As the Fed and consumers continue to navigate a very tricky economic environment, we look at what areas are seeing price sentiment shift the most for insight into how it will likely impact consumer behavior.

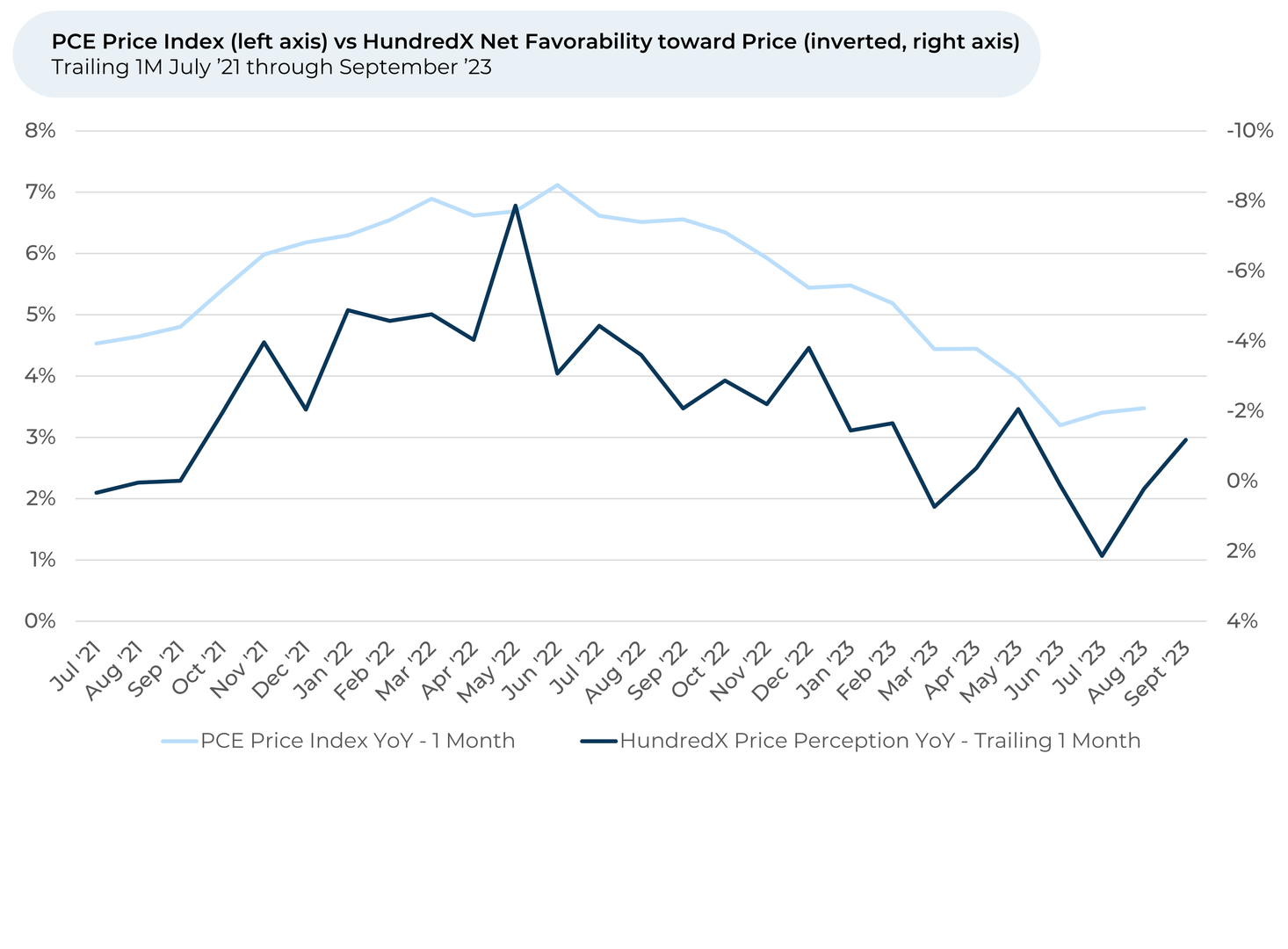

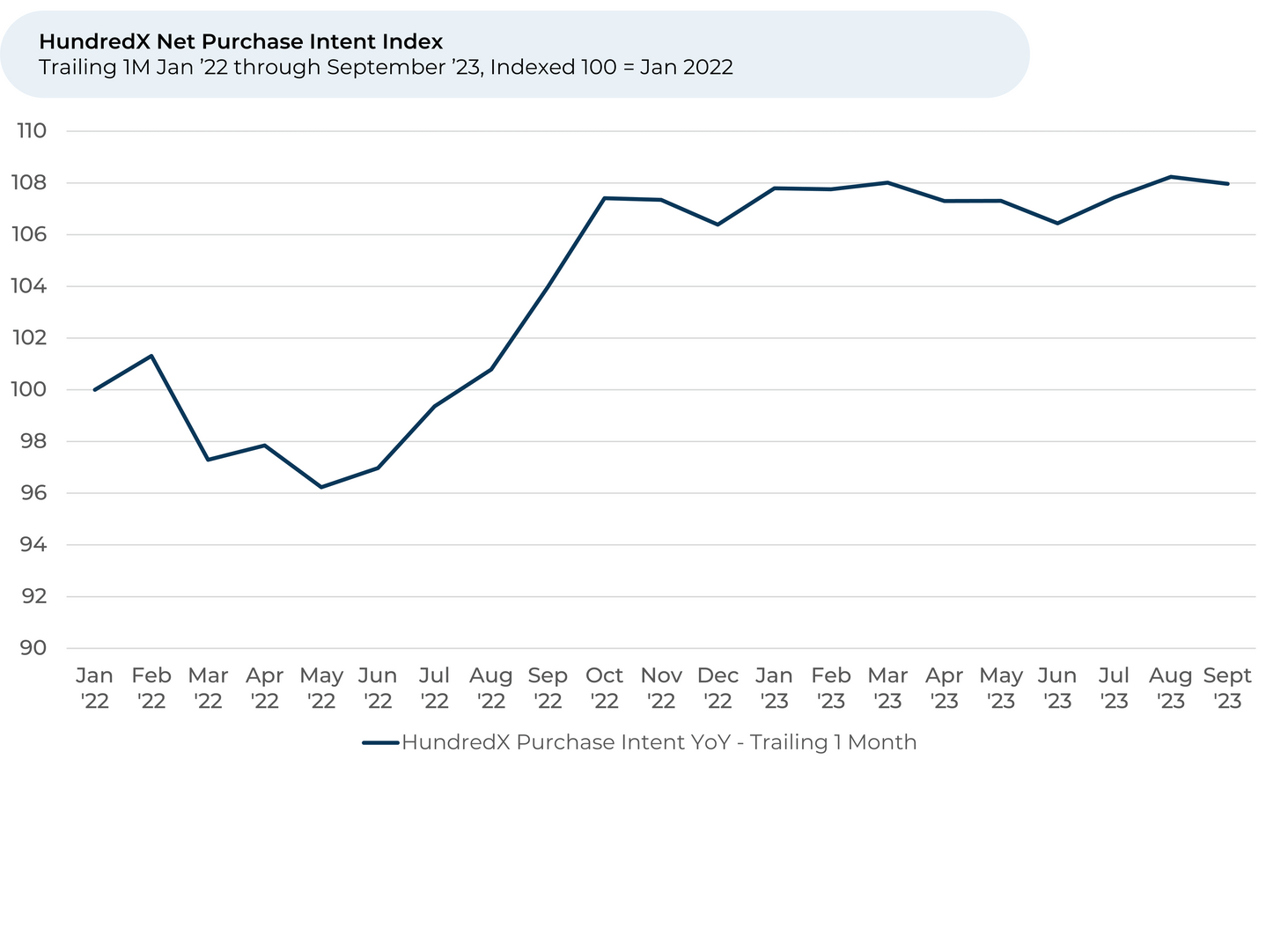

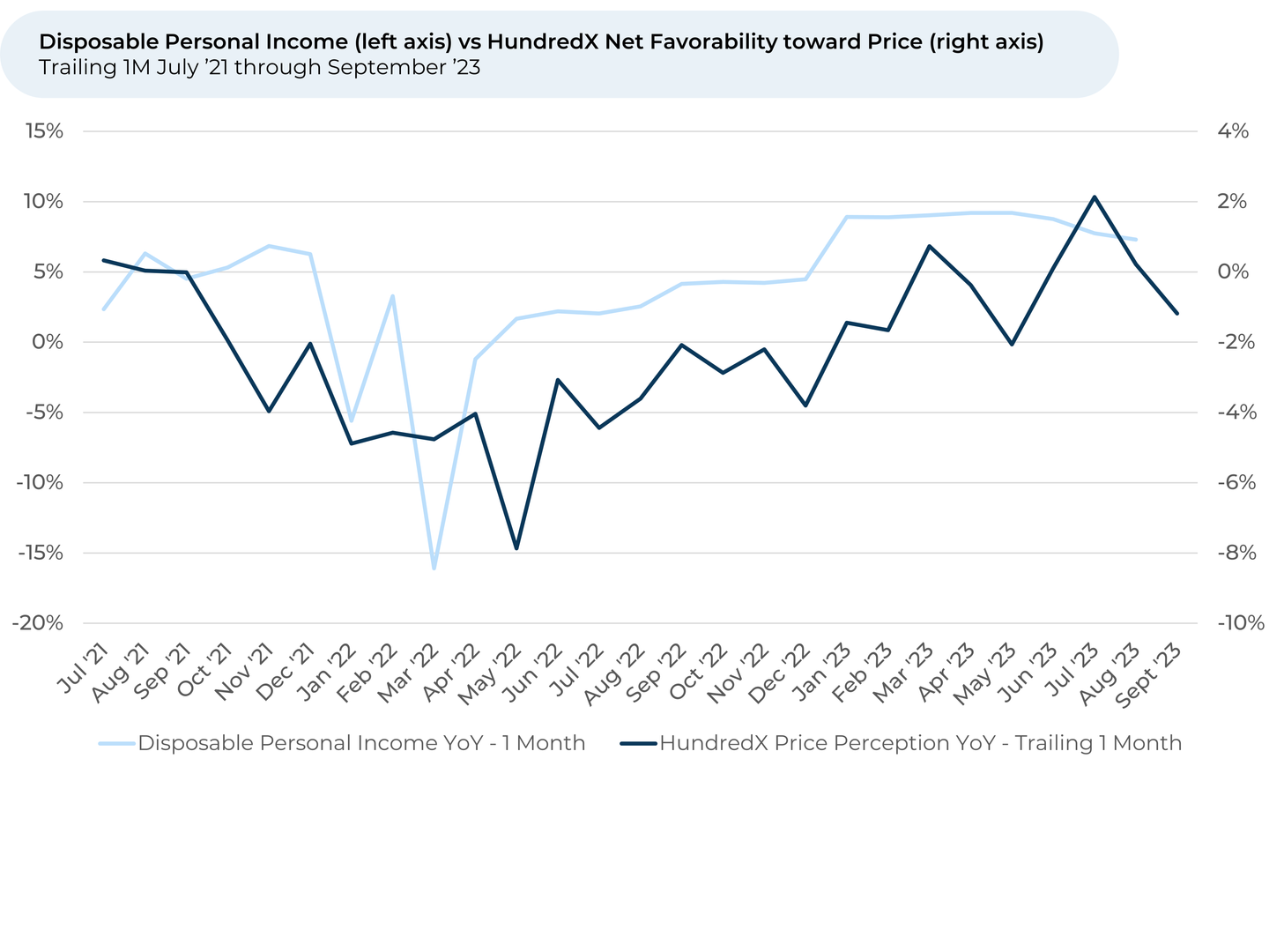

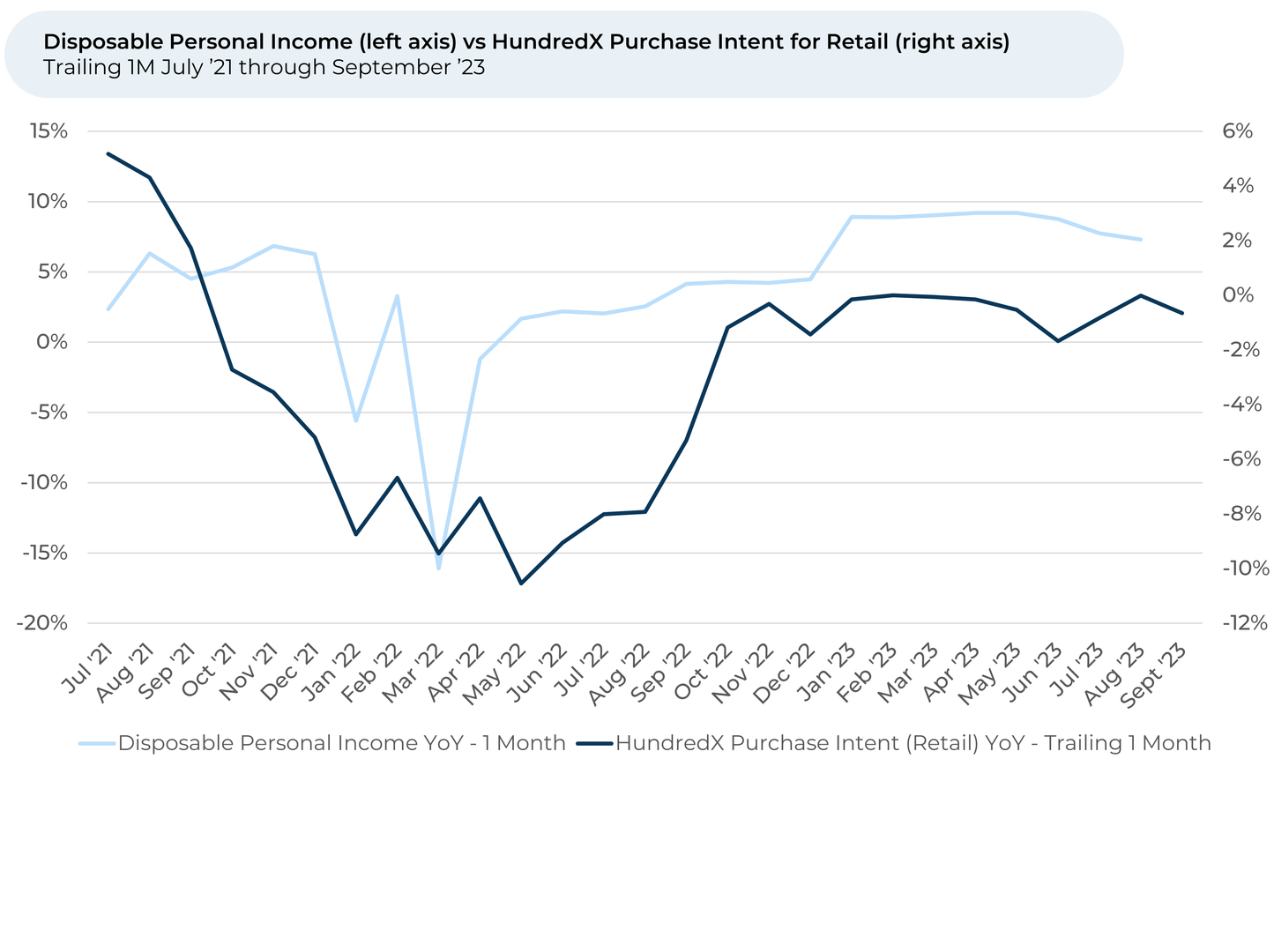

Over the past two months, customers’ overall perception of prices across all industries has fallen by 3%, negating the gains we observed earlier this year and indicating inflation probably has not come down in the last month. Changes in HundredX’s Price favorability¹,² index are typically inversely correlated with movement in the Personal Consumption Expenditures (PCE) Price levels (i.e. inflation) reported by the US government. HundredX’s Net Purchase Intent Index remained stable in September, indicating the consumer demand outlook is pretty unchanged despite stubborn inflation.

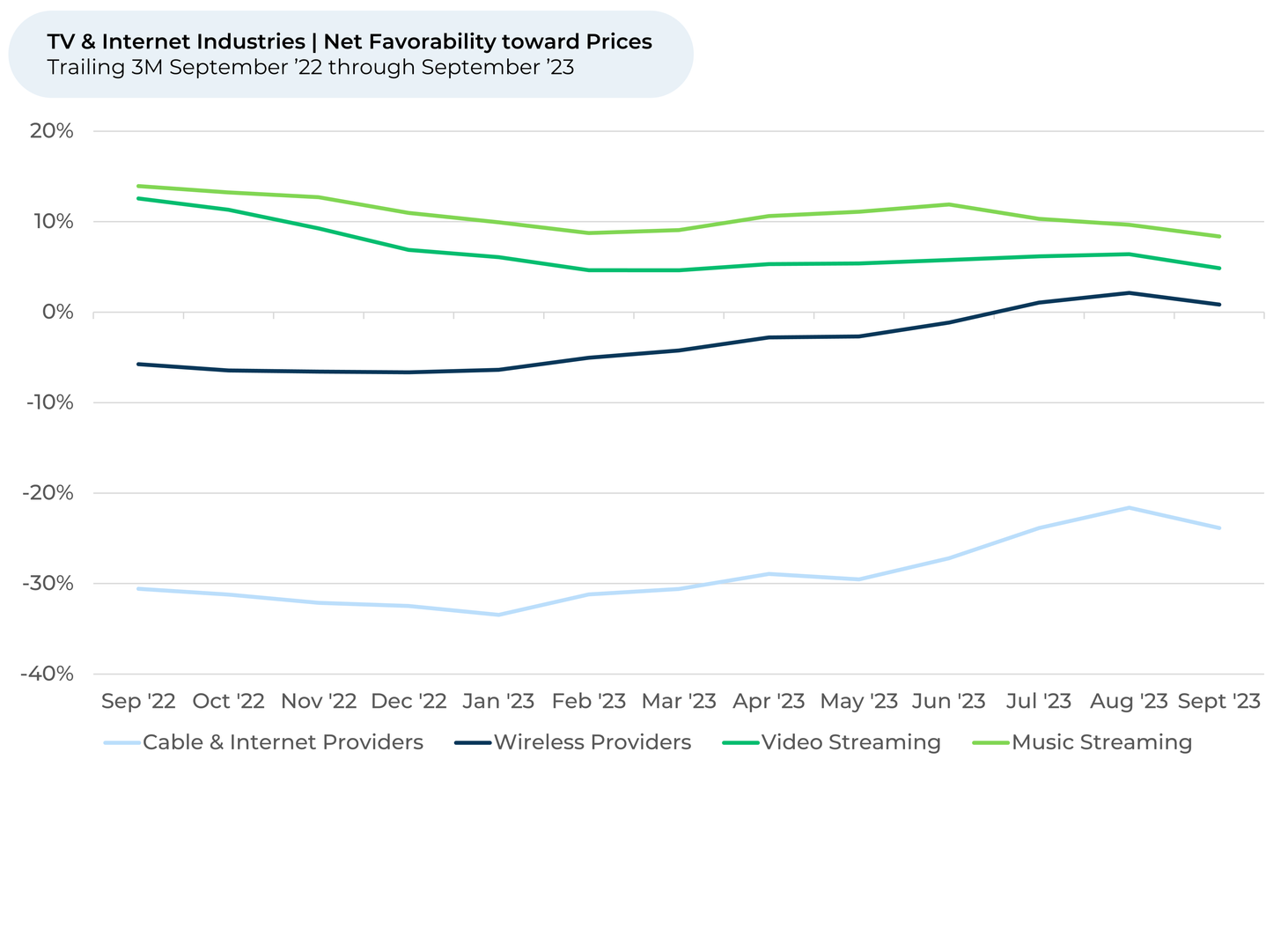

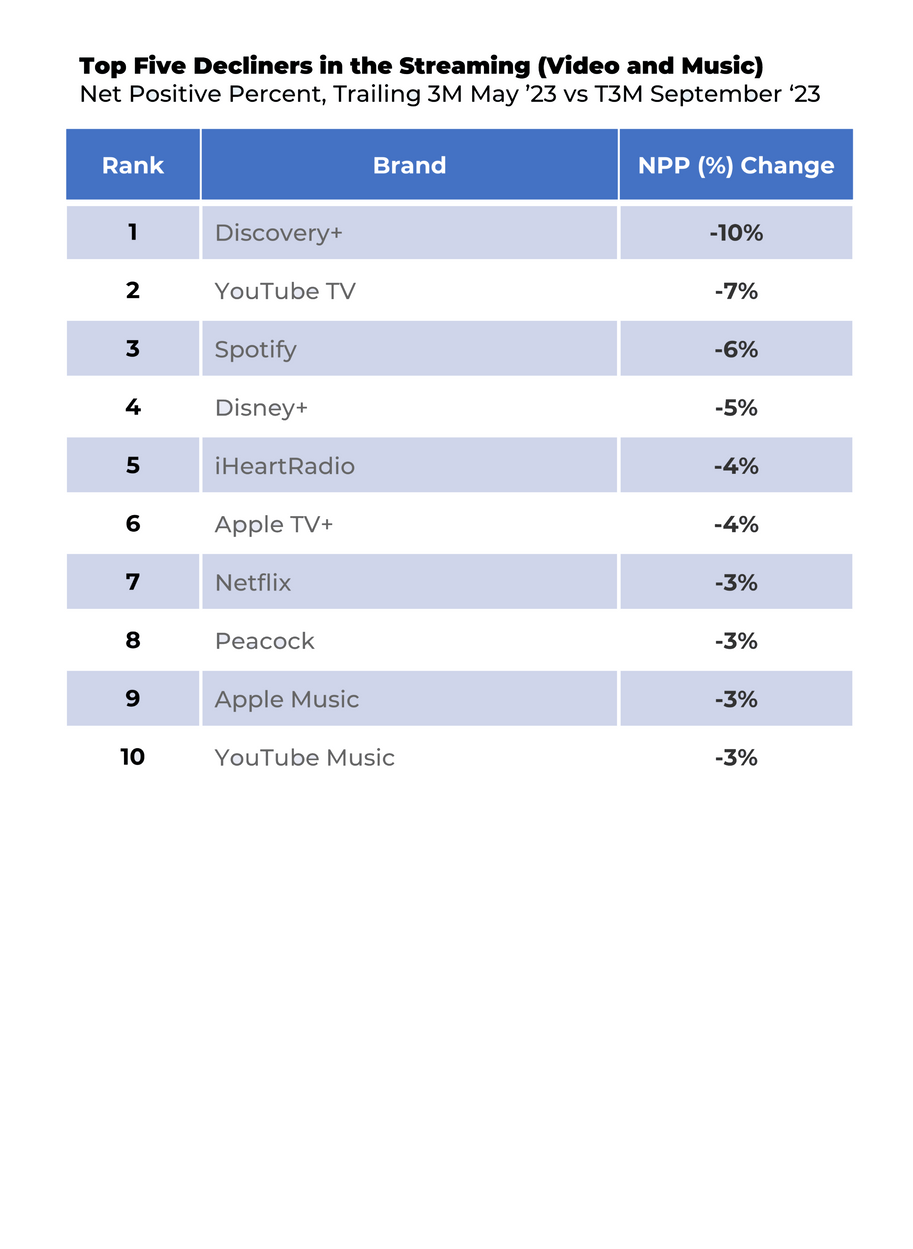

Online and app-based services, initially lauded as market disruptors for their affordability, now face users grappling with their climbing costs. Interestingly, the spike in the cost of streaming services seems to be reviving interest in cable.

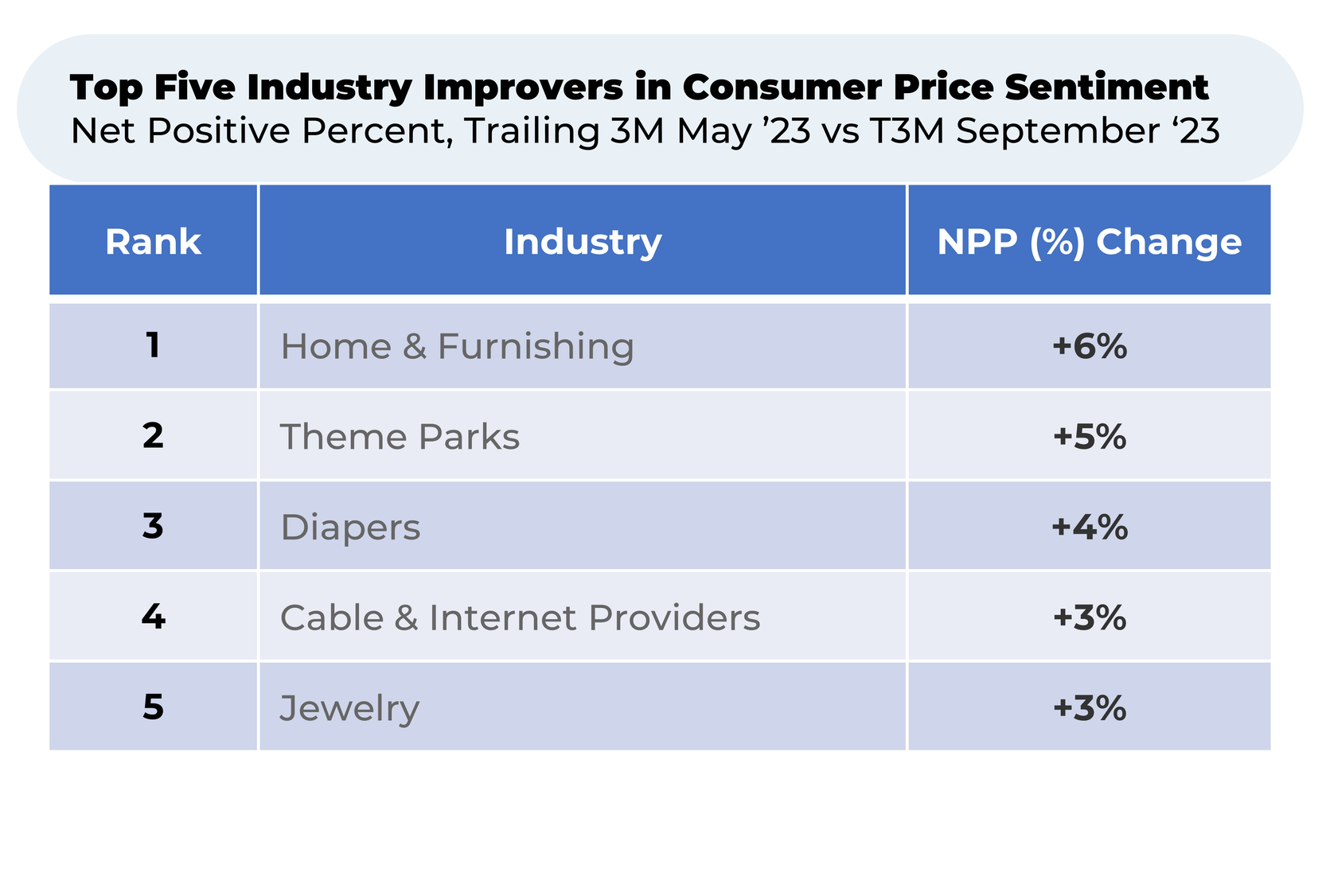

Analyzing millions of pieces of customer feedback from July 2021 across 82 industries and 3,000+ companies, we find:

- Price sentiment for online and app-based services fell the most over the last three months, but it doesn’t seem to be hurting demand. Customers feel unhappier about the cost of online dating services, video streaming and music streaming. However, the price increases don’t seem to be stopping people from using their favorite online services; since May, Usage Intent³ is up for online dating (+5%) and music streaming (+1%) and flat for video streaming.

- Streaming service prices have gotten so high that customers are warming to cable. While viewers still dislike the cost of cable far more than streaming, they feel cable prices are improving (net favorability up 3% since May). Loyalty Intent³ for cable and internet providers is also up 8% over the last year.

- With summer vacationing over, travel costs are seemingly improving and supportive of strong demand during the holiday travel season. Over the past three months, travelers have been feeling happier about price of airlines (+2%), ride sharing (+2%), car rental (+2%), and theme parks (+5%). Travel Intent is generally up for these industries, indicating demand should be strong this upcoming holiday season.

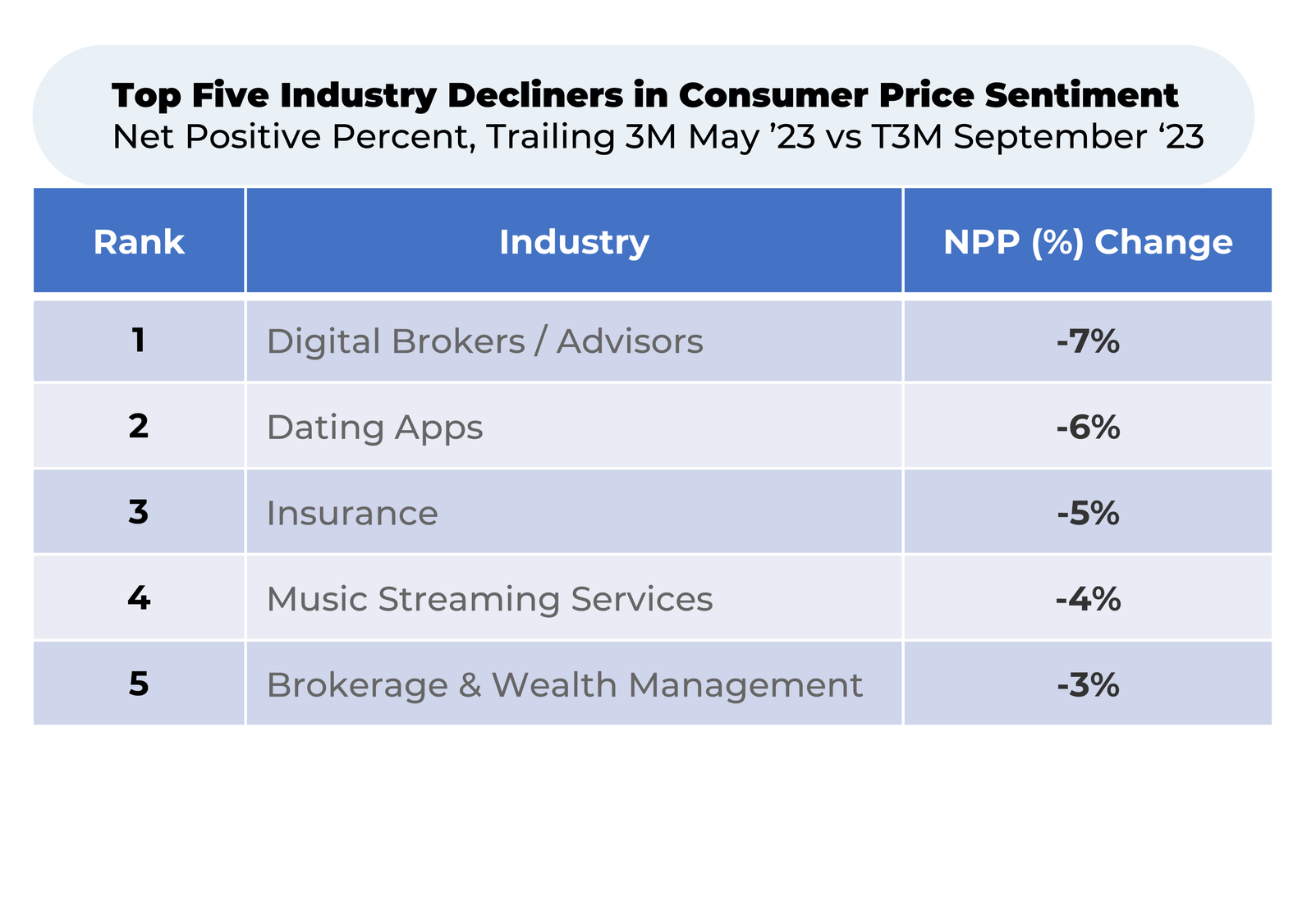

- Meanwhile, prices in the financial sector are facing headwinds: in the last three months, insurance price sentiment has dropped by 5%, digital brokers/advisors have seen a 7% decline, and brokerage & wealth management is down by 3%.

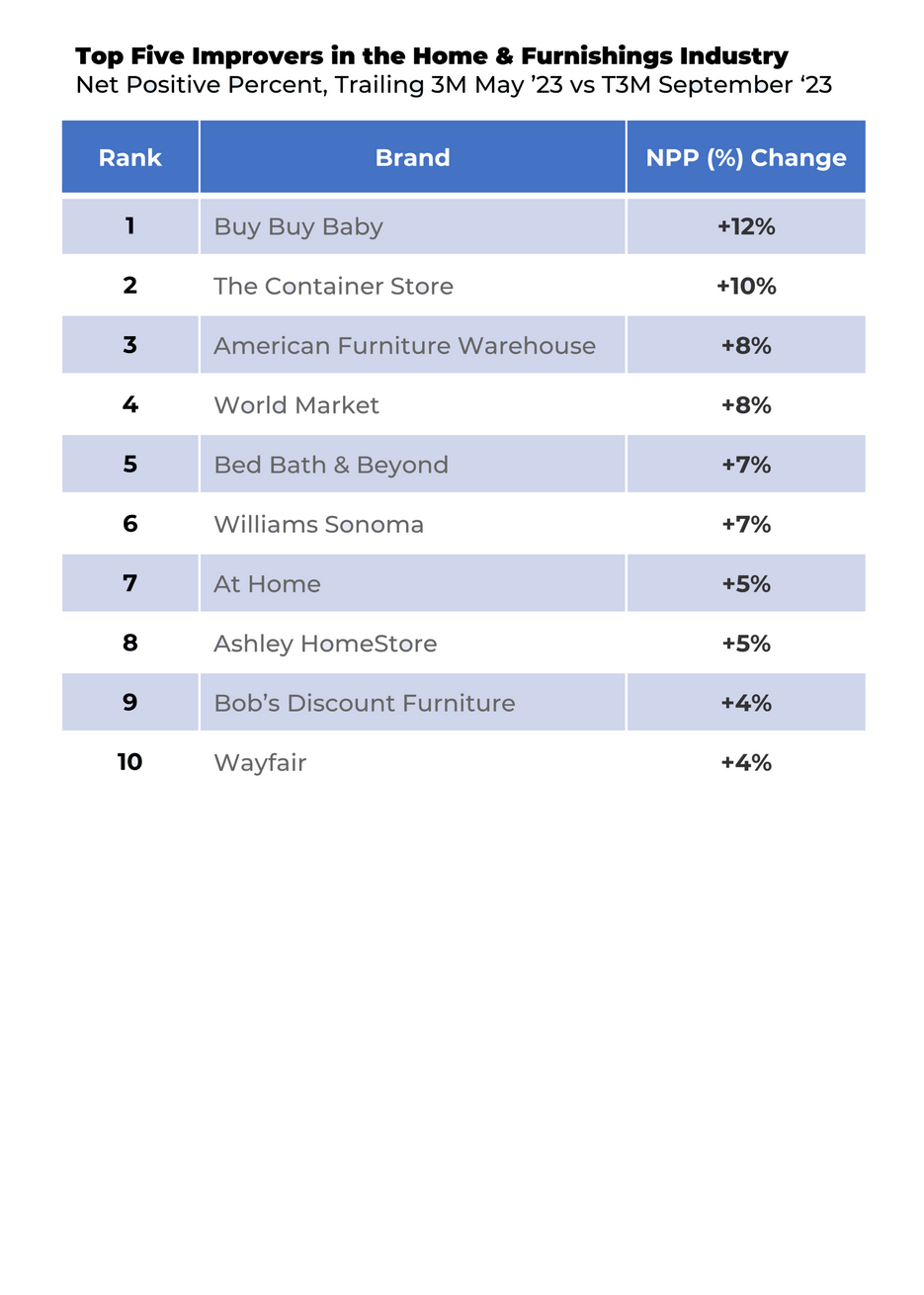

- The biggest price perception gainer is the home & furnishings industry, up 6% since May. Bankruptcy filings from Bed Bath & Beyond and Buy Buy Baby led to price competition across the industry.

Please contact our team for a deeper look at HundredX's data insights into the broader economy or specific sectors, industries or demographic groups.

- All metrics presented, including Net Purchase (Purchase Intent) and Net Positive Percent / Favorability, are presented on a trailing three-month basis unless otherwise noted.

- HundredX measures Net Favorability towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

- Usage Intent represents the percentage of customers who expect to use that brand/service over the next 12 months, minus those that intend to use less. Loyalty Intent is the percentage of customers who plan to keep using the service minus the percentage who intend to cancel. We find businesses that see Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.