented, including Net Purchase Intent (Purchase Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.