As the automotive industry shifts towards greener solutions and the Biden administration proposes new electric vehicle sales guidelines, our team at HundredX has been closely monitoring how customer tastes and company strategies have been evolving.

We've analyzed more than 80,000 pieces of feedback on 46 auto brands from April 2022 through April 2023 to bring you the latest trends in customer behavior across various vehicle types, with an emphasis on electric/hybrid vehicles. We find:

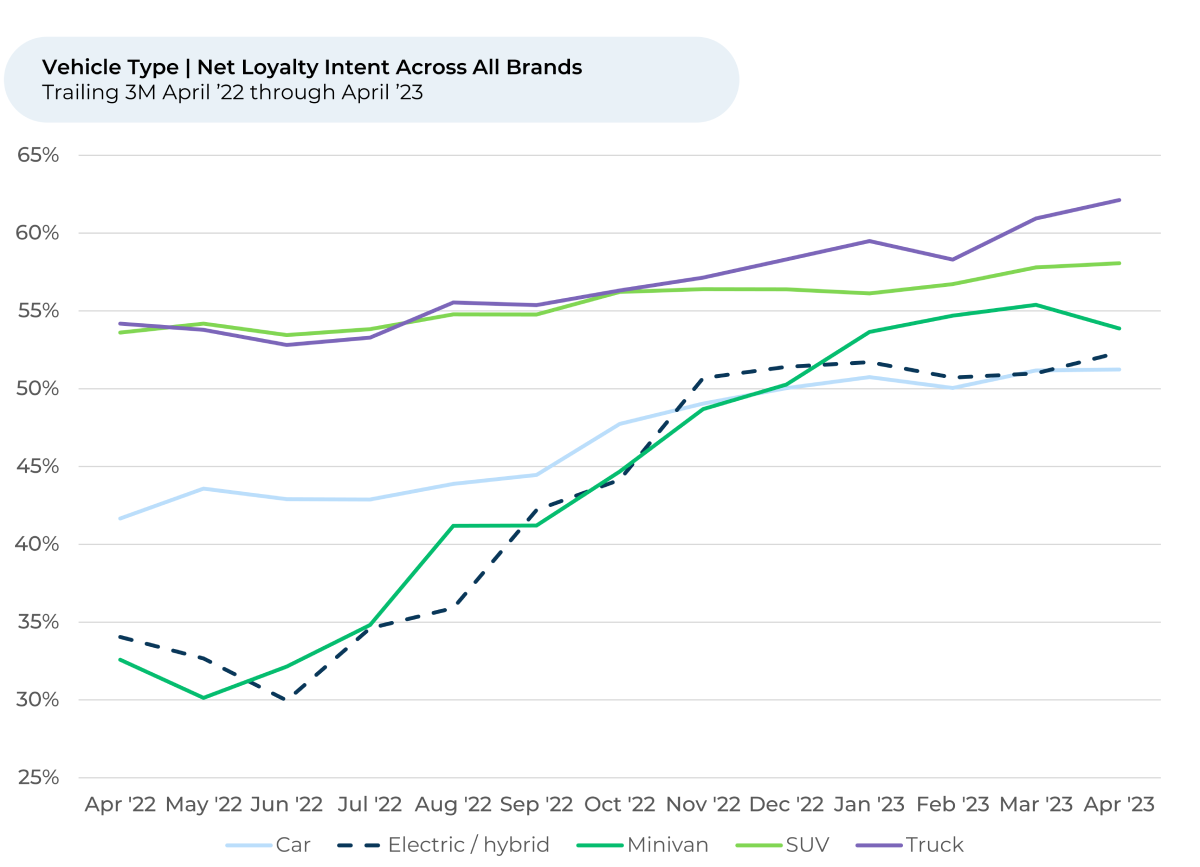

- Loyalty Intent among electric and hybrid vehicle drivers spiked over the last six months, up more than any other category except for minivans. Trucks have jumped to the highest Loyalty Intent of any category since the Fall of 2022.

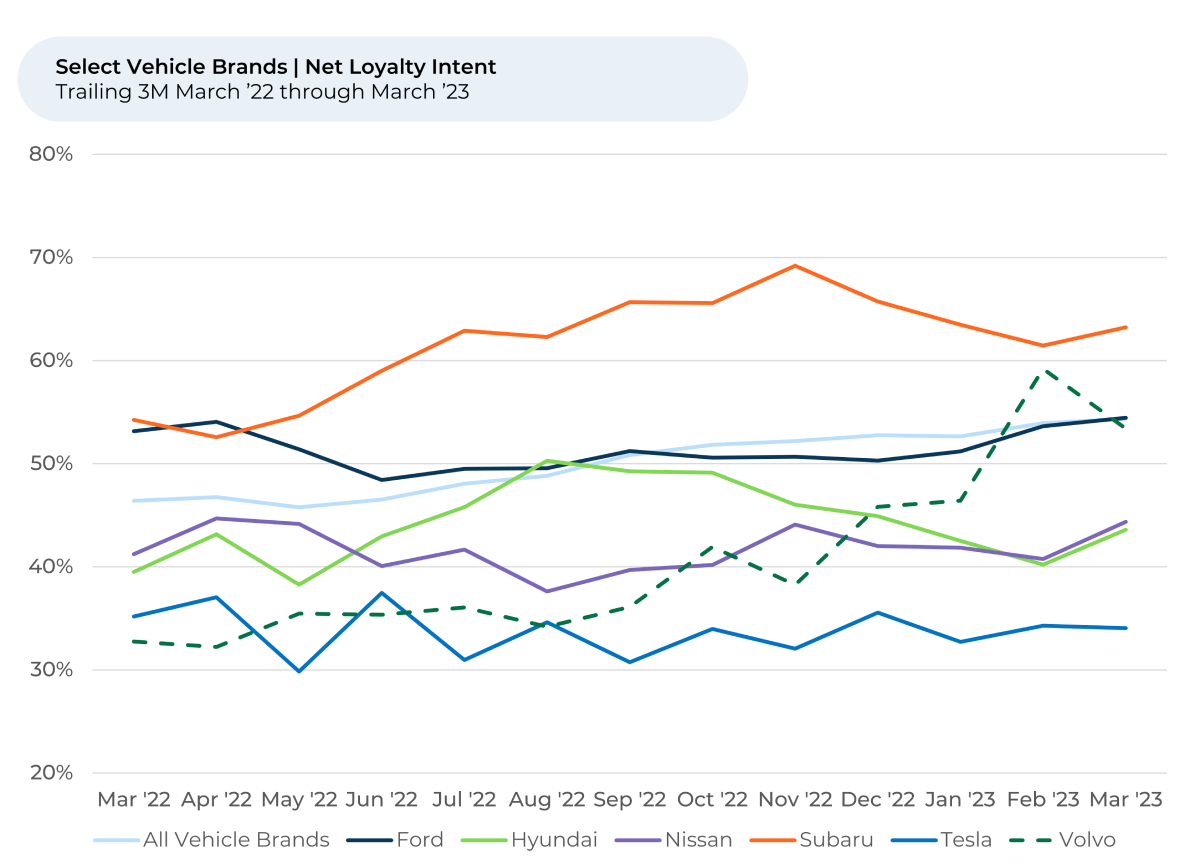

- While Toyota and Honda are the auto Loyalty Intent¹,² leaders, Volvo surged by 17% in the last six months - more than any other major auto brand. It is now the second-highest luxury brand, behind Lexus. The increase aligns with strong recent electric/hybrid vehicle sales for Volvo.

- Volvo customers increasingly like³ the comfort, performance, quality, and reliability of their vehicles.

- Customers also are happier with Volvo’s brand values, partially driven by customers liking Volvo’s stance on sustainability.

Some auto brands have seen significant recent shifts in Loyalty Intent. Over the past six months, the top gainers have been Mitsubishi, Volvo, Cadillac, Land Rover and Lincoln, all up 10% to 18%. However, we focused on Volvo’s gains because its Loyalty Intent is now in the top 10 of all covered auto brands and second highest among the luxury car makers. Volvo’s improvement appears to reflect its customers giving it credit for investments to boost electric vehicle sales along with the performance and comfort of its vehicles broadly.

Volvo Loyalty Intent rose 17% from October 2022 through April 2023, far more than the industry average of 5%. Volvo recently reported US auto sales volumes are up 10% YTD through April 2023 vs. last year, more than 6% growth in new vehicle sales for the broader industry, according to Automotive News. Volvo announced 69% growth in battery electric vehicles (BEVs) sold YTD vs. last year, far outpacing its overall average growth rate.

Loyalty Intent spiked more for Electric and Hybrid Vehicle Owners than almost every other category

Across all car brands, Loyalty Intent among electric vehicle owners increased 8% over the past six months, far more than Loyalty Intent for car, SUV, or truck drivers. Interestingly, Loyalty Intent only increased by more over the past six months among minivan drivers.

Less people leave feedback for hybrid or electric vehicles than other types of vehicles, seemingly corresponding to their low percentage of total US car sales. J.D. Power says less than 1% of the 250mn vehicles in the United States are electric vehicles. Yet, about 5% of the feedback collected by HundredX on cars over the last year was from people who owned electric/hybrid vehicles vs. 39% for SUVs and 35% for cars. This over-representation by EV/hybrid vehicle owners seems to imply that while there are fewer electric or hybrid vehicle drivers on the road, those that do drive these types of vehicles are increasingly loyal to their “greener” vehicles and feel strongly about them.

Volvo Drivers Happy with Comfort and Performance

While Volvo customers have long shown their appreciation for the comfort (66%) and performance (64%) of their vehicles, they are increasingly liking their quality and reliability, too. Customer sentiment towards performance rose 7% over the past six months, and sentiment towards quality and reliability increased 6%. This demonstrates that customers are increasingly trusting Volvo to deliver reliable vehicles, likely accounting for at least some of its recent increase in Loyalty Intent.

“Love this vehicle - it is so comfortable to ride and drive,” one Volvo customer told HundredX. Another customer said, “The safety rating, comfort, and design of the Volvo sold me in one day. I enjoy driving my XC90 every day.”

“The Crowd” of real drivers tells us quality and reliability, comfort, and performance are the top three reasons why a person likes or dislikes a vehicle brand.

Volvo's commitment to sustainability and innovation, especially with the increased adoption of electric vehicles, has resonated with customers. Customers’ sentiment towards Volvo’s brand values and trust increased 7% over the past six months as well. Notably, almost half of the respondents who left feedback on Volvo’s brand values and trust this year said they feel positively about the company’s sustainability efforts.

It can be speculated that Volvo's strong performance in the electric vehicle segment, coupled with its commitment to providing comfortable, reliable, and high-performing vehicles, has contributed to increased loyalty intent compared to other brands. As the electric vehicle market continues to expand and capture the attention of consumers, HundredX will continue to see whether surging brands like Volvo can continue gaining share or whether others will do a better job investing to address evolving customer needs and preferences we observe.

- All metrics presented, including Net Loyalty Intent (Loyalty Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Loyalty intent reflects the percentage of customers who plan to purchase a specific car brand again minus the percentage who plan to switch to a new one.

- HundredX measures sentiment towards a driver of customer satisfaction as the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.