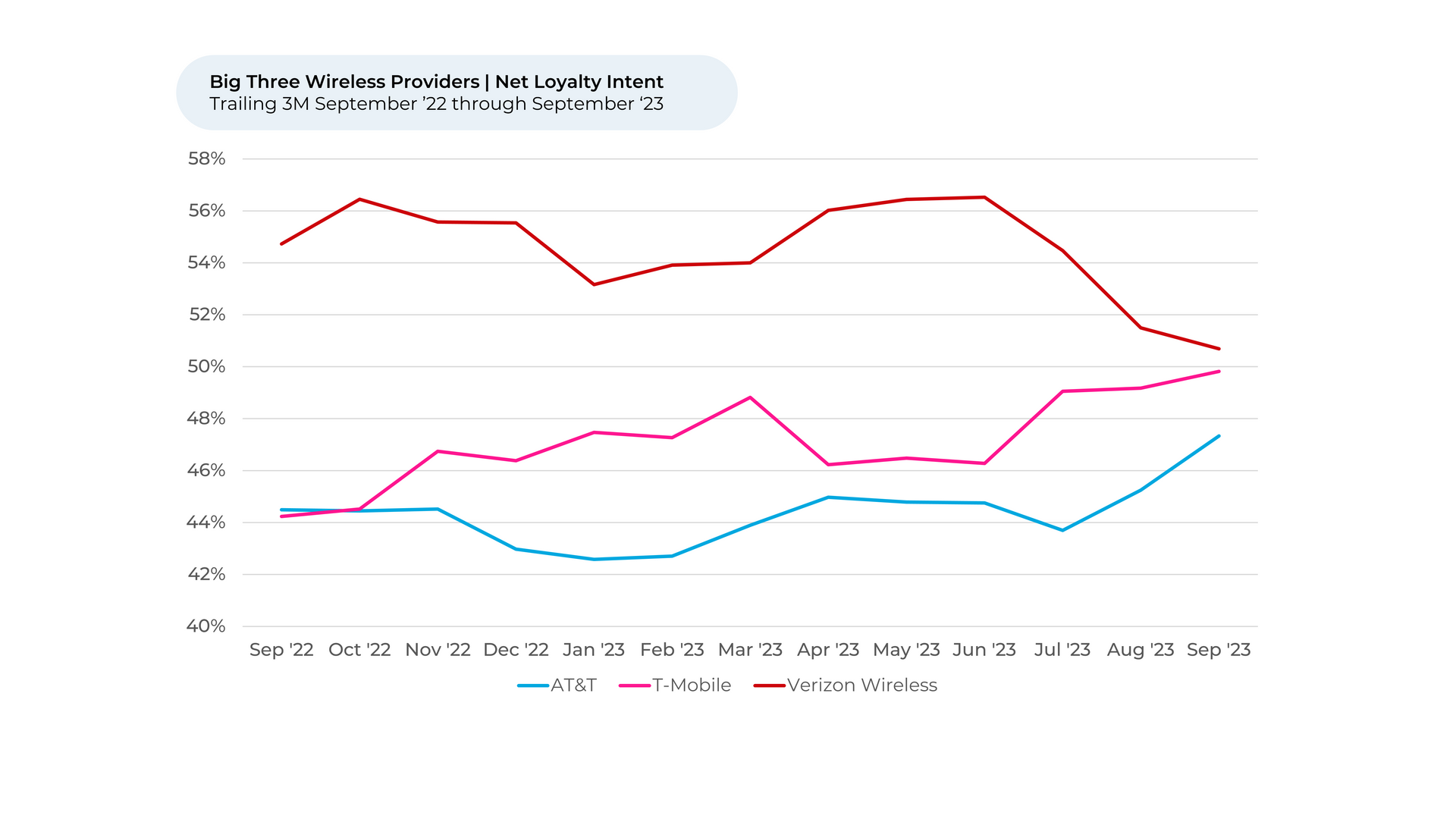

Recent strength in feedback from “the Crowd” of real AT&T customers, in comparison to the other Big Two mobile carriers, aligned with AT&T better-than-expected earnings report on October 19th. HundredX data also indicates weakening Loyalty Intent1,2 in Verizon and growing strength in T-Mobile, which should result in share continuing to shift away from Verizon towards AT&T and T-Mobile into 2024.

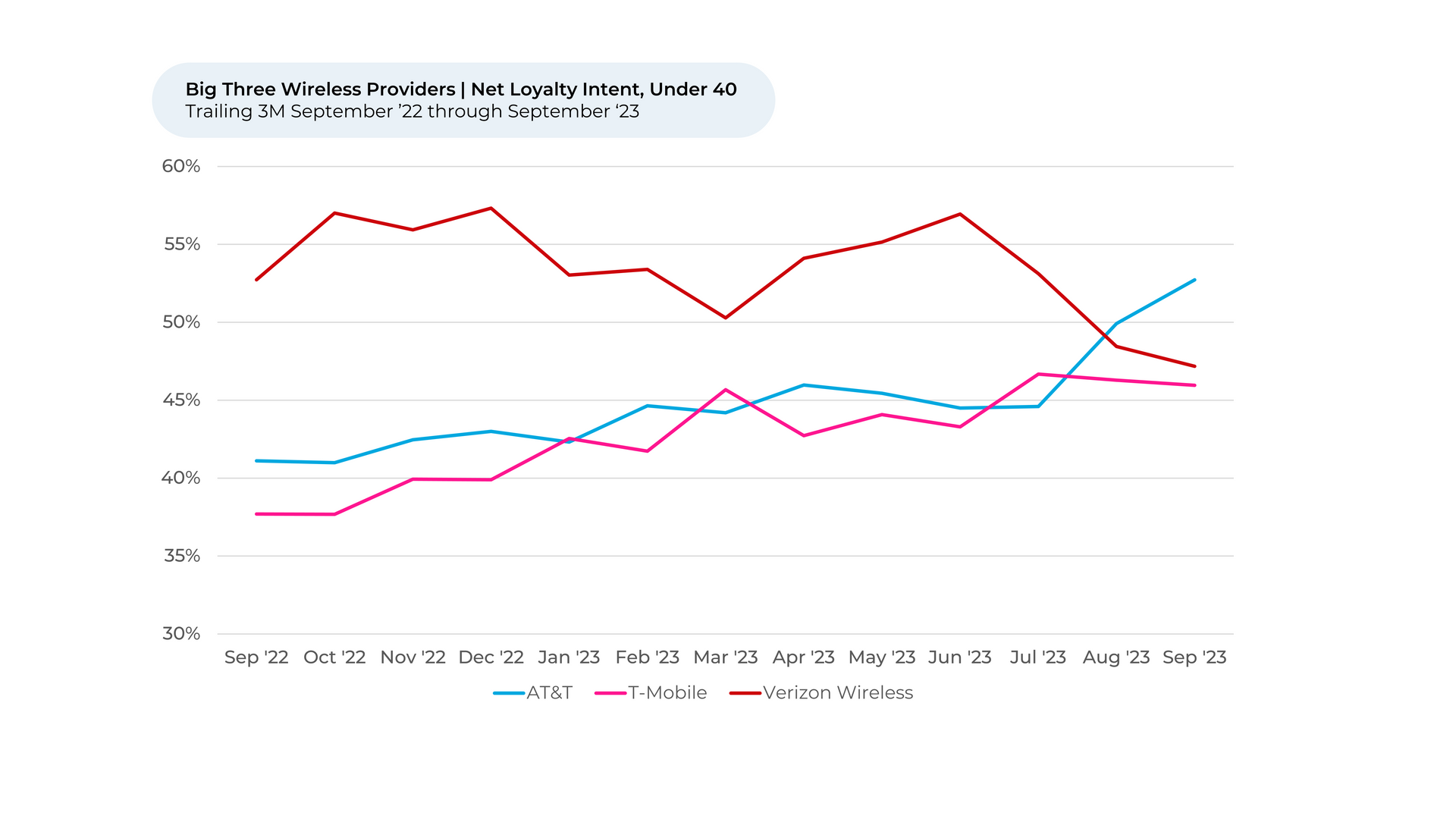

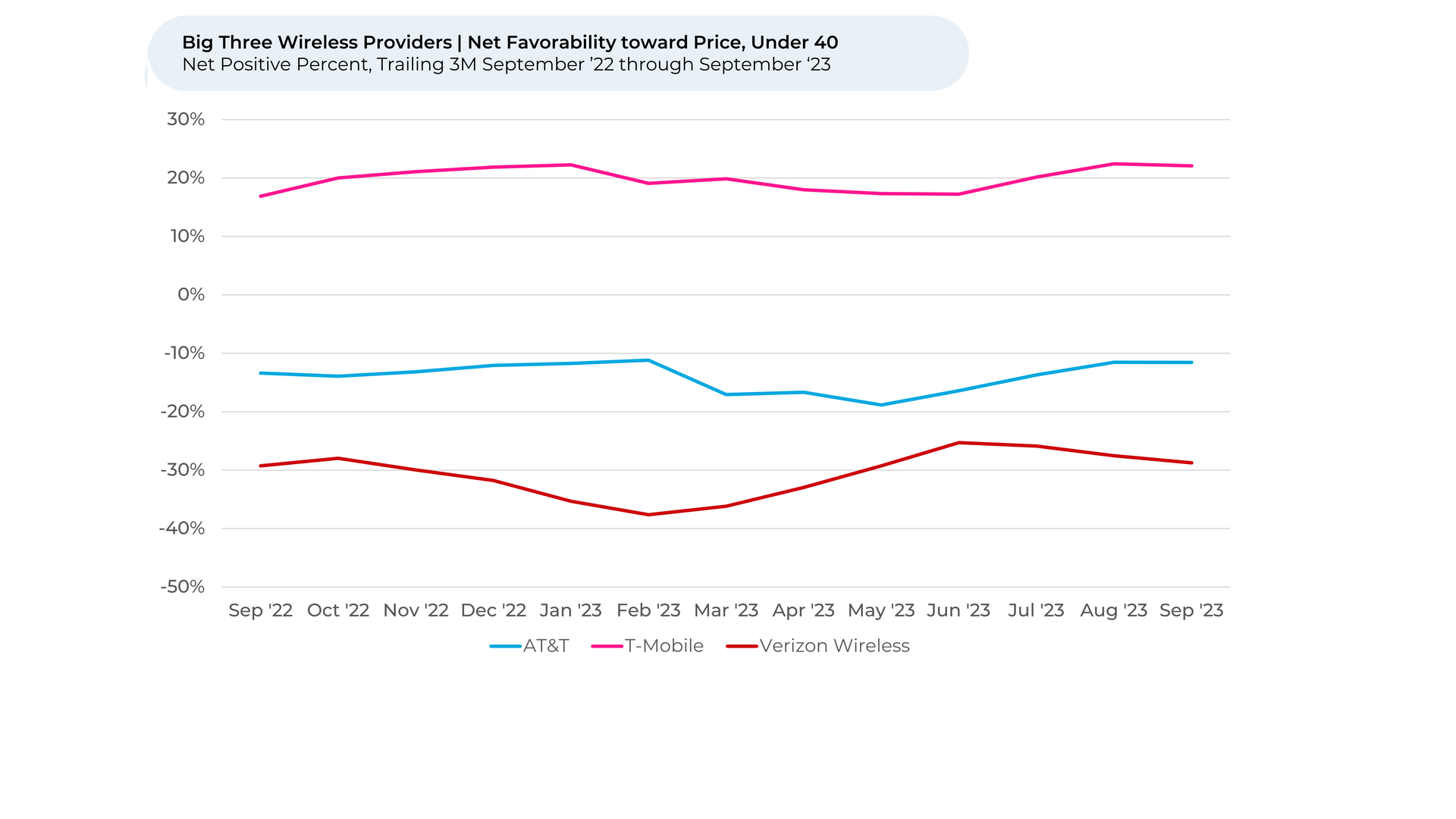

Our data affirms a generally consensus view across the industry, which is Verizon is going to continue losing ground to AT&T and T-Mobile over the next 6-12 months, which are undercutting Verizon on price while offering increasingly robust coverage and speeds. We’ve found AT&T in particular is pulling Gen-Z and millennial customers away from Verizon.

Analyzing more than 70,000 pieces of feedback from wireless customers, September 2022 through September 2023, we found:

- Verizon’s Loyalty Intent fell 6% in the last three months, while T-Mobile and AT&T gained 4% and 3% respectively.

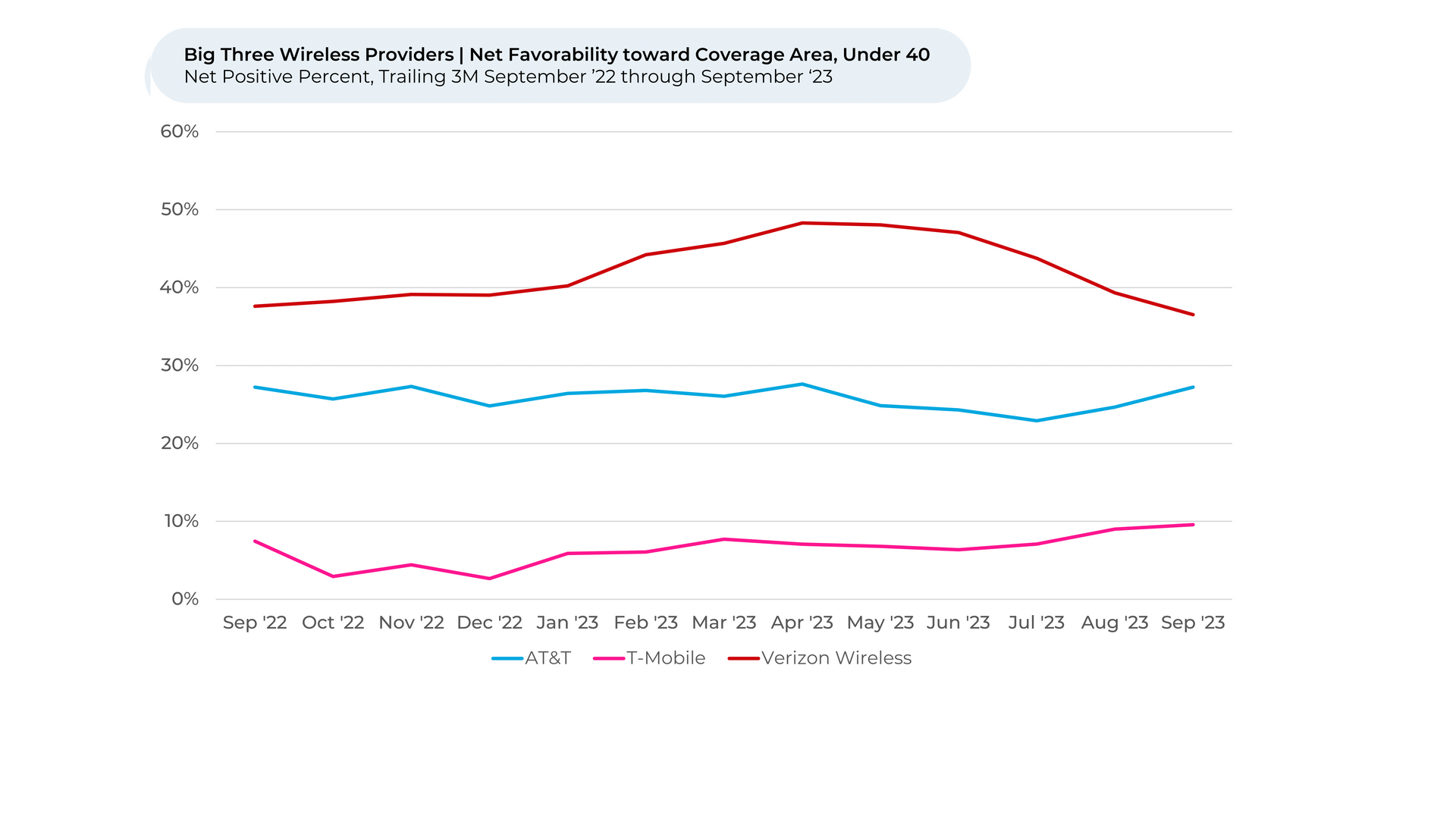

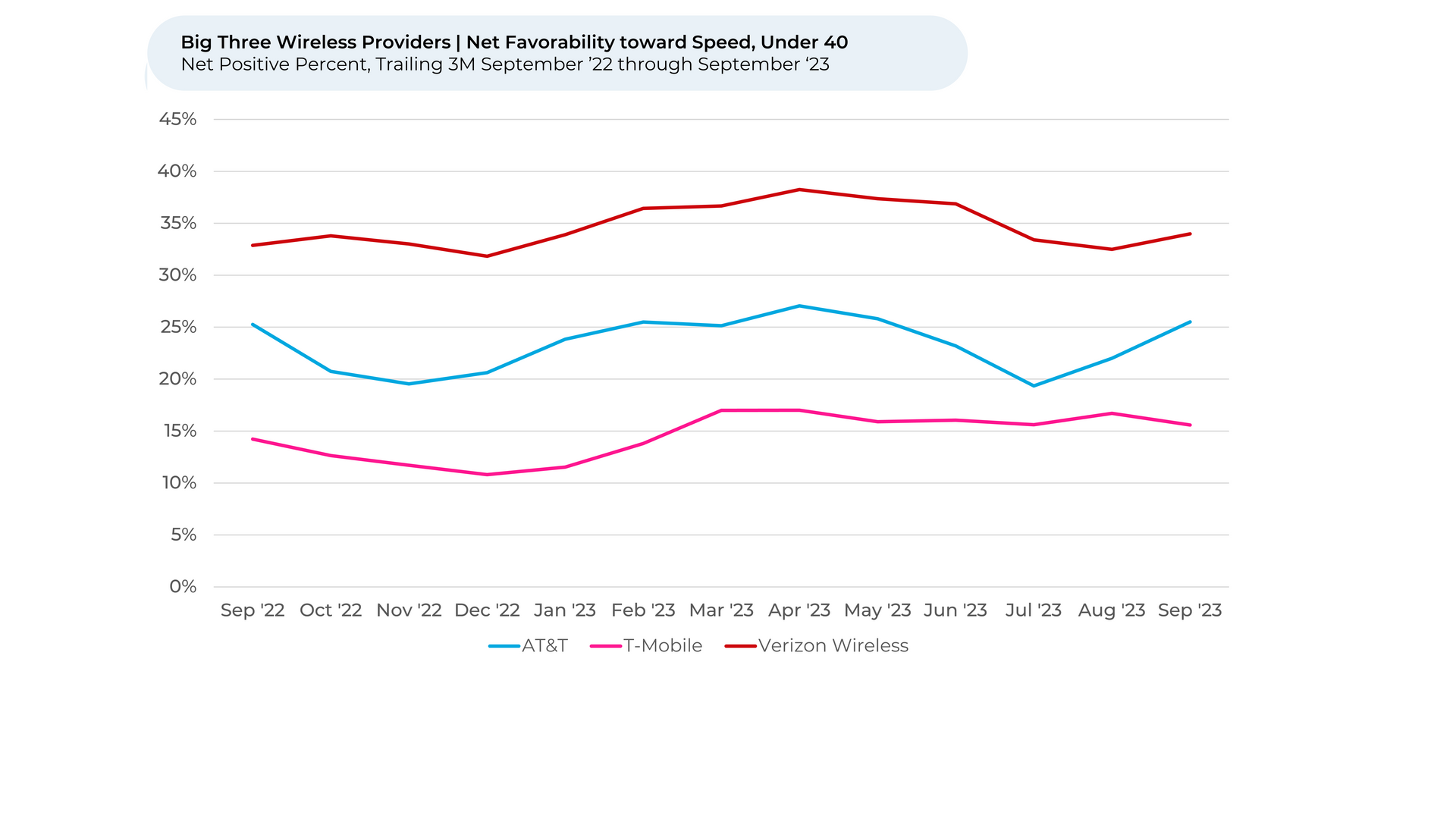

- Customers continue to view Verizon as best-in-class for network speed, coverage, and quality, but AT&T is starting to catch up, with customer perception³ towards these factors increasing.

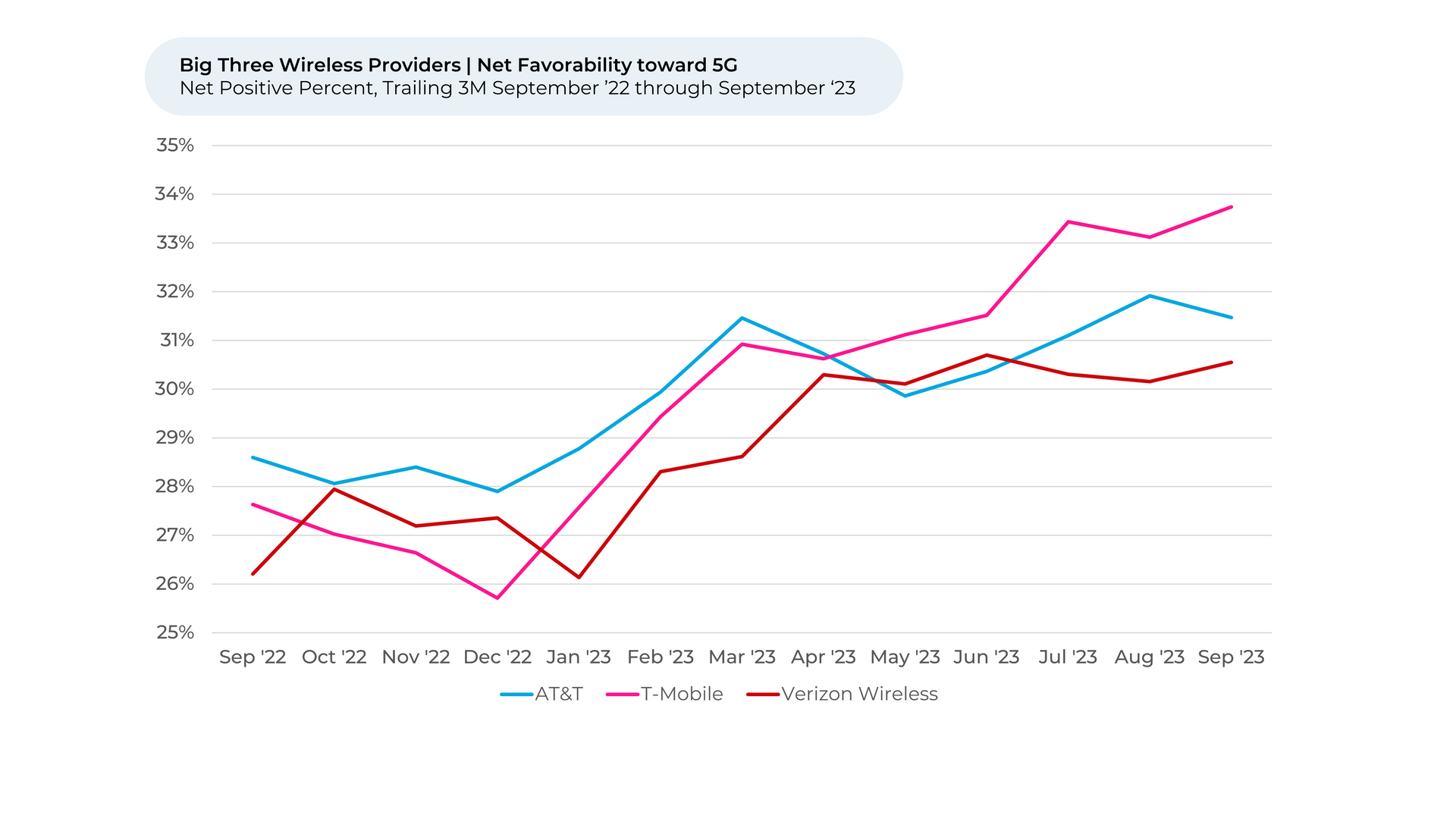

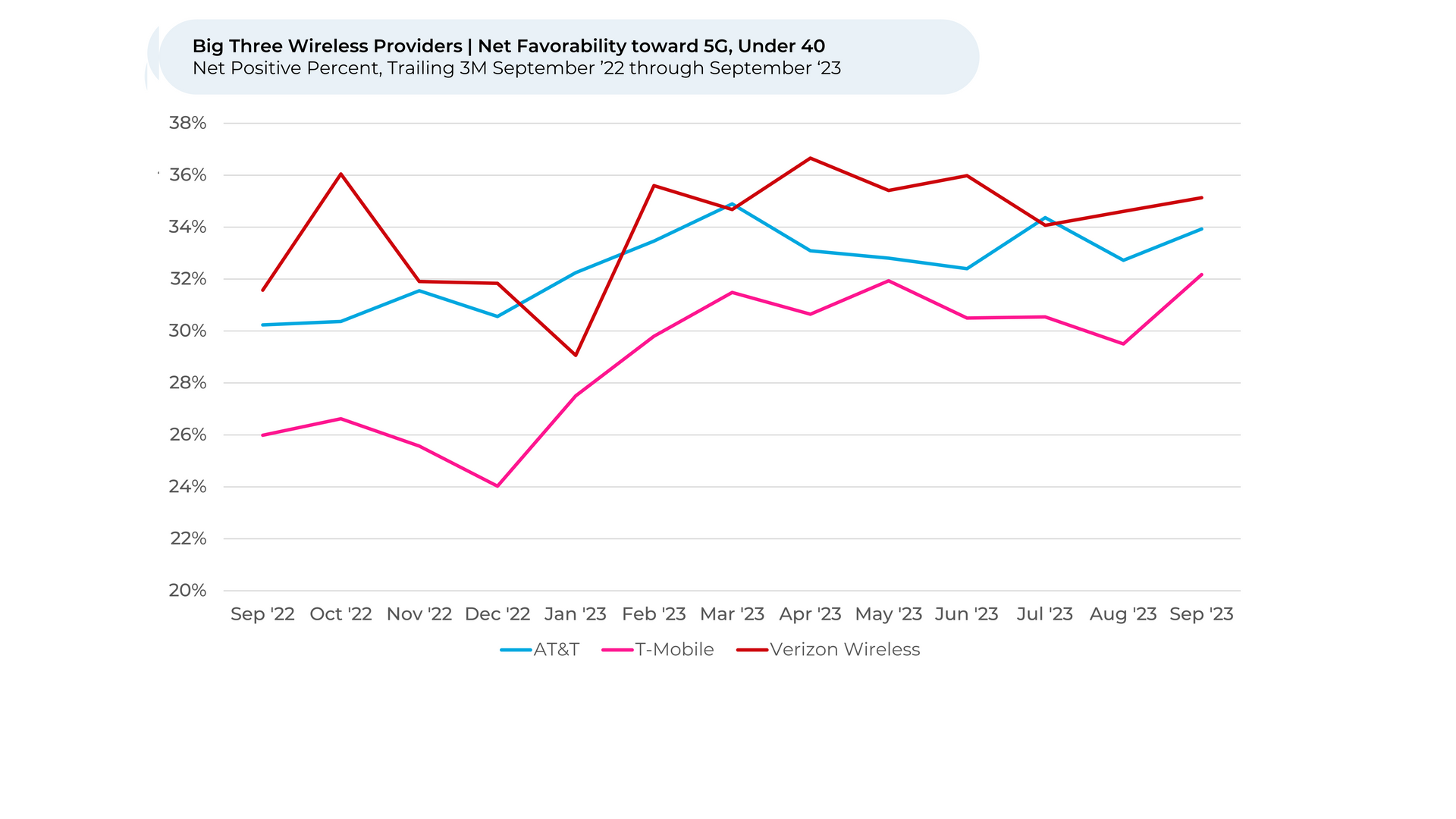

- 5G has jumped in importance as networks expand and more people get 5G phones. T-Mobile is the leader in perception towards 5G, followed by AT&T and then Verizon. 5G is now selected 8th out of 16 drivers of satisfaction we track, up from 16th two years ago.

- Once viewed as the middle ground between Verizon’s network quality and T-Mobile’s affordable prices, AT&T is particularly gaining ground with Gen-Z and millennial customers. Over the past few months, Loyalty Intent for young adults rose 8% for AT&T, while falling 10% for Verizon.

- At the same time, perception toward AT&T’s price, 5G, speed, and coverage improved significantly for young adults.

Please contact our team for a deeper look at HundredX's wireless provider data, which includes more than 180,000 pieces of customer feedback across 20 brands.

- All metrics presented, including Net Loyalty Intent (Loyalty Intent), and Net Positive Percent / Favorability are presented on a trailing three-month basis unless otherwise noted.

- Loyalty intent reflects the percentage of customers who plan to continue using a specific wireless provider minus the percentage who plan to switch to a new one. We find businesses that see Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.

- HundredX measures favorability towards a driver of customer satisfaction as the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.