Former Express Scripts boss Tim Wentworth takes the reigns as the new CEO at Walgreens at a pivotal juncture. Strong competitors like Walmart are making strides in the pharmacy aisle, while Walgreens pharmacists are protesting what they view as insufficient staffing and resources to do their jobs safely and ethically for their patients.

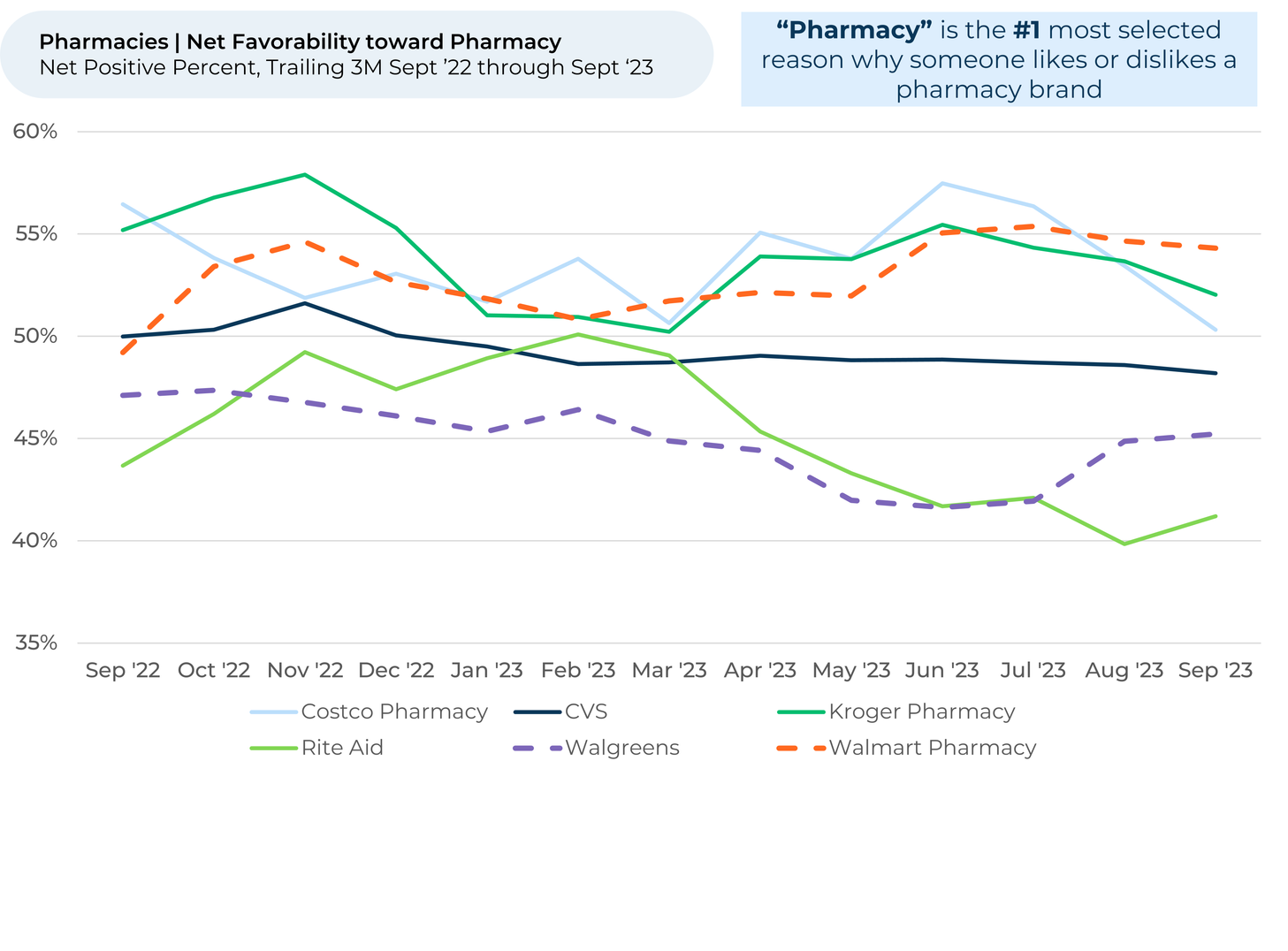

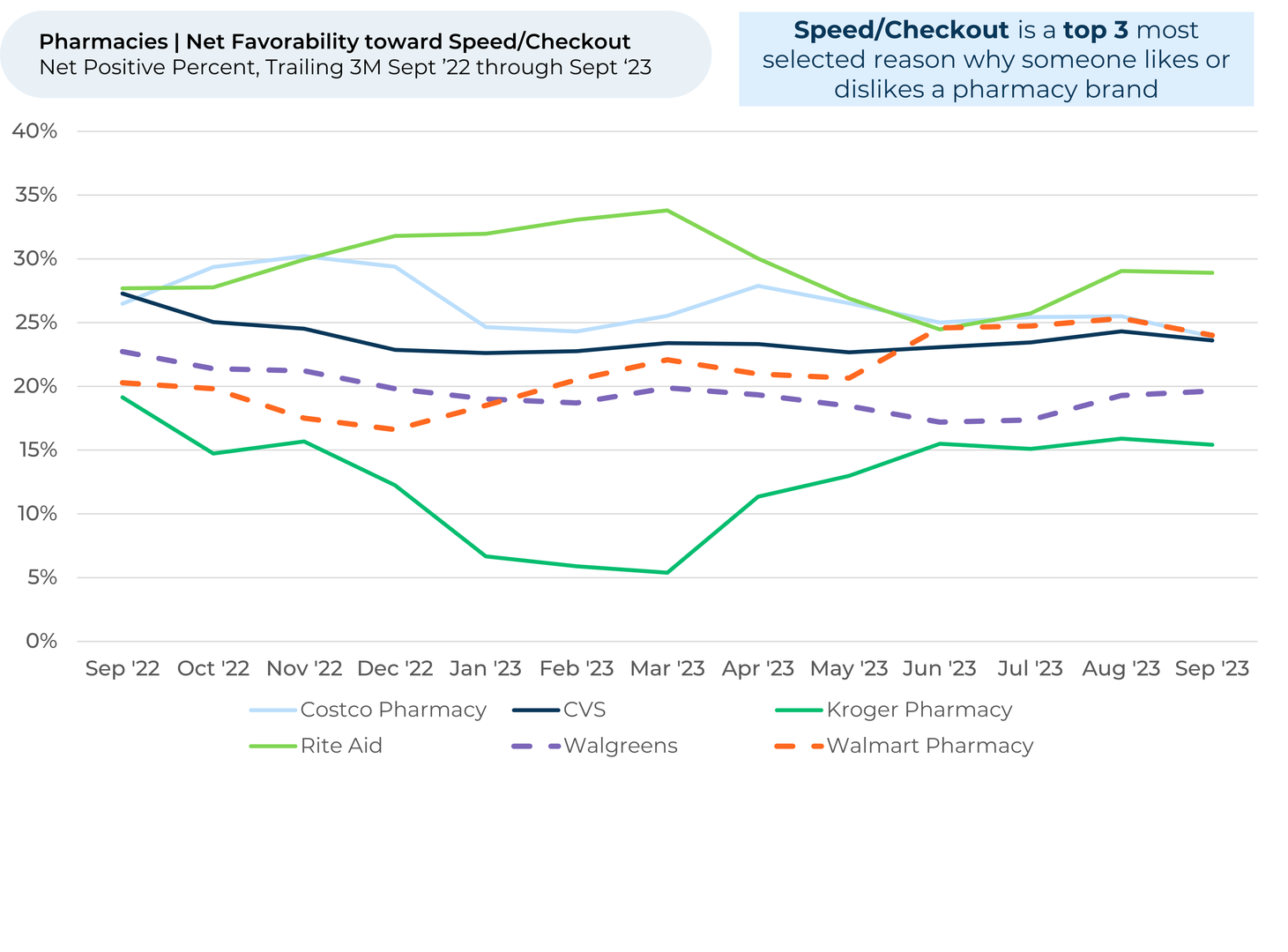

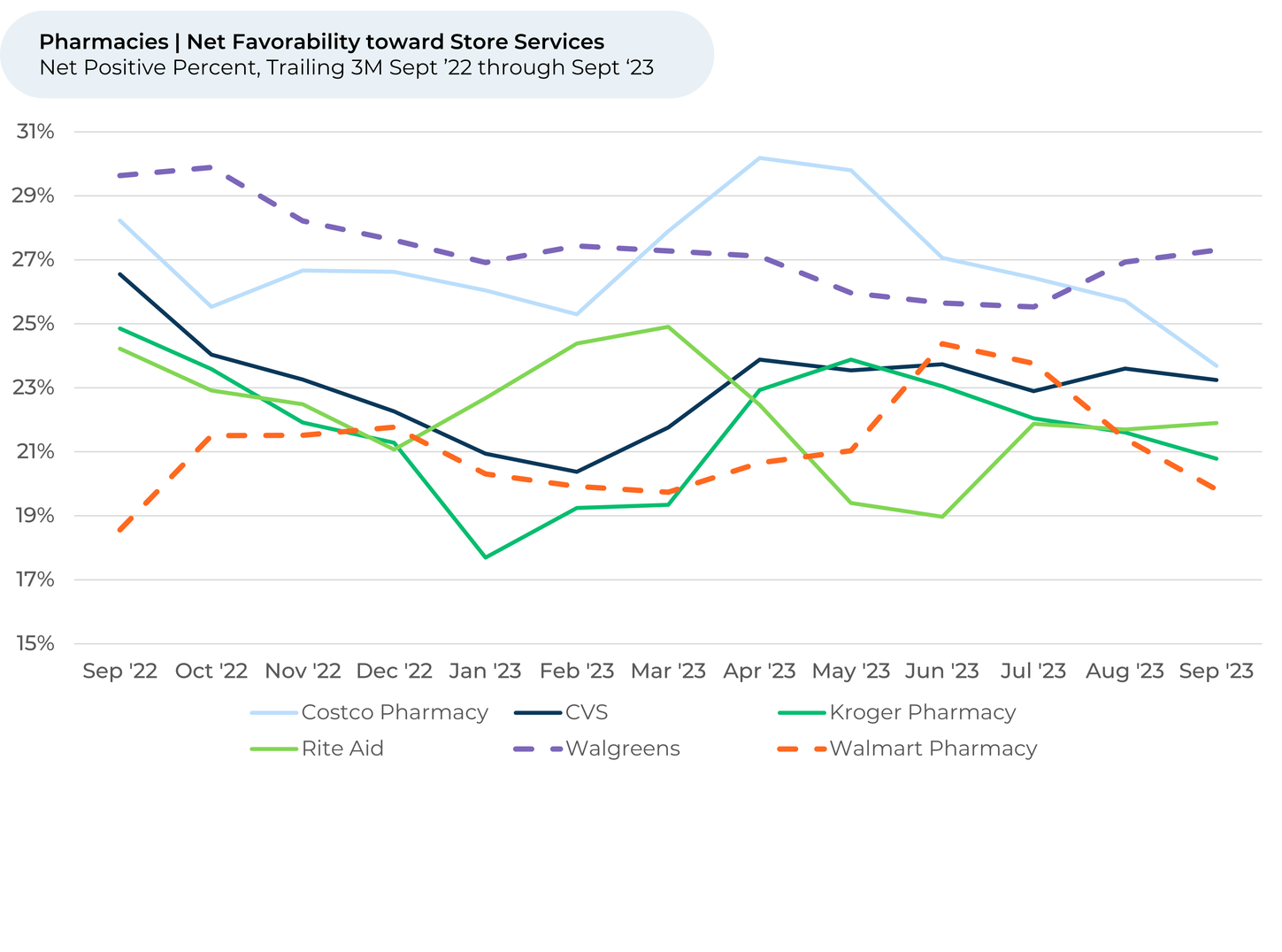

Walmart Pharmacy has long been a leader on price, and over the past year it has also become a leader in customer satisfaction with its pharmacy services and speed/checkout. While Walgreens has struggled in these areas versus peers, in recent months customers feel it has improved and is closing the gap with Walmart.

Wentworth will need to cut through the noise and identify what will move the needle most for Walgreens in his first 90 days. While employees feel stores are understaffed, customers sharing feedback with HundredX actually rank Walgreens as a leader in both store and health services, and middle of the pack on speed and checkout. The real issue, according to customers, appears to be its employees’ knowledge and attitude, where it lags its peers.

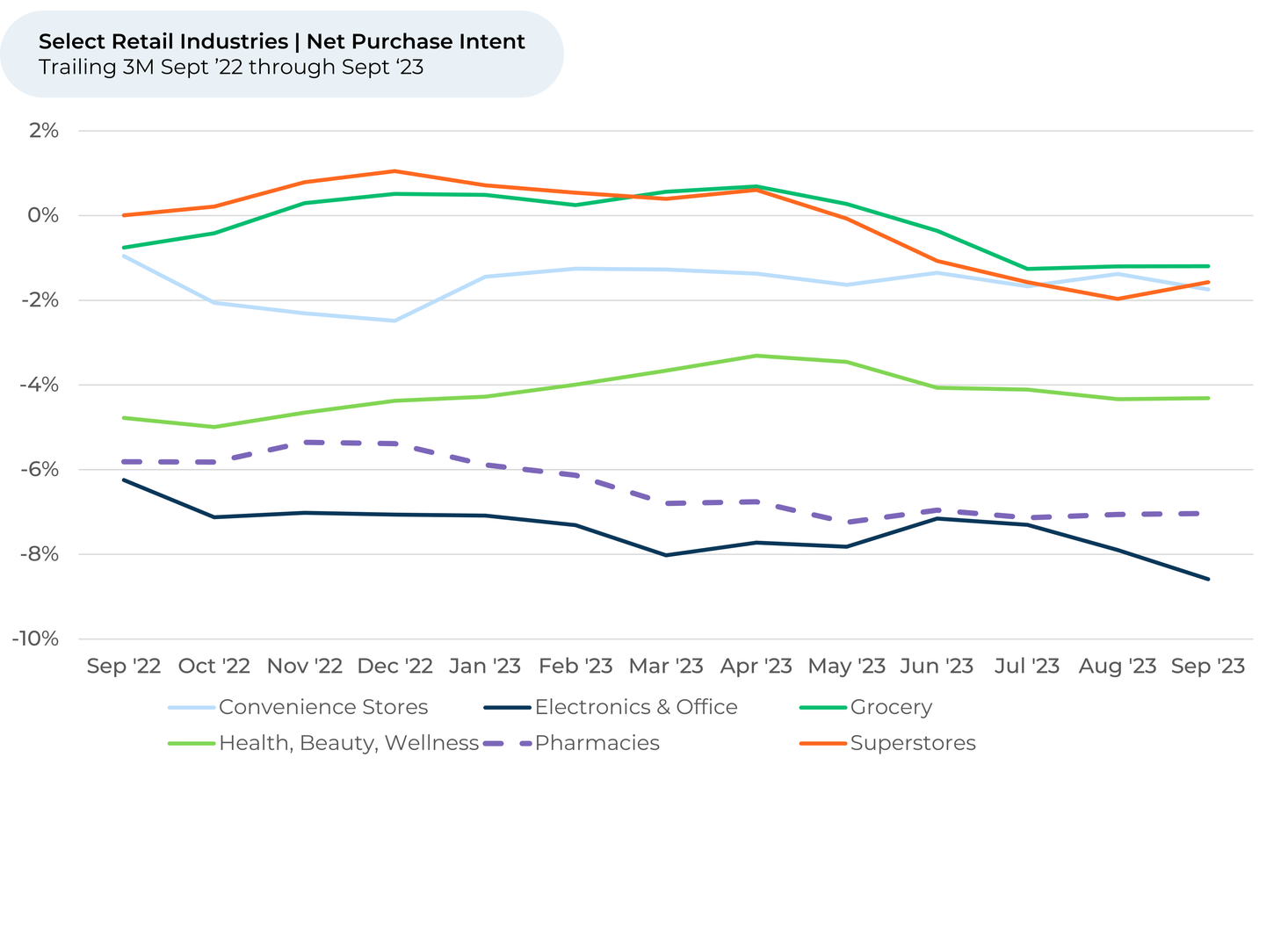

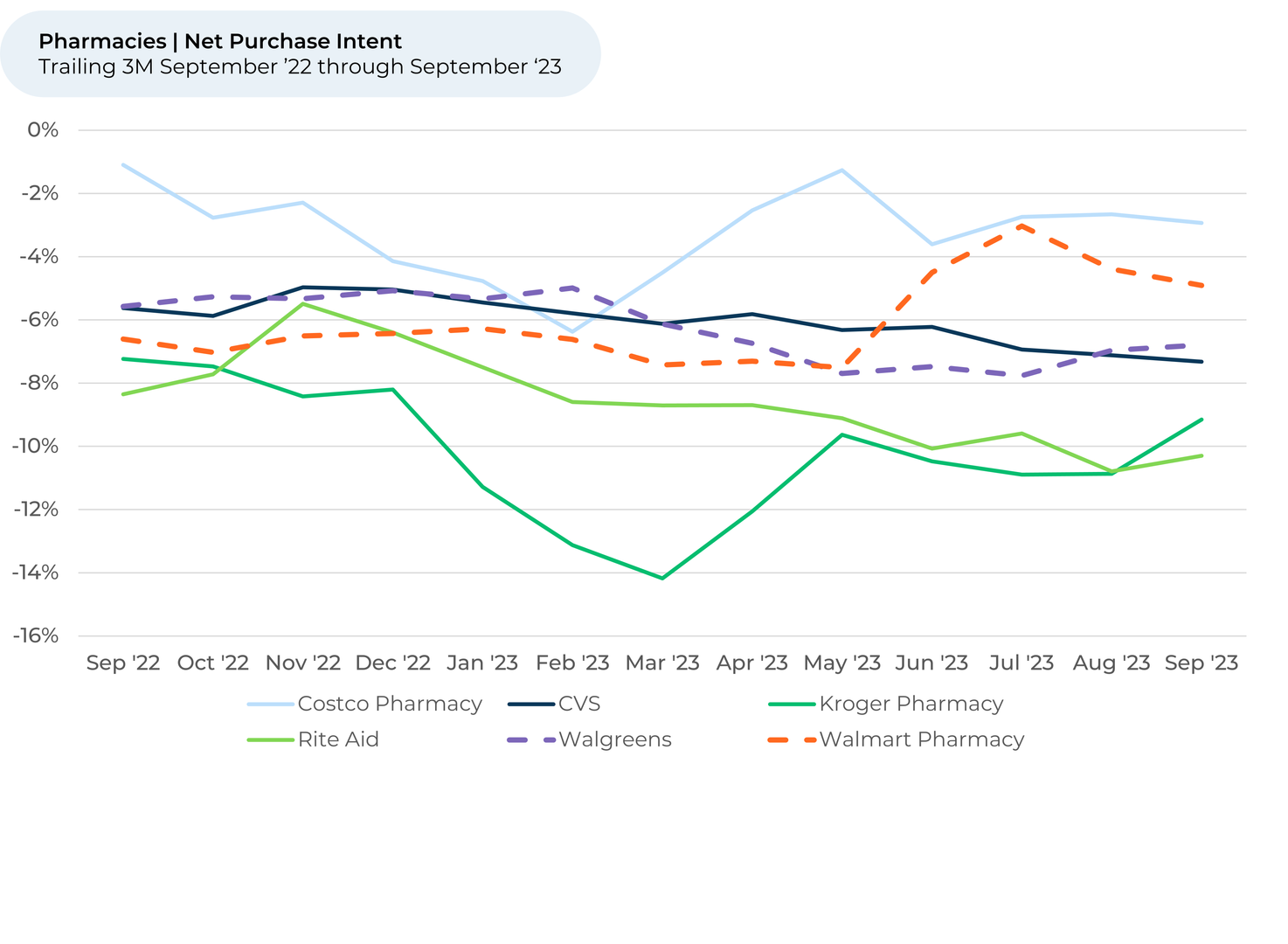

Analyzing over 70,000 pieces of customer feedback across 12 pharmacy brands, from September 2022 through September 2023, we find:

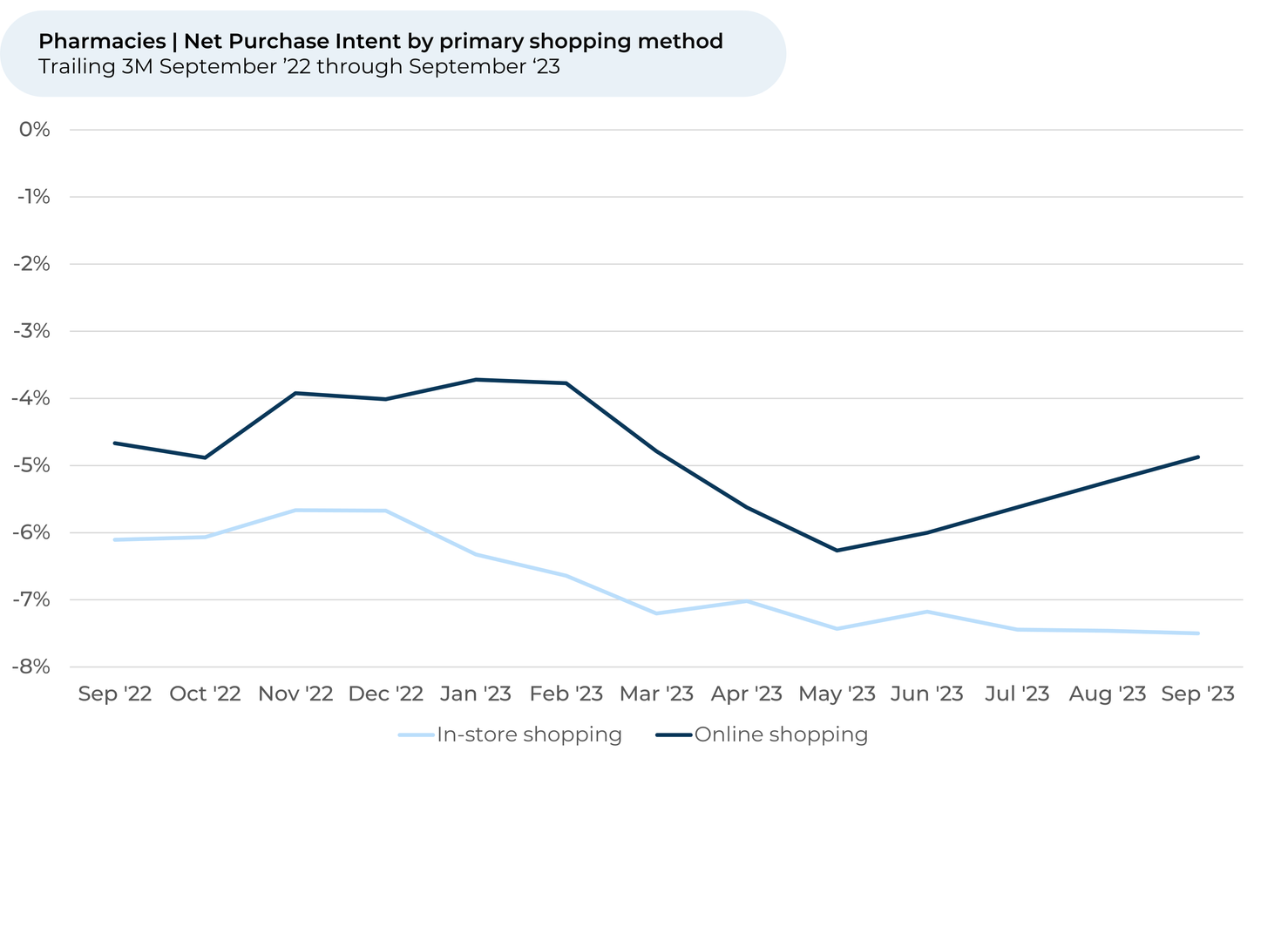

- Walgreens’ growth outlook is improving, with a 1% increase in Purchase Intent¹,² over the past three months while most other leading brands were flat to down.

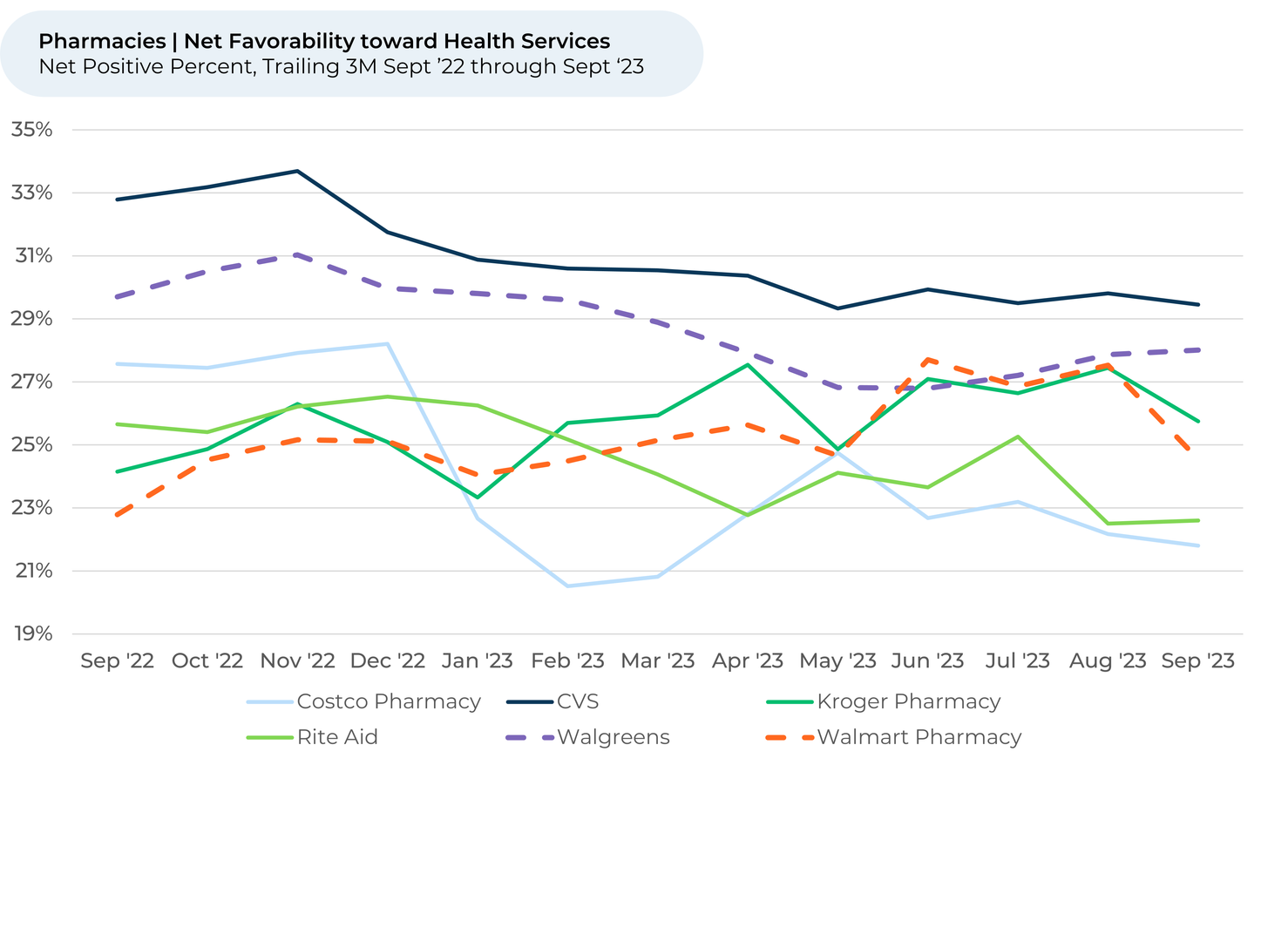

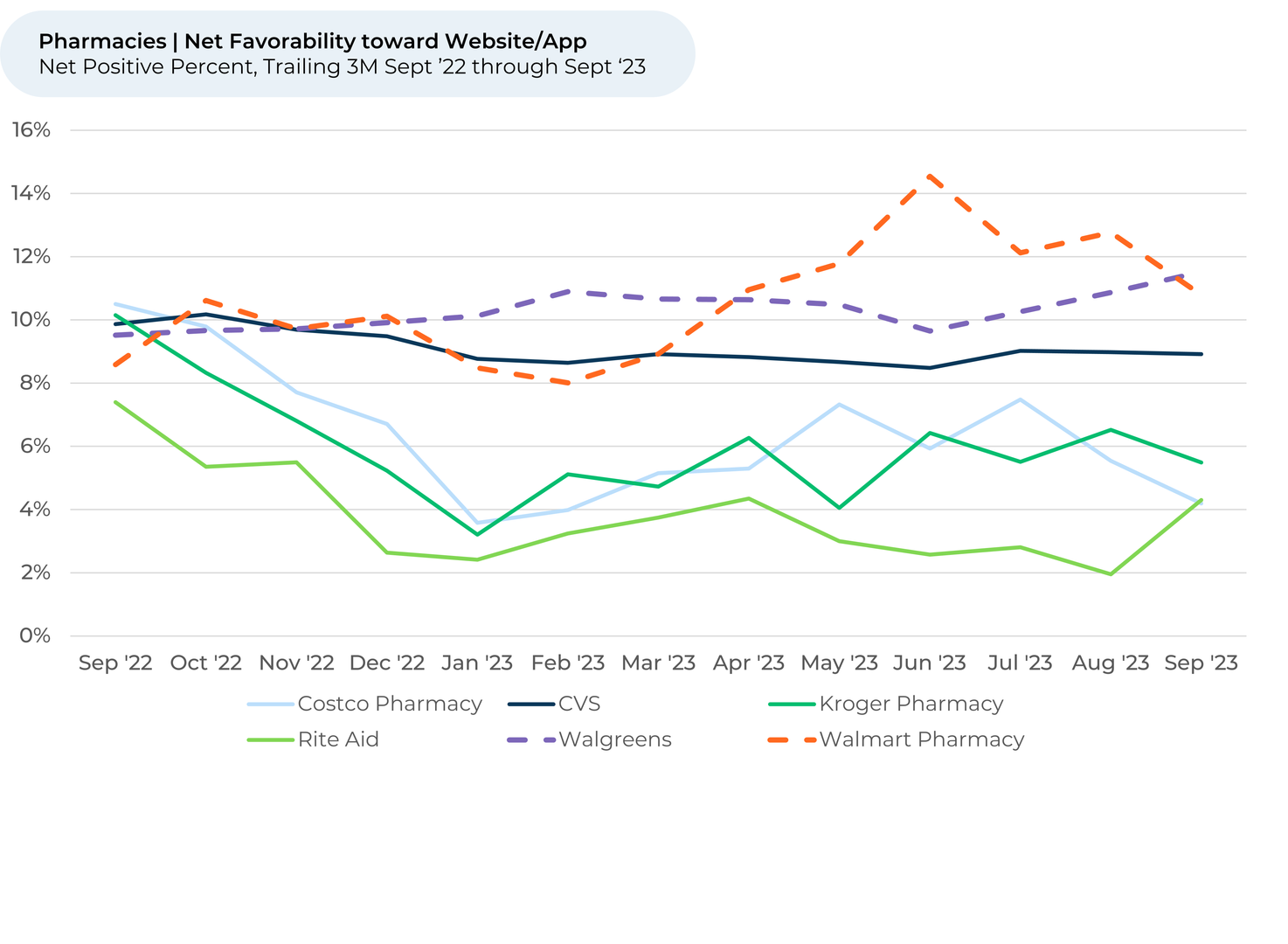

- Some key reasons for the improvement include progress for Walgreens’ pharmacy services, speed, and checkout recently. Net favorability³ for pharmacy services and speed/checkout were +4% and +2% over the last quarter.

- Walgreens should continue to lean into its leadership in satisfaction with health and store services. The management team seems to be appropriately focused on this opportunity based on its comments on its October 12 earnings call. The challenge lies in maintaining this lead amidst staffing woes and recent employee walkouts. Its recent unveiling of new virtual healthcare services should help.

- Meanwhile, after improvements over the year, Walmart is now the leader in customer satisfaction with pharmacy services, passing Kroger and Costco.

- In the digital arena, Walgreens and Walmart exhibit closely matched customer perception concerning website and app usability. With a 1% rise in Purchase Intent for customers who primarily shop online since May, the emphasis on digital platforms makes sense. Wentworth’s experience with digital pharmacies should be useful here.

Please contact our team for a deeper look at HundredX's pharmacy data, which includes more than 150,000 pieces of customer feedback across 12 pharmacy brands (including over 12,000 on Walmart Pharmacy and over 55,000 on Walgreens).

- All metrics presented, including Net Purchase (Purchase Intent) and Net Positive Percent / Favorability, are presented on a trailing three-month basis unless otherwise noted.

- Purchase Intent represents the percentage of customers who expect to spend more with that chain over the next 12 months, minus those that intend to spend less. We find businesses that see Purchase Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.

- HundredX measures Net Favorability towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.