In last month’s travel update, HundredX found that flyers started to forgive Southwest for its December holiday troubles. This month, we find Southwest’s positive Travel Intent1,2 momentum continues for June, as “The Crowd” of flyers feel happier about the airline’s ability to deliver them to their destinations on time.

Analyzing over 280,000 pieces of real traveler feedback (including 80,000 across 25 airlines) from June 2022 through June 2023, HundredX discovers:

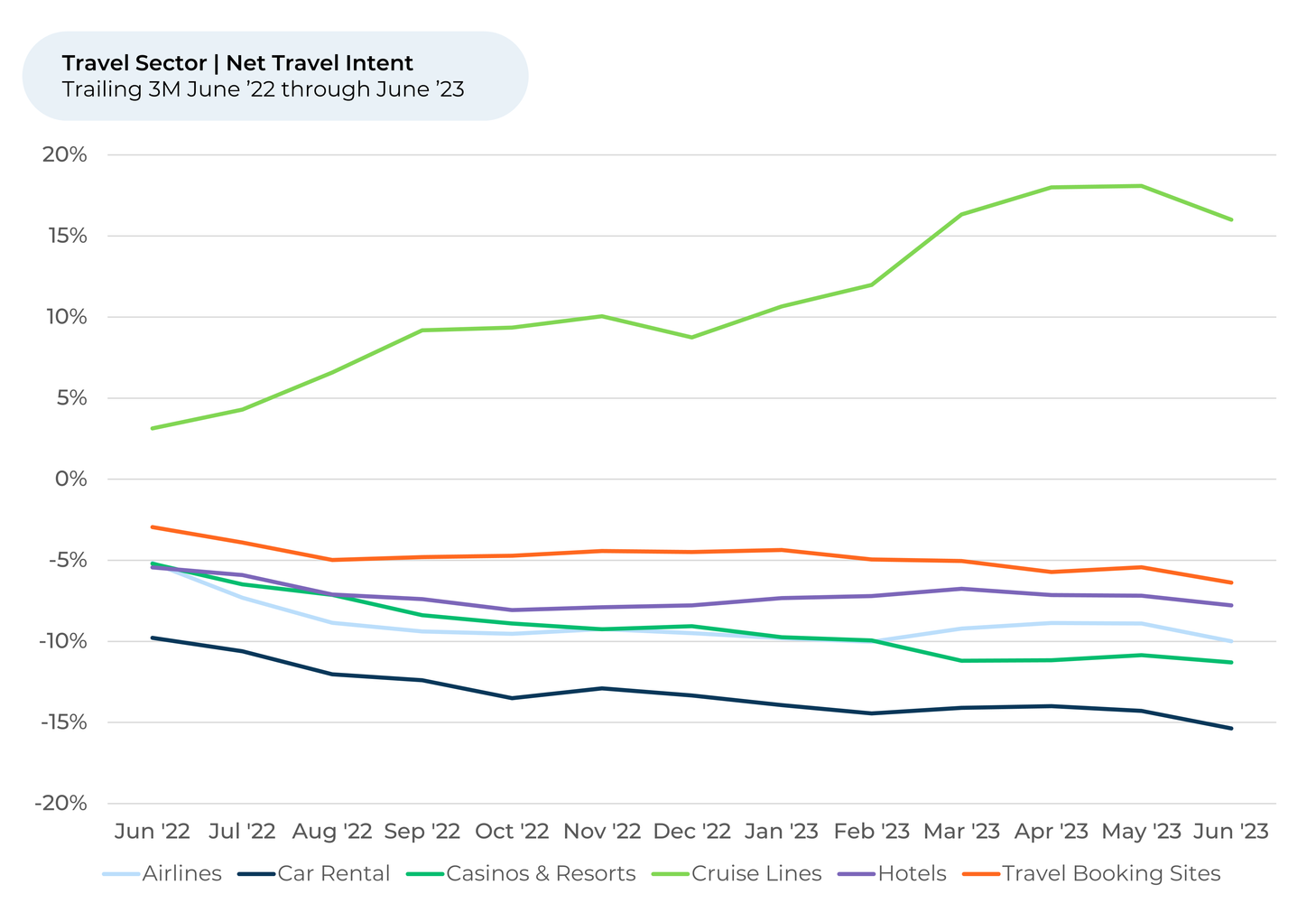

- As we move through the summer travel season, we find Travel Intent actually dipped from May to June for every travel-related industry except casinos and resorts.

- The cruise industry broke its long positive Travel Intent run, with its first decline this year.

- Southwest appears to be on a clear road to recovery after its technical troubles in December. Travel Intent and sentiment toward On-Time continue to improve for Southwest, while United, Delta, American, and JetBlue give up gains from earlier in the year.

The travel sector takes a dip

Over the past month, Travel Intent fell 1% to 2% for every travel-related industry except for casinos and resorts. It marks the first dip the cruise industry has seen since bottoming in March 2022 – something that we will dig into in an upcoming post. Make sure to subscribe to our newsletter so you don’t miss it!

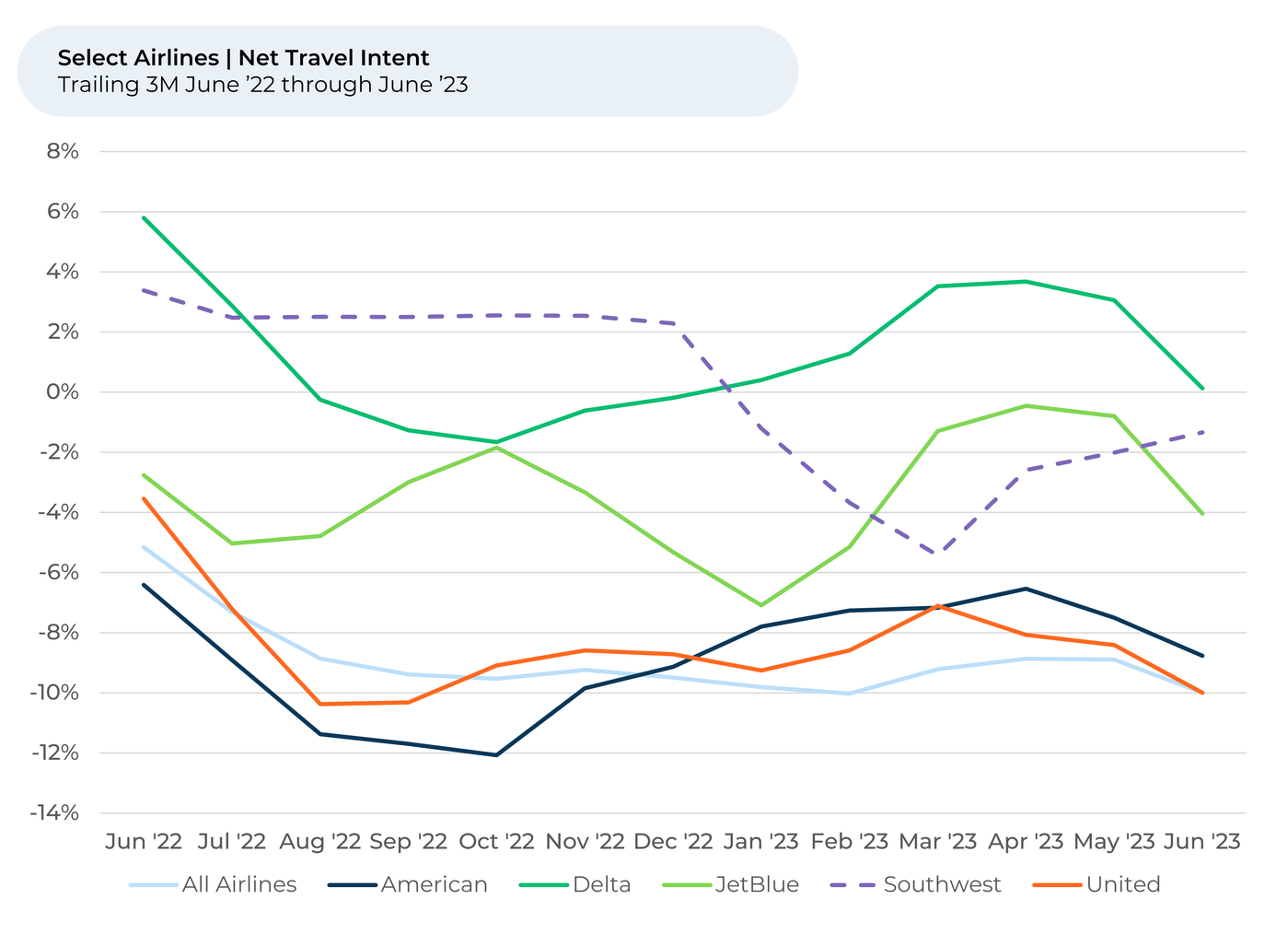

Airlines, the focus industry of this post, fell 1% over the past month, along with most other industries, after being stable for most of the year. After rising at Southwest’s expense for much of the year, we find some of the biggest U.S. airlines giving up their gains in recent months.

Southwest flies while others fall

From May to June, Southwest Travel Intent gained 1% while it fell 1% to 3% for American, Delta, JetBlue, and United.

This continues a trend we noticed last month. Southwest Travel Intent plummeted after technical troubles saw it ground thousands of flights in December. Additional technical issues briefly grounded Southwest planes in April. The airline pledged more than $1 billion in technology investments in January.

Either the upgrades are already paying off or flyers have begun to forgive Southwest – over the past three months, Southwest Travel Intent gained 4%, while falling 1% to 3% for its biggest competitors.

“I know they had a breakdown over the holidays but they are still consistent and reliable. They compensate customers for inconveniences,” a Southwest flyer told HundredX in June.

Travel Intent soared for Delta and JetBlue after Southwest’s plummeted earlier in the year. The opposite is now happening. As we mentioned last month, Southwest appears to be positioned to regain some market share as it recovers some of the ground it lost to Delta and JetBlue on Travel Intent.

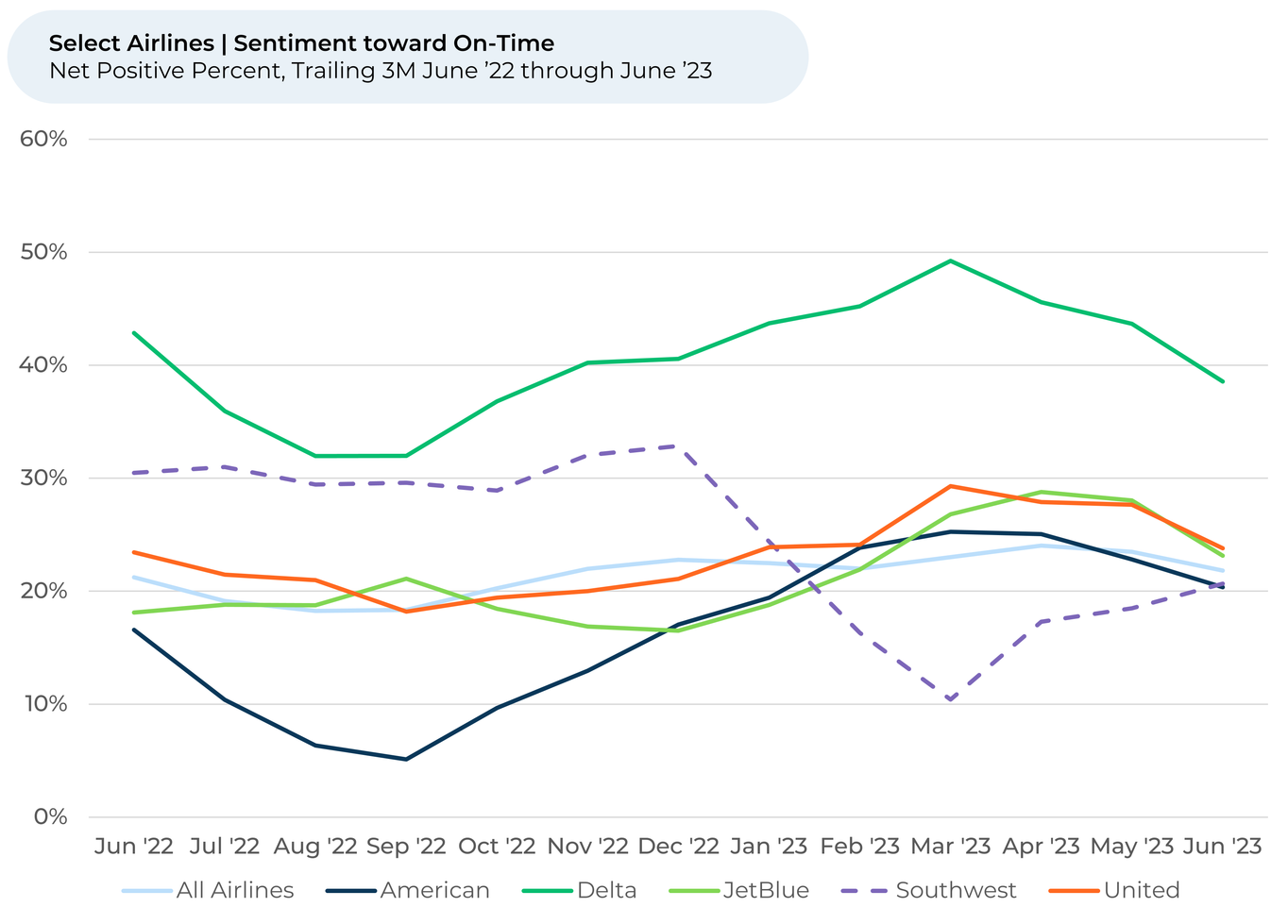

Southwest recovering with On-Time

After December, flyers voiced their displeasure with Southwest’s ability to keep their flights on-time. Customer sentiment3 towards being “On-Time” as a reason they liked or disliked Southwest plummeted.

Last month Southwest continued the trend that began in March, as the only mega U.S. airline to gain in on-time sentiment. Sentiment has increased 10% since March for Southwest, while it has dipped 4% to 11% for Delta, American, JetBlue, and United.

Southwest’s recent Travel Intent and sentiment gains have helped it make up a large chunk of what it lost, but it still has a way to go. Travel Intent is still 3% lower than it was in December 2022, and On-Time sentiment is 12% lower. We will watch to see whether Southwest’s investments continue to drive gains in Travel Intent and ultimately market share.

- All metrics presented, including Net Travel Intent (Travel Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis unless otherwise noted.

- Travel Intent for most Travel subsectors represents the percentage of customers who expect to travel more with or spend more with that brand over the next 12 months, minus those that intend to travel or spend less. We find businesses that see Travel Intent trends gain versus the industry have often seen revenue growth rates, margins and/or market share also improve versus peers.

- HundredX measures sentiment towards a driver of customer satisfaction as Net Positive Percent (NPP), which is the percentage of customers who view a factor as a positive (reason they liked the products, people, or experiences) minus the percentage who see the same factor as a negative.

Strategy Made Smarter

HundredX works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

####

HundredX is a mission-based data and insights provider. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on specific drivers of customer satisfaction, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out: https://hundredx.com/contact.