January may be dry, but the rest of the year isn’t.

While drinkers worldwide participate in Dry January by staying sober throughout the month, the average drinker isn’t planning to change their longer-term drinking habits. We’ve found aggregate Consumption Intent¹,² which measures if people plan to drink more, less, or the same over the next year, didn’t change from December to January over the last three years. This lack of movement indicates that while some drinkers may be taking a break in January, they aren’t planning to cut back on drinking for the rest of the year.

We have seen some notable recent trends. Examining 80,000 pieces of feedback from the past year across 68 popular alcohol brands, we find:

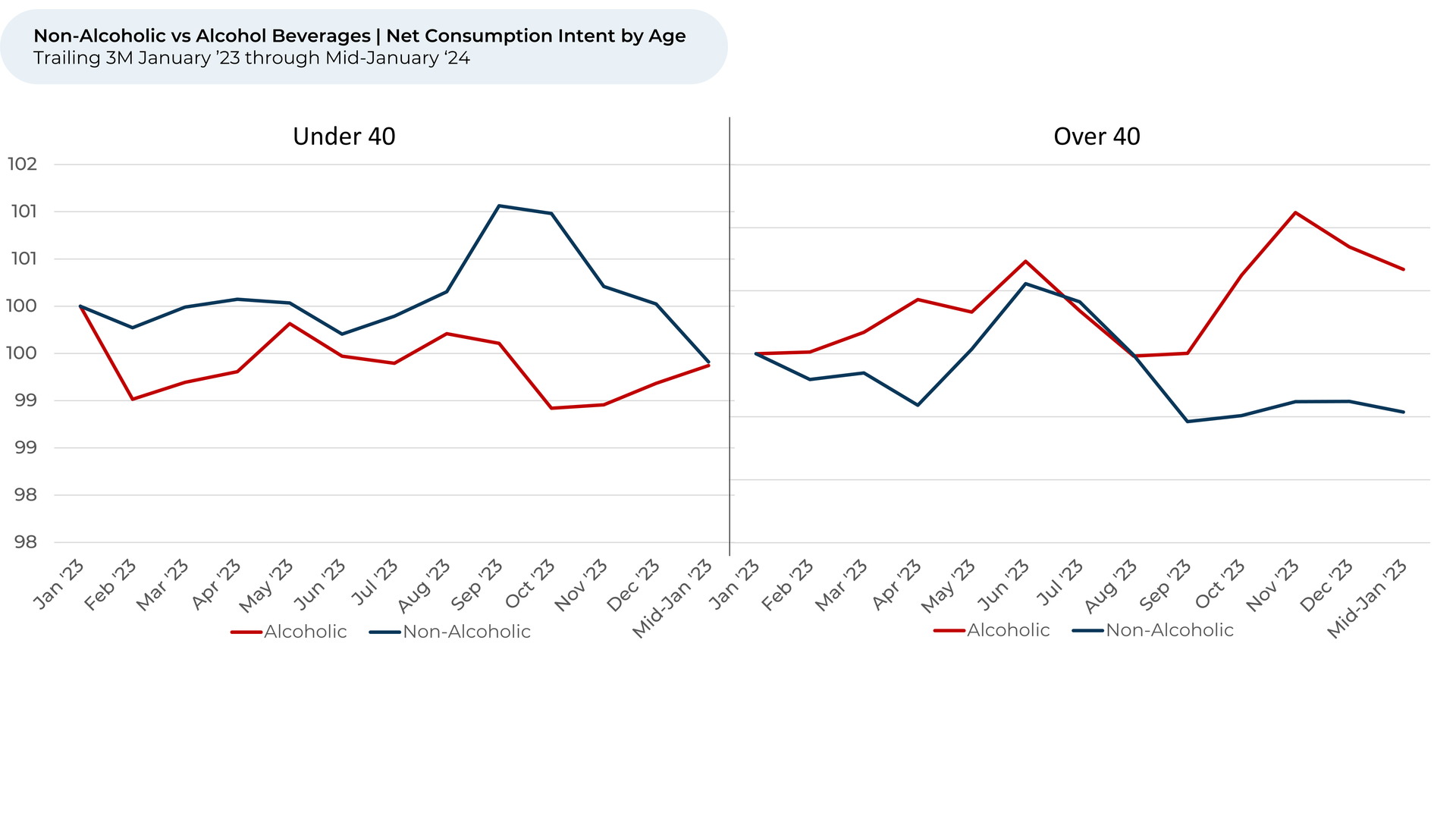

- Age makes a difference: Alcohol Consumption Intent as of mid-January has remained relatively stable for drinkers under 40, while it has increased year-over-year for drinkers over 40.

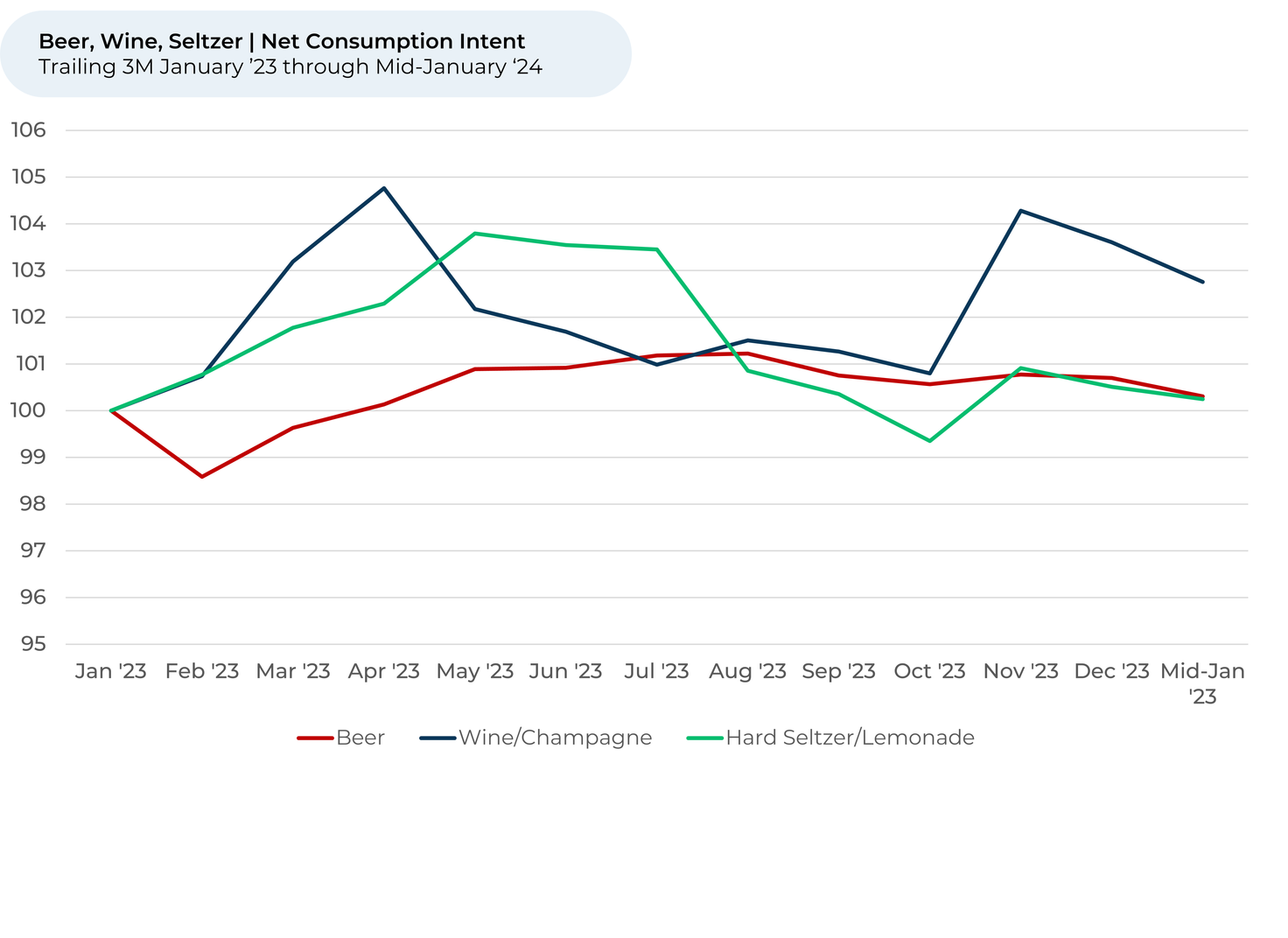

- Wine (+3%) is up the most year-over-year, ahead of beer and hard seltzer (both flat), although wine has fallen slightly in recent months.

- Brown liquor is having a moment.

Since the summertime, rum and whiskey are up in Consumption Intent while vodka and tequila are flat or down. However, rum’s Consumption Intent is starting to fall again after a late summer, early fall surge.

Please contact our team for a deeper look at HundredX's data on Alcohol and Spirits, which includes more than 150,000 pieces of customer feedback across 68 alcohol brands.

- All metrics presented, including Net Consumption (Consumption Intent) and Net Positive Percent / Favorability, are presented on a trailing three-month basis unless otherwise noted.

- Consumption Intent for alcohol represents the percentage of customers who expect to consume more of that brand over the next 12 months, minus those who intend to consume less. We find businesses that see Intent trends gain versus the industry or peers have often seen revenue growth rates, margins, and/or market share also improve versus peers.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.